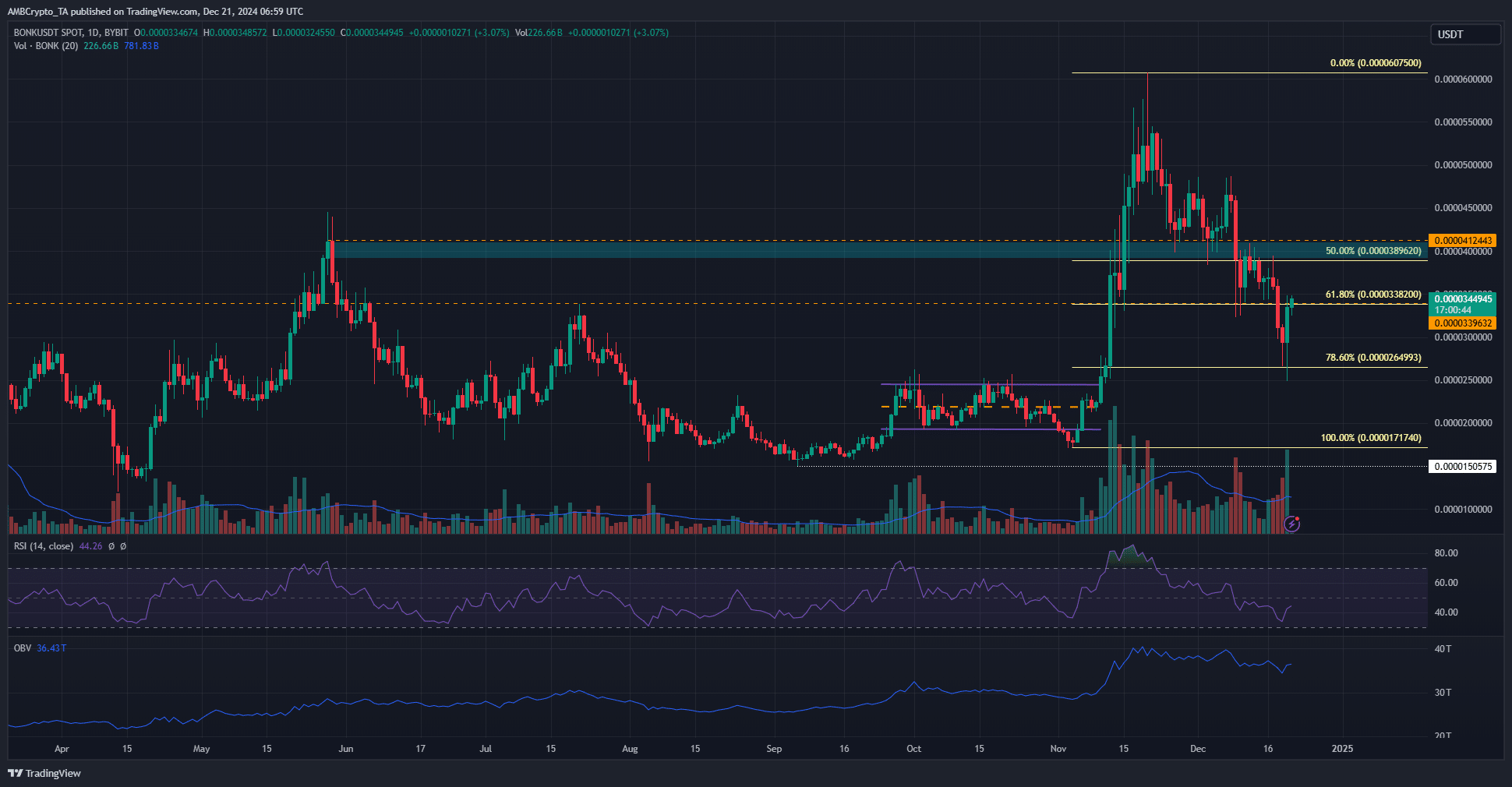

- BONK’s RSI and OBV revealed strong bearishness over the past month

- A bounce to $0.00004 might be likely, but whether the market structure can shift bullishly would depend on capital inflows

As a seasoned crypto investor with battle-scars from multiple market cycles, I can’t help but feel a mix of caution and hope when analyzing BONK’s current situation. The steep decline over the past month, coupled with the bearish RSI and OBV indicators, certainly raises red flags. However, the recent 39% surge from the local lows at $0.0000248 has given me a glimmer of hope.

Over a period of 30 days spanning from November 20 to December 20, the value of BONK dropped by a significant 59%. During this continuous decline, there were notable instances of high selling volume on specific dates, such as December 9, when Bitcoin [BTC] experienced a rejection at the $100k mark.

Ever since, my memecoin has been battling to maintain crucial resistance points. To be frank, the recent Bitcoin dip pushed BONK towards yet another important support level at approximately 0.0000265 USD.

