- Dogecoin’s open interest has fallen sharply, reflecting reduced trader optimism and market activity.

- Recent price decline to $0.32 raises concerns about DOGE’s short-term recovery prospects.

As an analyst with over two decades of market experience under my belt, I have seen bull runs and bear markets come and go. The recent decline in Dogecoin’s open interest and its subsequent 20% price drop has raised some concerns about its short-term prospects.

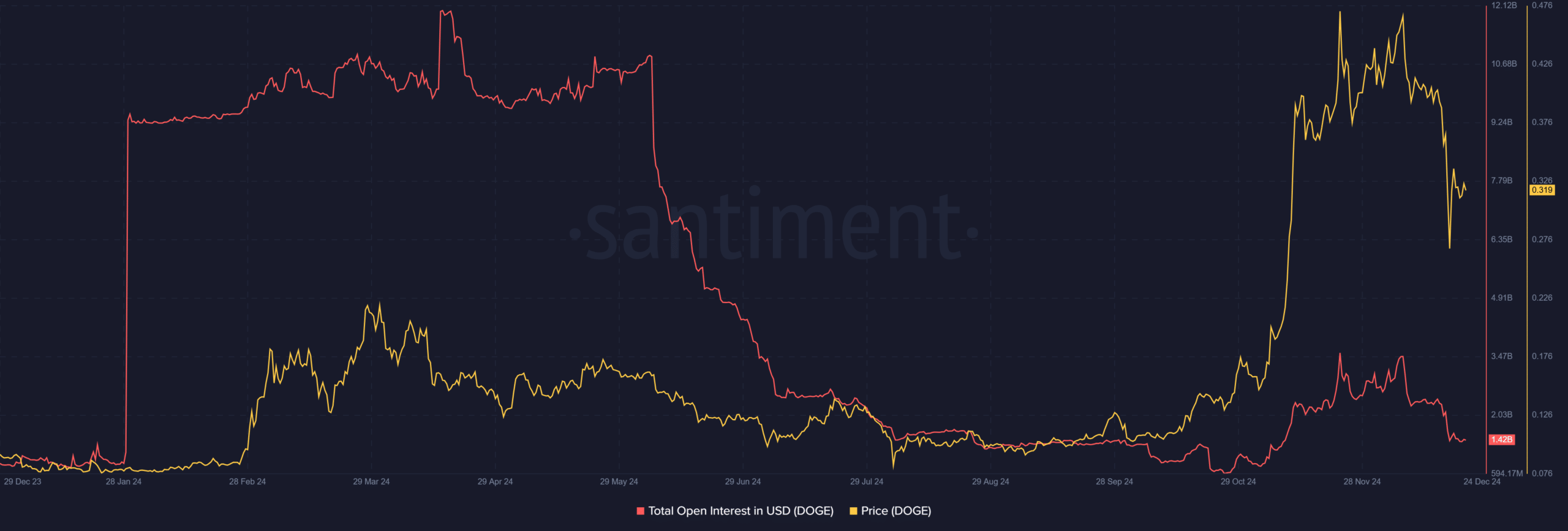

In April, the open interest for Dogecoin [DOGE] reached an annual peak of $12 billion, but it plummeted by October. There was a small increase in early November, however, the open interest is now nearing another dip to levels not seen since November 10th.

The current decrease in value bears a striking resemblance to Dogecoin’s 20% drop in price during the last seven days, causing speculation about Dogecoin’s immediate future. How will this latest change in investor opinion affect Dogecoin’s future trajectory?

Dogecoin’s open interest plummets

Dogecoin’s open interest has plummeted to $1.42 billion, a stark contrast to its April peak of $12 billion. A sustained drop in OI, particularly during DOGE’s recent price decline to $0.32, points to traders unwinding positions amid reduced optimism.

This bearish trend in OI often indicates waning confidence in short-term price recovery.

Over the last week, Dogecoin’s price has fallen by approximately 20%, and this decline, along with a decrease in Open Interest (OI), indicates that traders are hesitant to start new positions. This cautiousness suggests there might be more drops unless the market mood changes positively.

