- Bitcoin and Ethereum netflows pictured similar patterns around Christmas

- Open Interest trends revealed wary sentiment among traders

As an analyst with over a decade of experience in the crypto market, I have witnessed numerous trends and patterns unfold before my eyes. While it is always challenging to predict the future with absolute certainty, history often repeats itself in the world of cryptocurrencies.

In the last seven days of December, Bitcoin [BTC] typically experiences a surge (Santa Claus rally), only to give back these increases during the subsequent week. This pattern has been observed since 2021, though there was an exception in the year preceding that.

In the week after Christmas, it’s been common for the prices of significant alternative cryptocurrencies like Ethereum (ETH) and Dogecoin (DOGE), apart from Bitcoin, to drop significantly. Is it likely that this pattern will persist through the year 2024?

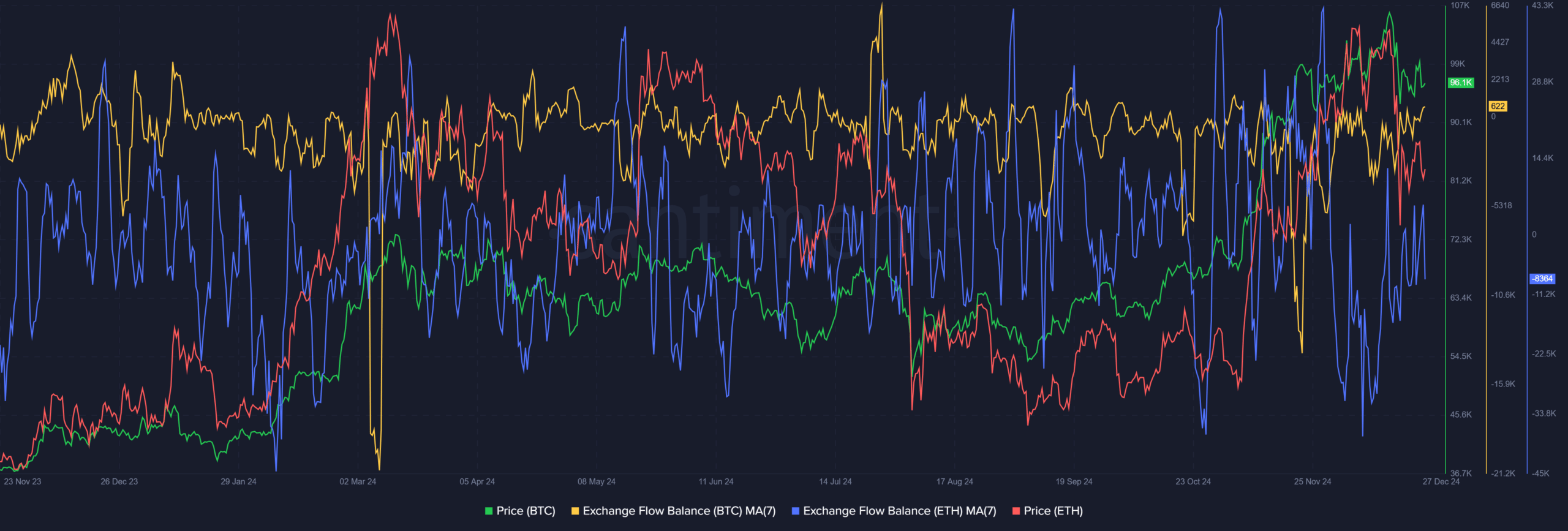

Major assets’ exchange flows and the price correlation

Over the Christmas period in 2023, AMBCrypto analyzed the movement of Bitcoin (BTC) and Ethereum (ETH) into and out of exchanges. To make the data more manageable, a 7-day moving average was applied. On December 22nd, the 7-day moving average for BTC inflow increased to approximately 1,481 coins, while the corresponding figure for ETH inflow reached around 32,805. A few days later, this flow reversed direction.

On the 26th and 27th of December, the running averages for Bitcoin (BTC) and Ethereum (ETH) exchange outflows stood at -5,915 and -9,626 respectively. This suggests that these cryptocurrencies are being accumulated, as large amounts are leaving the exchanges.