BONK bulls attempt to scale the $0.0000338 resistance

Yesterday’s Relative Strength Index (RSI) for BONK stood at 44, indicating a downward trend or bearish momentum as it’s below the neutral level of 50. Over the past month, On-Balance Volume (OBV) has shown a pattern of lower highs and lower lows, suggesting a continuous weakening in the market. Alongside consistent losses since mid-November, this trend suggests that the bears are still dominating the market.

Due to the recent decline, the memecoin reached a point for re-evaluation at the 78.6% Fibonacci level ($0.0000264), but it didn’t dip below this mark in its daily close. Starting from the lows of $0.0000248 hit on Friday, the value of the altcoin has surged by approximately 39% since then.

In simpler terms, a particular price point of $0.00004 has historically provided support (a level where the price tends to bounce back). However, in the past few weeks, this same price point has become a barrier for the price increase, acting as resistance. Analysts believe that it will act as strong resistance again. If the market closes above $0.0000394 during a daily session, it would change the overall market structure to bullish (indicating a potential price increase).

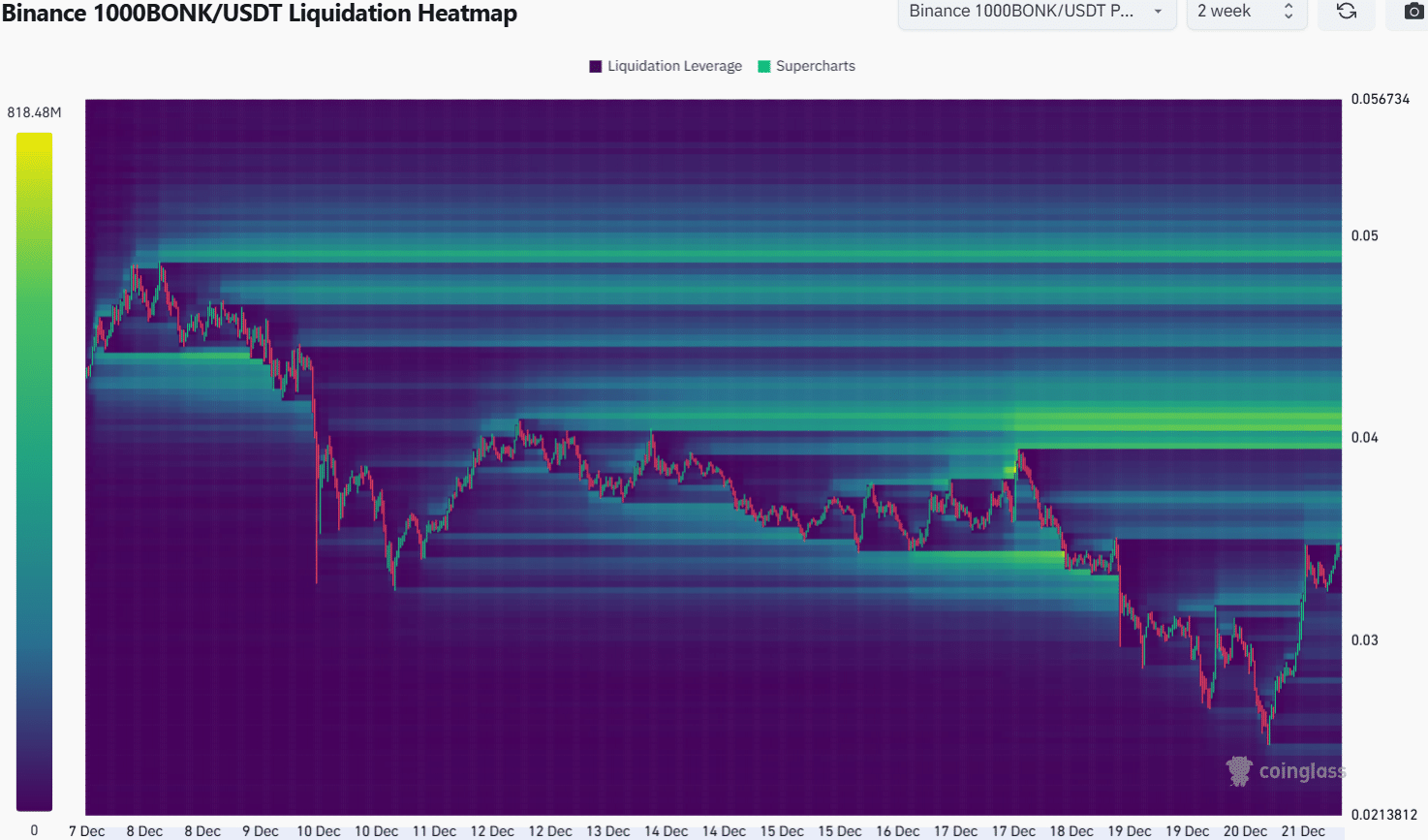

Liquidation levels agree with technical findings

On the daily chart, there was a significant cluster of potential liquidation points within the $0.00004 resistance area, as revealed by the 2-week liquidation heatmap.

