- Bitcoin trades near key support as Mt. Gox movements stir market uncertainty.

- Rising derivatives activity hints at cautious optimism despite bearish technical indicators.

As a seasoned crypto investor with battle scars from multiple market cycles, I find myself treading familiar yet uncertain waters as Mt. Gox’s Bitcoin redistribution stirs market unrest. The recent dip to $94,435.63 is reminiscent of past corrections that always seem to come when I least expect them.

The movement of approximately $49.3 million worth of Bitcoin (BTC) from Mt. Gox has caused waves in the market, igniting concerns about increased market instability due to potential price fluctuations. Out of this amount, around $19 million was sent to newly created wallets, while roughly $30.6 million ended up in a concluding wallet.

This significant shift in activity brings forth important debates on if it might be indicative of a series of selling actions. Currently, Bitcoin is being traded at $94,435.63, demonstrating a minimal decrease of 0.72% over the past day.

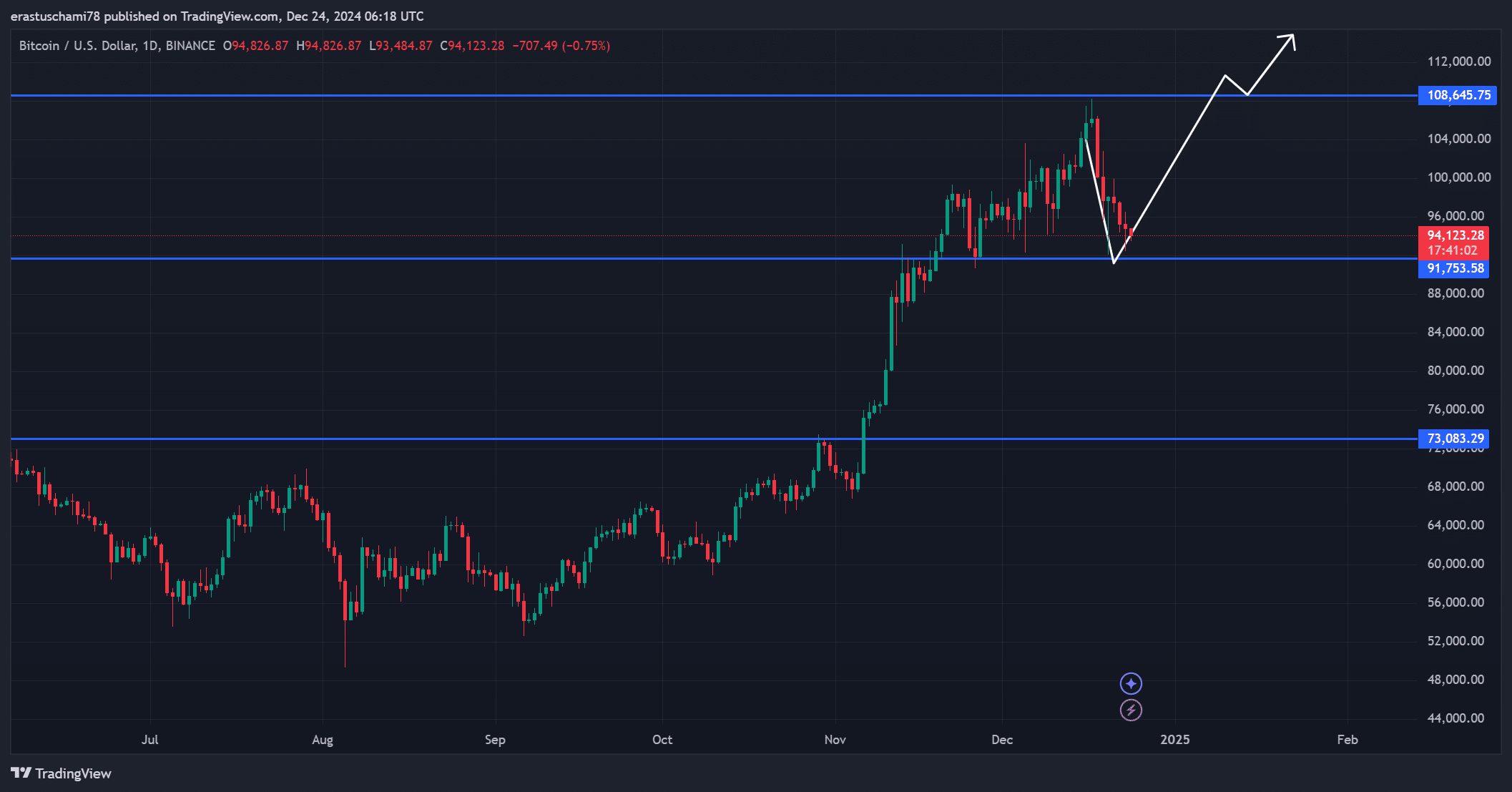

Can BTC break resistance or risk losing support?

Bitcoin is trading within a critical range, with support at $91,753 and resistance at $108,645. A break below $91,753 could open the door to a plunge toward $73,083, signaling bearish dominance.

Should Bitcoin surpass the $96,000 mark, it might gather steam and potentially reach $100,000. Consequently, the current phase where Bitcoin’s price is stabilizing could be crucial; it may predict whether Bitcoin will advance or fall more in the upcoming days.

