- EigenLayer’s address growth highlighted surging adoption with a 148.61% hike in new addresses

- Market sentiment stabilized as development activity and MVRV ratios pointed to balanced trading dynamics

As a seasoned researcher with years of blockchain analysis under my belt, I can confidently say that EigenLayer [EIGEN] is making waves in the Ethereum staking solutions space. The impressive surge in new addresses and sustained engagement from existing users is a testament to the platform’s growing appeal.

Recently, in the bustling blockchain world, EigenLayer [EIGEN] has experienced significant network expansion, indicating its increasing importance within Ethereum staking options. To be more specific, during the last seven days, the platform has witnessed a spike in newly created addresses, active users, and overall user interaction.

Collectively, these trends underscore a growing fascination with EigenLayer’s products, positioning it as a notable leader within the Ethereum network. Currently, EIGEN is being exchanged at $3.69, after experiencing a minimal decrease of 1.66% over the past day.

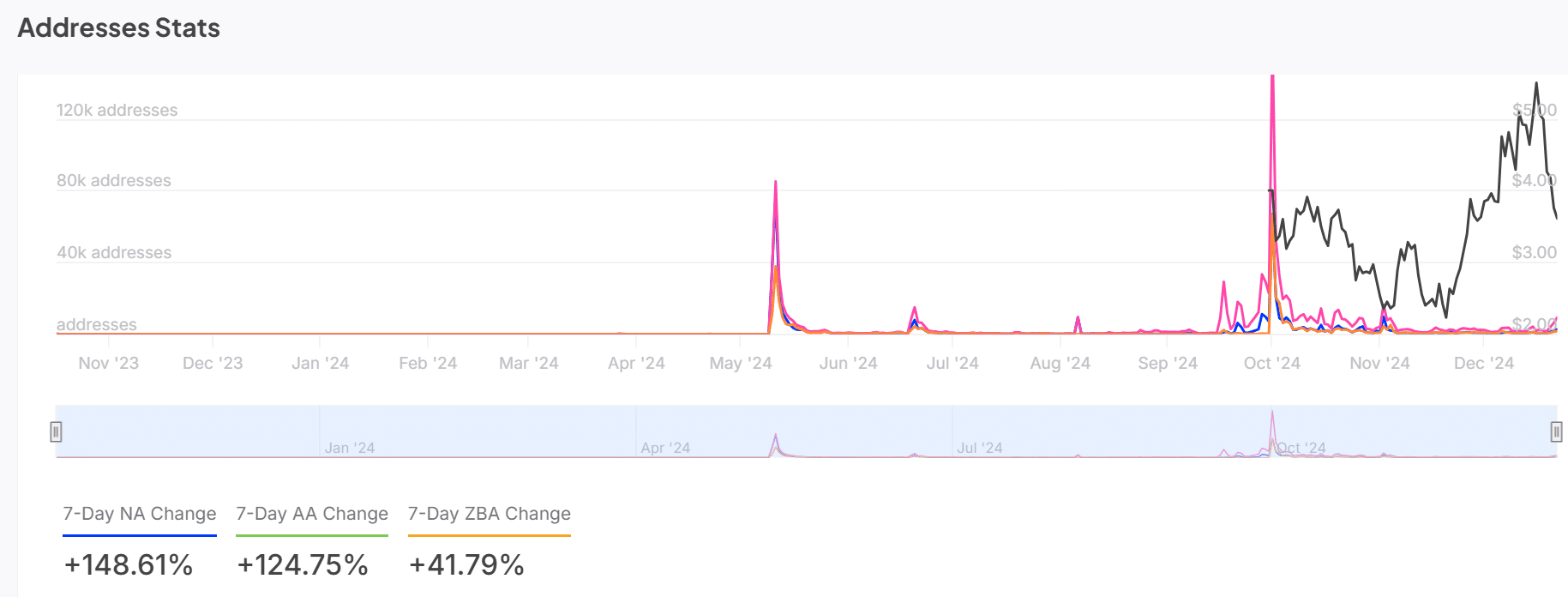

EIGEN address growth shows expanding network activity

EigenLayer’s statistics on addresses revealed a rapidly expanding and engaging network. The substantial increase of 148.61% in new addresses indicated a significant influx of new users, attracted by the platform’s cutting-edge staking proposals.

Furthermore, the significant rise by 124.75% in active user addresses indicates continuous engagement among current users, which is a mark of robust retention. Concurrently, the 41.79% surge in zero-balance accounts suggests growing curiosity from prospective investors who are investigating the platform.

The collection of these measures suggests that EigenLayer is growing its influence within the Ethereum staking community.

