- Ethereum accumulating address holdings have surged by 60% since August 2024

- Volatility took charge of Ethereum’s price action over the last 48 -72 hours

As a seasoned crypto investor with over a decade of experience navigating the volatile waters of the digital asset market, I have learned to appreciate the ebb and flow of the tides, and the importance of long-term strategies in this dynamic landscape.

After reaching a peak of $4,109, the Ethereum price chart has experienced a significant market downturn. In fact, before its recent surge that increased it by more than 7% in 24 hours, ETH had fallen to as low as $3,095.

Discussions about the market adjustment were widespread among major players, as per CryptoQuant’s analyst Mac D. He suggests that the correction could potentially be influenced by broader economic conditions.

By the time the news was published, it was clear that the altcoin needed to recover since its investors were still buying it.)

ETH accumulation address holdings surge

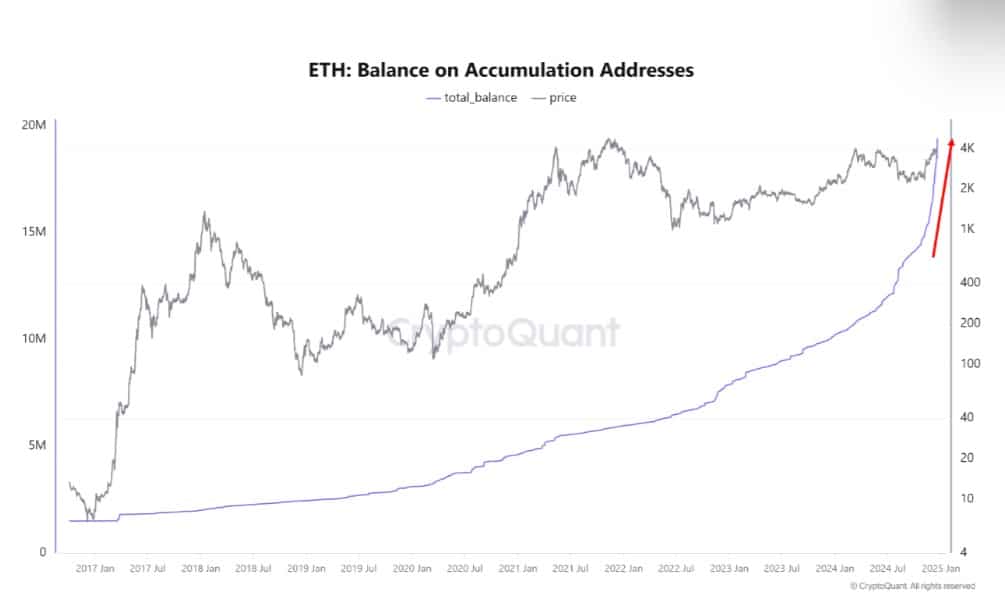

As per CryptoQuant’s analysis, the number of Ethereum addresses amassing coins has seen a substantial increase recently, exceeding growth rates from past market cycles.

From the data we’ve examined, there was a significant rise in the number of registered addresses for Ethereum (ETH) in August, marking an increase of approximately 16% or around 19.4 million ETH tokens out of a total supply of 120 million ETH. In terms of growth rate, this surge represented a considerable 60% jump from a 10% increase in August to a 16% increase by December 2024. This rapid escalation was unlike any other observed during previous Ethereum cycles.

The increase in Ethereum (ETH) addresses highlights a broad consensus among market participants about potential pro-cryptocurrency initiatives from the Trump administration. Furthermore, this trend implies that even with its volatile pricing, shrewd investors are likely to keep investing in Ethereum.

In the immediate future, a market adjustment seems inevitable due to broader economic conditions. However, over the long haul, the growth potential for ETH remains robust as more and more investors purchase it and the number of accumulation wallets continues to grow.

Impact on altcoin’s price

Just as anticipated, an increase in Ethereum’s accumulation significantly influenced its price trend. To illustrate, during the accumulation phase, Ethereum’s value climbed substantially, rising from a minimum of $2,116 to a peak of $4,109.

Currently, as I’m typing this, Ethereum is being traded at approximately $3,504. This value represents an increase of more than 5% compared to its price 24 hours ago.

