- Aave’s ecosystem thrived with strong user engagement, increasing transactions, and diversified protocol adoption.

- Governance and bullish technical indicators solidified Aave’s leadership and highlighted sustained market confidence.

As a seasoned analyst with years of experience navigating the tumultuous seas of the crypto market, I can confidently say that Aave [AAVE] is not just weathering the storm – it’s surfing the wave. The platform’s impressive TVL, strategic moves like GHO and wrapped assets integration, and robust user engagement metrics paint a picture of a thriving ecosystem.

Aave, a leading player in the field of Decentralized Finance (DeFi), consistently pushes boundaries through its advanced system. Boasting a total value locked (TVL) of $22 billion, it serves as a pillar in the DeFi sector.

The strategy of this platform, demonstrated by the launch of the GHO stablecoin and the integration of assets like WETH and WBTC (wrapped versions of Ethereum and Bitcoin), clearly indicates a commitment towards expanding liquidity sources and adapting to changing market requirements.

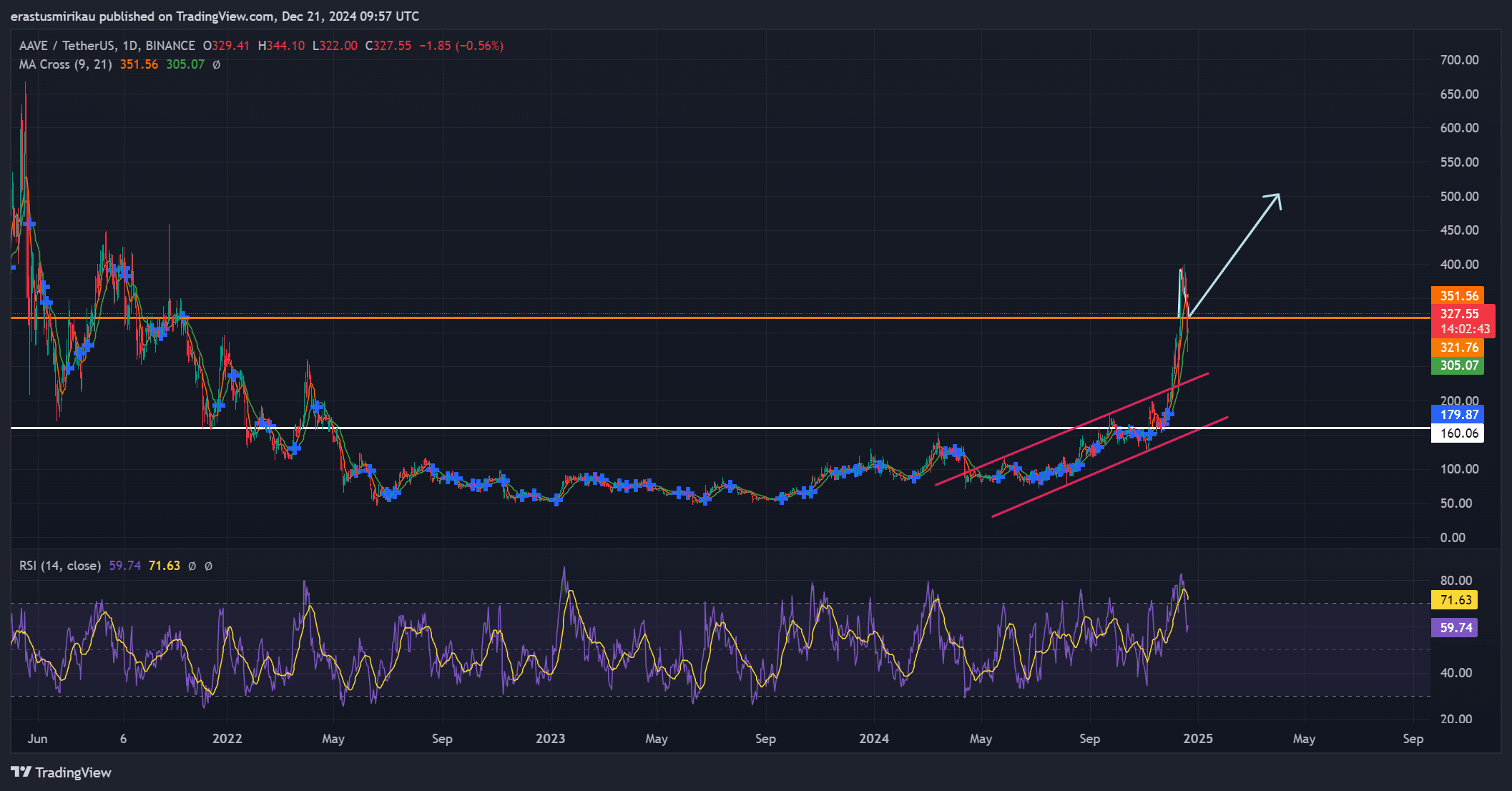

As of now, Aave is being exchanged for approximately $331.01, marking a significant 13.05% rise over the last day. This substantial price hike prompts an intriguing query: Will Aave maintain its upward trajectory and continue to stand as a leader in its field?