MDIA signals stagnation and cautious sentiment

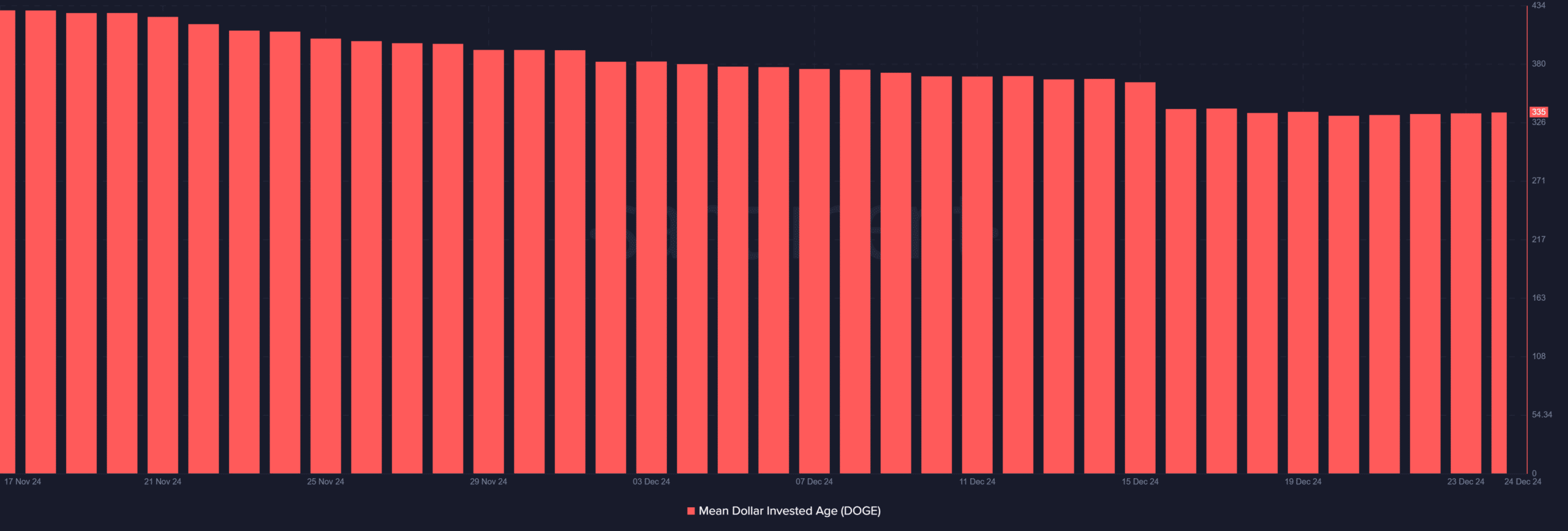

It appears that more and more Dogecoin owners are choosing to keep their coins instead of selling them. (The MDIA suggests this trend.)

The metric MDIA, which calculates the typical age of cryptocurrency coins on a blockchain based on purchase price and time elapsed, has been gradually increasing to approximately 335 days. This pattern implies that long-term investors are unlikely to be actively trading or shifting their assets, indicating a potential slowdown in market activity.

Historically, an increase in Media Dominating Industry Assets (MDIA) has tended to coincide with decreased market liquidity and lower consumer interest, which is typically interpreted as a bearish indication.

As I observe the continuous rise in the DOGE market, it seems to highlight an absence of new investment or heightened speculation. This trend mirrors the recent drops in its price, suggesting a prevailing sense of caution among investors regarding Dogecoin’s near future.

