- Altcoin resumed its decline, approaching a month-long consolidation range that it previously broke out of.

- Technical indicators revealed a strongly bearish market

As a seasoned crypto investor with battle scars from countless market cycles, I’ve learned to read the charts like an ancient prophecy. The current state of AXS is a stark reminder of why we always buckle our seatbelts before entering the wild west of cryptoland.

After a seven-day period marked by decline, during which AXS lost approximately 15.22%, optimistic traders, or bulls, have regained momentum. Their actions over the past day have boosted the asset value by an encouraging 10.22%, providing a hint of optimism.

Nevertheless, a closer examination by AMBCrypto revealed that Axie Infinity’s token, AXS, appeared to be in a bearish trend at the moment. It’s possible that this downward movement may intensify, leading to further declines in the value of AXS on the price charts.

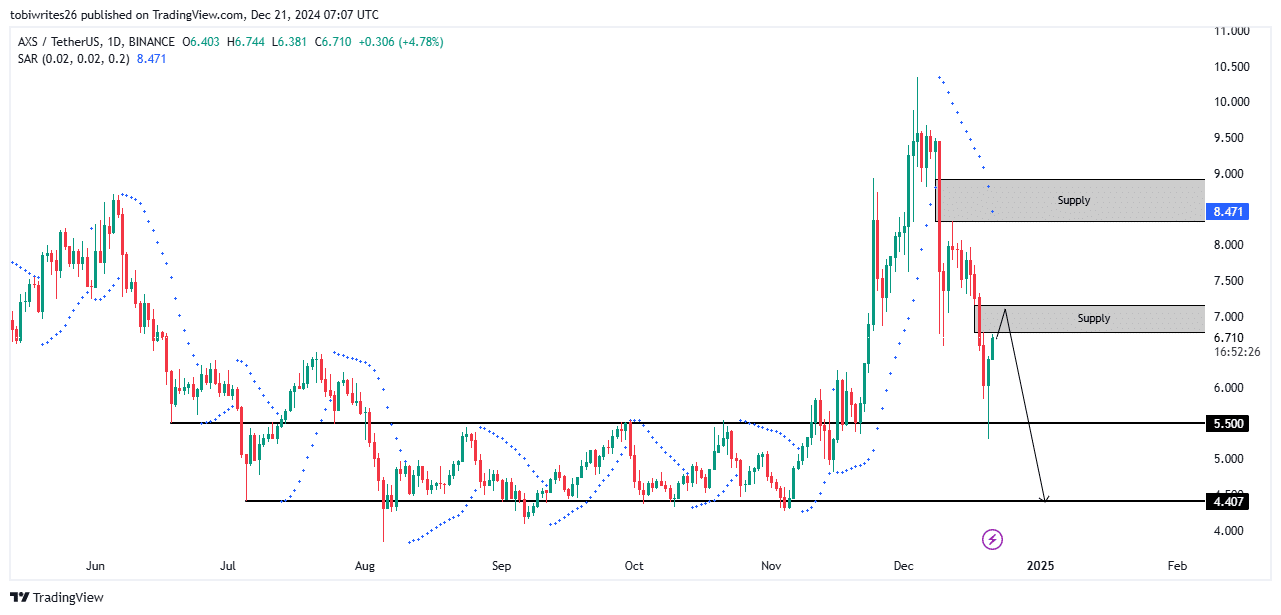

A return to consolidation

Over the past two weeks, AXS has experienced a significant drop, amounting to approximately 48.67% in value between December 4th and December 20th. However, after hitting a resistance area, which has now turned into support, it has shown signs of recovery with recent daily gains. As of now, the altcoin appears to be trending back towards its lower price range for consolidation.

Consequently, the bounce propelled AXS into a region of increased supply ranging from $6.78 to $7.156. Intense selling activity might cause the price to drop further in this area.

According to AMBCrypto’s analysis, if selling pressure increases significantly, AXS could potentially return to the price range it left behind in November, which might result in a continued decrease in its value.

If the support level doesn’t hold, the asset might increase towards another high resistance point before continuing its downward trend again.

As a researcher, I’ve found that my recent technical analysis aligns with the ongoing bearish sentiment, indicating a prolonged period of market weakness, as per AMBCrypto’s findings.