Are users driving AAVE’s ecosystem forward?

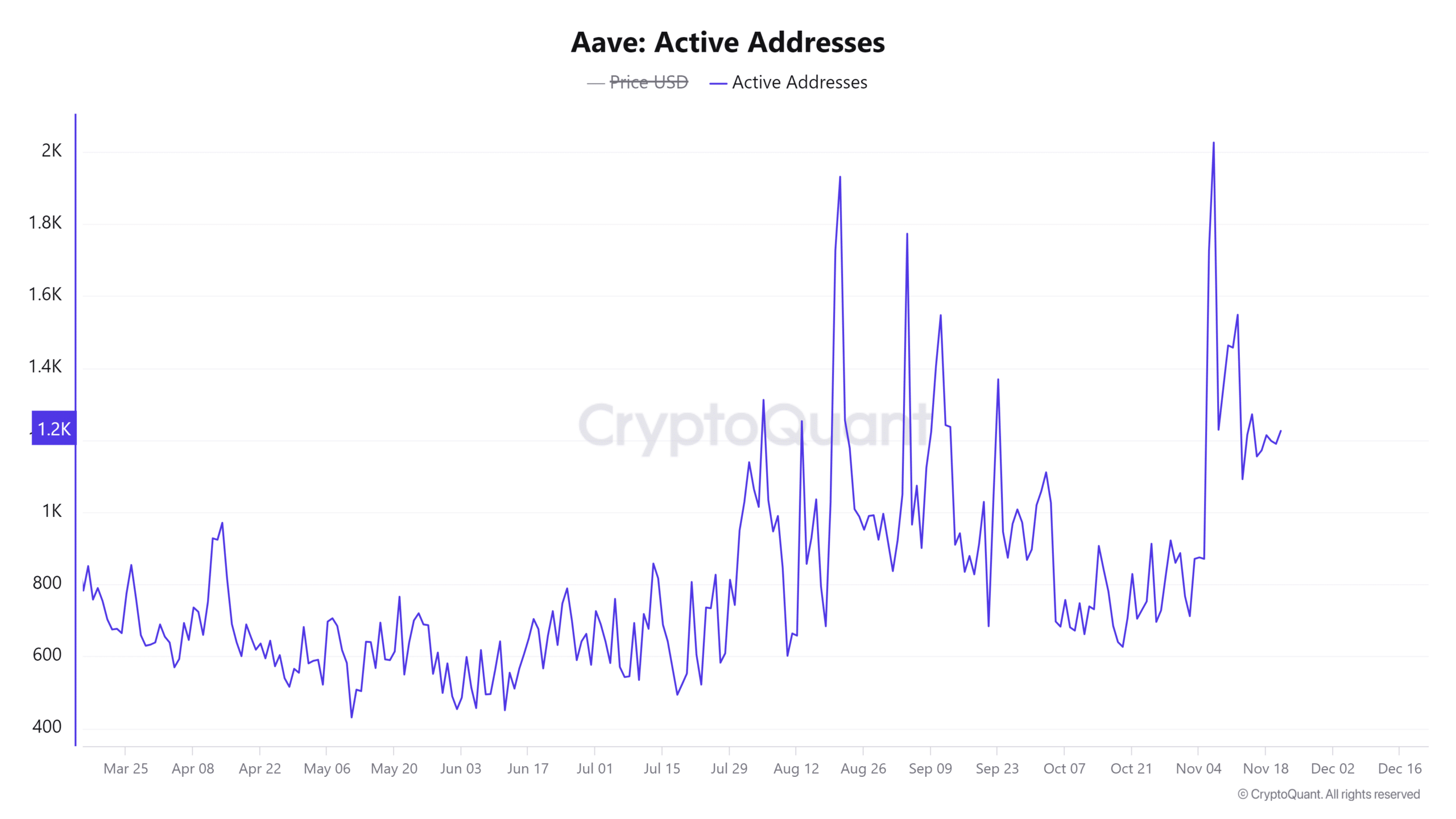

User interaction continues to be crucial for Aave’s prosperity. Daily statistics on active addresses reveal a 1.09% increase, indicating that 168.75 distinct addresses are currently engaging with the platform.

