- ETH has formed an inverse head-and-shoulders pattern, often seen as a bullish indicator that could drive gains.

- Liquidity inflows and a gradual reduction in exchange supply have increased the likelihood of an ETH rally.

As a seasoned researcher with years of market analysis under my belt, I find the recent developments in Ethereum (ETH) particularly intriguing. The convergence of several bullish indicators is reminiscent of a symphony, each playing its part to create a harmonious melody pointing towards an uptrend.

Following several weeks of downward market trends, even a 8.87% dip over the last week, Ethereum [ETH] is now showing signs of rebound. In the last day alone, it has registered a 2.41% increase, indicating a growing enthusiasm among traders.

According to AMBCrypto’s analysis, various market indicators point towards Ethereum’s latest increase potentially signaling the beginning of a wider price surge.

ETH shows double bullish signals

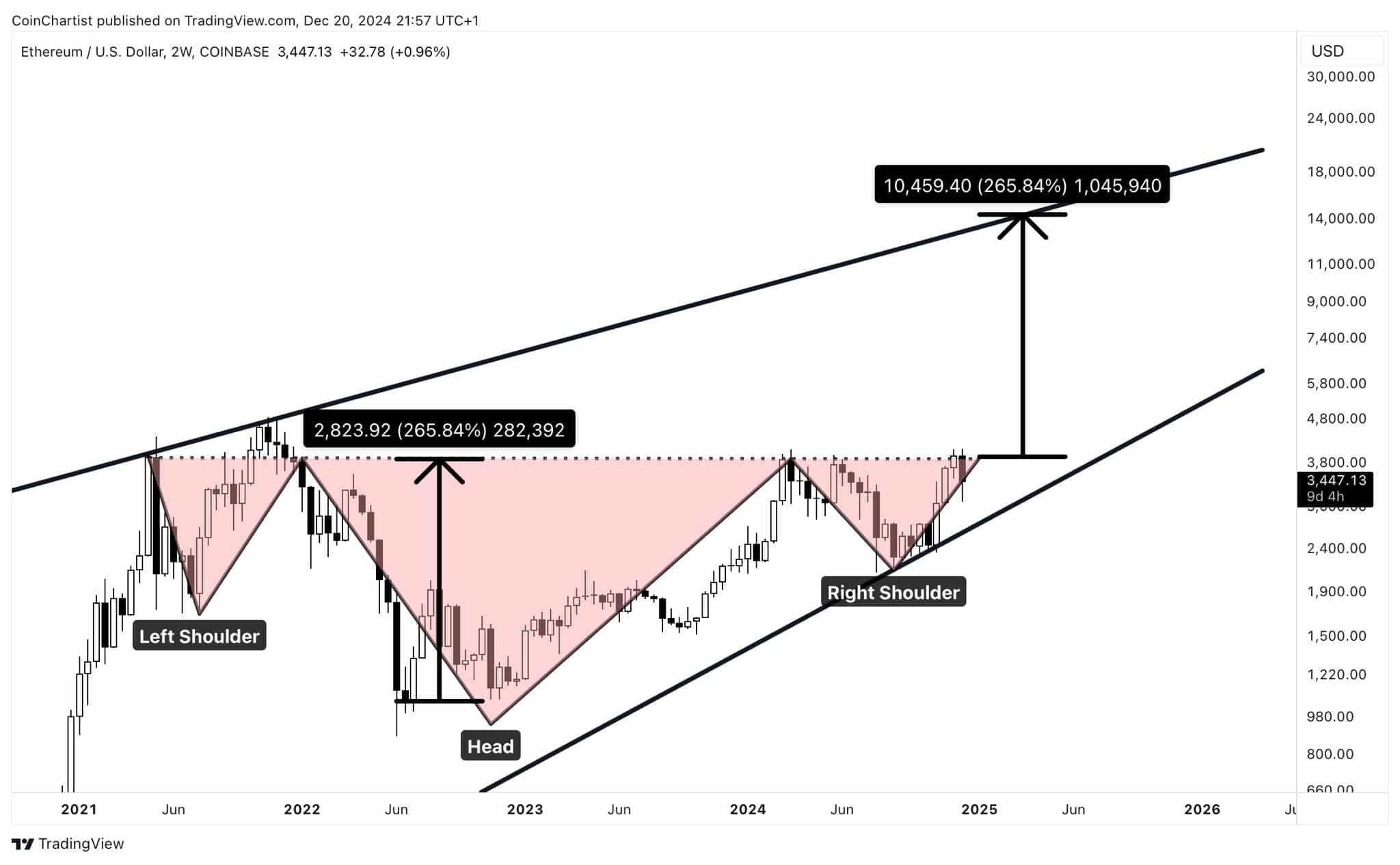

Right now, ETH is being traded inside an upward sloping channel, a pattern that typically signals a rise in its value. Inside this trend, it has also created an inverse head-and-shoulders pattern, which is often a positive sign for buyers.