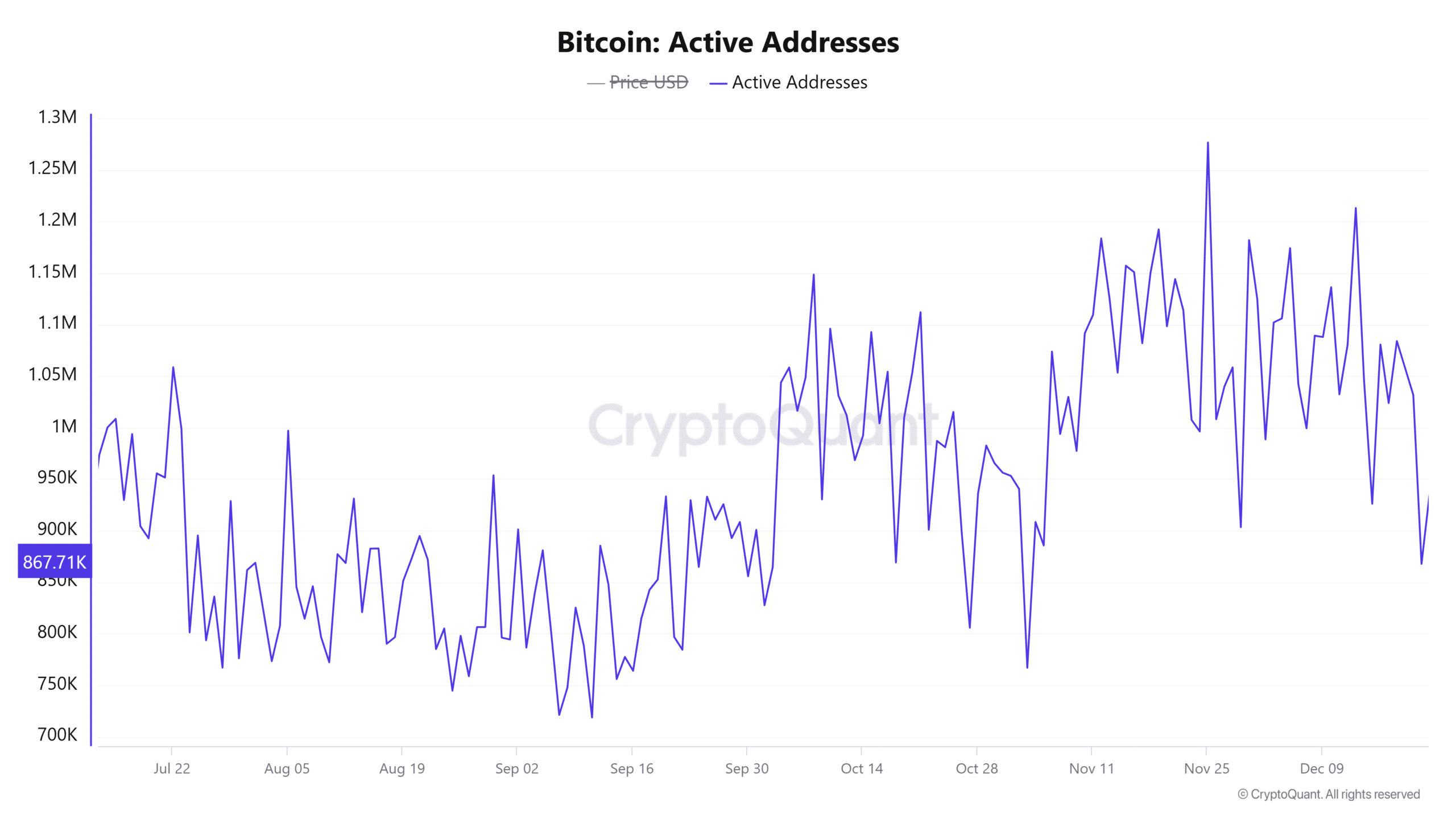

Active addresses show rising engagement

Over the past day, the number of active Bitcoin addresses grew by approximately 1.21%, amounting to about 9.75 million. This growth indicates a higher level of user interaction, possibly indicating new investors joining the market. The surge in activity could be linked to the ongoing speculation surrounding the Mt. Gox situation.

Furthermore, an uptick in network activity generally indicates growing demand, which is usually associated with a robust market. Consequently, continuous expansion in active Bitcoin addresses may foster its short-term recovery.

