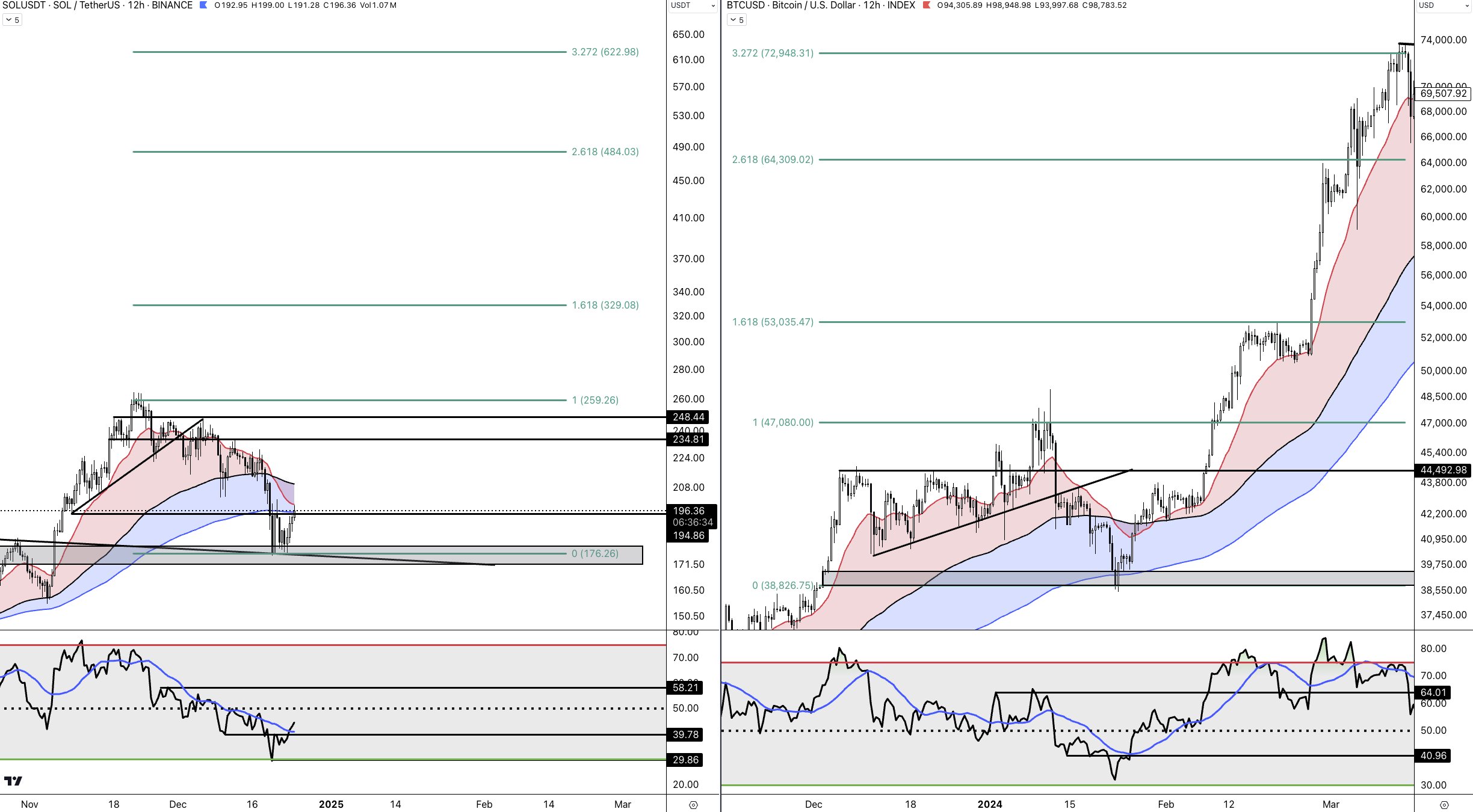

- Solana’s short-term risk bottomed at a level it reversed in the last 4 corrections.

