- XRP has declined again after a slight rebound in the last trading session.

- Whales remained in the accumulation mode despite price decline.

As a seasoned researcher with years of experience in the cryptospace, I have seen my fair share of market fluctuations, and the recent trend of Ripple (XRP) certainly caught my attention. The persistent whale accumulation despite the price decline is reminiscent of the classic “buy the dip” strategy that we often observe during market downturns.

The drop in Ripple’s [XRP] price has sparked interest among big investors, as data from the blockchain shows a noticeable increase in ‘whales’ buying XRP.

With a balanced MVRM (Market Value to Realized Value Ratio) and the price holding steady near significant support points, this could indicate a possible bullish turnaround for the cryptocurrency.

Ripple whale accumulation in full swing

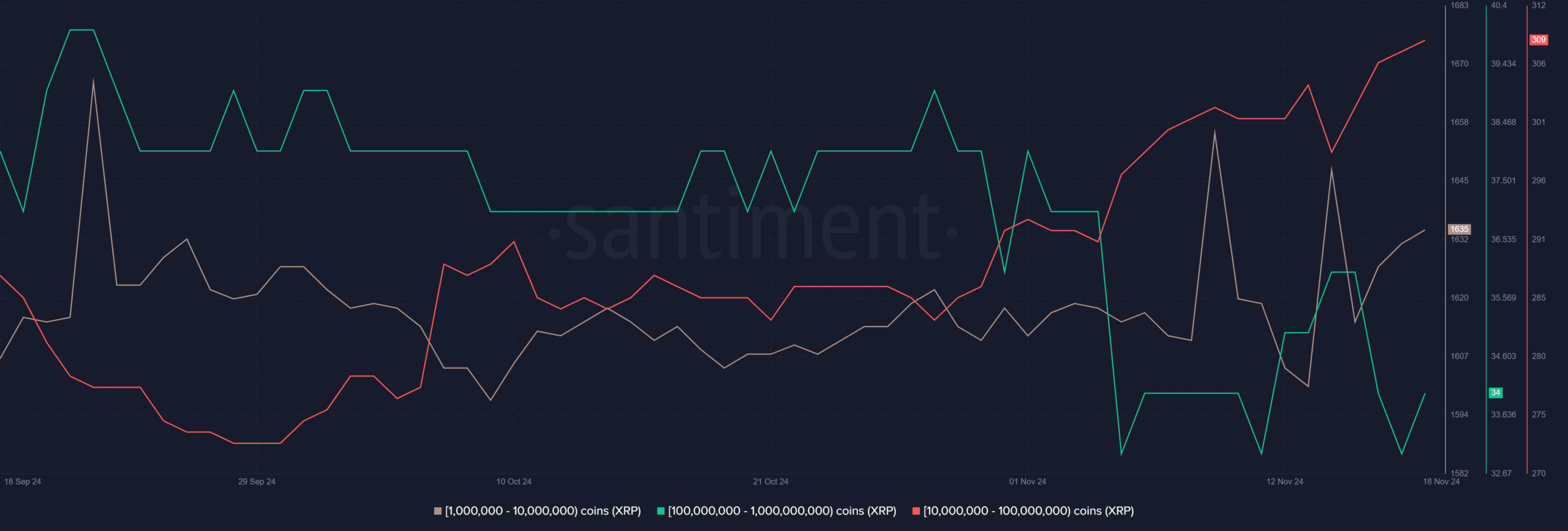

The Chart for Whale Holdings of Ripple demonstrates a consistent rise in the amount of Ripple held by significant investors. Examining wallets containing between 1 million and 100 million XRP reveals an upsurge in hoarding activities.

As the accumulation period grew stronger, the price of XRP was under continuous decline, indicating that significant investors were employing a well-known “buy at a discount” or “dip buying” approach.

Historically, the build-up of whales (large investors) during market declines frequently indicates impending price increases, as they typically prepare for substantial bullish trends by strategically positioning their investments.

The current trend highlights growing confidence in XRP’s medium-to-long-term recovery.

Key support levels provide stability

The price of Ripple has been holding steady around $2.32 due to a robust foundation provided by its 50-day moving average, which stands at approximately $1.59 on the XRP Price graph.

