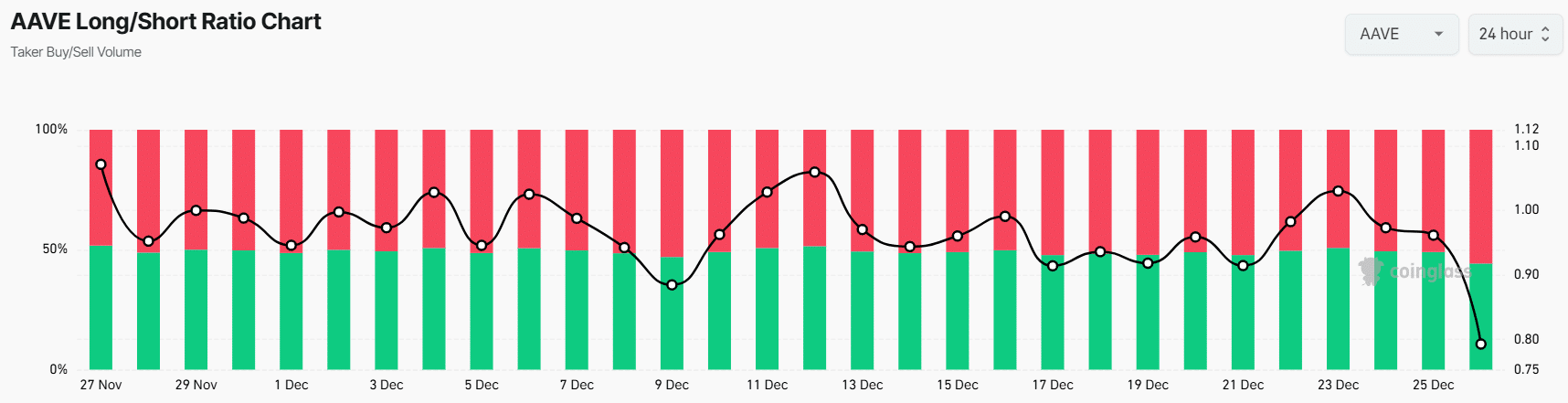

- 58.9% of top AAVE traders held short positions at press time.