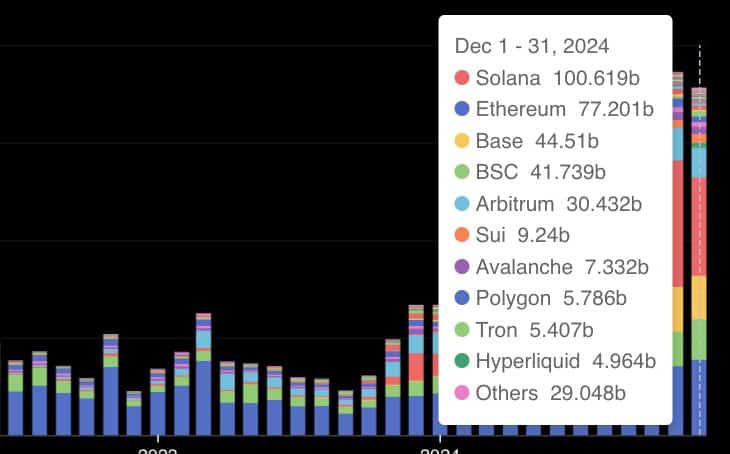

- SOL’s DEX trading volume surpassed $100B for the second consecutive month.

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen the market ebb and flow like the tides. However, the recent performance of Solana (SOL) has me intrigued. The short-term risk bottoming at a consistent level that has historically signaled a price recovery is a pattern I can’t ignore.

Looking at Solana’s (SOL) price chart compared to its short-term risk index, we observe that it has bounced back from a recurring level during past bull markets. This pattern implies a possible bottom for cautious traders, as this level often signifies a floor for risk aversion in the market. In the past, when the risk index reached this low point, a recovery in price on the charts followed suit.

Indeed, this persistent pattern suggests that the current placement of SOL might be a precursor to further price increase.

As a researcher, I have observed some historical trends that, when combined, point towards potential opportunities for entry. If these trends continue as predicted, it seems plausible that the price of Solana may experience an upward surge in the near future.

As a researcher delving into historical patterns, my findings have fostered a tentatively hopeful perspective regarding the immediate future of SOL’s performance. This could potentially bolster its standing within the market.

Solana apes Bitcoin’s early 2024 pattern

Similarly to Bitcoin in early 2024, Solana followed suit, reaching unprecedented peaks. This period witnessed Bitcoin surging from approximately $47,080 to an astounding $74,000, fueled by substantial investments at crucial support levels around $45,000.

Just like Solana, it has shown a comparable trend, rebounding from an essential support level around $193.84. This significant support is formed by the intersection of historic resistance that has now been transformed into a supportive level.

The replication indicates that it’s possible for SolarCoin (SOL) to experience a growth trajectory similar to Bitcoin’s, with significant barriers potentially being overcome to propel additional increases in value.

If Solana keeps moving along this trajectory, it might aim for the next potential resistance point around $248.44, which aligns with a significant Fibonacci retracement zone. If the momentum resembles that of Bitcoin, surpassing this level could propel SOL towards $328.98 and potentially even further – Imitating Bitcoin’s climb.

To summarize, the analysis hinted at a forecast with potential for significant growth, suggesting that SOL might reach new peaks – Similar to Bitcoin’s past performance in a similar timeframe.

Surge in DEX volume amid altcoin season

As a researcher, I’ve noticed an impressive dominance by Solana in the DEX (Decentralized Exchange) market lately. In fact, it has exceeded $100 billion in trading volume for the second consecutive month, setting itself apart from other chains. Meanwhile, Ethereum trails behind with a trading volume of approximately $77.201 billion, demonstrating a strong competitive presence, albeit with slightly lower performance compared to Solana.

Platforms such as Basis and Binance Smart Chain (BSC) also recorded impressive trading volumes of approximately $44.51 billion and $41.739 billion, respectively. This underscores the dominance Solana currently holds in the market.

The smaller platforms such as Arbitrum, Sui, and Avalanche accounted for approximately $30.432 billion, $9.24 billion, and $7.332 billion respectively within the Decentralized Exchange (DEX) market. This suggests that while their influence is growing, they still represent a relatively small portion of this market.

Ultimately, as predicted, the altcoin surge appeared to point towards a market capitalization increase, emphasizing a potential “altseason” for cryptocurrencies.

Based on this pattern, it seems that SOL, which currently shows signs of bullishness, may experience even greater growth as the market environment appears to be advantageous for altcoins.

Given that the market capitalization has reached over $3.36 trillion, it seems like the perfect moment for a Solana surge might be upon us, particularly in Q1 of 2025. This could potentially propel SOL to unprecedented heights, possibly matching or even exceeding its past records.

Keeping a close eye on Solana is essential since it might follow or amplify the general increase of altcoins. This could potentially boost its value and standing in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-26 11:03