- BTC, ETH, and XRP defended crucial short-term support levels.

- Will they bounce back to their new highs ahead of Christmas?

As a seasoned researcher with years of experience navigating the cryptocurrency markets, I’ve seen my fair share of market swings and trends. The recent performance of BTC, ETH, and XRP has been intriguing, to say the least.

On December 18th, the U.S. Federal Reserve reduced interest rates by 0.25%, yet their projected increase in interest rates for 2025 caused a dip in Bitcoin‘s price from $100K.

In the course of a single trading day, it was quite a rollercoaster for me as an Ethereum [ETH] and Ripple [XRP] investor. Unfortunately, Ethereum dipped 6.8%, whereas Ripple plunged by a steeper 10%. Despite these short-term losses, the major digital assets seemed to be finding solace at their immediate support levels. Yet, financial analysts remain hopeful and bullish about risk-on assets, suggesting that we might see positive movements soon.

So, will the big three bounce back or slide lower? Let’s explore charts for insights.

Bitcoin defends $100K: Will ETH, XRP rebound?

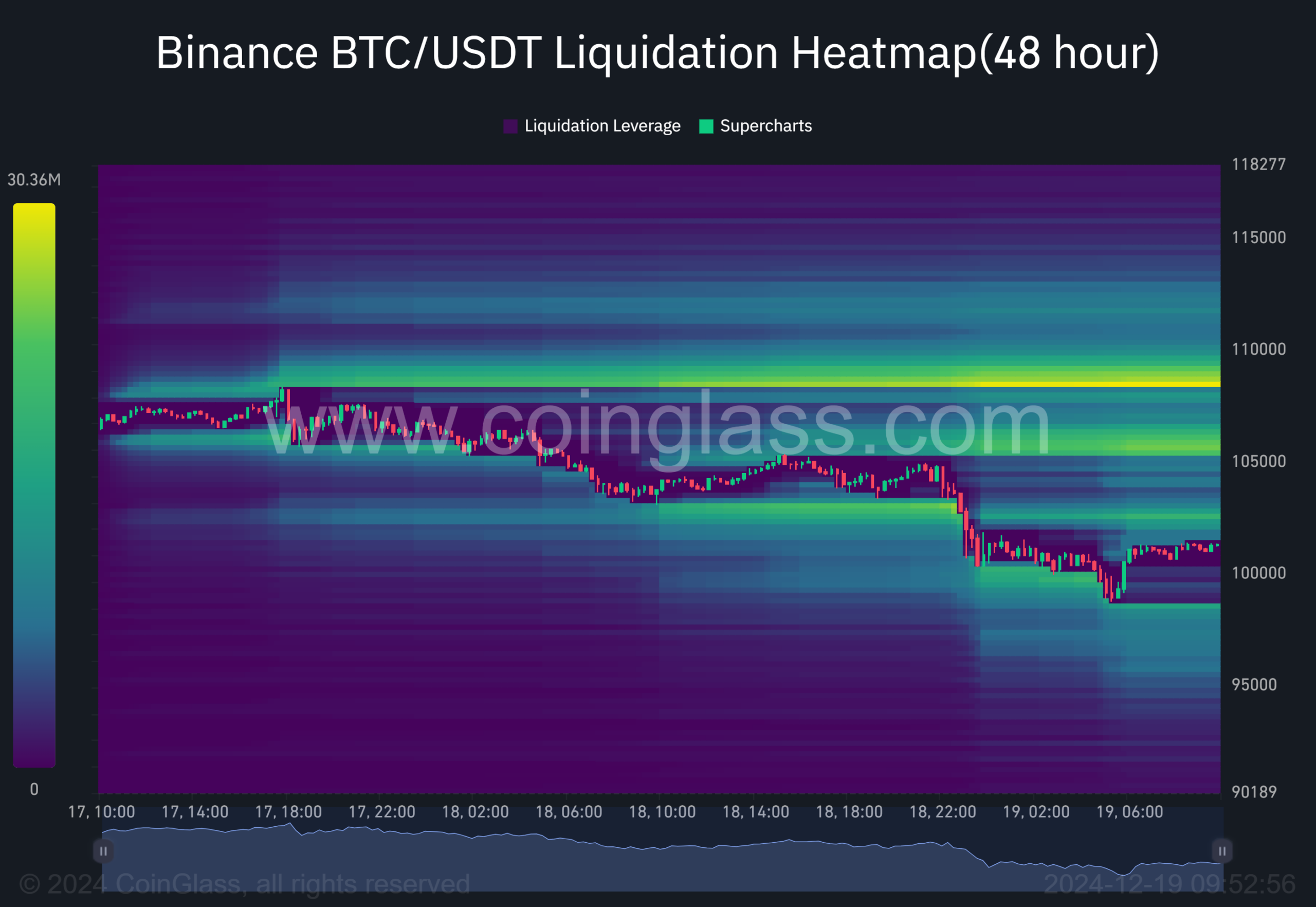

Starting from December 12th, Bitcoin bulls have successfully guarded against falls below the $100,000 mark. After the Federal Open Market Committee (FOMC) meeting triggered selling, this resistance held steady at the psychological price level. This suggests that it has now become a support point.