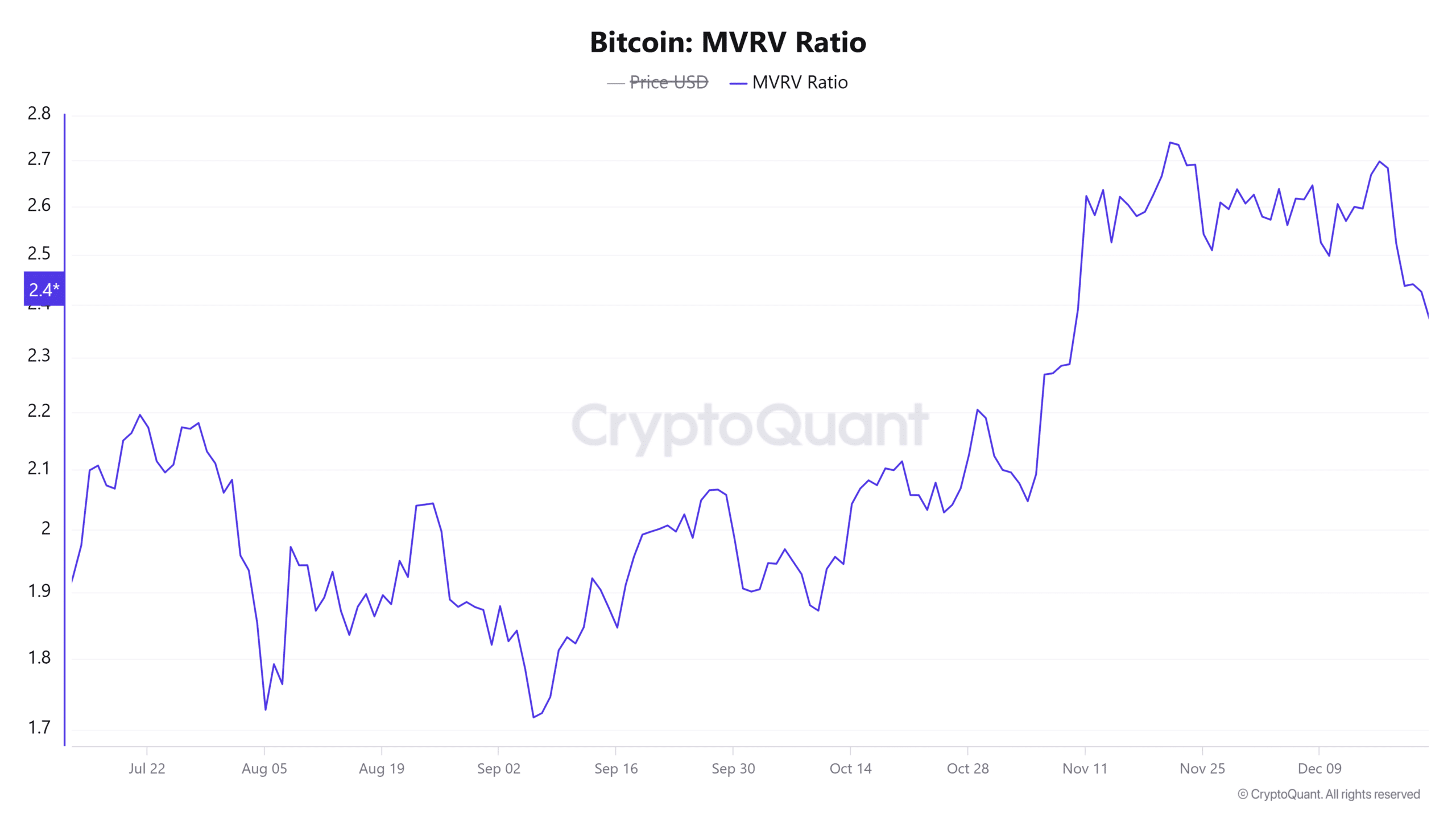

Is BTC undervalued? MVRV ratio insights

Currently standing at 2.4 following a 1.17% decrease, the MVRV ratio suggests a period of reduced speculation intensity. Typically, lower ratios have corresponded with more favorable pricing for long-term investors in the past.

As I delve deeper into the Bitcoin market, any continued drops suggest dwindling trust amongst the players, which keeps me on my toes as a trader. Consequently, the MVRV (Moving Average Value to Realized Value) ratio proves invaluable for assessing Bitcoin’s current standing within the market.