Even though the token had difficulty surpassing the $2.46 Fibonacci resistance point, its persistence in staying above essential moving averages suggests a positive market outlook beneath the surface.

Strong trading activity continues, suggesting ongoing market engagement. The combination of large investors stockpiling and less supply being offered for sale boosts XRP’s capacity to surmount existing obstacles, potentially leading to a recovery.

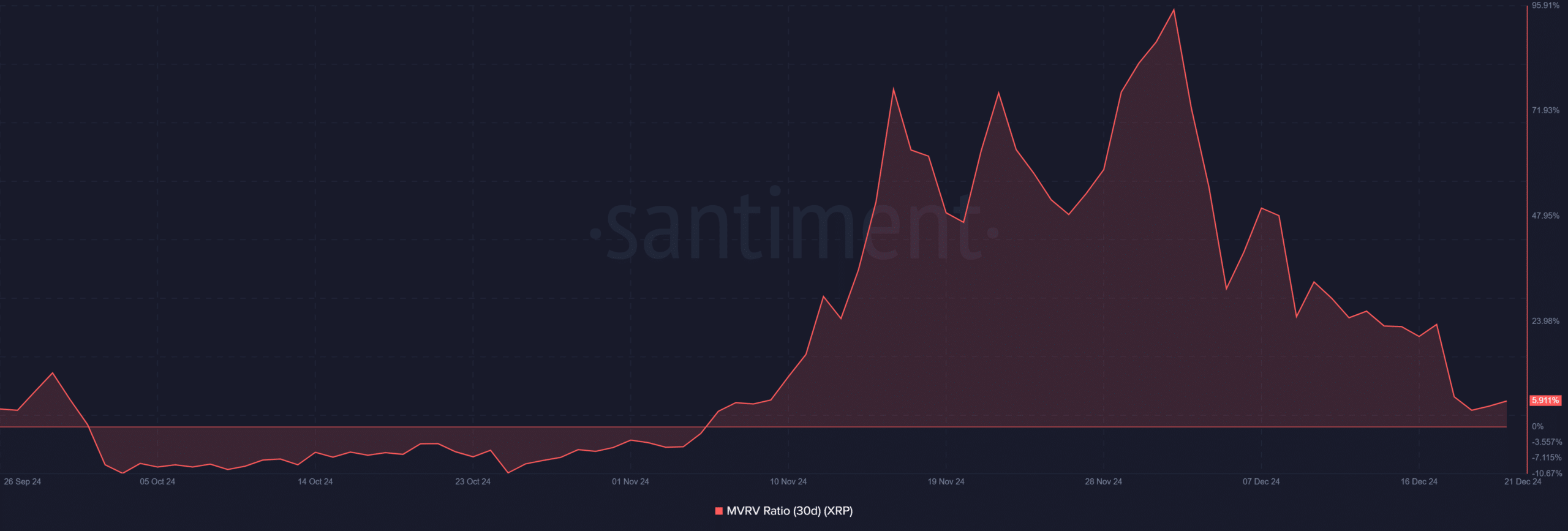

MVRV ratio indicates waning sell pressure

Based on data from Santiment, the 30-day MVRV (Made-vs-Realized Value) Ratio graph shows a substantial drop to around 5.91%. This trend suggests that Ripple investors who bought the token over the last month are less likely to sell for profit.

A lower MVRV (Mempool Value to Realized Value) ratio tends to decrease the probability of immediate sell-offs, as it corresponds with the ongoing period where large investors (whales) are amassing more assets.

A combination of less selling by traders, higher involvement from large investors, and the price consistently staying above important support points indicates a tentatively positive perspective on XRP’s future performance.

As long as resistance holds around $2.46, various signs suggest that the price might rise over the next few weeks.

– Realistic or not, here’s XRP market cap in BTC’s terms

The present market situation of XRP, marked by the hoarding of large amounts by ‘whales’ and less urge to sell, lays a strong base for its possible revival.

When the value of the token reaches crucial points, attention in the market turns towards if it can surpass resistance and continue its upward trend. The upcoming trading days should give us insight into whether XRP’s strength results in a prolonged bullish surge.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-22 03:04