- Gauging the Movement price prediction as MOVE recovered well from its short-term retracement.

- The retest of the 78.6% level and its defense highlighted bullish conviction.

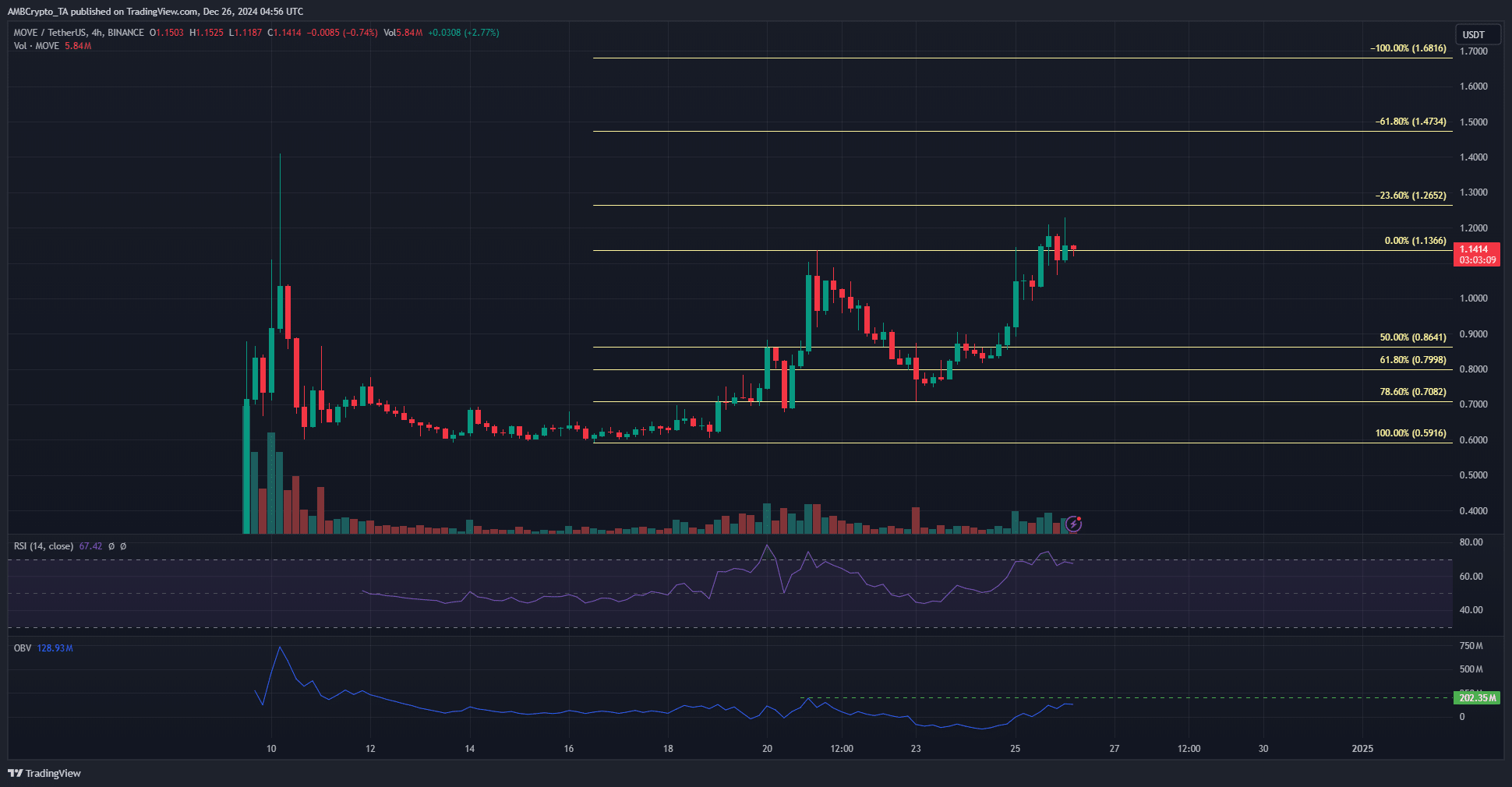

As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by Movement’s [MOVE] recent performance. After a strong rally from $0.59 to $1.13, followed by a brief retracement to the 78.6% Fibonacci level, MOVE has bounced back impressively. This resilience, coupled with Bitcoin‘s [BTC] short-term bullishness, is a bullish sign indeed.

Over the last 24 hours, the Movement [MOVE] has shown impressive growth, increasing by 12.09%, contrasting with a 1.7% decline in the overall altcoin market. This notable outperformance offered a positive sign for optimistic investors, or ‘bulls’.

Bullish structure for MOVE- but also some volume concerns

The trends in Movement crypto’s pricing showed a robust upward momentum. Following its surge from $0.59 to $1.13, there was a correction that brought it back down to approximately $0.7 – a point close to the 78.6% Fibonacci retracement level.

After that, the value of the token has surged noticeably, with Bitcoin’s [BTC] recent short-term optimism playing a role over the last few days.

As MOVE was recuperating, the trading activity noticeably increased. Although it was heartening to see this uptick, the On-Balance Volume (OBV) hadn’t surpassed its recent peak just yet.

