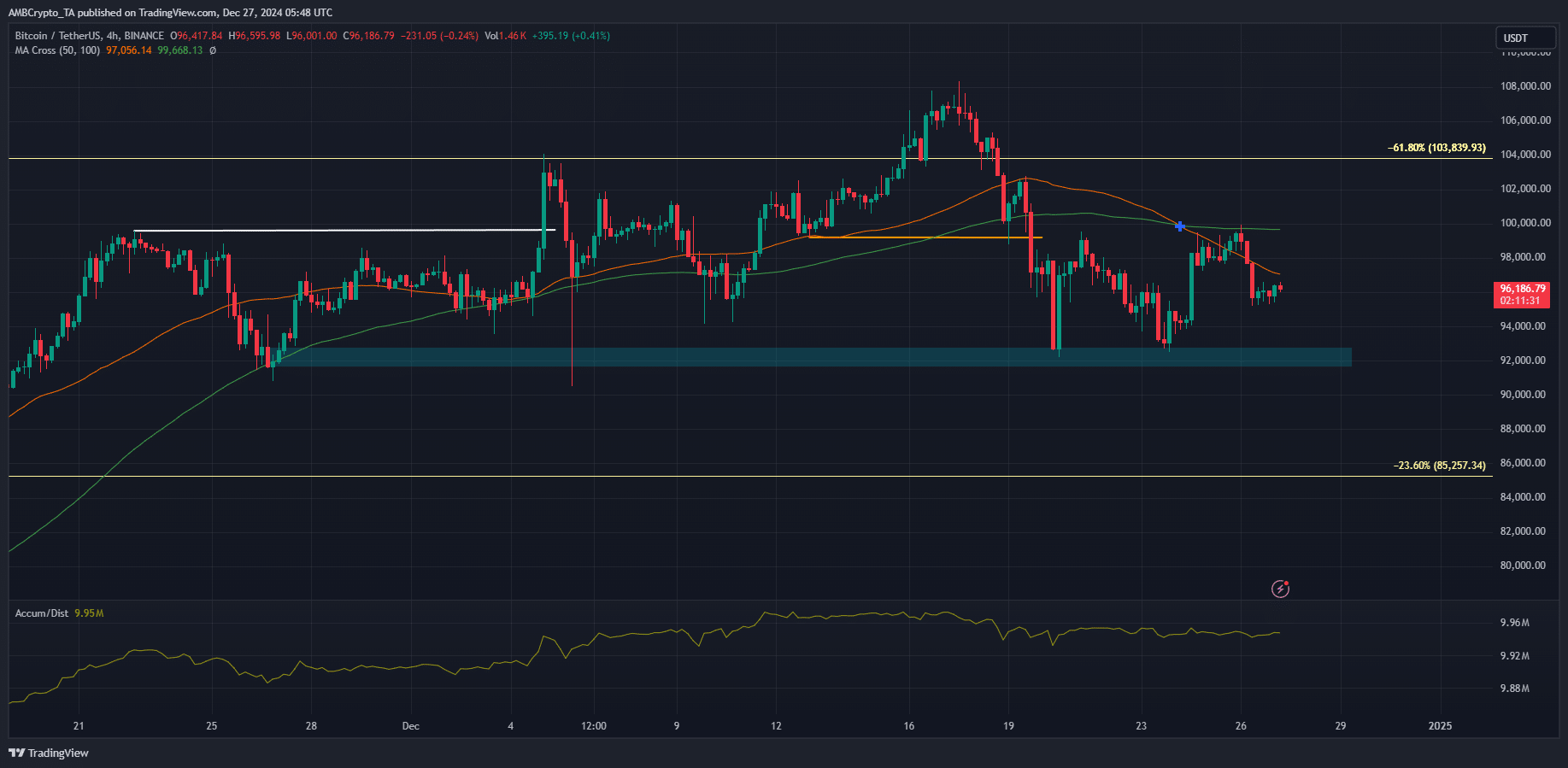

- Bitcoin retained a bearish structure on the 4-hour chart

- Steady selling was seen recently, but sentiment appeared to point towards a price bounce

As a seasoned researcher who has weathered countless market fluctuations, I must say that the current state of Bitcoin [BTC] is a familiar sight. The bearish structure on the 4-hour chart is reminiscent of many winter evenings when the market seems to hibernate, only to awaken with renewed vigor come spring.

Starting from Christmas Day, Bitcoin [BTC]’s festive surge started to slow down and failed to breach the $100k barrier on Boxing Day. Meanwhile, the two-day U.S. Federal Reserve meeting that commenced on December 17 concluded with a policy statement. This statement predicted only two potential interest rate reductions in 2025 as opposed to the earlier forecast of four.

Today witnessed a drop of more than 2.5% for the Dow Jones, equating to approximately 1,150 points. Although these losses were recouped later on, the market’s treatment towards Bitcoin has remained less favorable.

Risk-on asset status slows recovery

In simple terms, Bitcoin’s movement tends to influence the broader crypto market. Over the past day, Bitcoin decreased by approximately 2.75%, and the value of altcoins dropped by about 2.31%. By looking at the 4-hour chart for Bitcoin, it appears that the bearish trend is still dominant.

On December 19th, it took a bearish turn, as indicated by the orange mark. Since then, the A/D indicator has been gradually decreasing, suggesting less buying activity. Furthermore, a bearish moving average crossover occurred, underscoring the downward trend experienced over the past ten days.

