- The 6–12 month holder cohort contributed to Bitcoin’s recent price stagnation below $100K.

- Declining whale transactions and reduced Open Interest suggested potential short-term sideways movement.

As an analyst with over two decades of experience in the financial markets, I find myself intrigued by the current state of Bitcoin (BTC). The market’s recent stagnation below $100K is not just a numbers game for me; it’s a fascinating study of investor behavior.

Over the last several weeks, Bitcoin’s [BTC] value has mostly stayed stable, showing only minimal increases, even though there is widespread expectation that it might surge by the end of the year.

For about a month now, or since mid-December, Bitcoin hasn’t been able to maintain prices consistently above $100,000. Instead, its value has mostly moved between roughly $94,000 and $95,000.

As an analyst, I’m observing a 5.8% decrease in price over the past week. Currently, Bitcoin is being transacted at approximately $95,657, signifying a 2.5% dip in its value within the preceding 24 hours.

Who profited during the $100,000 range?

In light of the current market standstill, experts are now concentrating on studying investor actions more closely, with the aim of identifying what influences Bitcoin’s price fluctuations.

A CryptoQuant analyst, Yonsei Dent, has highlighted insights from the Spent Output Age Bands (SOAB) indicator.

This measurement monitors Bitcoin transactions made by investors according to their holding durations, providing a more transparent view of sell-off trends among various market players.

It appears that individuals who held Bitcoin for a duration of 6-12 months were the most frequent sellers during the latest Bitcoin price increase. They mainly cashed in on the gains they accumulated from the market’s early-year growth spike.

It’s worth noting that investors who probably purchased Bitcoin near the debut of the spot ETF in early 2024 have played a substantial role in putting selling pressure on the market, causing the recent price plateau.

On the other hand, it seems that individuals who have owned Bitcoin for more than a year—referred to as long-term holders—have been selling comparatively less throughout this timeframe.

Furthermore, the Binary Coin Days Destroyed metric indicates that there was less selling of older Bitcoins in December as opposed to November.

As a dedicated cryptocurrency investor, I’m confidently keeping my stash, optimistically anticipating further price escalations.

Mixed sentiment in the market

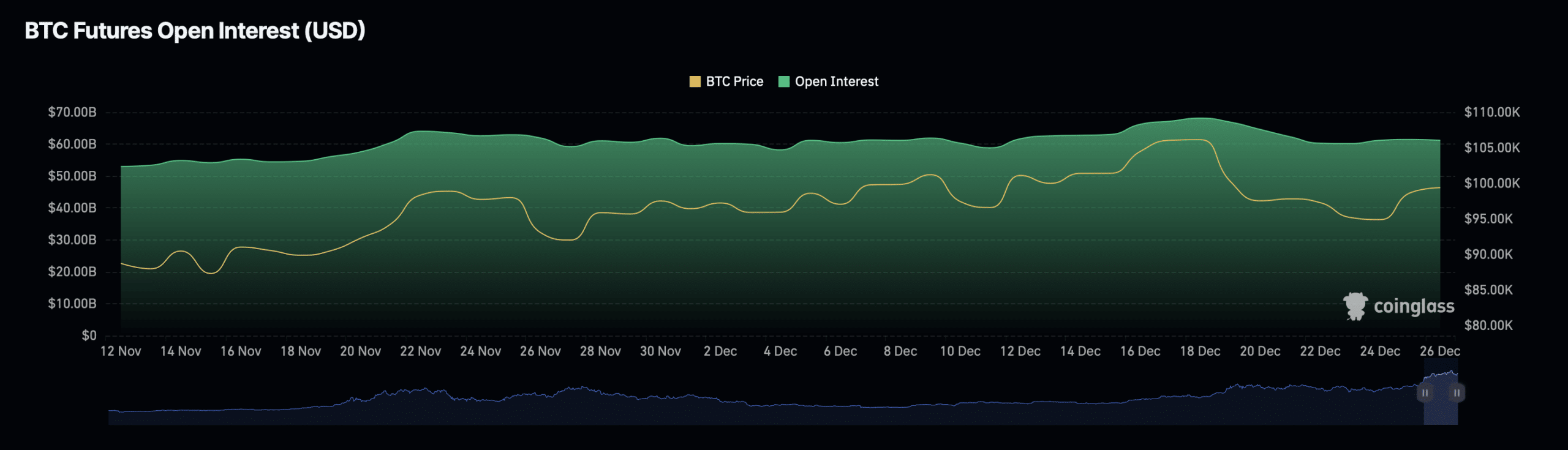

Also, Bitcoin’s Open Interest provided additional insight into the market’s direction.

