- On-chain metrics revealed that exchanges registered outflows of $3.69 million worth of RENDER

- Render’s Open Interest surged by 10% in the last 24 hours – A sign of increasing trader interest

As a seasoned crypto investor with battle-hardened nerves and a knack for spotting promising opportunities amidst the digital chaos, I find myself intrigued by the recent bullish developments surrounding RENDER. The on-chain metrics are painting a compelling picture, with significant outflows from exchanges and a surge in Open Interest suggesting a growing interest among long-term holders and traders alike.

The native token of Render, called RENDER, could potentially experience a significant increase as it edges closer to a bullish surge. Interestingly, the overall mood in the crypto market seems to be improving as well, with heavyweights such as Bitcoin (BTC), Ethereum (ETH), and XRP exhibiting optimistic trends.

RENDER bullish on-chain metrics

Despite an optimistic perspective, it appears that long-term holders and traders have shown a high level of enthusiasm and faith in the token, as suggested by the analysis firm Coinglass. Intriguingly, data from RENDER’s Spot inflow/outflow has shown that exchanges globally have experienced substantial outflows totaling approximately $3.69 million of RENDER tokens.

When it comes to the world of digital currencies, “outflow” is used to describe the transfer of assets from exchange platforms to individual wallets. This action may signal a positive trend in market momentum and a possible advantageous moment for purchasing these cryptocurrencies.

Over the past day, there’s been a 10% increase in Open Interest for Render, indicating a rise in trader engagement and the creation of fresh contracts. This spike comes as the price approaches the potential breakout point.

RENDER technical analysis and key levels

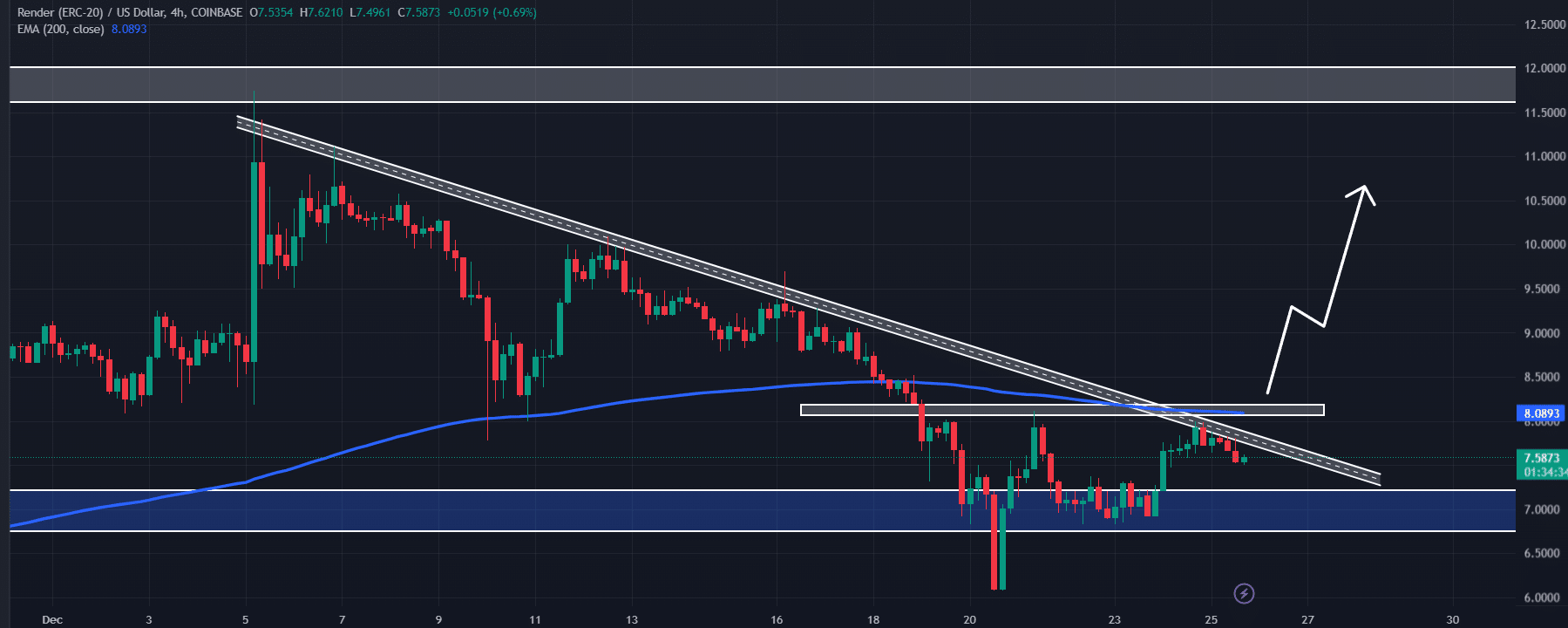

As a crypto investor, I’ve noticed some promising signs for RENDER based on my analysis. It seems that it could potentially break free from its downward trendline, a significant horizontal level, and the 4-hour 200 Exponential Moving Average (EMA). This suggests an opportunity that might be worth exploring further.

If this altcoin manages to surpass its current price barriers and ends a four-hour trading period above $8.10, there’s a good chance it will first increase by approximately 15%, reaching around $9.50. Furthermore, under favorable conditions, it might rise by up to 40% to touch the $11.65 mark in the long run.

At the current moment, the Relative Strength Index (RSI) of RENDER stood at 50.5, meaning the asset is currently below the overbought threshold. This implies that there’s potential for further growth in the upcoming days since the asset still has room to increase in value.

As an analyst, I found that by merging these on-chain indicators with my technical analysis, it became apparent that the bulls had been holding a strong position in this asset. This suggests that they may offer crucial support as the asset navigates through its current obstacles at present.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-26 12:07