- LUNC burns 19.67M tokens daily, reaching 394B burned to support recovery and reduce 5.5T supply.

- LUNC price stabilizes near $0.00011 amid declining market activity, cautious trading, and mixed momentum.

As a seasoned researcher who has navigated through countless market cycles, I find it intriguing to observe Terra Luna Classic [LUNC]’s ongoing burn strategy and its potential impact on the token’s future growth. With over 394 billion tokens burned, the ecosystem’s recovery plan is making steady progress, though we must remain vigilant about market volatility.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastAs an analyst, I’m reporting that my analysis reveals the LUNC ecosystem in Terra Luna Classic is persistently implementing a vigorous token burn policy. On December 22, 2024, a total of 19,674,564 tokens were burned daily, according to my findings.

Based on figures from the LUNC Burn Tracker, a total of 7,265,976 tokens were burned by individual wallets, with an extra 12,408,588 tokens being burned via on-chain processes.

Approximately 394 billion LUNC tokens have been destroyed, decreasing the number of circulating tokens from an original 5.5 trillion.

The Burn Initiative plays a vital role in the revival strategy for Terra Luna Classic. Its objective is to maintain price equilibrium and foster long-term expansion.

Price stabilizes amid market volatility

As a researcher studying cryptocurrency markets, I’ve observed that LUNC experienced a 1.82% price surge over the last 24 hours. Currently, it’s being traded at roughly $0.0001123, and within this period, the total volume of transactions involving LUNC amounted to approximately $37.21 million.

Nevertheless, the value of this token has experienced a dip, dropping by around 12.31% during the last week. Currently, its market capitalization stands at roughly $618.43 million.

Over the last day, the price of LUNC has varied between approximately $0.0001054 and $0.0001135. In the past week, its price range has been from about $0.00009174 to $0.0001344.

LUNC is trying to maintain its value close to the support level of about $0.0001100, while encountering potential resistance around $0.0001200.