The Open Interest quantifies the overall worth of active Futures agreements, acting as a gauge for market opinions and trading fluidity.

Based on figures provided by Coinglass, the open interest for Bitcoin has dropped slightly by approximately 0.69%, now standing at an estimated value of around $60.68 billion.

Bitcoin’s Open Interest volume has also dropped by 1.45% to $94.14 billion.

These drops suggest a decrease in speculative trades, implying that traders are adopting a more cautious approach due to the lack of significant changes in Bitcoin’s price trend.

A decrease in Open Interest usually indicates less market involvement, which may lead to a temporary restriction on substantial price fluctuations.

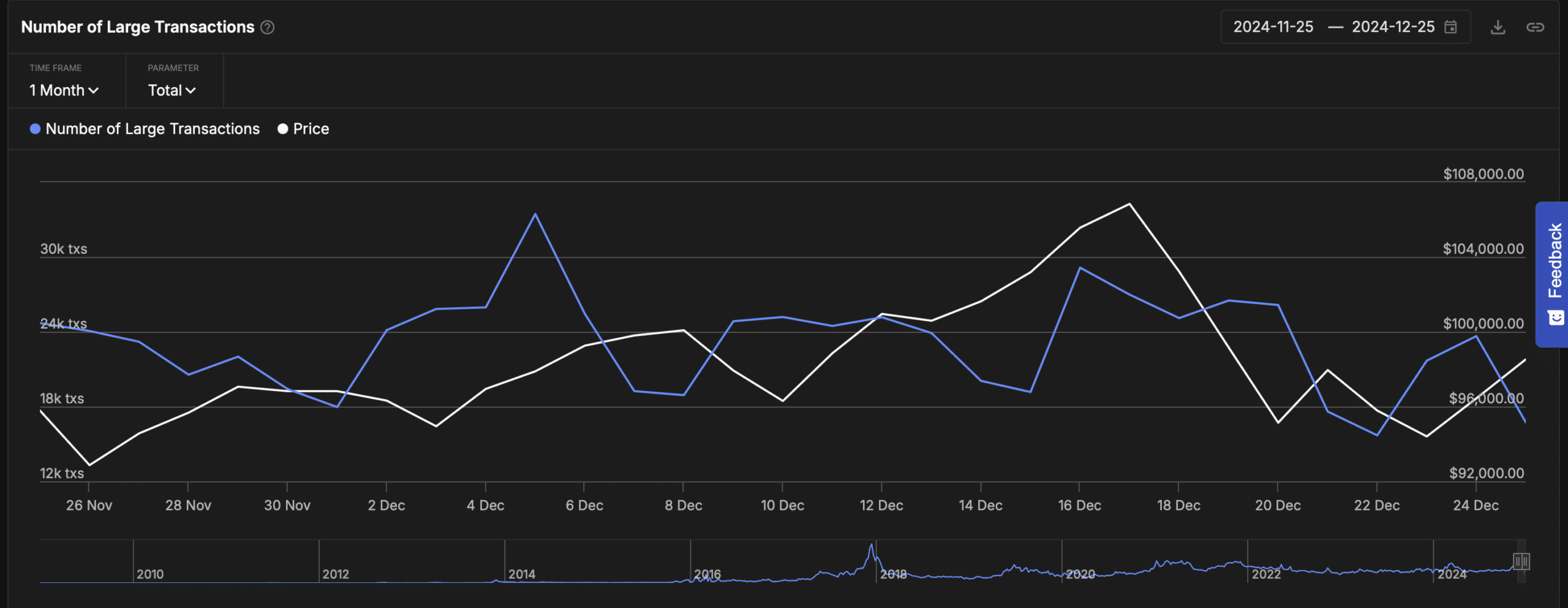

Meanwhile, Bitcoin’s whale transaction activity, has shown a sharp decline over the past month.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

According to data from IntoTheBlock, there’s been a substantial decrease in transactions worth over $100,000. This number fell from approximately 39,900 transactions at the beginning of December to only 16,700 by the 25th of December.

Transactions involving whales (large investors) frequently signal the involvement of institutional or wealthy individual investors. A decrease in these transactions might imply less market confidence, or a short-term halt in significant investment accumulation.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-26 23:36