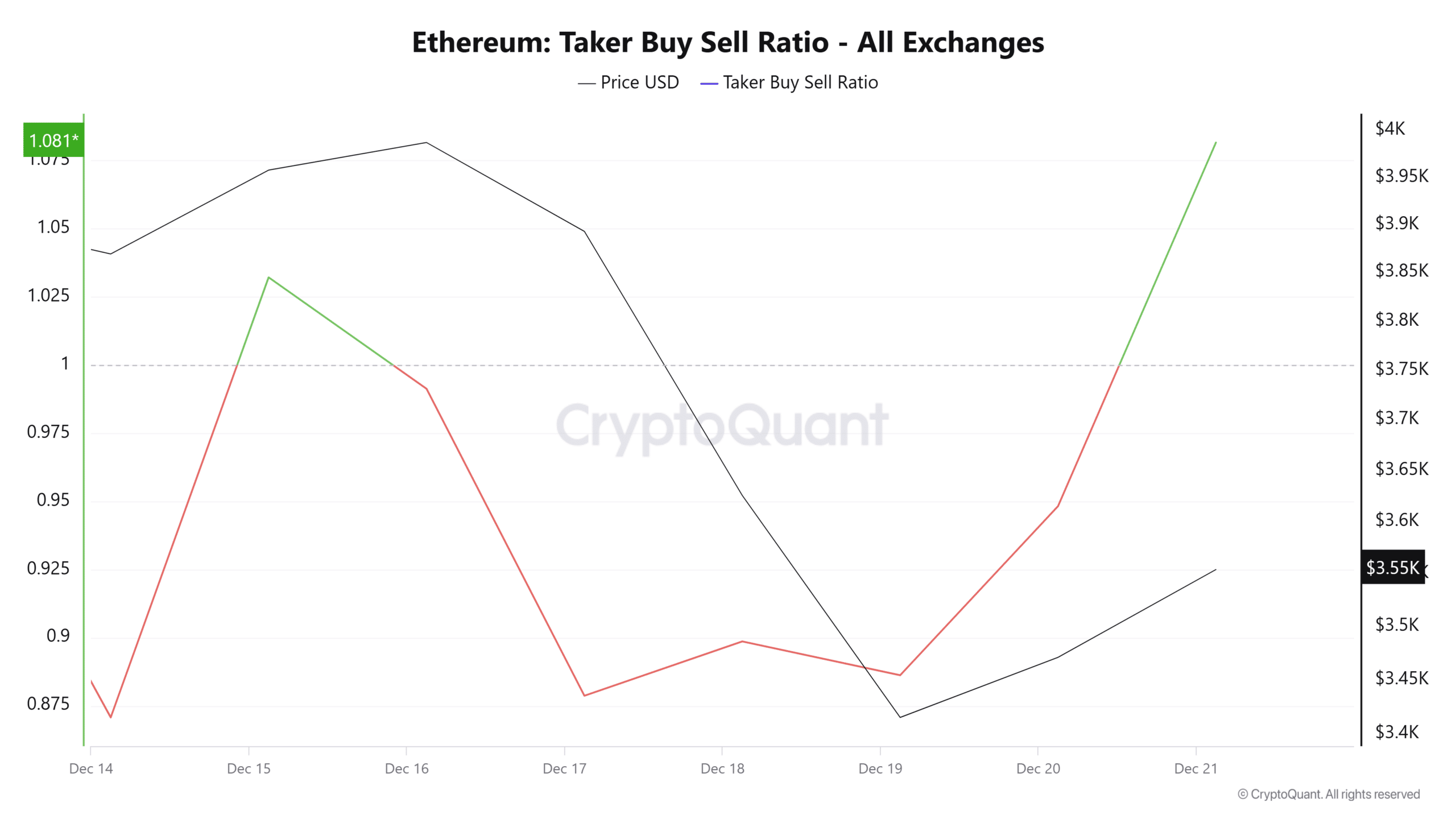

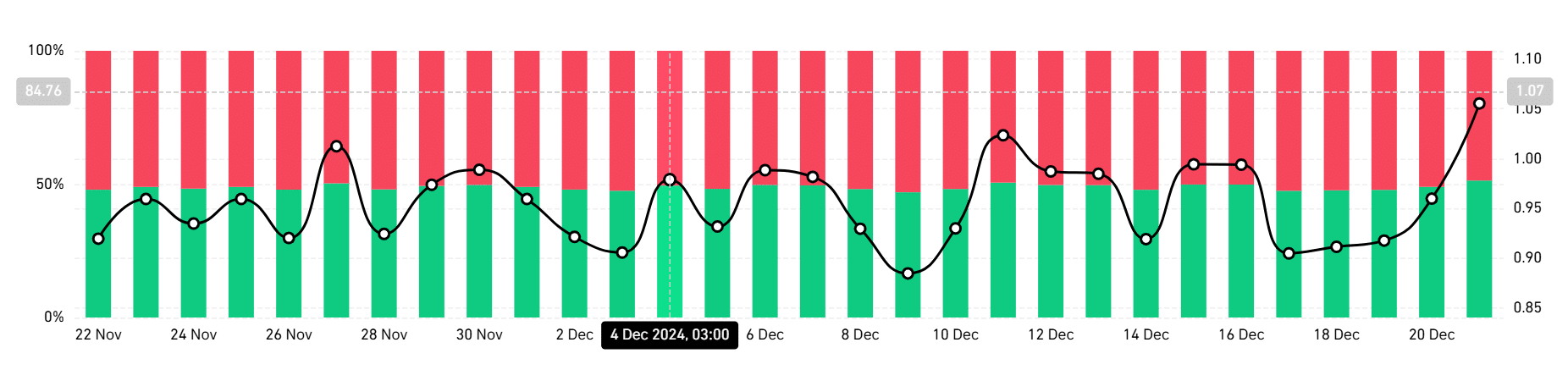

The significant increase in purchases has primarily fueled this reversal trend we’re observing. This surge is evident when looking at the Taker Buy/Sell ratio, which peaked at 1.08 as of the current report.

This trek suggests that buyers are showing greater eagerness than sellers. Consequently, it’s possible that the current demand could surpass the available supply.

Similarly, this buying pressure suggests a strong optimism among traders, as shown by the increased number of investors choosing to buy (go long). In fact, at the moment, these long position holders are controlling the market, accounting for about 51%. This indicates a general expectation that prices will continue to rise.

To summarize, as more investors opt to invest in Ethereum, this cryptocurrency could be primed for additional growth. Increased ownership by investors generates increased demand, leading to higher buying pressure. This surge in demand can potentially create a shortage of supply, which puts substantial upward pressure on the price of Ethereum.

If the rate of increasing addresses persists, there’s a possibility that Ethereum might regain the price level of around $3,713. On the other hand, a similar dip as witnessed recently could cause Ethereum to slide down to approximately $3,300.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-22 04:08