- At press time, POL seemed to be trading within a broader bullish structure, despite some market pressure

- Hike in selling activity has heightened bearish momentum, with a potential for further declines

As a seasoned researcher with years of market analysis under my belt, I’ve seen bullish patterns turn bearish faster than a cheetah chasing its prey. The current state of POL seems to be no exception. Despite the broader bullish structure, the asset is trading within a descending channel, with sell pressure mounting.

For the past seven days, the price of POL has decreased by 18.90%, and negative sentiment seems to be prevailing in the market. In just the last day, this asset has experienced a 1.15% drop, strengthening the bears’ control over the market.

According to AMBCrypto’s examination, it appears that the decline in POL’s value might not have reached its end yet. In fact, there could be more significant drops to come in the short term.

Can a bullish pattern reverse POL’s downtrend?

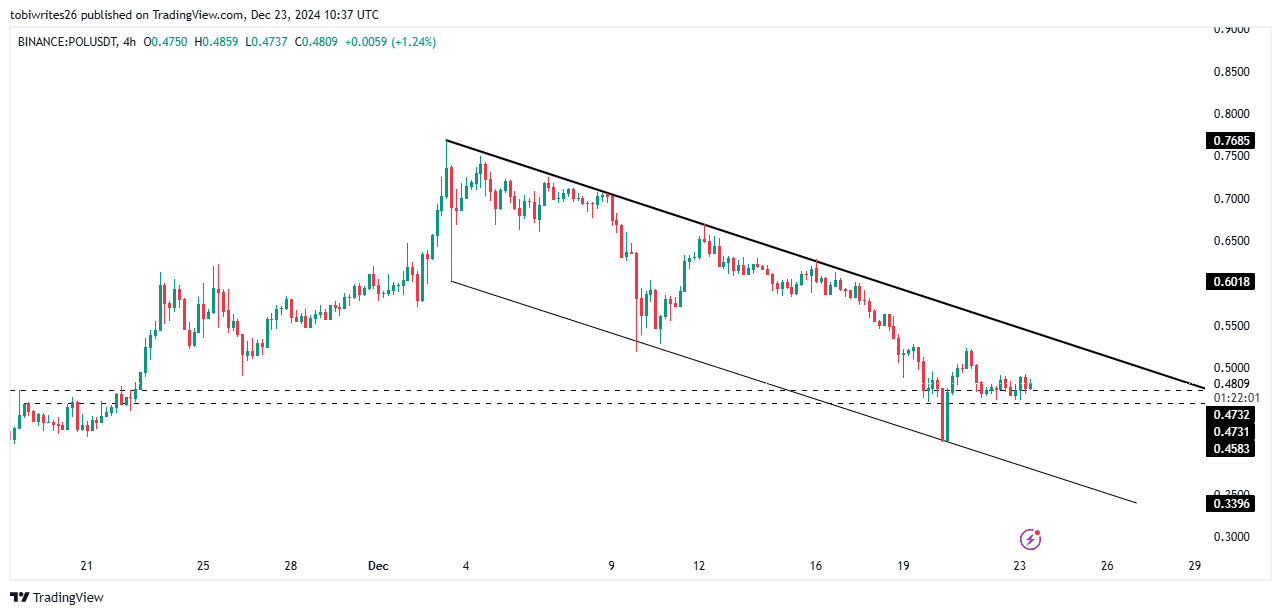

Currently, at the point of composition, Price of OurAsset (POL) is being exchanged inside a downward trending channel – a pattern marked by the recurring movement of the price between two significant points: The support level and the resistance level.

As a crypto investor, I noticed that the price was being challenged at around 0.4731, right smack in the middle of the trading range, and there’s another potential support level waiting below at approximately 0.4583.

Generally speaking, this situation could suggest a potential robust recovery moving upward. Yet, upon further examination, it appears that the asset has come to a halt at this point, demonstrating very little noticeable increase in momentum.

