- Smart Dex traders and whales sold Worldcoin at an average price of $3.85.

- If this order holds, WLD could pivot to reverse its recent losses.

As a seasoned analyst with years of experience navigating the cryptocurrency markets, I see the recent sell-off of Worldcoin (WLD) by smart DEX traders and whales as a potential turning point for this digital asset. The average sale price of $3.85 suggests a profit-taking phase that may have been triggered by the extended rally from $1.50 to $4, where these significant players cashed out.

Intelligence traders utilizing Decentralized Exchanges (DEX) and large investors (whales) have offloaded Worldcoin [WLD] for an average price of approximately $3.85. The transactions by DEX traders took place at around $3.8, whereas whales sold their shares at a slightly higher price of $3.9. This could suggest that these market participants might be aiming to capitalize on profits.

Following the sales, there seemed to be a significant drop in meaningful purchasing actions, indicating that traders might be showing caution. A select few have started buying again, implying differing opinions among them regarding the prospects of long-term investments.

Currently, at $2.4, investors appear to be taking a wait-and-see approach.

The absence of immediate purchases after substantial sales might indicate a possibility of future price drops or a period of price stability at the current level. However, if Worldwide (WLD) manages to become more stable or exhibits positive buying signals, it could potentially draw investors back into the market.

As a Worldcoin trader or investor, I find myself keeping a keen eye on the market’s immediate reaction following the recent selling spree by major players. It seems wise to tread cautiously and observe the market closely in the short term.

This move might provide insights into where WLD’s price might head after the departure of Smart DEX traders and large investors.

WLD’s price action and prediction

2024’s second half saw a prolonged slide in the WLD/USDT pair, but this trend reversed at the $1.50 level, which initially acted as a resistance and later provided support.

After surging from $1.50 to $4, WLD dipped down to the $2.41 trading range. During this rally, it seems Smart DEX and large whale traders cashed out near the peaks. If the $2.41 level manages to hold firm, there’s a possibility that WLD might shift direction to recover from its recent losses.

The MACD (Moving Average Convergence Divergence) indicator hinted at a possible change in trend momentum, since the histogram became narrower in the bearish zone, implying a potential decrease in negative momentum.

Additionally, WLD’s tests showed consistent demand at the $2.41 price point, suggesting a continued interest from buyers. If the resistance at $2.41 holds strong, it is possible that WLD might push towards prices exceeding $4 in the near future.

If the price of WLD manages to surpass the $6.01 threshold, it might trigger a return test towards stronger resistance at $9.519. This could indicate a potentially bullish trend for WLD during the initial months of 2025.

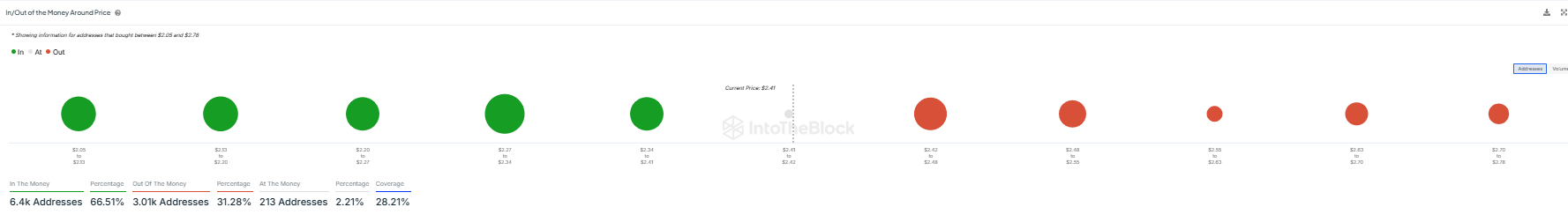

In/Out of the money around the current price

WLD’s profitability around the current price reveals distinct investor positions.

Approximately two-thirds (66.51%) of cryptocurrency addresses currently have a value higher than their original purchase price, suggesting they may serve as a potential support level because their owners are earning a profit. On the other hand, around one-third (31.28%) of addresses show a lower value than the initial investment, signifying unprofitable positions for these holders.

If WLD’s price rises, the substantial majority ‘in the money’ could provide a stabilizing effect.

Instead, it’s possible that resistance might emerge closer to the higher price levels, where investors are still in the red. This resistance could limit any further increases in value.

Realistic or not, here’s WLD market cap in BTC’s terms

Realistic or not, here’s WLD market cap in BTC’s terms

In simple terms, the balance between profitable and loss-making positions held by investors might impact the short-term price fluctuations of WLD. This is because investor responses at the point where they break even on their investments can significantly influence the market’s behavior.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-20 01:11