A balanced market sentiment?

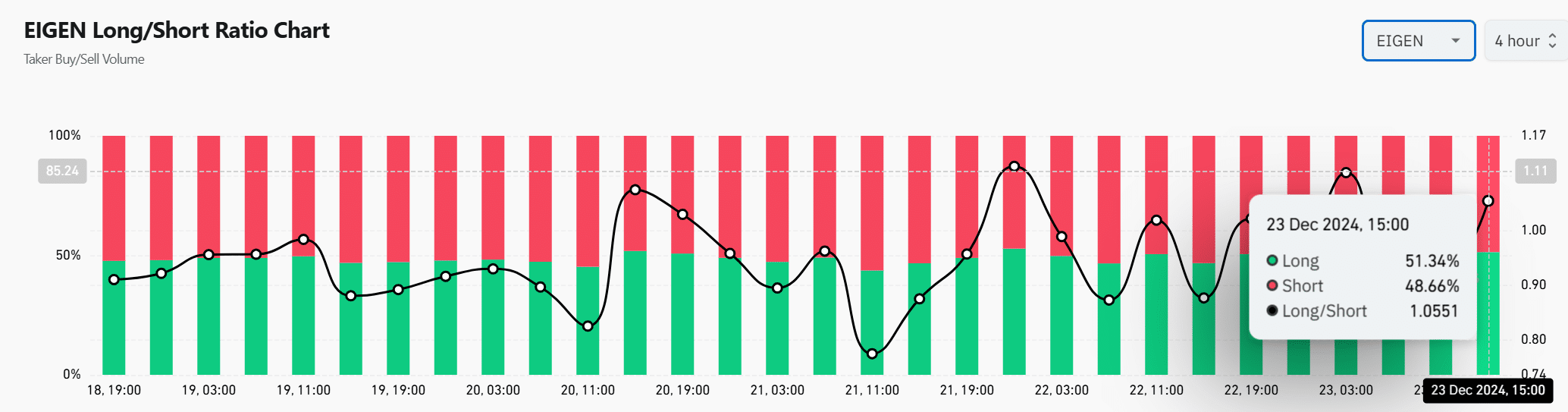

The market sentiment for EIGEN has remained fairly well-balanced, as the long/short ratio indicated a near-equal split. At the time of writing, 51.34% of positions were long, with 48.66% short – Underlining a cautious yet optimistic outlook among traders.

Lately, an increase in long investments indicates that certain financiers anticipate a possible price rise, disregarding the asset’s recent market fluctuations.

The equilibrium indicates a market that’s thoughtfully considering both risks and possibilities, showing no strong inclination towards either. Such an attitude usually signals forthcoming major shifts, making it crucial to keep a close eye on this situation.