It’s worth noting that the 100-day Exponential Moving Average (EMA) has previously halted Bitcoin’s drops since October, and now it lines up with the lower boundary of the channel. As a result, the range between $98,000 and $100,000 is currently serving as a robust temporary support level for Bitcoin.

The mid-range of $104K and upper level of $108K-$109K could be feasible if the support holds.

From my perspective as a crypto investor, if we were to see a break below our current support levels, things might get tougher. This downturn could potentially intensify, offering opportunities to the ‘bears’ to further capitalize on the situation. In such an unfavorable scenario, the bearish traders might find it achievable to push prices down towards $90K and even $85K.

To clarify, the recent drop was not only due to a search for liquidity, but this search was primarily focused on the price points of $102.5K, $105K, and $108K (indicated by bright yellow lines).

In simpler terms, if there’s enough buying activity (liquidity), Bitcoin is likely to bounce back, but less trading during the Christmas holiday might lead to more selling, causing further price drops.

How will ETH and XRP react to the above BTC’s price scenarios?

ETH, XRP price prediction

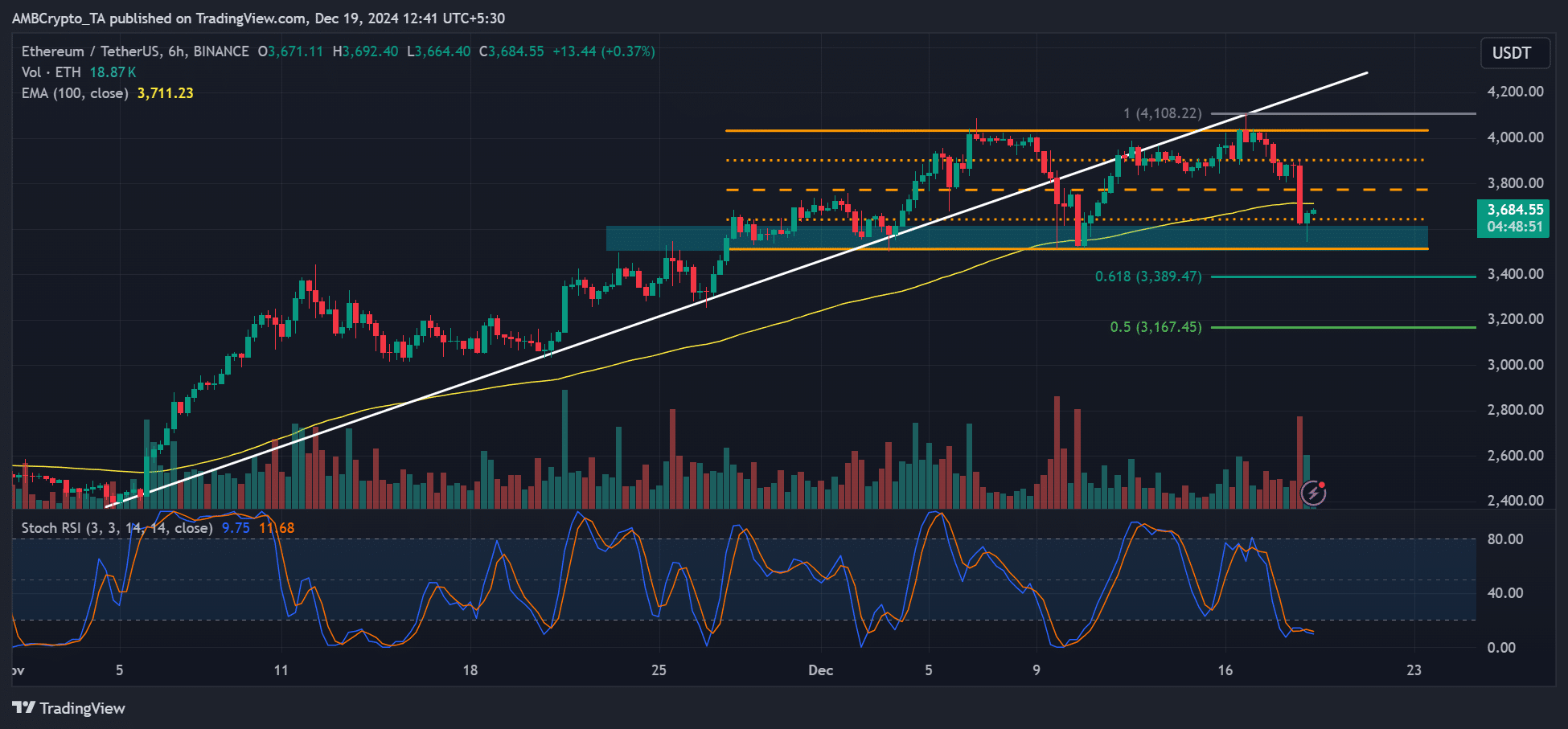

Since early December, Ether (ETH), often referred to as the “king altcoin,” has been holding steady within a range between approximately $3,500 and $4,000. Similar to Bitcoin (BTC), it experienced a decline from around $4,100, but it rebounded at the lower end of its current range, currently sitting at $3,500.

