- The falling wedge breakout signals bullish potential, targeting $24 with $10.88 as key resistance.

- Positive metrics, including oversold RSI and strong social sentiment, reinforce Polkadot’s rally potential.

As a seasoned analyst with over two decades of experience under my belt, I’ve seen bull markets come and go, but few have captivated me like Polkadot [DOT] at present. The falling wedge breakout is not just a technical pattern for me; it’s a beacon of hope that signals the start of something truly special.

On the weekly chart, Polkadot (DOT) has shattered the confines of its descending wedge formation, a significant technical indication that typically heralds robust upward price movements.

Currently priced at $6.83, showing a 1.98% drop at the moment, the ongoing breakout and retest period for this cryptocurrency looks promising for traders. The crucial point now is whether DOT can maintain this energy and surge towards its mid-term goal of reaching $24.

DOT’s breakout and price prediction

The falling wedge breakout on Polkadot’s chart highlights strong potential for a bullish reversal. The price is now facing its first major resistance at $10.88, with a midterm target at $24.

Furthermore, the latest test of the breakout point reinforces the technical forecast, implying that investors are buying at crucial points. Consequently, Polkadot’s trend seems ready for significant growth as long as the momentum continues.

Analyzing the stochastic RSI and moving averages

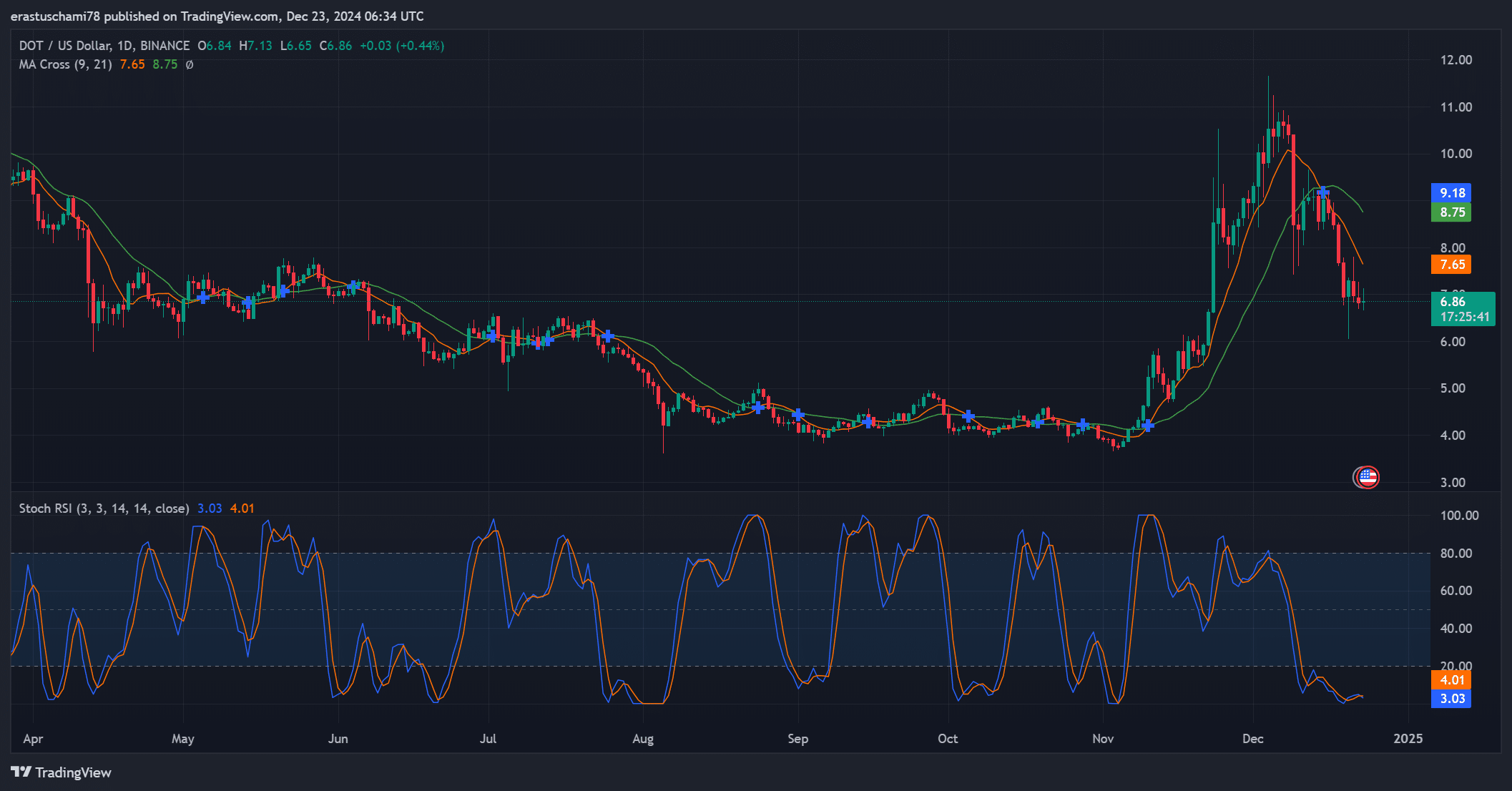

Analysis of technical indicators suggests that Polkadot could be heading for a bullish trend. The Stochastic RSI, specifically at 3.03 and 4.01 levels, indicates oversold conditions which often precede a brief recovery or rebound in the immediate future.

Furthermore, the moving average cross-over on the daily graph seems to indicate a brief period of market stabilization for DOT, potentially signaling an imminent reversal in its declining trajectory.

Together, these indicators point to a promising outlook for the cryptocurrency in the coming weeks.

