- Bitcoin moved past $108,000 fueled by bullish whale and institutional activity before crashing.

- Funding rates maintain relatively low activity indicating spot dominance.

As a seasoned analyst with years of experience in the cryptocurrency market, I’ve witnessed numerous bull runs and bear markets. The recent surge past $108,000 by Bitcoin was indeed an interesting development, fueled primarily by whale and institutional activity. However, the subsequent crash to around $101,000 serves as a reminder that this market can be as unpredictable as a rollercoaster ride at an amusement park.

Bitcoin (BTC) displayed a bullish trend earlier in the week as it aggressively sought price increases. On Wednesday, the 18th of December, it reached a new record high exceeding $108,000. This upward momentum was primarily driven by the active participation of large investors, often referred to as “whales.

If Bitcoin maintains its current upward trend, there’s optimism that it could reach around $110,000 by the week’s end. This digital currency king reached a new all-time high of $108,364 on Wednesday, demonstrating once more that the bulls are still dominant in this market.

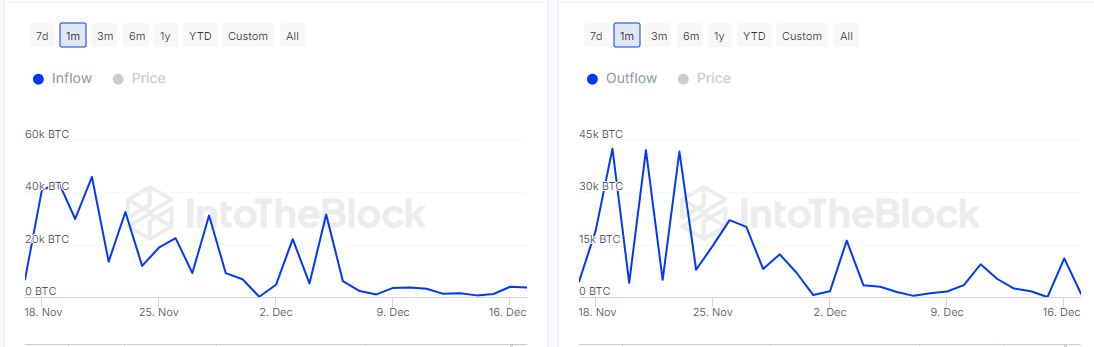

Data recorded on the blockchain shows an increase in whale activity, with large Bitcoin holders adding a significant amount (from 619.43 BTC on December 14th to 3,620 BTC by December 17th). Conversely, outflows from these large holders have decreased, dropping from approximately 11,060 coins on December 16th to 917 BTC the following day.

At approximately the same period, a significant increase in demand was observed for the big storage container, coinciding with a substantial reduction in selling pressure from the “whales”.

Consequently, the surge in demand caused prices to rise significantly. Yet, it’s worth noting that inflows from large holders decreased substantially, dropping approximately 50% to around 1843 BTC by Wednesday. Despite this decrease, it’s still more than the 473 BTC worth of outflows.

As an analyst, I can mention that I observed a net positive movement of Bitcoin funds from ETFS. Intriguingly, the most recent data on Bitcoin Exchange-Traded Funds (ETFs) indicates a surge in inflows, reaching approximately 275.3 million BTC on Wednesday.

Are Bitcoin bears taking over?

Although these findings were made, certain ETFs like Grayscale and Ark Invest experienced significant withdrawals. The strong upward trend was interrupted by a substantial decline that brought the price down near $101,000. This suggests possible profit-taking or further short-term outflows may occur in the future.

The retreat in the market can largely be attributed to a swift response following remarks by Federal Reserve Chair, Jerome Powell. Specifically, Powell stated that the Federal Reserve does not have the authority to purchase or own Bitcoin.

Data from the Bitcoin spot market shows that there were more withdrawals than deposits over the past three days, with this trend being especially pronounced on Wednesday when net withdrawals reached a peak of approximately $824.78 million.

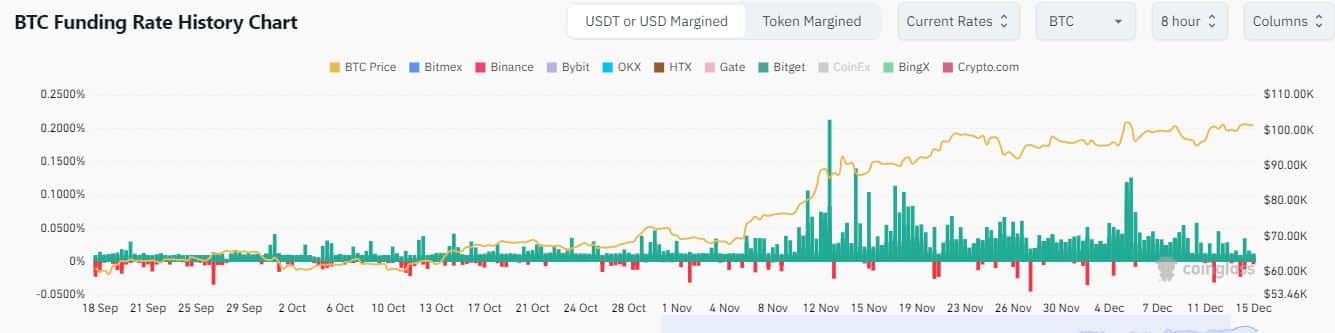

source: Coinglass

What’s the significance of these findings? Essentially, it seems that whales (large investors) and major institutions have been leading the market surge this past week, suggesting they expected prices to rise. At the same time, smaller retail investors seem to be struggling under the weight of increasing prices.

The Bitcoin funding rates data showed a more moderate level of activity compared to the initial weeks of December and November, indicating that derivative traders have been proceeding with caution this week in order to prevent liquidations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Essentially, the demand for immediate fulfillment seems to have held sway this week, with the number of liquidations remaining comparatively small.

source: Coinglass

A decrease in funding rates might indicate reduced volatility and possibly smoother advancements for Bitcoin. Yet, investors need to exercise caution, particularly considering the recent trend of ETFs experiencing withdrawals.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-19 12:39