Moving up towards $3,700 and potentially $4,000 is possible if the lower range holds firm. Breaking above the trendline support (the white line) would suggest a resumption of the uptrend that started in November, which we had initially seen.

That said, if the channel’s support cracked, ETH bears could drag the altcoin to $3.3K or $3.1K.

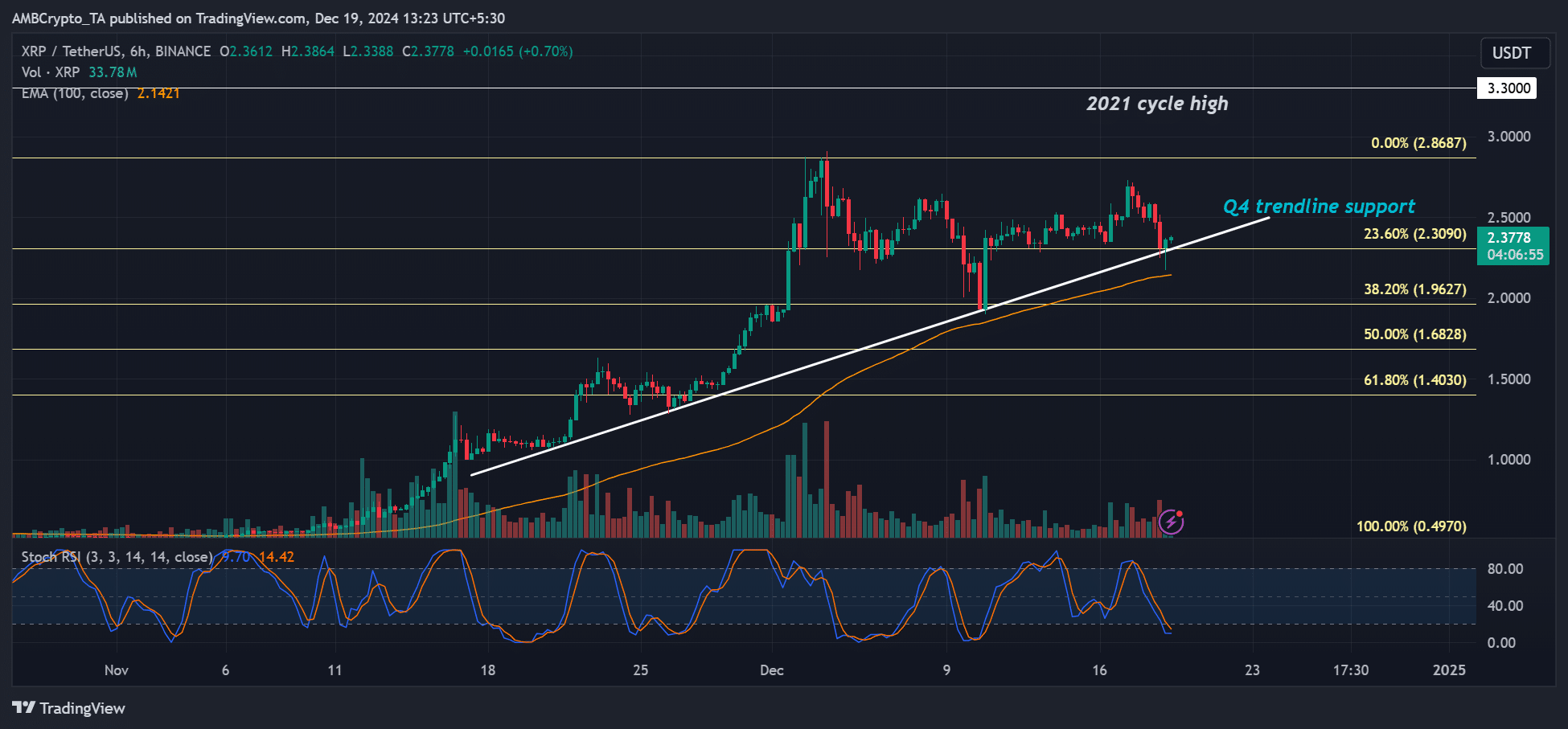

It’s noteworthy that even amidst the other major cryptocurrencies, XRP’s chart showed strength. Although it experienced a 10% decline, it managed to stay above its trendline support from Q4, making this level particularly significant to monitor for the remainder of 2024.

Bulls could eye a $2.8 level or push higher to the 2021 cycle high of $3.3 using the support as a springboard. The bullish leaning was supported by the recent stablecoin RLUSD launch and ETF expectations in 2025.

Read Bitcoin [BTC] Price Prediction 2024-2025

However, a crack below it could empower short sellers to push XRP lower to $2 or $1.6.

To summarize, it appears that the major cryptocurrencies, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) have managed to hold onto crucial price points, hinting at a possible shift in market trends towards an upward trajectory. However, considering the anticipated reduction in trading activity during the Christmas season, there’s a question as to whether this recovery will be sustained.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-19 17:12