According to AMBCrypto’s analysis, the liquidity in the southern region appears thin. Consequently, it seems quite probable that we will see another attempt to break through the resistance in the upcoming days.

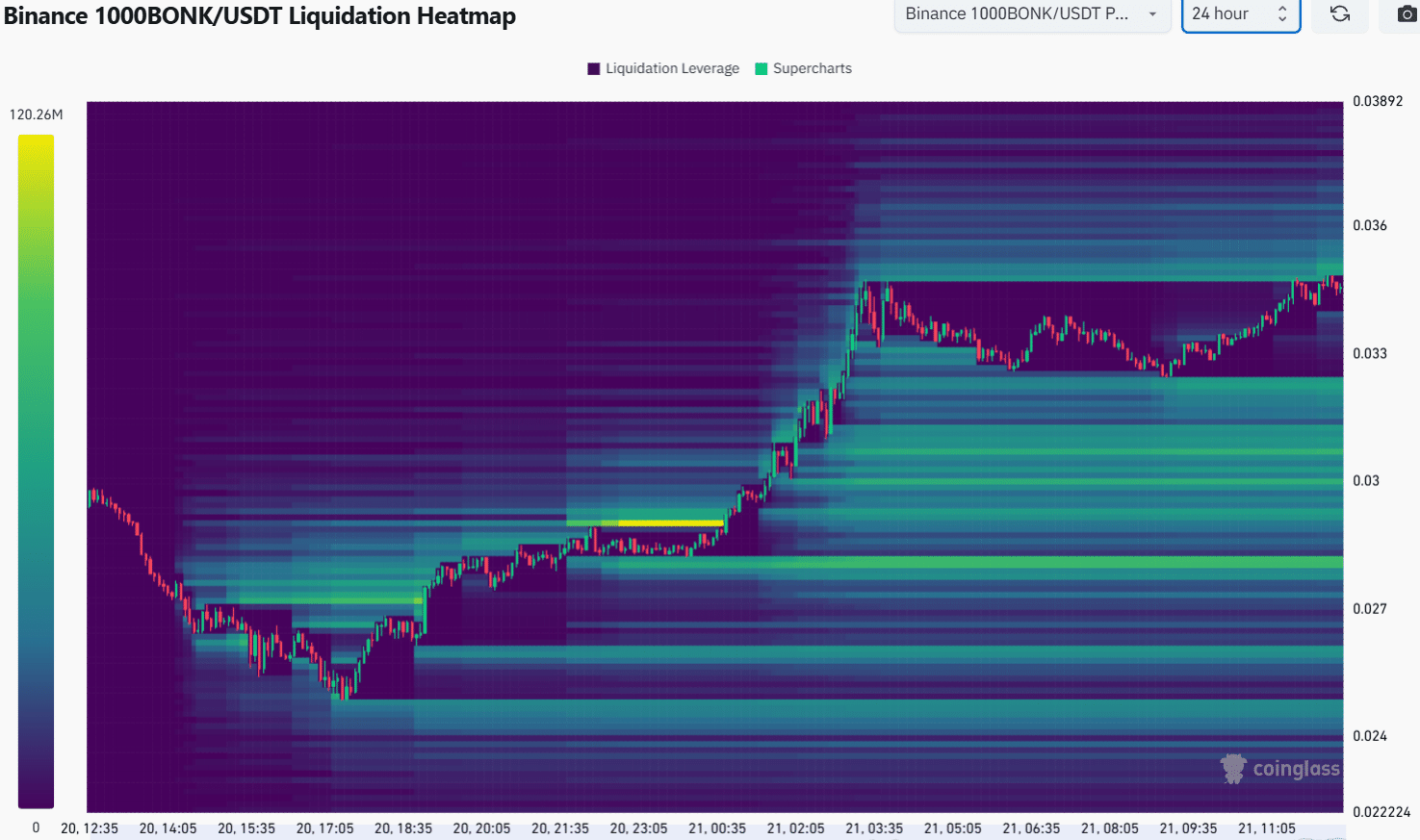

Based on the 24-hour market heatmap, there seems to be a possibility of a price range formation between approximately 0.0000322 and 0.000035. This suggests that the increased liquidity around the 0.000035 mark in recent days might lead to a temporary downward price movement, or bearish reversal.

Is your portfolio green? Check the Bonk Profit Calculator

As a researcher, I found an intriguing observation: The magnetic pull around the 0.00004 mark appeared significantly stronger. Regardless of potential price fluctuations over the following day or two, my projection for the upcoming week points towards the 0.00004 resistance as a potential target.

Read More

2024-12-21 19:03