It’s clear that purchasing activity has been increasing significantly, though it hasn’t reached a point where it outweighs the sales observed since the 20th of December.

Consequently, while MOVE has reached a fresh peak, it may find it challenging to advance further because of insufficient trading activity. At the same time, the Relative Strength Index (RSI) indicates that the upward trend is strong.

The upcoming price levels to focus on are approximately $1.26, $1.47, and $1.68. For now, the area around $1.20 may present as a barrier for further increases, while the range between $1.03 and $1.05 could act as an attractive region for potential buying opportunities.

If the price falls slightly below $0.997, this shift could signal a change in market sentiment from bullish to bearish, potentially indicating an upcoming correction or retreat.

Open Interest nearly doubles in three days

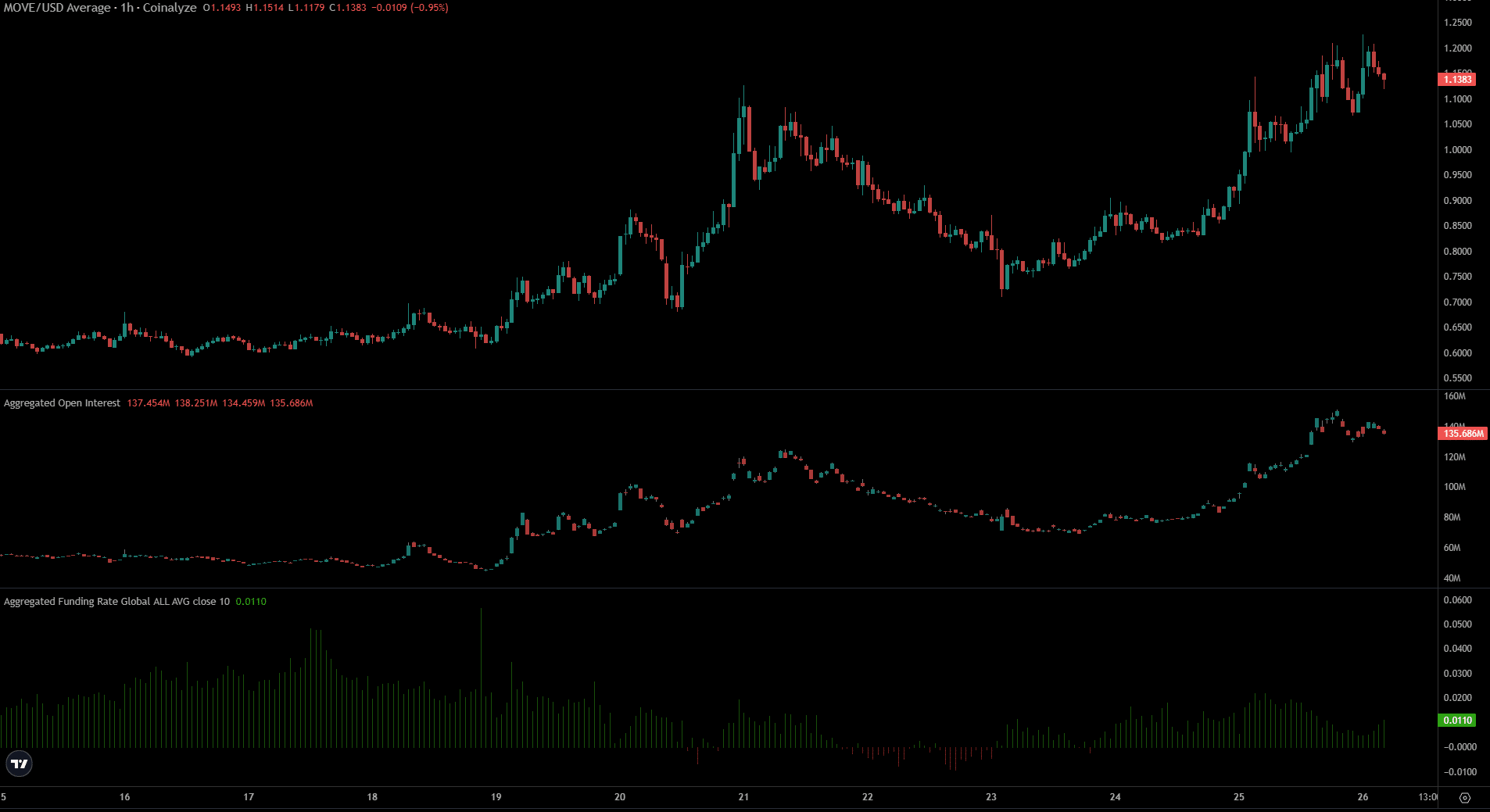

Starting on December 23rd, the Open Interest figure has almost been doubled, climbing up from $71.8 million to approximately $135.68 million as of now.

Read Movement’s [MOVE] Price Prediction 2025-26

This reflected heavy bullish speculative activity as MOVE saw gains in the past three days.

The Funding Rate remained favorable, signaling a bullish attitude among traders. Persistent interest in the spot market could boost the popularity of the Movement token, potentially enabling it to break through the $1.2 resistance level.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

2024-12-26 16:07