- Solana network activity maintains positive trajectory the bearish market conditions.

- Assessing the chances of SOL entering recovery mode after a bearish week.

As an analyst with over two decades of experience in the crypto market, I must say that the Solana network’s resilience and activity during these bearish times is quite impressive. It seems to be thriving against all odds, much like a phoenix rising from the ashes.

Despite the recent market slowdown, the Solana [SOL] blockchain continues to show indications of a lively network operation. The impact of ‘bears’ has been noticeable in dampening the market enthusiasm that was prominent in November and more recently.

Solana’s business operations continue uninterrupted, as demonstrated by its recent surge in activity. To put this into perspective, the network’s Total Value Locked (TVL) has just reached a new peak for 2024, standing at approximately 55.37 million SOL. It’s important to consider TVL in terms of SOL rather than dollar value due to fluctuations in the price of SOL.

source: DeFiLlama

A rise in Total Value Locked (TVL) tends to signal a long-term positive outlook, as well as active network participation. Despite the current market’s bearish trend, Solana’s on-chain activity has maintained a high level. In fact, the daily volume for the past two days averaged over $3 billion.

The data from Solana transactions indicates a surge in network activity, as the number of transactions has been steadily increasing for several months. In fact, the highest number of transactions ever recorded on the Solana network occurred just within the past day – a staggering 67.77 million transactions! This is the most significant transaction count we’ve seen in the last eleven months.

Source; DeFiLlama

Is SOL ready for a bullish comeback?

Lately, we’ve seen an increase in network activity, which might suggest a rise in organic interest for Solana’s native cryptocurrency. Yet, it’s important to note that the broader market has been experiencing a downturn, particularly over the last week, and Solana’s crypto hasn’t escaped this trend.

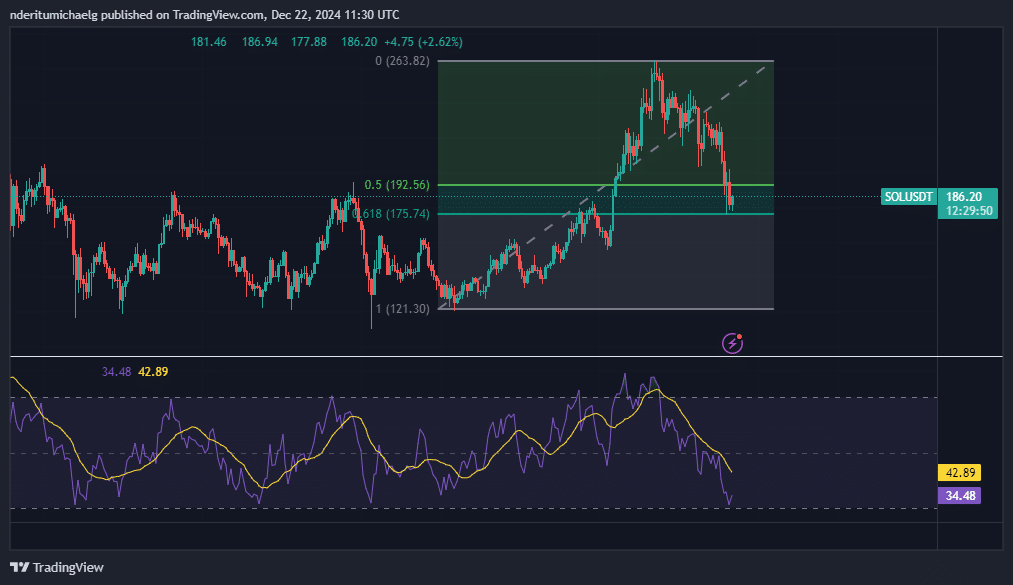

Last week, SOL experienced a drop of 23% from its peak to its trough. Interestingly, this descent allowed it to revisit a significant point. The price movement has stayed within the range defined by the 0.5 and 0.618 Fibonacci retracement levels, which were established based on the SOL’s September lows and November highs.

In the recent downturn, the Relative Strength Index (RSI) nearly dropped to overbought levels, suggesting a potential for further price decline in the near future. Yet, the trend was already hinting at bear market fatigue when this report was composed.

If a bullish recovery within the Fibonacci range seems likely, then traders should watch for indicative signals as the recent bearish aggression appears to be subsiding. However, it’s important to note that despite this, there has still been a negative flow of funds, but the intensity of these outflows has noticeably decreased over the last four days.

source: Coinglass

A decrease in outgoing activity could potentially lead to some improvement. Yet, the derivatives market suggests that Solana (SOL) might still need time before it’s prepared for a robust rebound.

In the past two days, the funding rates (based on open interest) have been below zero. This is significant because it marks the first occasion in the last six weeks where Solana’s funding rates have dipped below zero.

source: Coinglass

Keep in mind that Solana’s funding rates have recently begun to trend towards the positive end over the past day.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-23 03:04