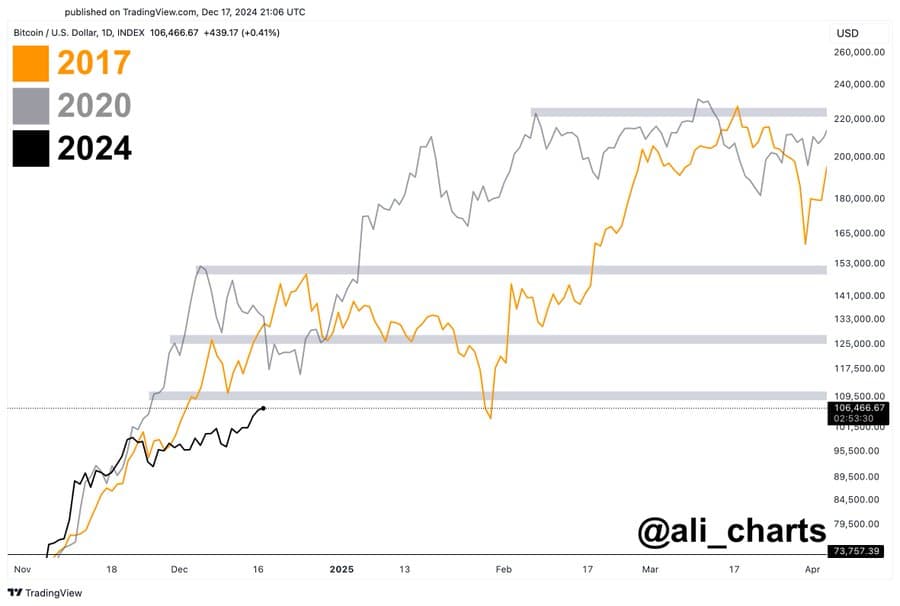

- BTC appeared to be following the trajectory of the previous bullish cycles of 2017 and 2020, potentially setting the stage for a significant price surge.

- Long-term holders were expected to play a pivotal role in this phase, contributing to upward price momentum.

As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a mix of excitement and caution as I observe Bitcoin‘s current trajectory. The parallels between this cycle and those of 2017 and 2020 are undeniably striking, hinting at potential record highs of $220,000. However, history has taught me that every bull run comes with its fair share of corrections and turbulence.

For a while now, Bitcoin (BTC) has been holding steady above the significant milestone of $100,000, even as the overall market experiences a downturn after reaching an unprecedented peak of over $108,000.

For the last seven days, Bitcoin has found it tough to maintain its monthly profitability, only managing to grow by 0.64%. However, within the past day, it has experienced a more substantial growth of approximately 2.05%.

As per AMBCrypto’s report, these price swings might be indicative of a larger bull run, with Bitcoin aiming to set fresh all-time highs.

BTC to $220,000: A cautious journey ahead

According to cryptocurrency expert Ali Chart, Bitcoin appears to be following similar trends from its 2017 and 2020 price surges, leading some to predict that it could reach a maximum value of approximately $220,000, potentially signaling a market peak.

Following its current path, Bitcoin might run into three significant points where the demand could potentially decrease due to increased selling, before it regains its bullish trend.

The current market downturn seems to be following a larger pattern, moving towards significant turning points.

Ali Chart outlined the potential price milestones:

Should Bitcoin’s price trajectory mimic its past trends in 2017 and 2020, we might expect a short-term pullback after it reaches around $110,000, a more substantial dip following the $125,000 mark, a significant correction nearing $150,000, and the possible conclusion of the bull market when it touches approximately $220,000.

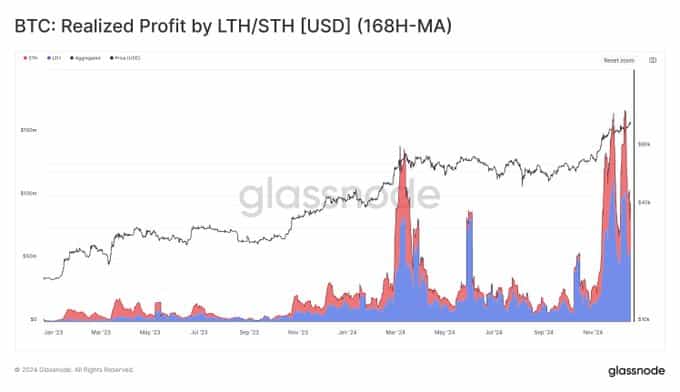

Based on AMBCrypto’s analysis, it appears that the current price corrections may be significantly impacted by long-term Bitcoin holders, as they seem to be playing a role in driving BTC’s recent downtrend.

Long-term holders drive distribution in the market

As reported by Glassnode, there was a significant change in the distribution pattern of Bitcoin prices following its record high, which occurred around the $90,000 mark in November.

For a while now, significant numbers of investors holding their assets for a long time (long-term holders or LTHs) have been selling off their positions, reaping profits and stirring up market action. This wave of selling has made up between 54% to 70% of the total trading volume, which amounts to approximately $73-$117 million traded each hour.

Notably, a specific market segment has been at the forefront of this profit-taking trend.

It appears that a significant portion of this activity can be attributed to Bitcoin (BTC) holders who have maintained their investments between 6 and 12 months. Many of these investors acquired their coins during the previous market cycle, and they have been predominantly responsible for cashing out profits over the past few weeks.

As a crypto investor, I’ve noticed that the Spent Output Profit Ratio (SOPR) for the recent 6-12 month cohort is showing similar trends to what we saw during the 2015-2018 bull market. Back then, the SOPR consistently stayed below 2.5 throughout many phases of the cycle.

Should history follow its pattern, Bitcoin (BTC) might be approaching a period of saturation, where investors cash out and new purchases pick up. This transition could spark another surge in BTC prices, much like what we’ve observed in past trends.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher, I’ve observed that after Bitcoin reaches new price milestones, tendencies of profit-taking and exhaustion seem to recur.

These stages might lead to adjustments prior to additional upward trends. It’s possible that price adjustments may happen at significant points such as $110,000, $125,000, and $150,000.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

2024-12-20 07:04