- XRP and ETH are in a tight race to attract capital from Bitcoin as market sentiment turns cautious.

- XRP has the potential to carve out its own asset class distinct from BTC by 2025.

As a seasoned crypto investor with roots stretching back to the early days of blockchain, I’ve witnessed my fair share of bull runs and bear markets. The latest FOMC’s move to cut interest rates has once again tested the resilience of the market, but it also presents opportunities for those who can read between the lines.

Once more, the robustness of the cryptocurrency market is under pressure as the Federal Open Market Committee (FOMC) concludes its 2024 meetings with a “speculative” tone. The third and last interest rate reduction for the year, which also marks the third in four months, triggered a significant drop in Bitcoin [BTC]. A long red candlewick wiped out five days of growth, causing Bitcoin’s price to slip under the crucial $100K threshold.

However, it seems this is merely a beginning. The Federal Reserve’s cautious approach suggests that Donald Trump’s conservative policies may result in elevated inflation rates over the coming months.

The investors appeared displeased with the recent news. As the market experienced a downturn, certain alternative cryptocurrencies endured significant losses in the double digits, whereas the leading coins managed to maintain their position, hinting at an imminent recovery.

The intriguing aspect is this: When it comes to capitalizing on the “Trump effect,” Ripple [XRP] stood out as the top contender. Could this advantage potentially position XRP favorably compared to Bitcoin and Ethereum in their ongoing competition?

The game is on!

Currently, I’m observing a significant increase in sell-offs relating to XRP. It appears that even XRP isn’t exempt from the turbulence within the market. As I write this, the elusive $3 mark seems to be slipping away, with XRP’s current price hovering around $2.30.

However, there’s still hope. December started off positively for XRP, with the coin recording four straight green candles, each representing approximately a 15% increase and closing around $2.80 – a level it hasn’t seen in three years. Given this trend, it seemed like a strategic decision to distribute XRP tokens.

From my perspective as an analyst, I observe that Ethereum’s day-to-day graph presents a high degree of volatility. This volatility manifests in sudden declines, which are then promptly countered by strong rebound surges.

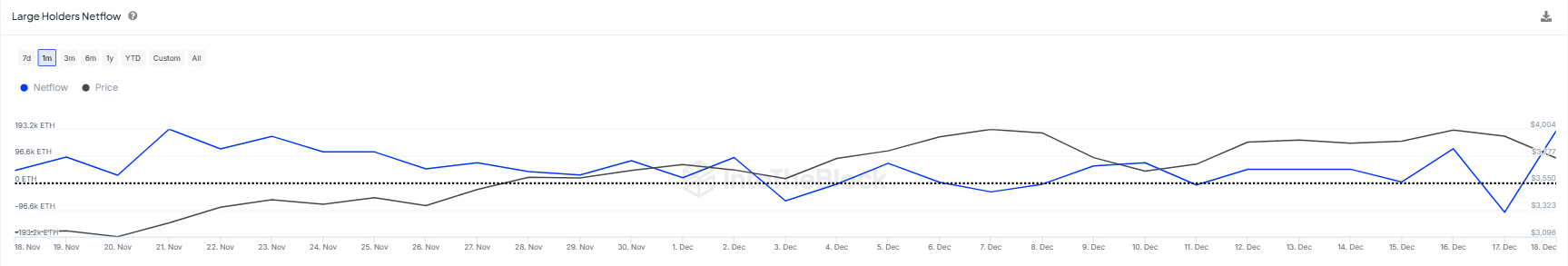

Between mid-November and mid-December, every dip appeared to be strategically scheduled, followed by a robust rebound. This indicates that whenever there was an increase in Ethereum’s supply, it was swiftly countered by aggressive buying.

Currently, both XRP and Ethereum are vying to surpass crucial resistance points. The contest is close, but the victor will be the one that can maintain its strength amidst unpredictability, bolstered by robust foundations. Will XRP reach $3 or Ethereum attain $4K first? Or could Bitcoin take center stage instead?

XRP or ETH, whose “dip” should you dig?

Over the last day, significant fluctuations have swept through the cryptocurrency market, as multiple elements converged to cause a series of unpredictable events. Among those most affected are individual, smaller-scale investors who seem to bear the brunt of these market swings.

Given the current market situation, it’s apparent that the fear of missing out (FOMO) might not resurface soon. Instead, investors are actively rebalancing their investments, aiming to offset their losses. The responsibility, it appears, has shifted towards the larger entities with substantial resources.

Here’s where things get intriguing: The recent drop has brought XRP and ETH very near to a vital support line. If major traders begin buying at this price, we might be witnessing the early stages of a temporary low. This could lead to a recovery, igniting optimism among smaller investors.

Regarding ETH and XRP, it’s clear that larger investors, often referred to as “whales,” have employed more strategic buying tactics with ETH. They’ve been seizing opportunities during market dips, purchasing ETH at a lower price, and subsequently selling it at a higher price when the $4K threshold is near.

In fact, recent data shows that traders cashed out around 105K ETH as the price neared its resistance point, which led to a near 3% decline the following day.

Source : IntoTheBlock

As a researcher observing the trend, I find myself intrigued by the increasing accumulation of Ethereum (ETH) by whales. This could potentially drive the price towards the $3.9K mark in the near future. However, it’s crucial to exercise caution and consider various factors that might influence this prediction.

Instead, let’s focus on Bitcoin, which has been surging, and managed to regain the $101K mark. This could be an optimistic indicator for the overall market.

Even though Bitcoin recently experienced a significant drop, this situation presents altcoins with an excellent chance to outshine. It appears that a rapid increase in retail interest for BTC in the near term is not likely, although whales and institutions are taking advantage of the price decline by investing.

Indeed, even as Ethereum grapples with its persistent issues, Ripple finds itself bolstered by several elements driving its progression. These include its strong track record, influential whale support, significant regulatory advancements, and the innovative RLUSD stablecoin project.

Read Ripple [XRP] Price Prediction 2024-2025

By 2025, XRP could distinguish itself as a standalone asset category apart from Bitcoin – an accomplishment that Ethereum has not achieved since it first began.

If XRP manages to accomplish this, it might find itself well-positioned to capitalize on Bitcoin’s volatility over the next year.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

2024-12-19 18:16