- Bitcoin’s derivatives metrics looked optimistic.

- But selling pressure remained dominant in the market.

As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by Bitcoin’s current predicament. On one hand, the optimism in derivatives metrics is palpable, suggesting a potential bull run on the horizon. However, it’s undeniable that selling pressure continues to dominate the market, causing jitters among investors.

As a market analyst, I’ve observed that my own analysis indicates Bitcoin (BTC) is experiencing some turbulence in its price movement recently, falling short of investor expectations. This situation seems to have stirred up anxiety across the Bitcoin community, based on the most recent data sets I’ve reviewed.

Yet, the turmoil in the market might unexpectedly work in favor of Bitcoin, often referred to as the ‘king coin’.

Bitcoin investors are panicking!

Last week, Bitcoin’s price experienced a drop exceeding 11%, causing it to fall below $95,000. Interestingly, despite the approach of the traditional Santa Claus rally – a period that usually boosts the crypto market – Bitcoin has been facing difficulties instead. As reported by AMBCrypto earlier, this was the case.

Currently, when I’m typing this, King Coin is being exchanged for approximately $94,078 per unit, and its total market value exceeds an impressive $1.86 trillion.

It’s worth mentioning that even with a significant week-long decrease in value (over 10%), only about 3.9% of all Bitcoin addresses had lost money on their investment, according to data from IntoTheBlock.

In the current situation, Santiment – a data analysis tool – shared a tweet pointing out an interesting market trend. The tweet indicated that the cryptocurrency markets started this week by dipping even more, causing some unease among individual investors.

Specifically, Bitcoin and Ethereum have been experiencing a significant amount of fear, uncertainty, and doubt (FUD) among newer investors who entered the market within the last 2-3 months.

The tweet mentioned,

Historically, when regular traders start selling due to fear or strong emotions, large investors (whales and sharks) often find it easier to acquire more assets with minimal opposition, leading to price increases or ‘bounces’.

It’s quite likely that we’ll see a shift in trends as the remaining days of this year pass by.

Will BTC register greens soon?

According to our examination of CryptoQuant’s data, there was a prevailing trend of sellers in the market, as indicated by the rising amount of crypto held on exchanges.

Contrarily, Santiment’s tweet suggested that when whales accumulate Bitcoin, it could potentially lead to a price reversal. Yet, this scenario didn’t seem to be unfolding.

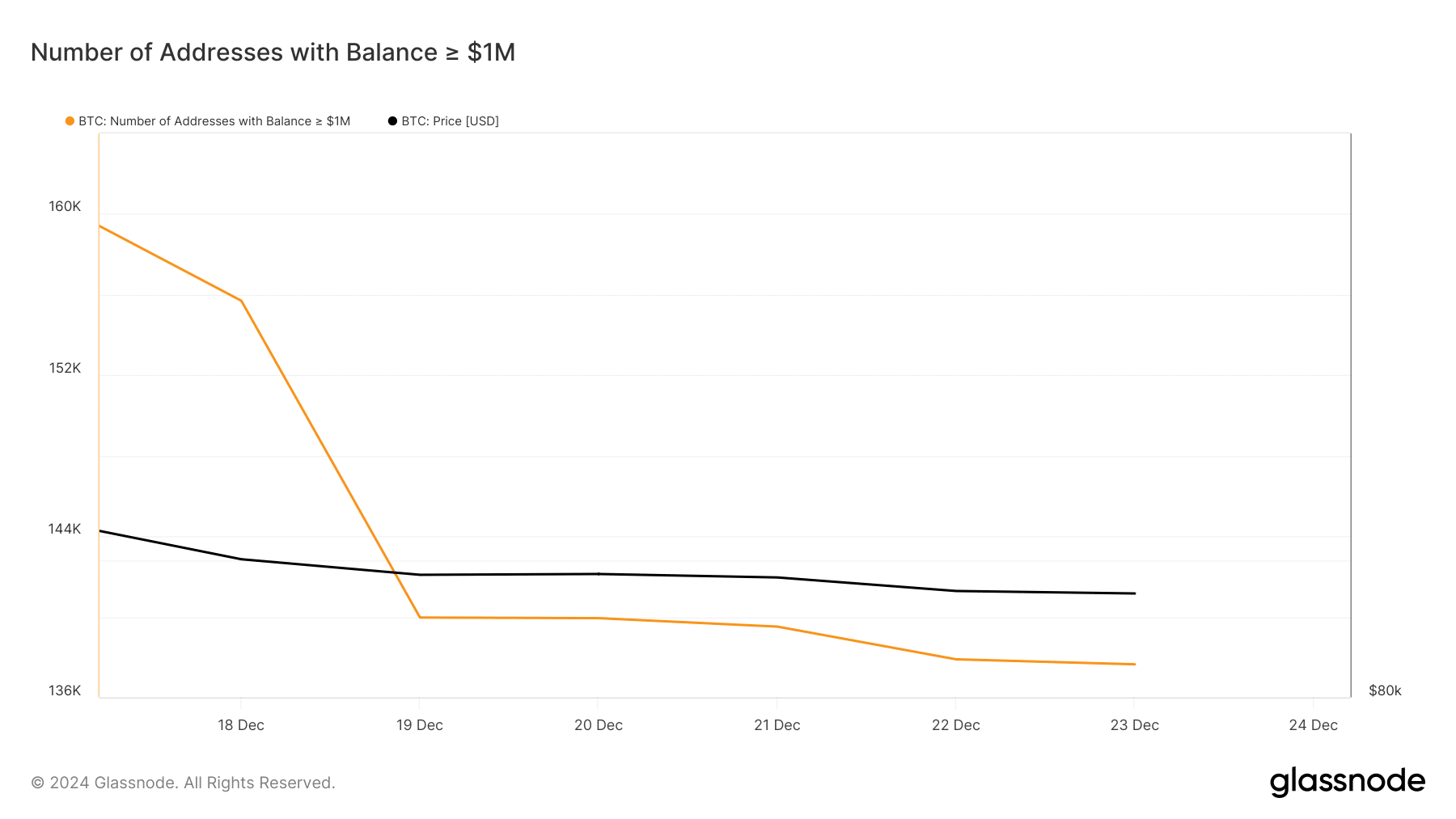

Last week, there was a significant drop in the number of Bitcoin wallets containing over $1 million, suggesting that major investors are offloading their bitcoins. This could potentially lead to further difficulties for Bitcoin in the near future.

Nonetheless, things in the derivatives market looked bullish as BTC’s funding rate was increasing.

Read Bitcoin [BTC] Price Prediction 2024-25

A funding rate increase in the crypto market means that the cost of holding long positions increases—a sign of rising bullish sentiment around an asset.

The taker buy/sell ratio was also green. This meant that buying sentiment was dominant in the derivatives market. If these metrics are to be believed, then expecting a trend reversal for BTC isn’t too ambitious.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-24 15:36