- MicroStrategy seeks approval for a 10 billion MSTR share count increase.

- MSTR’s 263% YTD gains more than doubled BTC’s 112%.

As a seasoned crypto investor with a keen eye for strategic moves, I find MicroStrategy’s decision to seek approval for a 10 billion MSTR share count increase intriguing. With my years of experience in the market, I can see that this move could potentially accelerate their Bitcoin acquisition program, which, given their impressive YTD gains (263% compared to BTC’s 112%), seems like a smart strategy.

MicroStrategy, a trailblazer in Bitcoin corporate holdings, intends to boost its outstanding MSTR shares up to 10 billion, with the aim of speeding up its Bitcoin purchasing strategy.

In a filing with the US regulator, the Securities and Exchange Commission (SEC), the firm notified shareholders of a special meeting to seek approval for the share increment.

Should the proposals get the green light, we’d see an increase in Class A common stock shares from 330 million to a staggering 10.3 billion. Moreover, the preferred stock would also experience growth, rising from its current 5 million shares up to a billion.

Reaching this point would elevate the combined share count above 11 billion, a figure that the company claims is instrumental in executing its ’21/22 Plan’ for Bitcoin acquisitions.

MicroStrategy to buy more BTC?

The proposal first surfaced in October 2024, aiming to accumulate a total of $42 billion within the subsequent three years. This goal will be achieved by securing $21 billion through the sale of equity shares and an additional $21 billion via debt instruments, specifically convertible notes.

Part of the board’s statement on the recent share count increment proposal read,

We aim to obtain shareholder consent to increase the allowable number of Preferred Stocks. This move will enable us to diversify the types of financial instruments we can offer for sale, further our business objectives such as the 21/21 plan and other strategic activities, all without requiring additional cash or Class A Stock.

In response to the recent development, Joe Burnett, the head of market research at Unchained, suggested that this action might cause Bitcoin’s price to rise. He put it simply by stating…

Mastercard (MSTR) is considering releasing an additional 10 billion shares. Given the current stock prices, this amounts to approximately $3.3 trillion or the equivalent of 36 million Bitcoins… It seems plausible that the value of Bitcoin could potentially rise significantly as a result.

However, others were concerned the move could dilute the current MSTR’s value.

As a researcher, I’ve been tracking MicroStrategy’s Bitcoin acquisitions, and since the 21/21 Plan was announced, they have purchased an additional 192,042 Bitcoins. Their latest purchase of 5,262 BTC was announced on December 23rd. Currently, these holdings amount to approximately 444,262 BTC, which equates to a staggering value of nearly $42 billion at the current price.

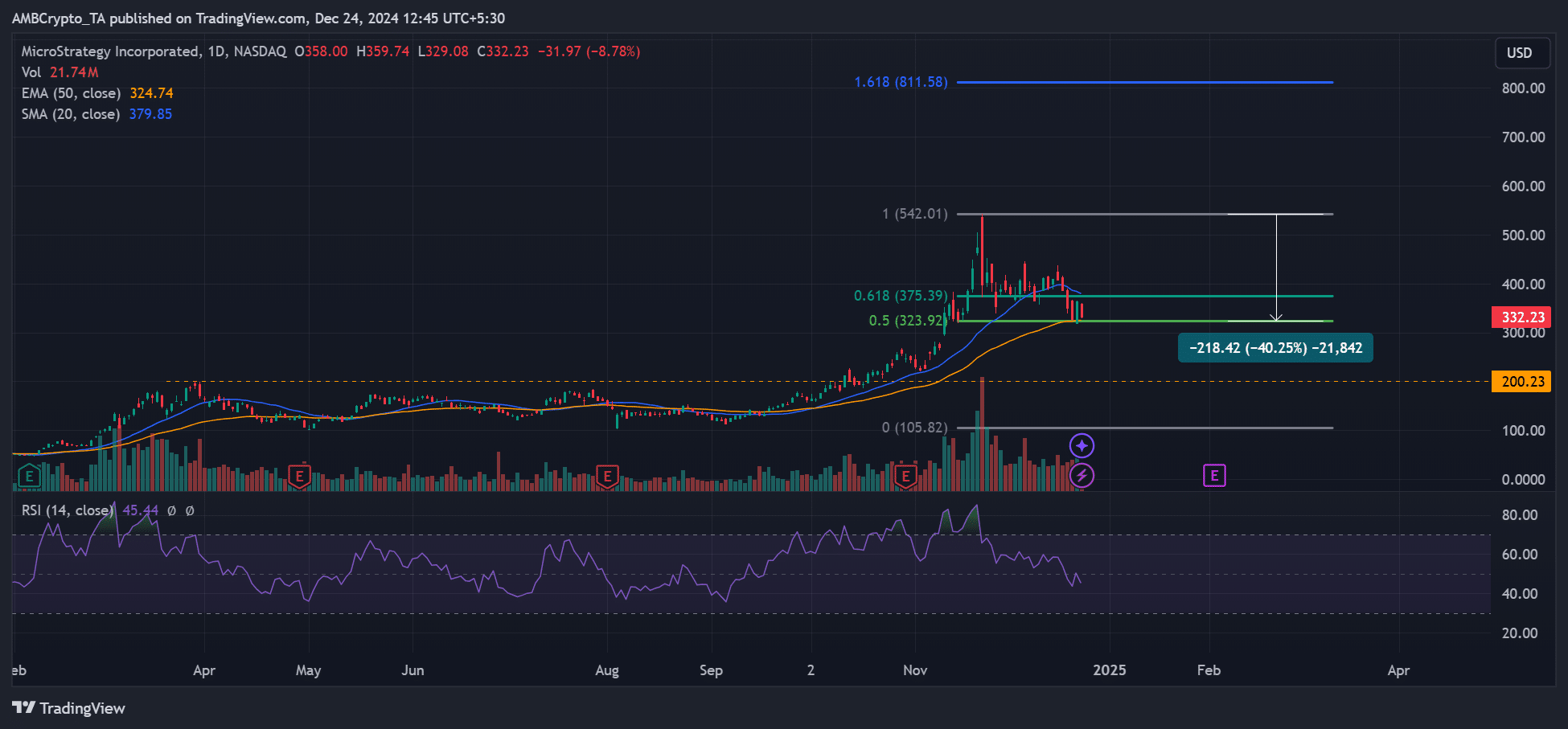

11% more was added to MSTR’s share price after their recent Bitcoin purchase, but the stock has dropped approximately 40% due to the correction in Bitcoin’s value from $108,000 to $92,000. However, despite this decline, MSTR still saw a 263% increase over the year-to-date period compared to Bitcoin’s 112% growth during the same time frame.

Although MSTR defended the 50% Fib level and 50-day EMA confluence at press time at $323; any extra BTC correction could lower the stock’s value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-24 16:39