This regular behavior shows that users have faith in the altcoin’s services. Furthermore, we observed a 1% rise in the number of transactions, totaling 5,772 in the past day.

These figures underline the steady expansion of its user base and growing interaction within the ecosystem, highlighting the platform’s relevance and reliability.

How AAVE protocol adoption supports expansion

1) The widespread acceptance of the protocol is fueled by its knack for innovation and providing diverse problem-solving options. The introduction of the GHO stablecoin has enhanced liquidity, giving users a reliable, decentralized choice for an asset.

Furthermore, the inclusion of Wrapped Ethereum (wETH) and Wrapped Bitcoin (wBTC) expands its attractiveness, allowing conventional cryptocurrency users an effortless means to engage in Decentralized Finance (DeFi).

As a result, Aave consistently prioritizes the practical use of its protocol to keep a wide range of users engaged, simultaneously acting as a link connecting traditional and blockchain-based finance systems.

Insights about a company’s functional condition can also come from analyzing transaction and market liquidity data. It appears that the number of transactions made within the last 24 hours has grown by 1%, indicating an uptick in user engagement.

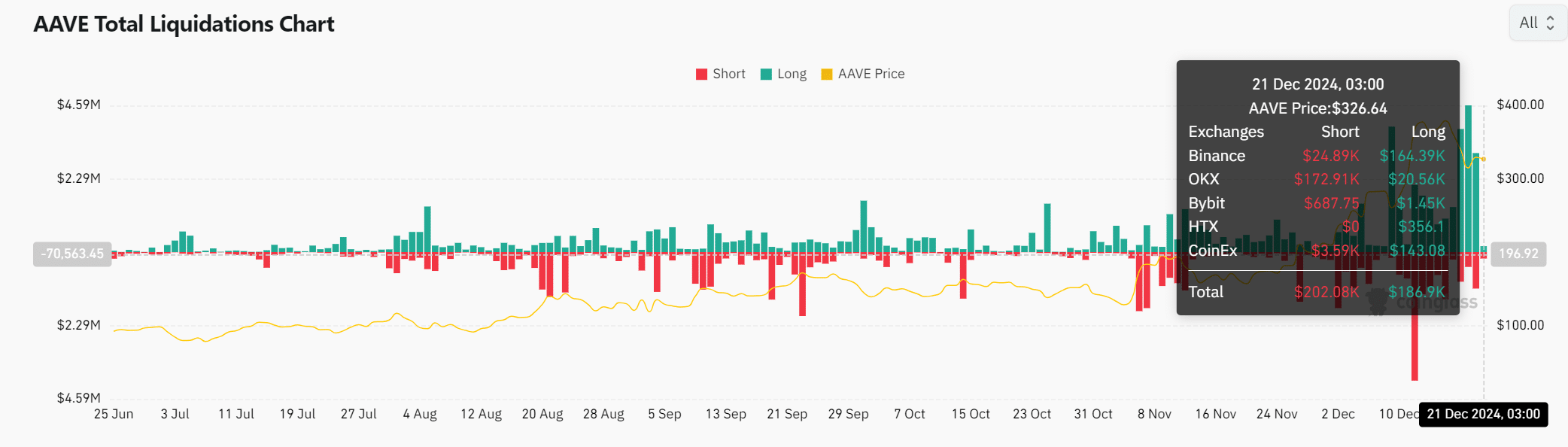

As an analyst, I can express this by saying: From my analysis, it appears that the market has maintained a stable balance, as evidenced by the liquidation data. Specifically, long liquidations amounted to $186.9K, while shorts totaled $202.08K. This suggests a resilient equilibrium in market sentiment, with both bullish and bearish positions holding roughly equal ground.

What do the charts say about price trends?

Lately, Aave’s price trend shows a positive outlook, indicating a bullish stance among investors. The Relative Strength Index (RSI) at 71.63 indicates robust momentum, even though it is approaching the threshold for being overbought.

Furthermore, the Moving Average cross indicators sustained an uptrend, and the significant resistance level was marked at $351.56.

With a mix of both long and short holdings in the liquidation data, the graphs seem to indicate that the market has faith in the altcoin’s ability to perform well.

Read Aave’s [AAVE] Price Prediction 2024-25

In summary, Aave’s knack for fostering user participation, continuously improving its system, and utilizing decentralized decision-making keeps it at the forefront of Decentralized Finance (DeFi).

Its consistent growth and adaptability position it to sustain momentum and lead the space forward.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- LUNC PREDICTION. LUNC cryptocurrency

2024-12-22 09:11