During this period, the prices for Bitcoin remained stable while Ethereum saw a 10% increase, as we approached the last week of the year. These figures suggested that users were opting to transfer their tokens to exchanges to secure some gains, with a subsequent increase in accumulation during the following week.

2024 saw a surge in the value of cryptocurrencies similar to Santa Claus’s gift-giving spree, pushing Bitcoin to reach $99.6k, Ethereum to $3,560, and Dogecoin to $0.342. Over a three-day period before Christmas, these digital assets experienced a rise of 6% to 9%.

As we speak, the flow of transactions in cryptocurrency exchanges is increasing, indicating a possible surge in selling activity. Simultaneously, the value of Bitcoin and Ethereum has dropped by about 5% and 6% respectively, while Dogecoin experienced a more significant decrease of nearly 9%.

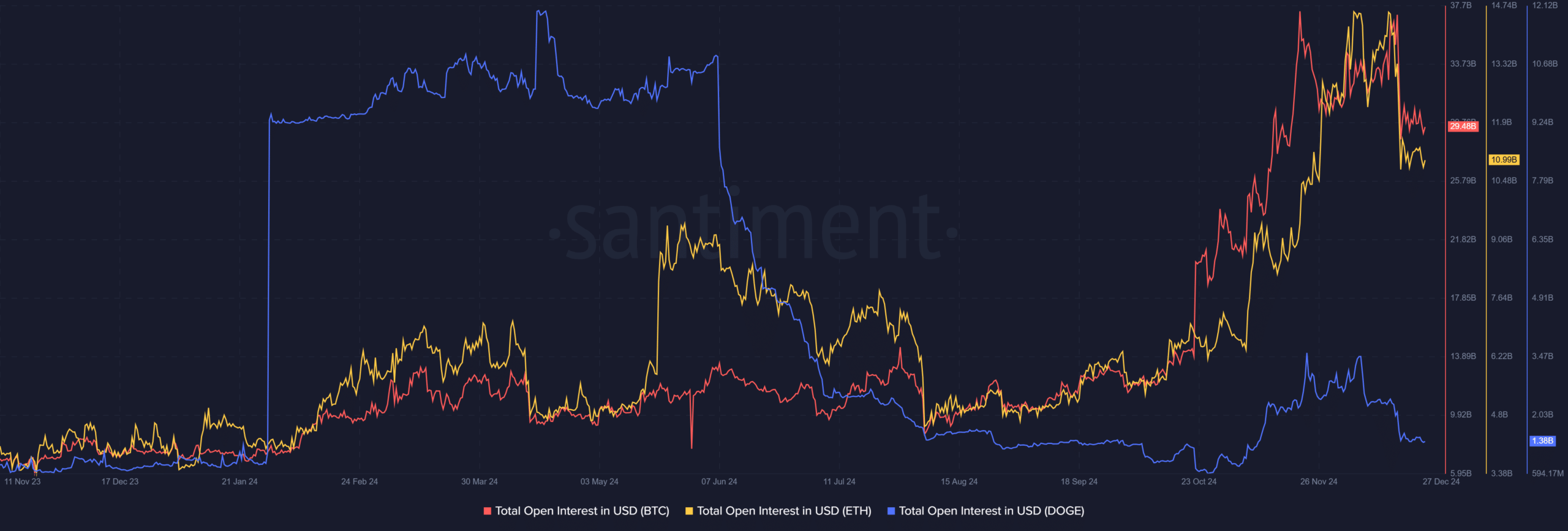

Open Interest showed muted sentiment leading into the festive week

The Open Interest of Dogecoin, Ethereum, and Bitcoin can be compared too. In 2023, the OI fell sharply from 22 to 25 December, before recovering quickly in the first two weeks of January.

Read Bitcoin’s [BTC] Price Prediction 2025-26

On the 17th of December in 2024, there was a significant decrease in Open Interest (OI). This decline could be linked to the broader market’s drop, which ensued after bearish news from the Federal Reserve caused the Dow Jones Industrial Average to plummet by 1,250 points on the previous Wednesday.

The Options Instrument (OI) kept wandering horizontally, suggesting that market participants were staying on the sidelines. Traders might seek opportunities to buy long positions. Furthermore, a potential increase in OI and trading volume over the next few days could result in the early 2024 gains being replicated in January 2025.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-12-27 22:15