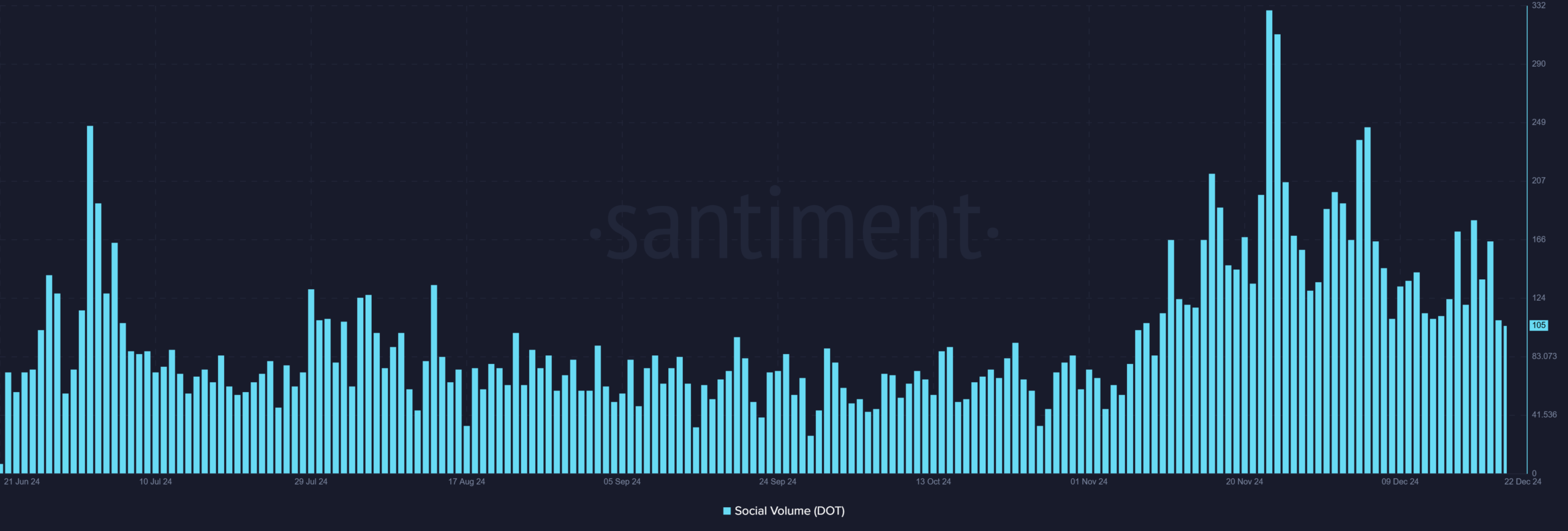

The social media data of 105 suggests an increasing curiosity towards Polkadot, since community interaction across various platforms is on the rise. This surge in activity, evident through regular peaks, frequently coincides with a revived interest in the asset.

Consequently, the optimistic views about Polkadot’s price increase are expanding, leading to a self-reinforcing cycle of positive feelings and market behavior.

DOT derivatives market supports the bullish outlook

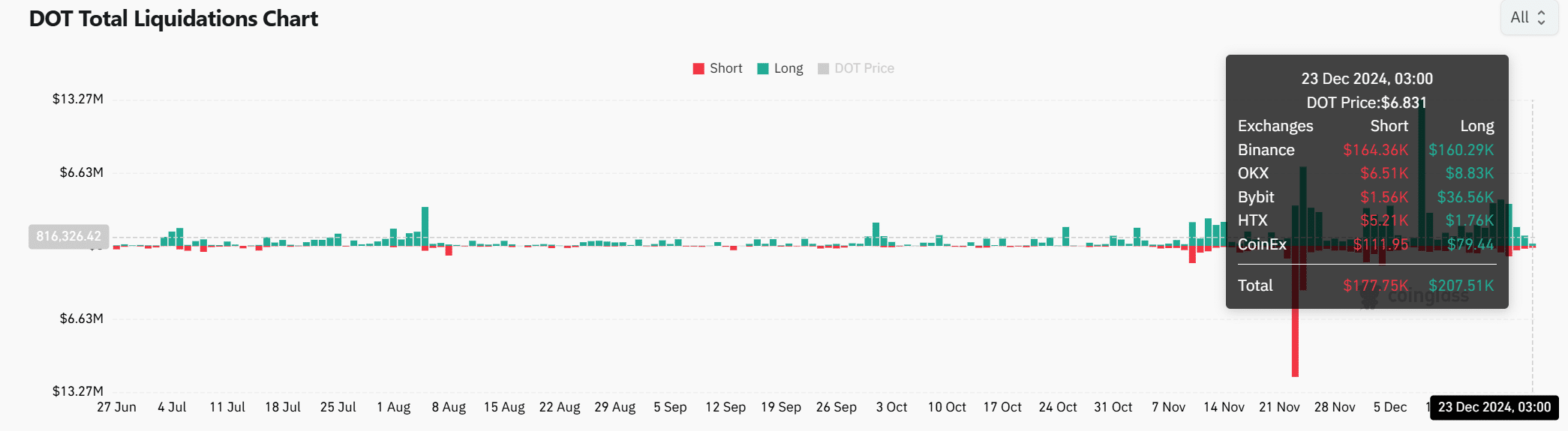

The total value of Polkadot’s long liquidations stands at approximately $207,510, which is higher than the $177,750 in short liquidations, indicating a rising level of trust among long position holders. Additionally, the funding rate, calculated by weighing open interest, remains positive at 0.01%, implying a predominantly bullish outlook.

The data suggests that Polkadot is growing more influential in the futures market, which could mean even greater prospects for growth ahead.

Read Polkadot [DOT] Price Prediction 2024-2025

Using a simpler, more conversational style: It looks like Polkadot is set up nicely for an increase in price due to its downward wedge breakout, positive technical signs, and increasing interest from social media and derivatives traders.

If we can successfully surmount the $10.88 barrier, it’s plausible that our long-term goal of reaching $24 could become reality, given the present trend’s trajectory. It’s clear that Polkadot is poised for a substantial leap forward.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

2024-12-23 12:07