Technical indicators show mixed momentum

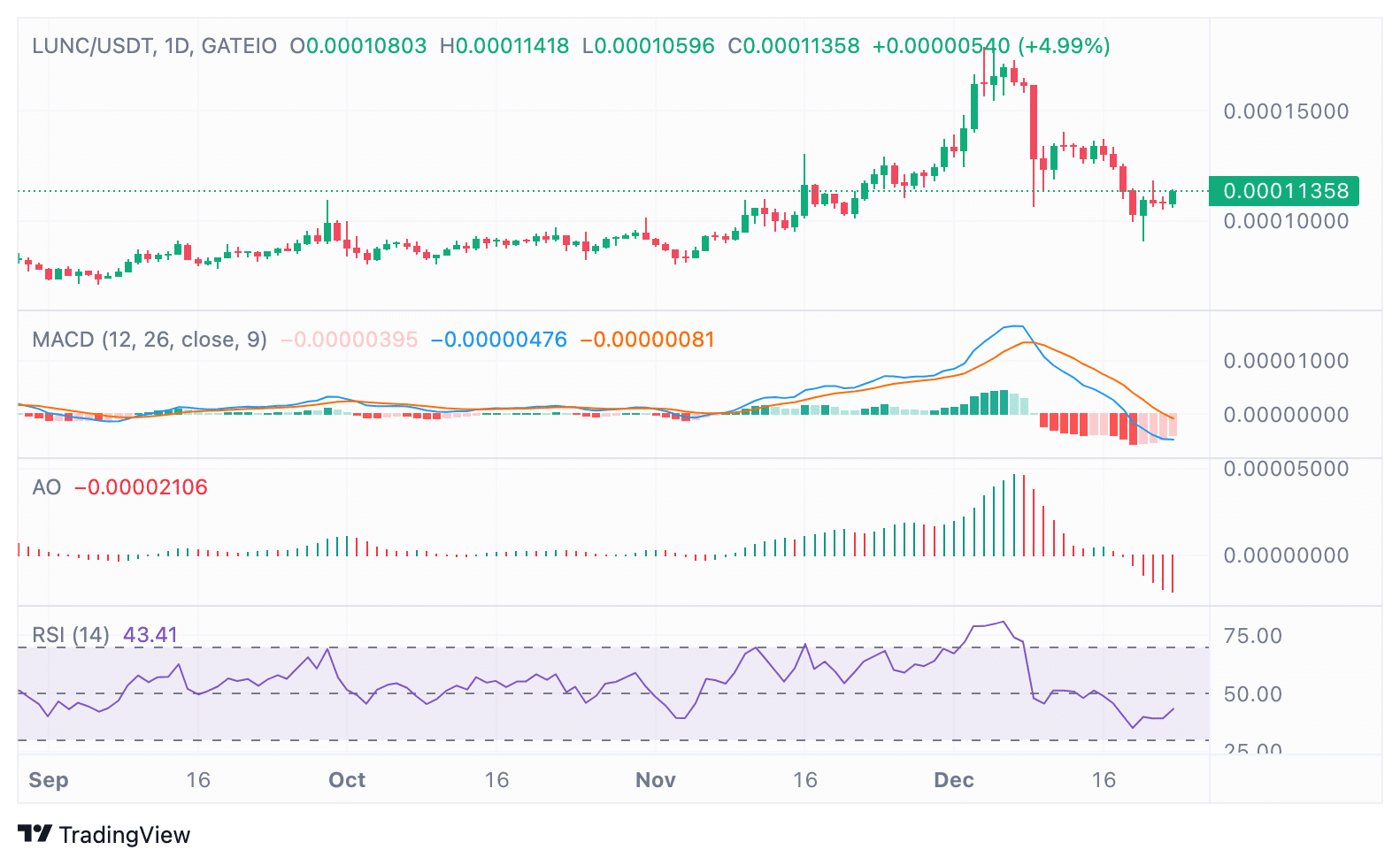

On the LUNC/USDT daily chart, the technical indicators show conflicting trends: while the MACD line has had a bearish cross-over, the diminishing size of the red histogram bars suggests that the bearish momentum is starting to weaken.

In much the same way, as the Awesome Oscillator (AO) showed decreasing selling pressure, it suggested that a potential reversal might occur if the AO’s readings surpassed their non-biased zones, indicating a possible shift in market direction.

The Relative Strength Index (RSI) stood at 43.41, recovering from oversold territory.

As an analyst, I’m observing that if this asset consistently rises above the 50-level, it could suggest a strong bullish trend is in play. On the flip side, crucial levels to keep an eye on for potential bearish signals are at $0.0001000 on the downside, and $0.0001200–$0.0001250 as key confirmation points for any bullish momentum.

Derivatives and liquidation data indicate cautious sentiment

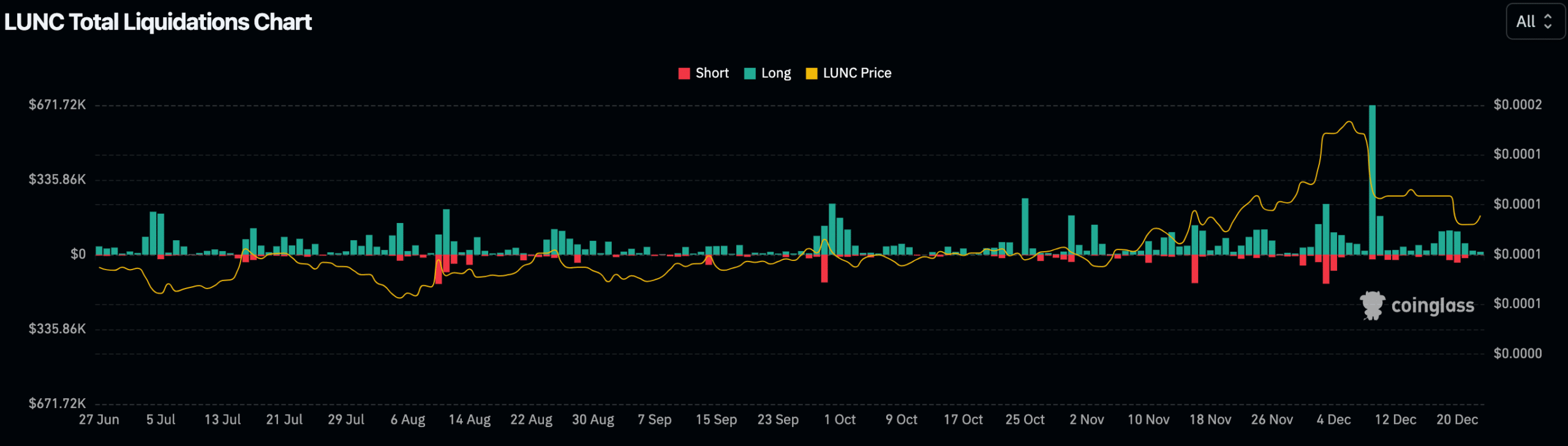

As a crypto investor, I’ve noticed a decrease in activity with LUNC derivatives as the trading volume dropped by 15.35% and open interest fell by 4.57%. However, despite this downturn, the 24-hour long/short ratio stands at 1.0255, indicating that long positions have a slight edge over short ones.

Notably, OKX traders exhibited stronger bullish sentiment, with a long/short ratio of 1.26.

As a crypto investor, I’ve noticed an interesting trend in the market data. It appears that a significant amount of long positions, totaling approximately $12,630, have been liquidated, whereas short positions only accounted for about $1,270 in liquidations. This disparity suggests a higher level of bullish leverage in the market, meaning there are more investors betting on the price to rise compared to those betting on it to fall.

Is your portfolio green? Check the LUNC Profit Calculator

Increased liquidation actions tend to occur alongside market turbulence (price volatility), reinforcing a sense of caution among investors.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-12-24 13:12