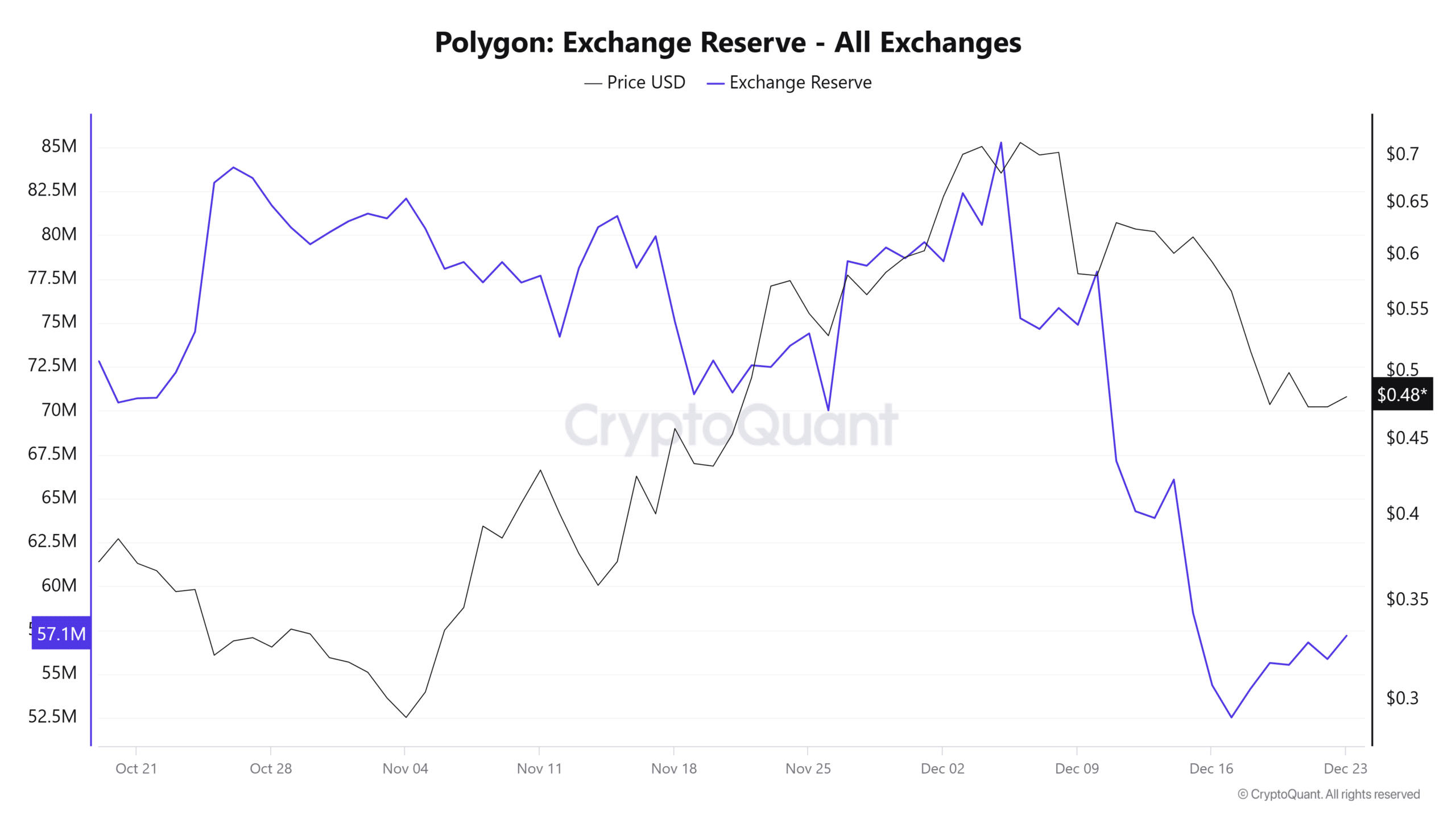

Additional investigation conducted by AMBCrypto indicates that the current blockchain data casts doubt on the prospect of a price surge. This is due to an increase in exchange reserves, which implies that the opportunity for a price decrease might be more likely at present, as the potential for a rally seems to be limited.

POL faces greater risk as availability on exchanges grows

As a crypto investor, I’ve noticed a substantial increase in the availability of POL on exchanges lately. Interestingly, data from CryptoQuant reveals that the Exchange Reserves have soared past 57 million, which is roughly 2 million more than the reserves we saw yesterday.

An increase like this usually suggests that traders are transferring their POL assets from storage to exchanges, thereby increasing the available supply. Such actions often signal upcoming sell-offs, which may cause the price of POL to decrease on the graphs.

Furthermore, it’s worth noting that the number of active addresses has been on a downward trend, currently standing at 1,231. This decrease implies reduced activity, as fewer addresses seem to be influencing price fluctuations. A drop in active addresses usually indicates waning interest in the asset, often linked to declining investor confidence.