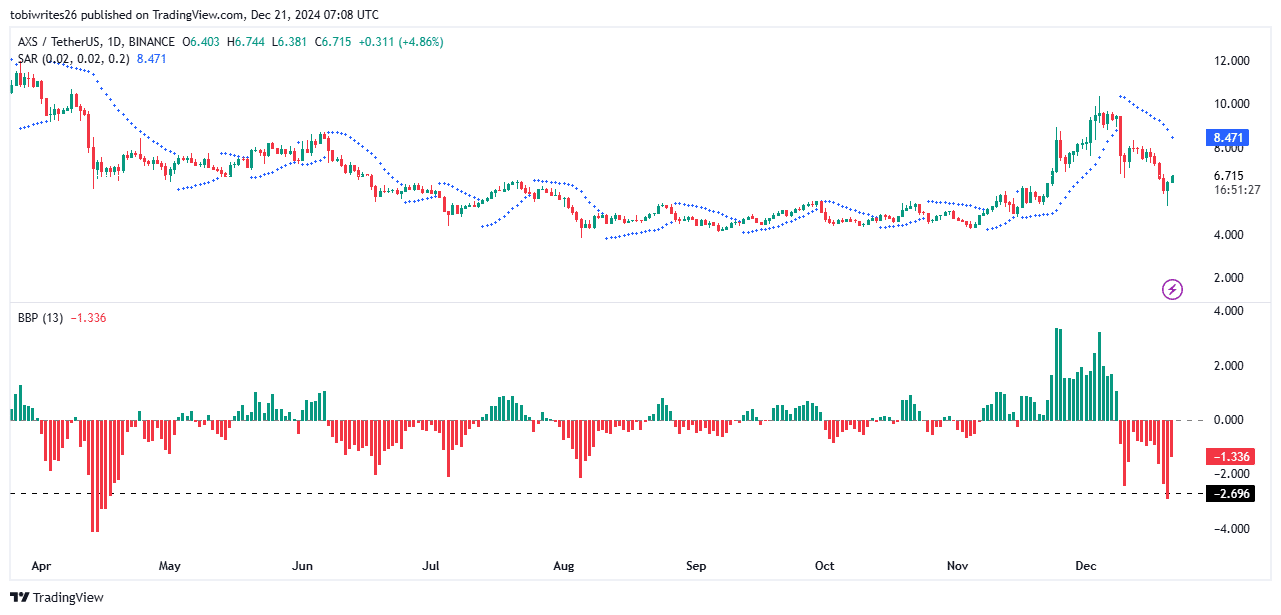

Bears take control

As I analyze current market conditions at this moment, it’s clear that AXS is experiencing considerable downward pressure from bearish forces. The Bull-Bear Power (BBP) indicator, a tool used to assess market control, indicates that the bears are currently in control, contributing to the ongoing price decline.

The increase in selling activity was clearly indicated by momentum indicators, reaching a low not seen since April 2022. This negative trend persisted as the indicator dropped even further.

In a similar fashion, the Parabolic SAR (Stop and Reverse) lines were plotted above the AXS’s value, as denoted by the dashed marks on the graph. This pattern implied significant selling force, hinting at a potential decrease in AXS’s price.

If these trends continue, the decrease from the supply area might pick up speed, potentially causing a more dramatic drop in prices.

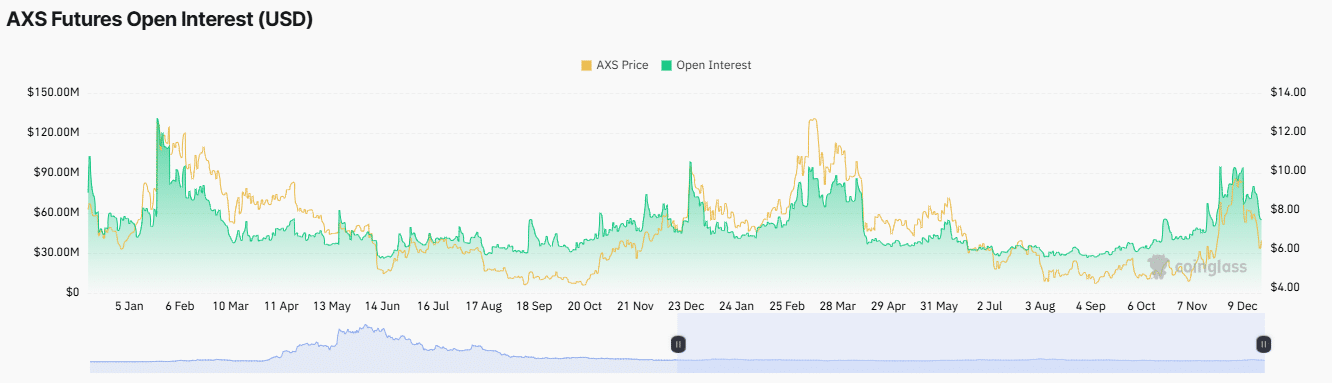

Selling pressure from derivatives traders

Ultimately, traders who specialize in derivatives have recently been offloading their AXS holdings, since both the Funding Rate and the number of active contracts (Open Interest) have been decreasing.

As a researcher, I’ve observed that the Funding Rate, a mechanism that sets fees for maintaining price parity between spot and derivative markets, suggests a prevalence of short selling activity. This implies that short sellers have been holding significant control in the market.

Indeed, the Funding Rate dipped below zero, reaching -0.0253%. This indicates that traders are generally pessimistic about the market’s direction.

Furthermore, the Open Interest decreased as well, dropping by 2.53% to reach $56.12 million. This decrease indicates that there are more short contracts compared to long positions currently, which could intensify the bearish influence on AXS’s price.

Should these patterns continue, the negative trend in the derivatives market might lead to a further decrease in the asset’s worth.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-12-21 17:11