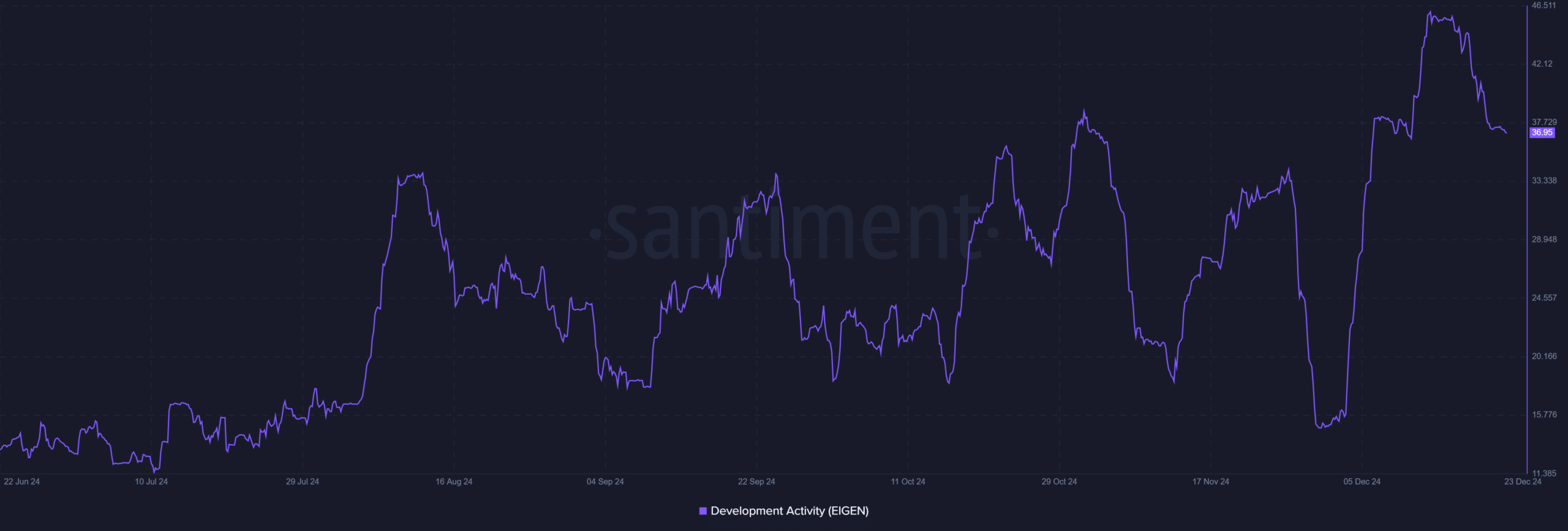

Steady development activity reinforces innovation

The progress in EigenLayer’s development has been consistent, currently standing at a score of 36.95. Although it hasn’t yet reached its maximum, this level of activity indicates ongoing refinements and advancements to the platform.

Frequent advancements and ongoing improvements demonstrate a dedication to maintaining a competitive edge in the long run, which is reassuring both users and investors about a project’s commitment. Consequently, EigenLayer’s persistent development work serves as a strong base for continuous expansion within the Ethereum staking market.

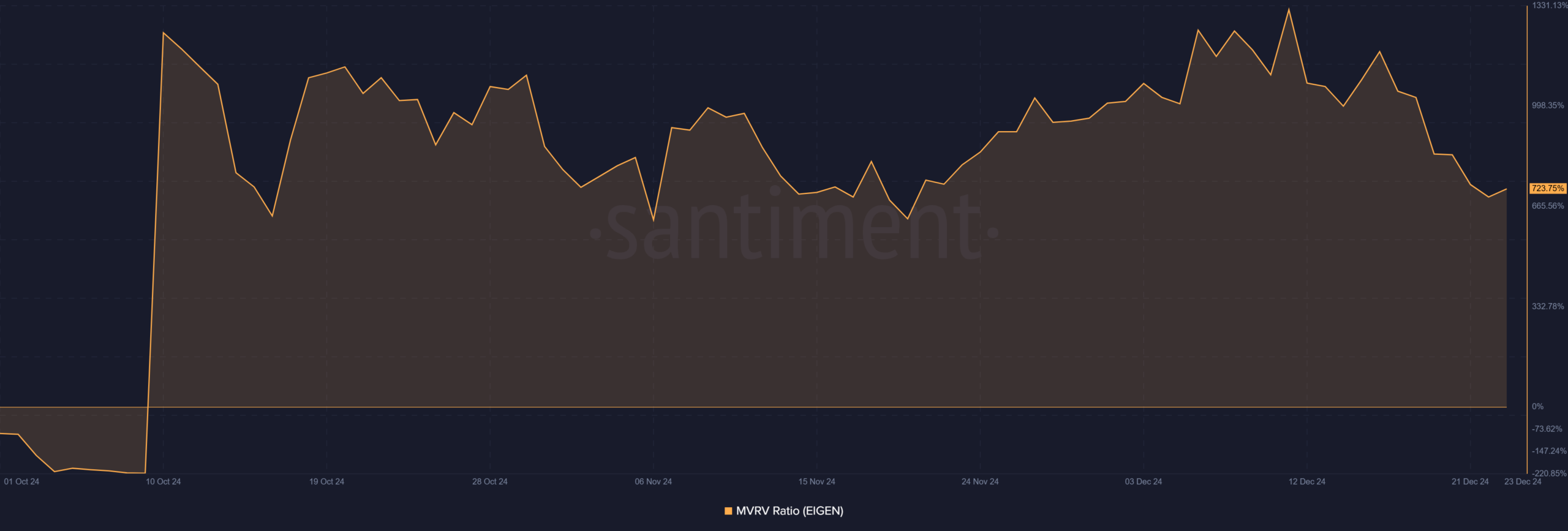

MVRV ratio signals potential for profit-taking

As an analyst, I’ve noticed that the MVRM (Moving Average of Realized to Unrealized Value Ratio) currently stands at 723.75%. This indicates that many early investors have realized substantial profits from their initial investments. Historically, high MVRM levels are associated with increased profit-taking, which might lead to short-term market fluctuations due to sell-offs.

On the other hand, this action might provide a chance for novice investors to jump in at reduced prices. The interplay of selling by profit-makers and buying by newcomers could result in intriguing price fluctuations in the near future.

Potential for recovery?

