- BONK has a bearish structure and firm downward momentum.

- The lower highs for the OBV showed heightened selling pressure and needs to be reversed before recovery can begin.

As a seasoned researcher with years of experience under my belt, I find myself analyzing the current state of Bonk [BONK]. The bearish structure and downward momentum are evident, but there’s always hope for a reversal in the short term. However, it seems like we’re not out of the woods yet as the meme coin market as a whole is yet to recover from its recent downturn.

Over the last few weeks, BONK [BONK] has been on a downward spiral, and it appears that its correction period is still ongoing. Moreover, the overall market of meme coins has experienced losses over the past month, with no signs yet of a recovery.

Analysis indicates a potential short-term price rise might occur. Yet, this could represent a revisit to the resistance area that was set earlier in the current month.

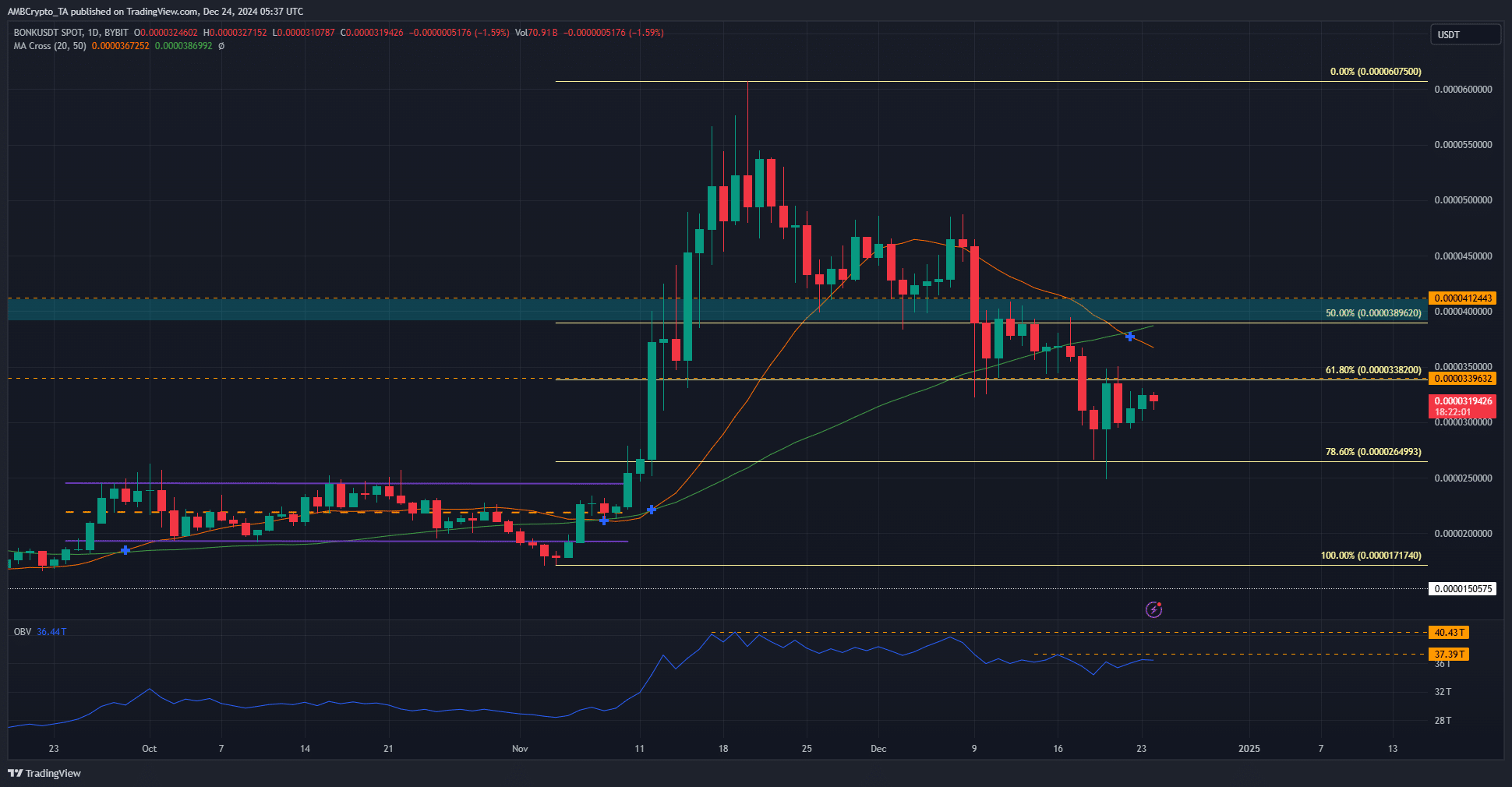

Moving averages form a bearish crossover

In simple terms, the moving averages (20 and 50) were positioned above the current price and recently crossed over in a way that suggests an ongoing downtrend. Additionally, a significant drop below $0.00004 during the second week of December hinted at a substantial pullback or correction to follow.

