- Bitcoin ETFs face $671.9M outflow, ending a 15-day streak as crypto prices plummet.

- Fidelity, Grayscale lead ETF sell-off as $1B is liquidated across the crypto market in 24 hours.

As an analyst with over two decades of experience in financial markets and a keen interest in the digital asset space, I’ve witnessed numerous market cycles and learned that sentiment plays a crucial role in shaping market behavior. The recent outflows from Bitcoin ETFs and the subsequent price drop are not unusual in this volatile landscape.

On December 19th, there was an unprecedented one-day withdrawal of approximately $671.9 million from Bitcoin exchange-traded funds (ETFs) operating in the United States.

Today’s event represents the greatest withdrawal since their initial release, breaking a 15-day series of deposits for Bitcoin ETFs and a 18-day sequence for Ethereum [ETH] ETFs.

According to information from Farside Investors, it was Fidelity’s FBTC that experienced the most significant withdrawals, totaling approximately $208.5 million. This was closely followed by Grayscale’s GBTC and ARK Invest’s ARKB, with withdrawals of around $208.6 million and $108.4 million respectively.

In contrast, BlackRock’s IBIT ETF remained unchanged, with no reported net outflows or inflows.

Market sell-off accompanies crypto price drops

In the same timeframe, noticeable drops occurred in Bitcoin and Ethereum prices, which mirrored significant decreases. Specifically, Bitcoin fell by approximately 9.2%, reaching roughly $93,145.17, and Ethereum saw a sharper decrease of about 15.6%. Additionally, during this period, over $1 billion worth of crypto positions were terminated.

As a crypto investor, I noticed a significant drop in the total net assets of Bitcoin ETFs. According to Sosovalue data, as of the 19th of December, the value stood at $109.7 billion, a stark decrease from $121.7 billion just two days prior. This steep decline wiped out most of the gains we had seen earlier in December.

The rapid decrease in Bitcoin’s value confirmed its stronghold over the cryptocurrency market, holding a share of approximately 57.4%. Despite the recent market chaos, it continues to hold the top spot as the most prominent digital currency.

Federal Reserve policy and broader economic concerns

The drop in cryptocurrency markets is not only related to internal issues; it’s also connected to broader economic concerns worldwide. Investors expected a 0.25% reduction in interest rates by the U.S. Federal Reserve, but the remarks from Chair Jerome Powell hinted at a more conservative approach.

According to Powell’s statements, we might anticipate just two interest rate reductions in the year 2025. This suggests a more gradual tightening of monetary policy compared to what was previously assumed.

The tough stance taken by the Federal Reserve influenced conventional markets noticeably; for instance, the S&P 500 experienced a drop. It’s thought that this uncertainty might have exerted additional pressure on the cryptocurrency market too, as investors moved their risk appetite away from growth assets.

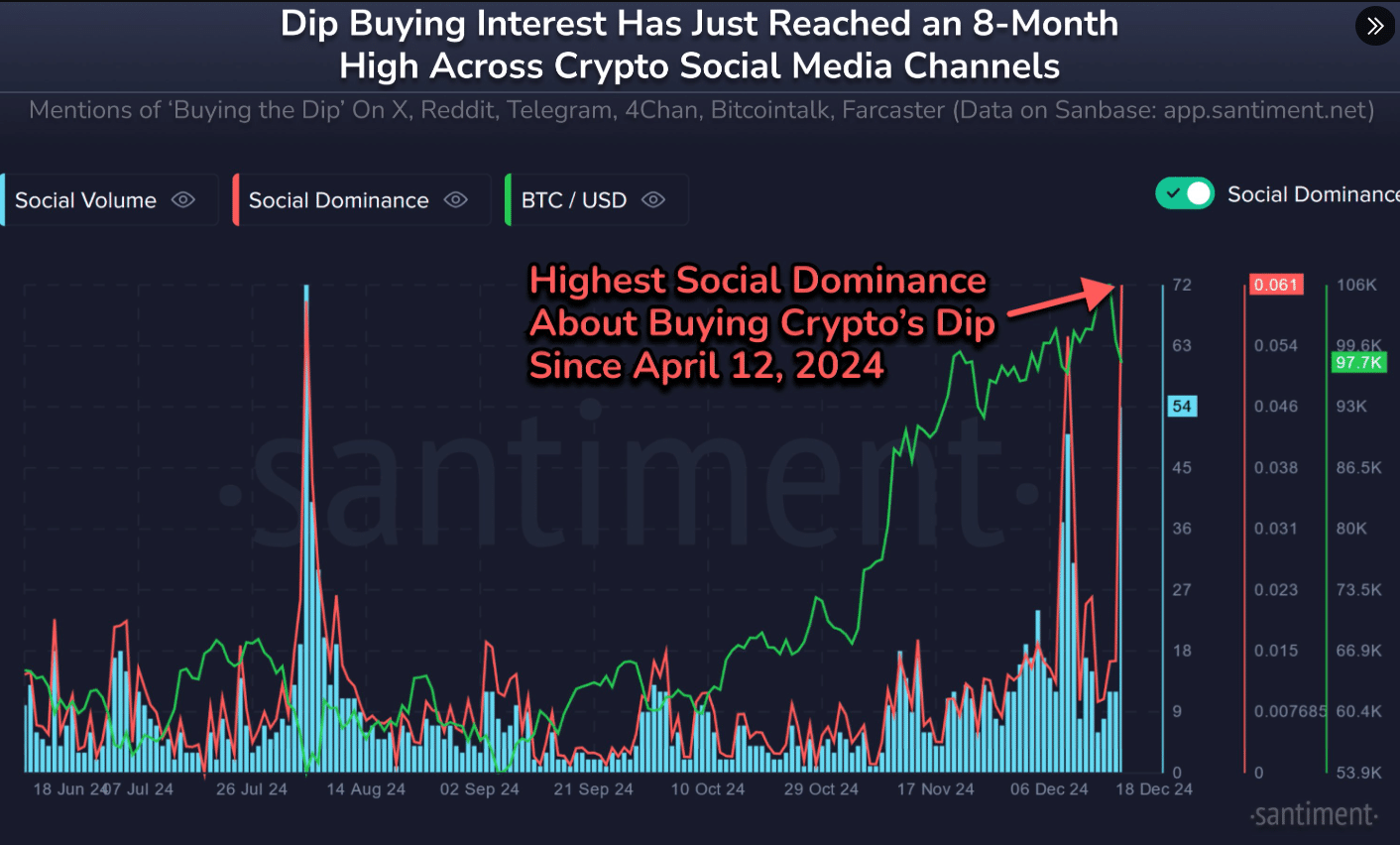

Increased “buy the dip” sentiment amidst market uncertainty

In contrast to the market’s decline, there was a noticeable increase in conversations about buying stocks at lower prices, or “buying the dip,” on various social media outlets. According to information from Santiment, discussions about this strategy peaked at levels not seen in more than eight months.

Previously, the intensity of this feeling was highest back in April. During that time, the value of Bitcoin plummeted from $70,000 down to $67,000, and then it kept on dropping further.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite some traders adopting a careful stance, the resumed conversations indicate that a segment of investors maintain a positive outlook, believing there could be chances for recuperation in the cryptocurrency market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-21 09:11