If ETH manages to surge past the upper line (resistance point) seen in this inverted head-and-shoulders chart, it may experience a considerable rise.

If the gap between the head and neckline is substantial, it could potentially lead to a surge in the asset’s value by approximately 265.84%, potentially elevating its price to around $12,000.

Currently, the bi-weekly graph indicates that the latest market drop is due to a rejection at the neckline. On the other hand, the daily chart hints at a possible turnaround, as Ethereum exhibits signs of revival with its recent price increases.

Rising liquidity flow into ETH

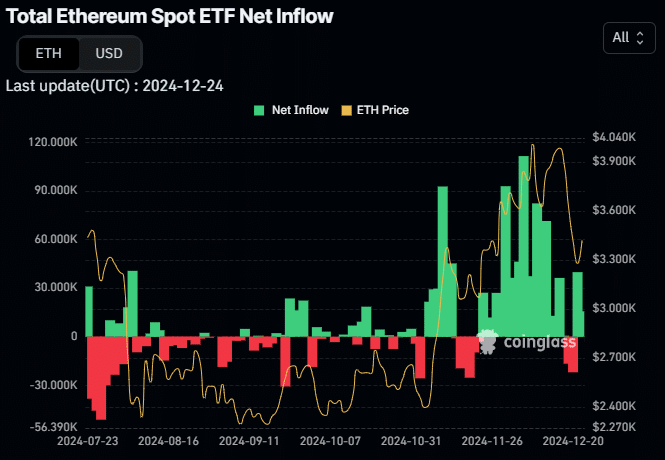

Institutional and traditional investors have shown a significant rise in their interest for Ethereum (ETH) over the last couple of days. This surge follows a prolonged phase where these investors were actively selling ETH.

Information gleaned from trades on the ETH spot Exchange-Tradable Funds (ETFs) indicates that over the past two days, conventional investors have invested approximately $54.54 million in Ethereum, which is thought to have boosted its recent price growth.

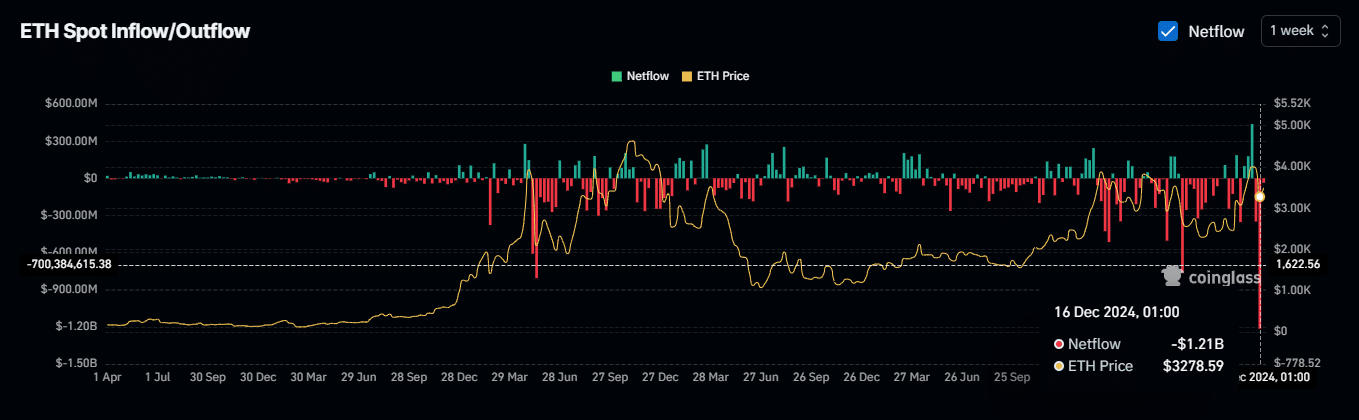

Furthermore, following last week’s unprecedented net outflow of approximately $1.2 billion (the largest ever for ETH since it was created), this trend persists. In fact, over the course of this week, an additional $35.93 million in ETH has been taken off exchanges.

As more Ethereum is withdrawn from exchanges and less is being deposited, while simultaneously there’s continued outflow rather than inflow in trading pairs, this situation may lead to a shortage of supply due to the growing demand encountering reduced accessibility.

Funding rate on the rise

Traders specializing in derivative Ethereum trading are becoming increasingly optimistic, as they’re entering long positions by buying ETH contracts. Currently, the funding rate is sitting at 0.0089%, which suggests a recent move towards positive sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

In simpler terms, when a cryptocurrency like ETH has a positive funding rate, it means that more investors who are buying (or ‘going long’) are active in the market. These investors are willing to pay regular fees to keep the balance between the current market price (spot) and the predicted future prices (futures) in check.

Should this favorable trajectory continue, it might empower ETH to surpass its existing resistance at the neckline. This could lead to a prolonged upward movement and perhaps reaching a new peak around the $12,000 mark.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-12-25 19:36