Following a successful defense of the 78.6% Fibonacci retracement level at $0.0000264, BONK investors can find cause for optimism. However, it’s important to remember that there’s still more ground to cover in terms of progress.

Since mid-November, the OBV (On Balance Volume) has been creating lower peaks. For the meme coin to resume its upward momentum, it’s crucial that this pattern is disrupted. Additionally, breaking past $0.000035 and establishing a higher low afterward would be the initial step towards undoing the previous bearish market setup.

Bullish Bonk coin price prediction?

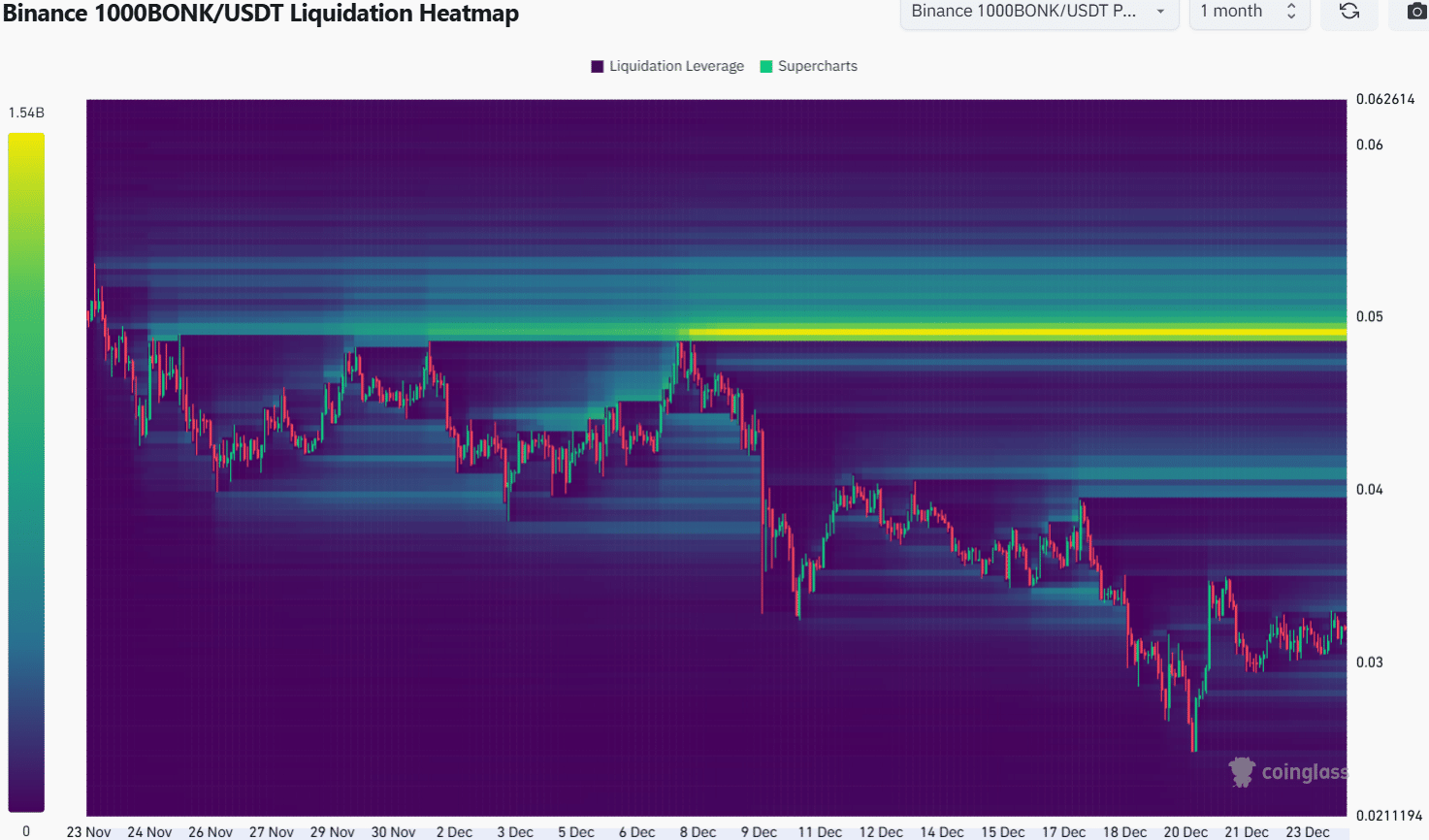

As a crypto investor, I’ve noticed a significant concentration of liquidity in BONK over the past month, specifically at the price point of $0.000049. Given the substantial size of this liquidity pool, it seems plausible that BONK may aim for this level in the upcoming weeks.

