- Short-term holders offloaded significant volumes over the past 24 hours, while large investors, including whales, remained on the sidelines, waiting for more favorable entry points.

- The buying ratio peaks at a new high last reached in April, opening buying opportunities.

As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. The recent dip in Bitcoin‘s price has caught my attention due to its similarities with past market conditions.

Bitcoin (BTC) has entered a correction period, falling by 4.43% over the last day and now trading under $100,000. This recent drop has reduced its monthly growth to approximately 4.94%.

Should a bullish trend develop, the value of Bitcoin could potentially exceed its past record high and head towards approximately $108,500, with further potential increases following. As AMBCrypto’s analysis indicates, the recovery might hinge on significant investors intervening at crucial price points amidst persisting bearish market scenarios.

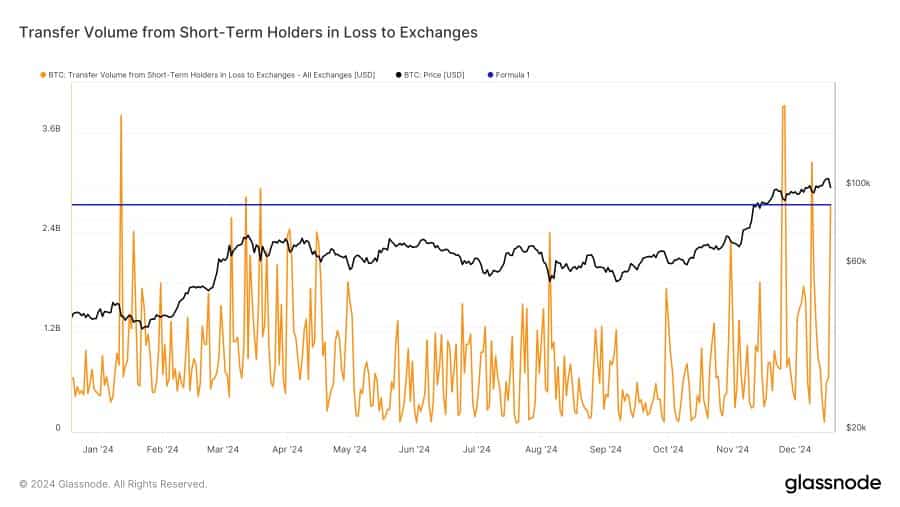

Short-term holders fuel Bitcoin’s recent decline

According to analyst Jam Van Straten, the primary reason behind Bitcoin’s recent drop in value is the high volume of trading by short-term holders. These frequent traders have unloaded approximately 26,000 Bitcoins, which equates to around $2.7 billion.

The transactions being referred to involve deals where some resulted in losses and others in profits. This diversity mirrors the fluctuating nature of their trading operations.

According to Van Straten, big-time investors, often referred to as ‘whales’, are currently keeping their funds on standby, biding their time to find the perfect moment to invest.

He explained:

“Big players are waiting for the price and not chasing it.”

It seems plausible that powerful traders might wait for market circumstances to match their strategies before taking action. When these significant players return to the market, their purchase activities may help Bitcoin regain its footing and potentially even increase in value.

Buying momentum could soon resume

According to Santiment, conversations regarding purchasing Bitcoin during its current downturn have peaked at unprecedented levels, mirroring a similar trend observed on April 12th, 2024, which was approximately eight months earlier.

Ever since that point, Bitcoin has skyrocketed more than 81%. Should history follow a familiar pattern, the present mood might ignite a comparable surge, propelling Bitcoin into uncharted territories of even greater prices above its current value.

Considering the possible benefits, it’s likely that whales will start purchasing again. If the buying trend continues to grow, Bitcoin could potentially increase further.

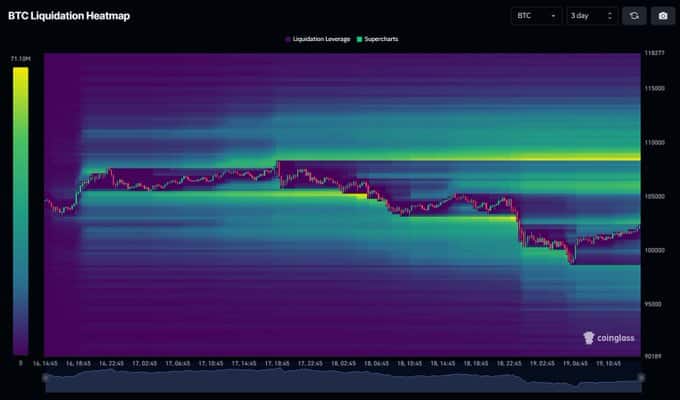

The additional examination suggests that Bitcoin could potentially be traded at levels higher than its prior peaks, due in part to the accumulation of significant liquidity near the $108,500 mark, according to analyst Mister Crypto’s observations.

Clusters of liquidity attract changes in prices, as assets tend to move towards these areas to settle outstanding trades before resuming their course.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This configuration implies that there’s a high probability that Bitcoin will attract buyers once again, particularly since optimistic discussions about its potential continue to prevail in the marketplace.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-21 03:03