Dogecoin struggles below key support levels as bearish momentum dominates

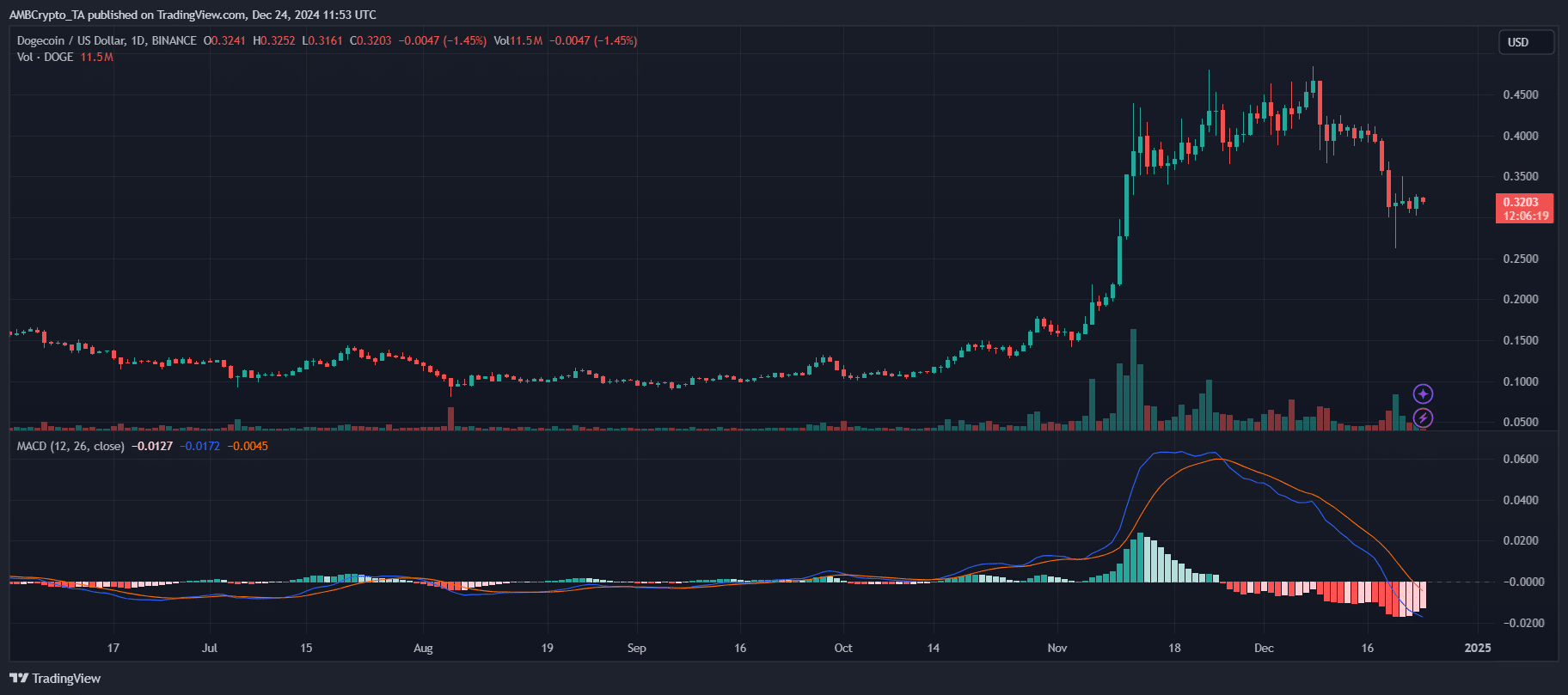

On a day-to-day basis, Dogecoin is finding it tough to retake crucial support points after its recent dip in value.

The price has fallen beneath the $0.35 mark, a level that used to provide strong support, hinting at persisting downward pressure in the market.

The MACD signal aligns with the pessimistic perspective at present. As it stands now, the MACD line is situated in an area signifying downward movement. While the histogram suggests lessening bearish pressure, a definite bullish crossover is yet to happen, which means that chances for recovery are still somewhat restricted.

Read Dogecoin [DOGE] Price Prediction 2024-2025

If the downward trend continues for Dogecoin, it may reach the $0.27 support point soon. But if purchasers can drive the price over $0.35 and keep up the momentum, a reversal toward the $0.48 resistance area could be possible.

The chance for this recovery depends on a rise in activity and strong demand returning, but currently, these factors seem rather subdued.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-25 01:11