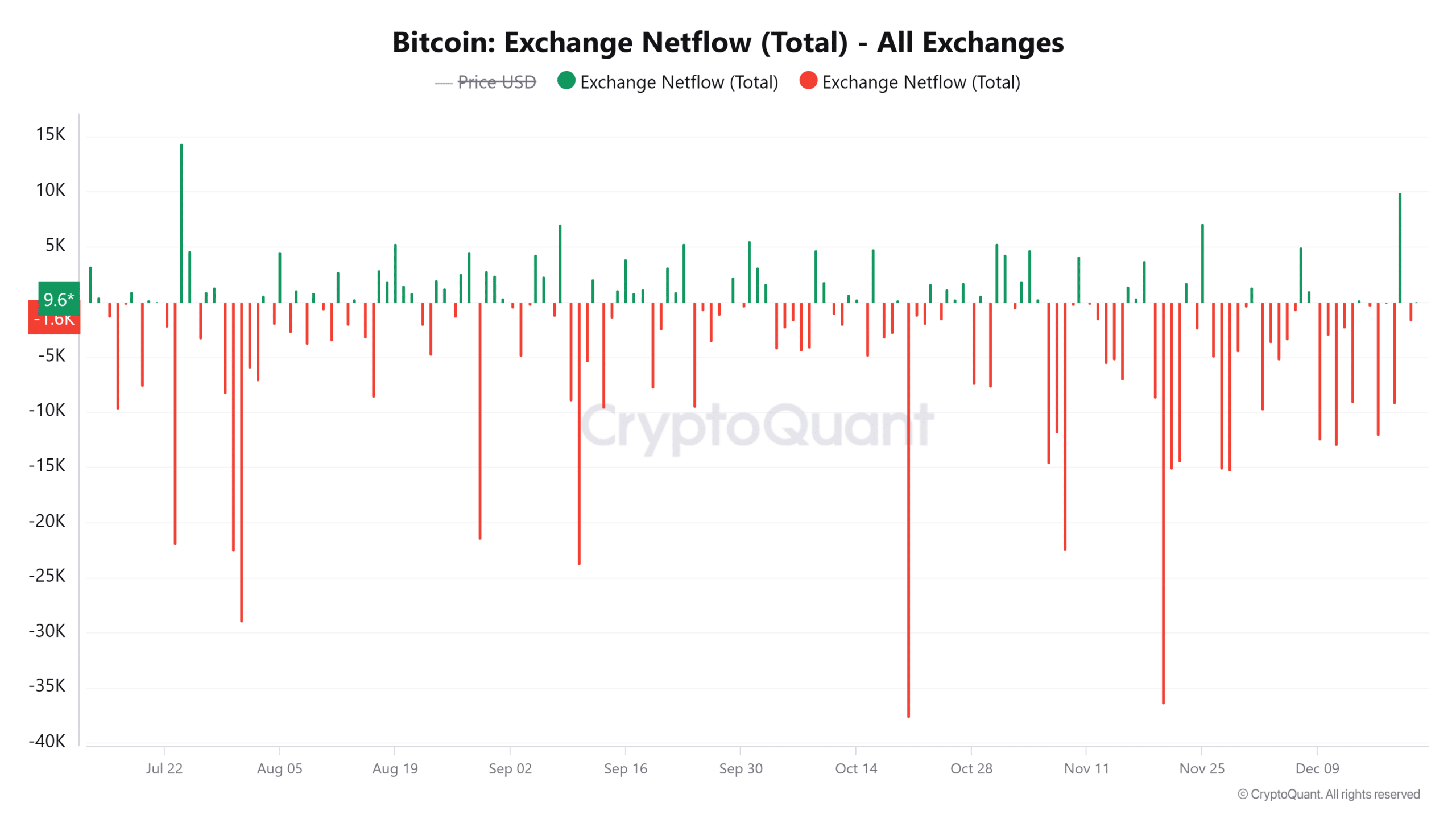

Exchange inflows suggest caution

The amount of Bitcoin entering exchanges significantly increased by 39.93%, reaching approximately 19,545 Bitcoins, sparking worries about possible sell-offs. While an increase in exchange inflows doesn’t always lead to immediate sales, it often indicates that traders may be planning to offload their holdings.

In other words, keeping a close eye on the exchange activity is crucial for figuring out if this spike signals a bearish trend continuation or just maintains its current state.