Before that, the $0.00004 region could also see a minor move downward after a retest.

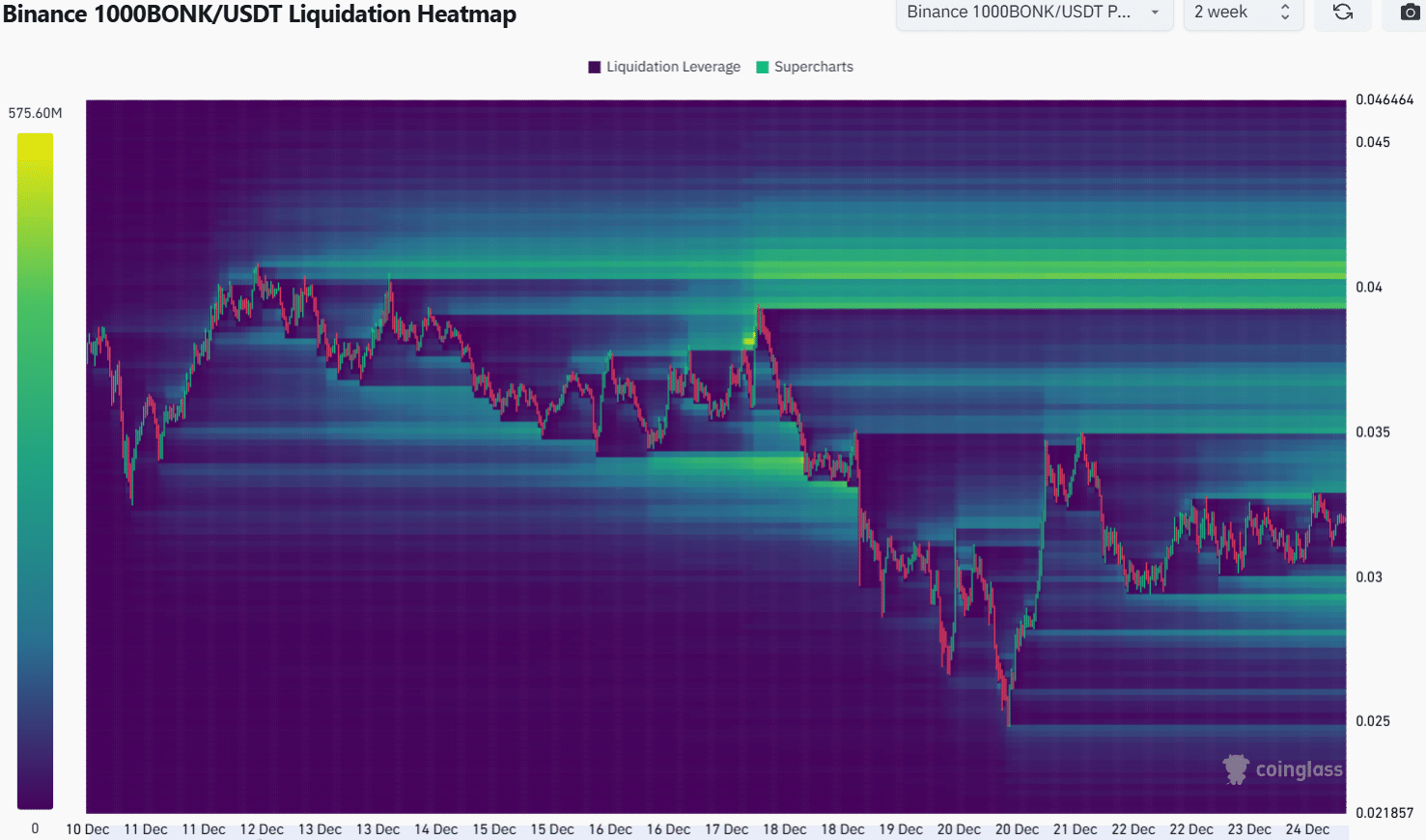

In simpler terms, the two-week chart showing potential asset sales (liquidation) indicated that the price level of $0.00004 might cause difficulties. It’s possible that these liquidation points could be surpassed before there is a pullback or drop in price.

The extent of this pullback isn’t certain and will hinge on the power of the BONK supporters and the bullish energy behind Bitcoin during that specific period.

Read Bonk’s [BONK] Price Prediction 2024-25

At levels below $0.00004, which is a notable technical resistance area, the price range of $0.000035 to $0.000037 might also serve as a barrier for the upward trend, potentially resisting further gains by bulls.

As a crypto investor, I find myself cautiously observing the trajectory of BONK. It’s essential to note that while day traders might find opportunities, for long-term investors like me, it’s prudent to remain watchful until the resistance at $0.00004 is successfully flipped into support.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-12-24 17:11