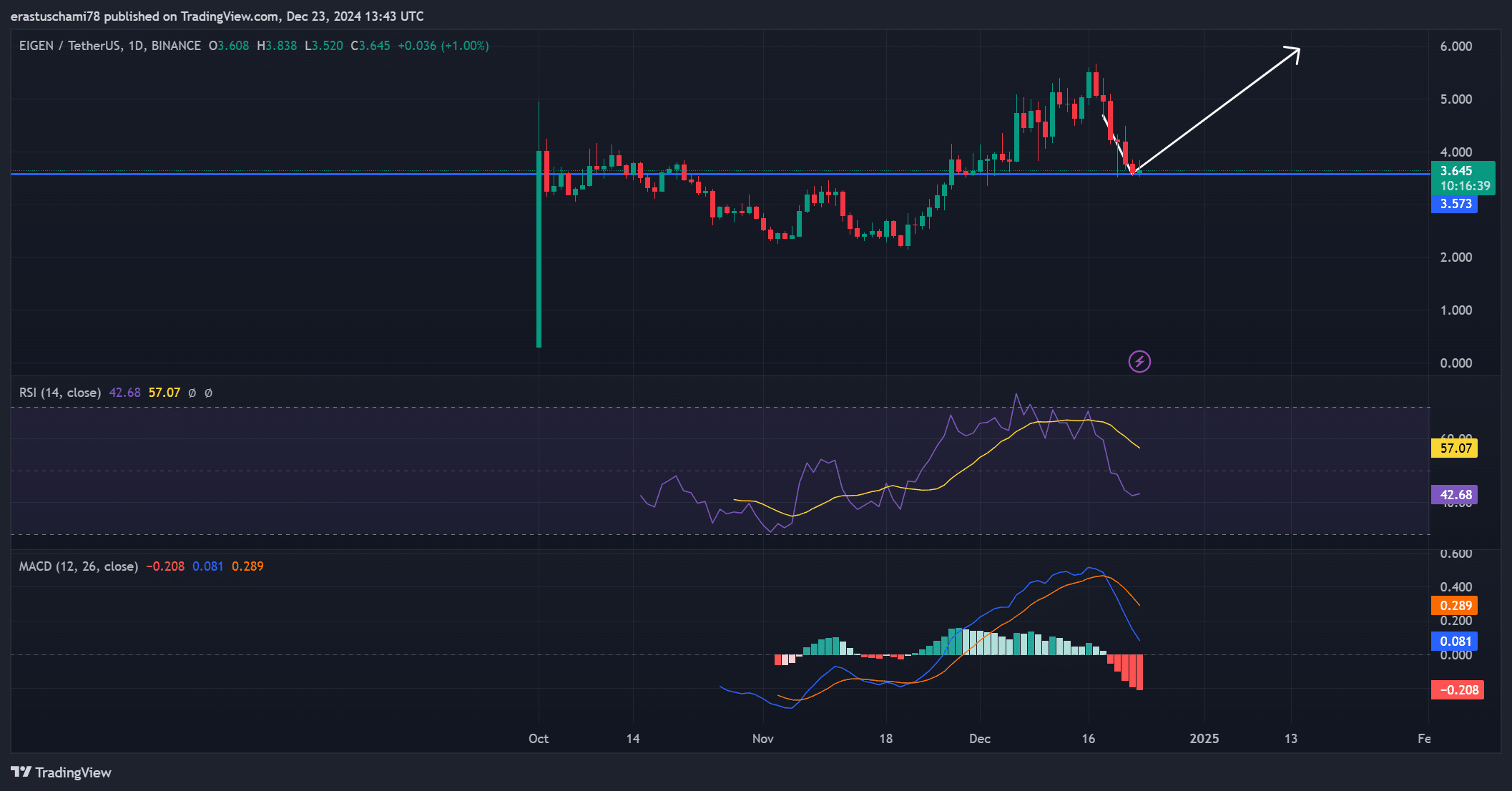

In simpler terms, the technical analysis provided ambiguous indications concerning EIGEN’s short-term price trend. For example, the Relative Strength Index (RSI) at 42.68 hinted that the token might be approaching oversold conditions, which typically triggers a rebound.

Currently, the MACD shows a hint of weak bearish movement, at -0.208. But with solid support around $3.57, EIGEN may find stability and potentially rebound if bullish trends become more pronounced. A shift in market sentiment could trigger a resurgence of positive momentum.

EigenLayer’s notable statistics on staking, favorable market opinions, and continuous development work highlight its increasing importance within Ethereum staking. Although temporary price hurdles persist, this platform’s exceptional performance metrics indicate that it is poised for long-term expansion.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-24 12:07