Crypto is down today- Will it regain the uptrend next month?

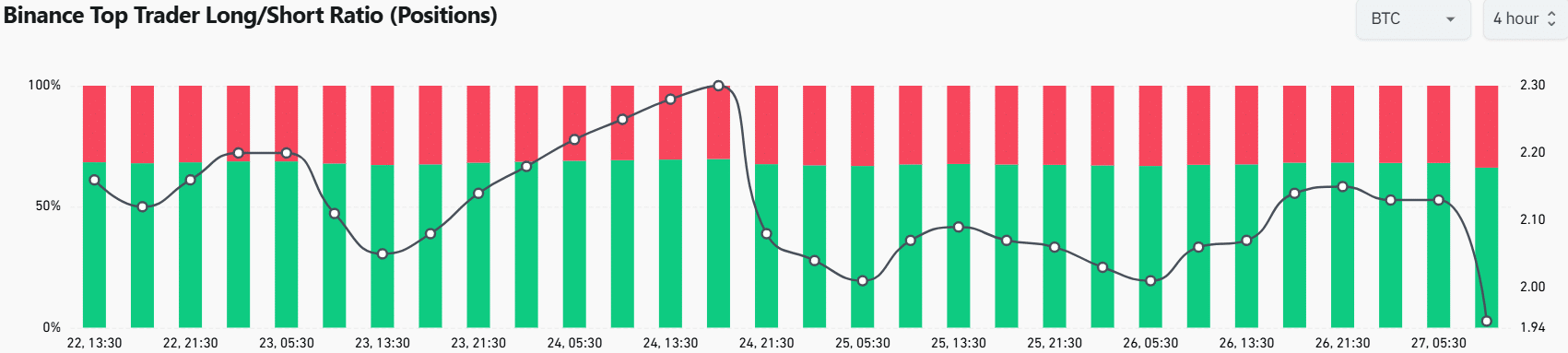

Examining the positions of leading traders on Binance, as gathered from Coinglass data, indicates a glimmer of short-term optimism. AMBCrypto discovered that this specific metric, which quantifies the long or short positions held by the top 20% of traders, stood at 1.95.

66.12% of the positions were long, while only 33.88% were short – Reflecting a predominantly optimistic outlook among experienced traders.

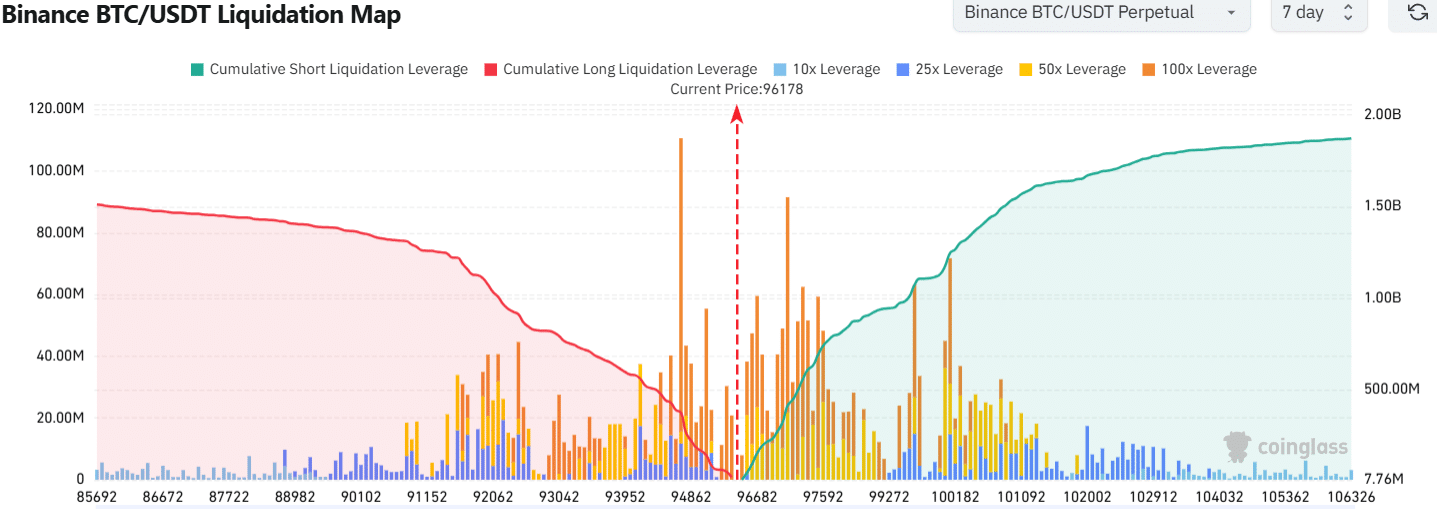

The liquidation chart solidified our optimistic short-term hypothesis. There were more liquidations moving upward, suggesting a higher likelihood of a search for liquidity heading northward over the next few days.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a crypto investor, I’ve noticed from recent data that there seems to be a potential resistance level at around $97.6k, which might halt any further price increase and could even trigger sellers. Additionally, as we approach the end of 2024, it appears that the market may continue to exhibit some volatility.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Moana 3: Release Date, Plot, and What to Expect

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2024-12-27 14:15