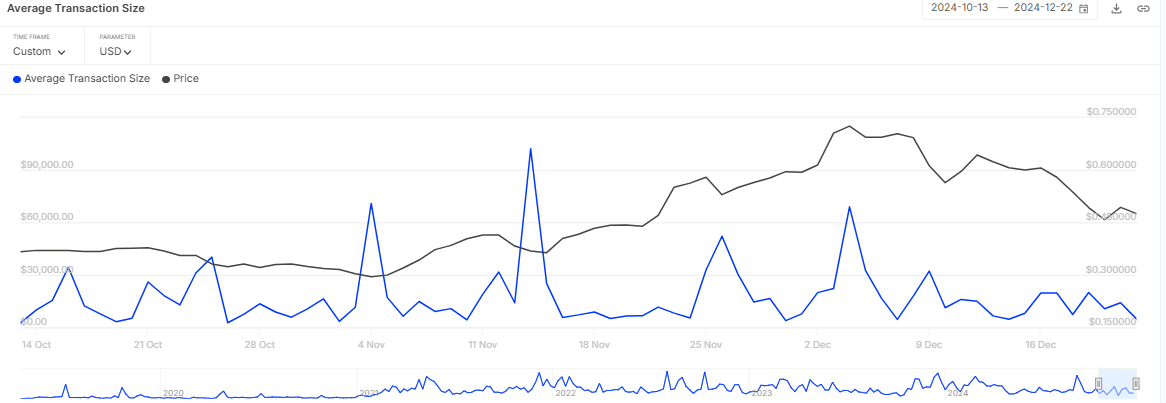

In the meantime, data from IntoTheBlock showed a continued decrease in the typical transaction amount. Whereas the weekly average was at $13,796.37, the 24-hour average dipped to $4,908.63—marking its lowest point for the week.

This underlined a significant reduction in the value of POL being transacted, further indicating a fall in market activity.

Collectively, these tendencies suggest a decrease in investor enthusiasm towards POL, potentially leading to continuous pressure that could keep its price low.

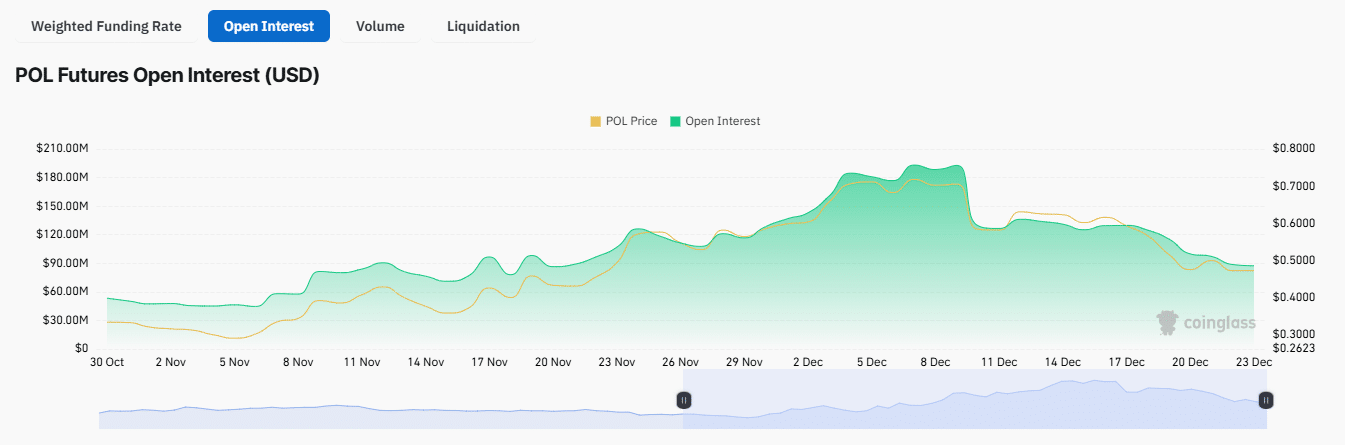

Trader faces closed positions

The amount of ongoing contracts, or Open Interest, decreased by approximately 2.60%. This decrease suggests an increase in the number of contracts being terminated, as the market appears to be moving downward. The total Open Interest now stands at around $88.30 million.

In the same vein, the data on liquidations shows a significant edge for those trading shorts, as more long positions were terminated. Over the past 24 hours, a massive $225,670 worth of long contracts have been closed out, while only $58,380 in short contracts experienced the same fate.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

2024-12-24 11:03