- Ethereum struggled below $4,000, with Binance outflows suggesting potential long-term accumulation.

- Negative social sentiment mirrored December 2023 trends, potentially signaling a bullish recovery for ETH.

How large withdrawals could impact ETH price?

As a seasoned analyst with years of experience navigating the cryptocurrency market, I have witnessed numerous trends and patterns that have shaped this dynamic industry. The current movement of Ethereum (ETH) outflows from centralized exchanges, particularly Binance, is an interesting development reminiscent of the 2021 bull market.

Over the last two months, I’ve noticed around 20.8 million Ethereum being withdrawn from centralized exchanges, a pattern that echoes the fervor of the 2021 bull market. Interestingly, Binance seems to be at the heart of this trend, handling over 7.8 million ETH, which amounts to about 33-39% of the total withdrawals.

According to CryptoQuant analyst Crazzyblockk, these withdrawals could indicate a long-term investment strategy through accumulation or staking, demonstrating investor optimism.

The substantial withdrawals from Binance demonstrate its ongoing impact on the cryptocurrency market, particularly its role in maintaining equilibrium between Ethereum’s supply and demand.

Due to Binance’s significant impact, bolstered by its massive user base of approximately 250 million worldwide and a whopping $21.6 billion in deposits, these withdrawals might decrease the amount of ETH available on exchanges. This could lead to an increase in ETH’s price if demand continues to be robust, as the reduced supply may exert upward pressure.

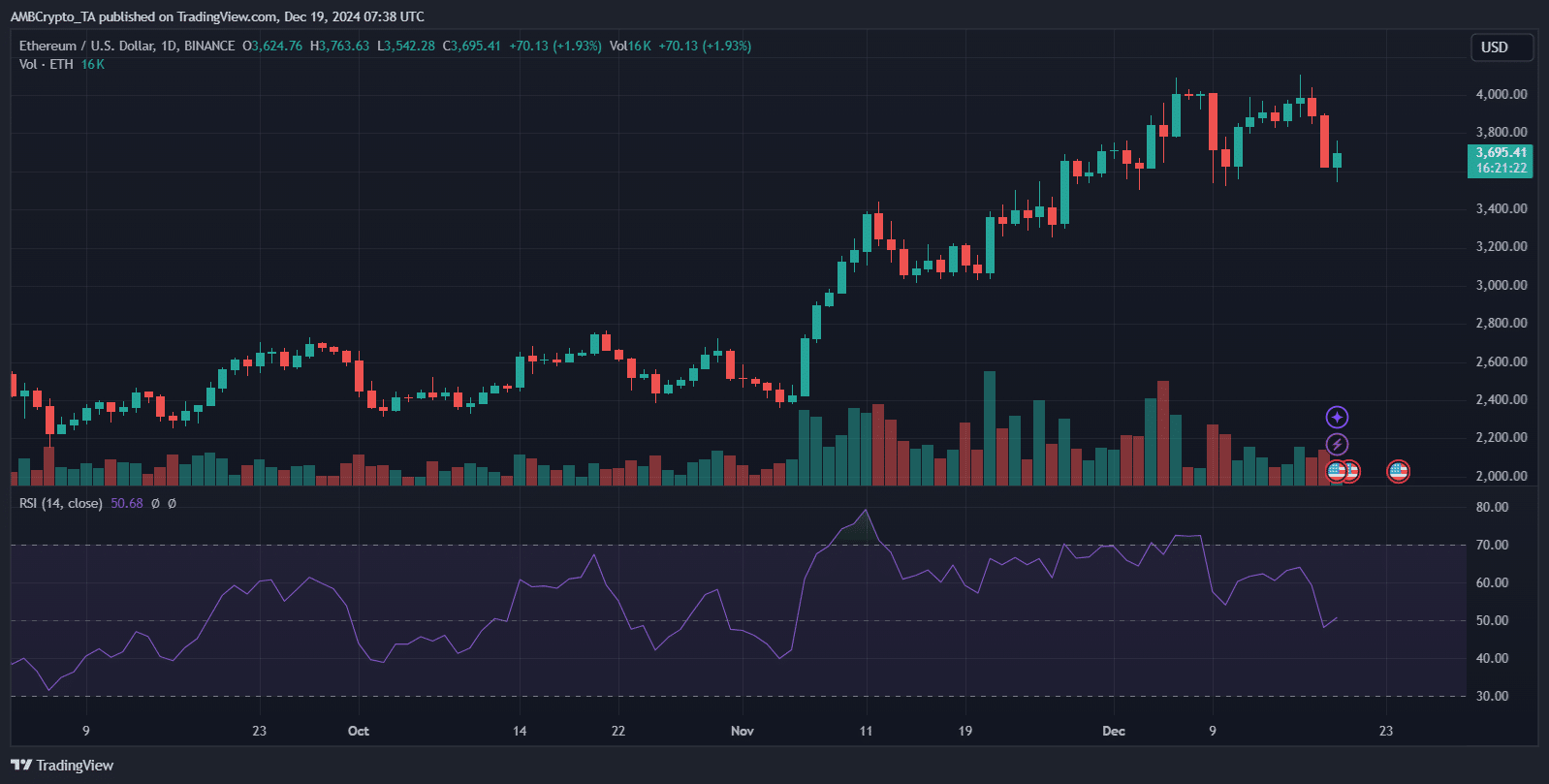

Ethereum market performance

Despite the overall surge in the cryptocurrency market, Ethereum hasn’t been able to surpass the $4,000 barrier like Bitcoin during its uptrend, even though it has tried.

Despite Bitcoin consistently hitting record highs nearly every month, the growth of Ethereum is relatively slow. In contrast to Bitcoin’s 5% weekly surge, Ethereum has only managed a 2.3% increase over the same period.

Even positive news, such as Deutsche Bank’s rumored Ethereum-based layer-2 blockchain leveraging ZKsync technology, has failed to inject upward momentum. Technical analysis suggests bearish signals, hinting at a potential price correction to $3,400.

The present situation with Ethereum suggests it may not be breaking out soon, which underscores the difficulties it faces in keeping investors confident, even though recent withdrawals hint at a long-term pattern of hoarding.

Read Ethereum’s [ETH] Price Prediction 2024-25

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-19 14:15