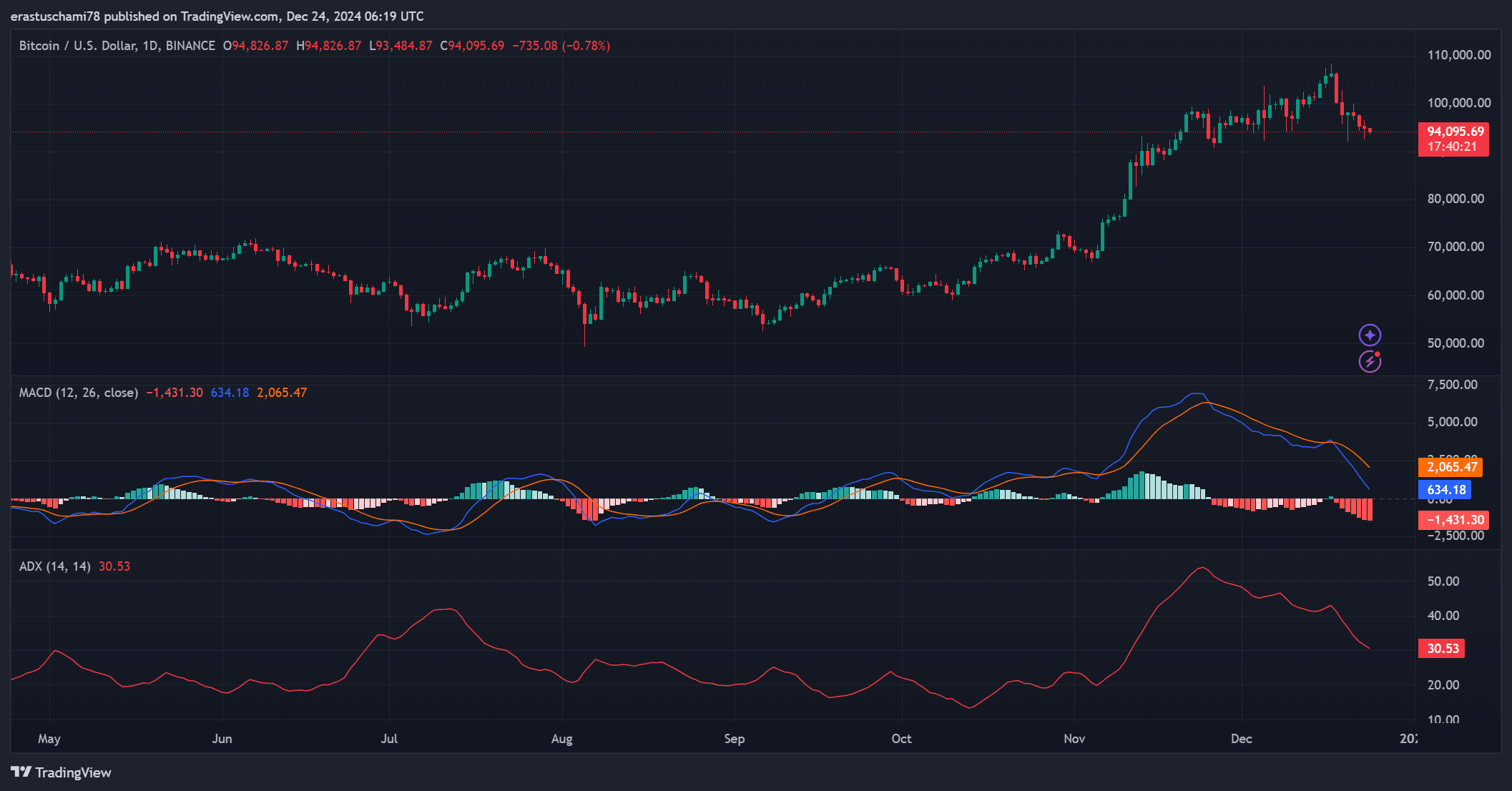

ADX and MACD reveal mixed signals

The ADX, currently at 30.53, indicates a moderately strong trend in the market. Meanwhile, the MACD shows bearish momentum following a crossover below the signal line.

In simpler terms, since the Moving Average Convergence Divergence (MACD) is close to the zero line, it indicates a possible shift in direction if buyers take over again. This means that the market’s technical indicators are showing a delicate equilibrium between positive (bullish) and negative (bearish) trends.

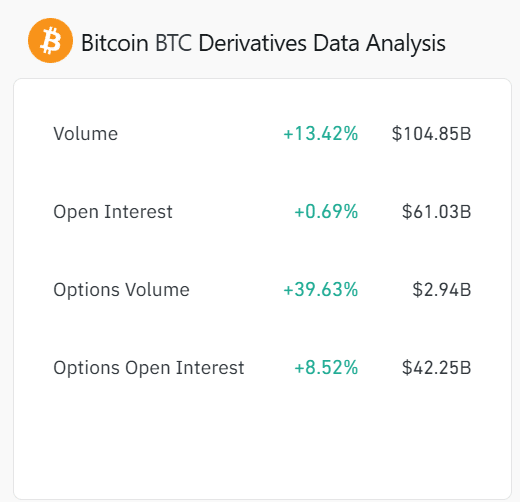

Derivatives data reflects cautious optimism

Bitcoin derivative trading has experienced a significant surge, as options volume jumped by 39.63% to reach approximately $2.94 billion. Additionally, total open interest expanded by 0.69%, reaching $61.03 billion, and options open interest specifically rose by 8.52% to about $42.25 billion.

The numbers show a rising curiosity about speculation, yet the increase in active bets (open interest) is relatively small, hinting at a lack of strong convictions regarding direction. This derivative data, thus, seems to convey optimism tempered by caution.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The Bitcoin distribution from Mt. Gox is causing a sense of apprehension, keeping the market tense. Whether Bitcoin can maintain crucial support and manage increasing influxes from exchanges will decide if this event leads to a mass selling or boosts trust instead.

For now, Bitcoin remains at a crossroads, balancing between fear and opportunity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-24 14:16