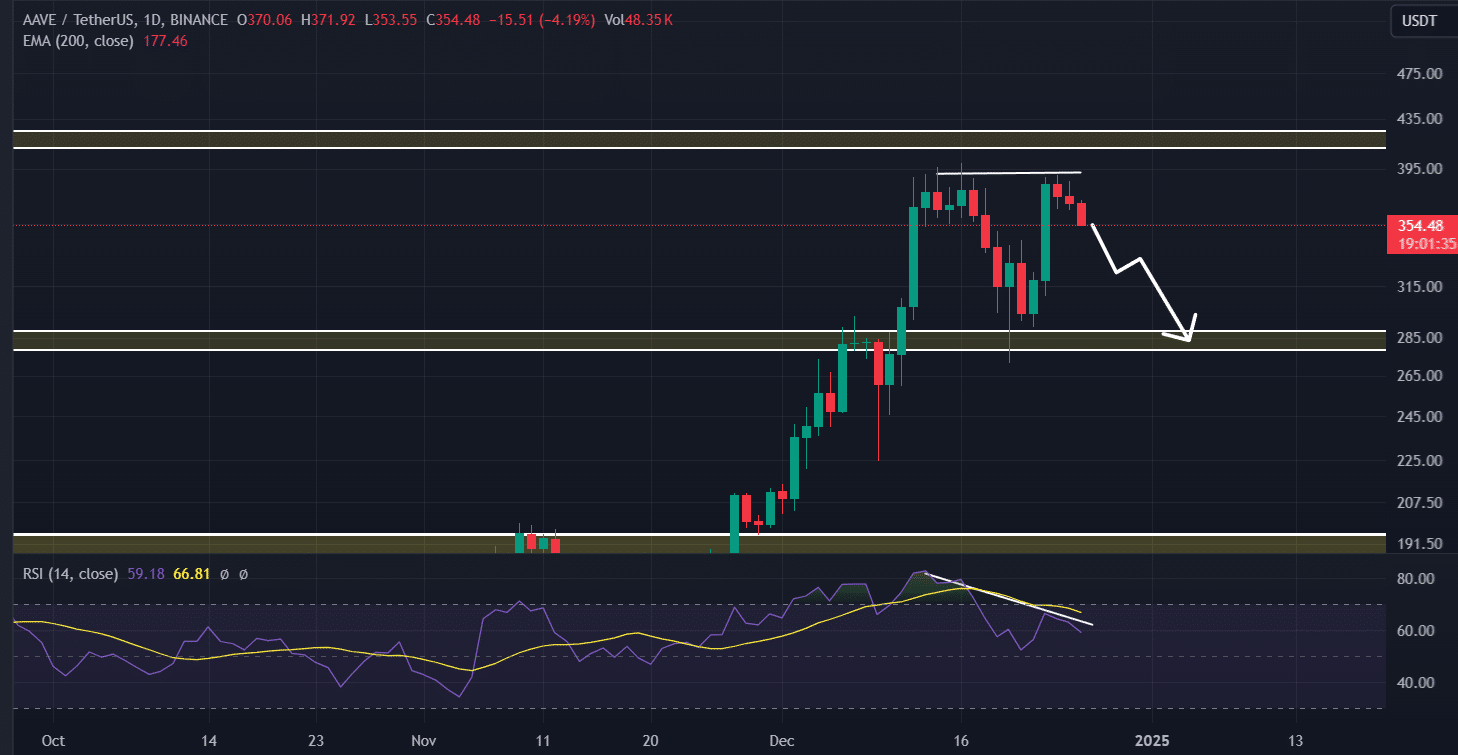

- AAVE’s daily chart formed a bearish divergence and a double-top price action pattern.

As a seasoned researcher with years of experience navigating the tumultuous seas of cryptocurrency markets, I can’t help but feel a sense of déjà vu looking at Aave [AAVE]’s current chart. The bearish divergence and double-top pattern on the daily time frame are red flags that have signaled trouble in the past.

Given the persisting market volatility, it seems likely that Aave (AAVE) may experience a drop in price over the next few days. This prediction arises from the formation of a bearish chart pattern on the daily scale.

Beyond the pessimistic price trend, another possible factor shaping AAVE’s unfavorable perspective could be investor sentiment and the possibility of cashing out or “booking profits” in the altcoin market.

Alongside AAVE, other significant digital currencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are exhibiting similar patterns of movement as well.

AAVE looks bearish

According to an analysis by AMBCrypto, the data from on-chain analytics company Coinglass indicates a significant influx of more than $5.2 million in Aave (AAVE) into cryptocurrency exchanges, as demonstrated by AAVE’s Spot Inflow/Outflow figures.

In the world of digital currencies, when assets are transferred from wallets to trading platforms (exchanges), it’s usually a sign of possible selling activity. This could potentially increase the supply of the currency and put downward pressure on its price.

It seems that while some investors are holding onto assets for the long term, traders are taking a more bearish stance, predicting a possible drop in prices, according to Coinglass’ reports.

As of the latest report, the Long/Short Ratio for AAVE stood at 0.79, which is the lowest it’s been since late November 2024. A ratio less than 1 suggests that traders are showing a significant level of pessimism or bearishness.

58.9% of top AAVE traders held short positions at this time, while 41.10% held short positions.

It seems I’m observing a shift in sentiment among traders and long-term investors, as they seem to favor taking short positions. This trend, coupled with the emergence of bearish price action, points towards a pessimistic view for the asset, suggesting a potential downward trajectory.

AAVE technical analysis and upcoming levels

Based on the technical analysis provided by AMBCrypto, it appears that AAVE is displaying a bearish double top chart formation. This pattern suggests a possible decrease in its price over the next few days, as indicated by the bearish divergence observed on the daily time frame.

According to the latest trends in pricing and past performance, it seems the value of this asset could decrease by approximately 18%, potentially falling to around $290 within a short time frame.

Read Aave’s [AAVE] Price Prediction 2025–2026

Current price momentum

At press time, AAVE was trading near $350 after a price decline of over 9% in the past 24 hours.

Over that timeframe, the trading volume decreased by 28%. This indicates a lower level of involvement from both traders and investors as they seem to be less active due to the downward trend in prices.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

2024-12-26 17:43