- ETH has turned green on daily and weekly charts, hiking by 1.67% and 1.74% respectively.

- Ethereum’s Futures signaled a potential recovery as selling pressure eased.

As a seasoned researcher with over a decade of experience in the crypto market, I have witnessed countless bull runs and bear markets. Having closely followed Ethereum’s [ETH] journey since its inception, I can confidently say that the recent green signals on ETH’s daily and weekly charts are promising. The fact that Ethereum’s Futures signaled a potential recovery with easing selling pressure is a positive development for the altcoin.

However, as a cautious analyst, I always advocate for a holistic approach when interpreting market trends. In this case, it’s essential to consider both derivatives and spot markets to get a comprehensive understanding of Ethereum’s trajectory.

In my analysis, the positive signs in ETH Futures markets could potentially boost Ethereum towards recovery. The healthy Funding Rate, increasing buying sentiment, surging Open Interest, and easing liquidation all point toward a reduction in selling pressure. However, it’s crucial to remember that market conditions can change quickly, so I advise keeping a close eye on these metrics moving forward.

It’s also important to note that while the derivatives market shows promising signs, investor behavior in spot markets is equally significant. If large holders continue accumulating and whales keep pouring capital into ETH, we could see a significant recovery in price. In my experience, when investor confidence rises across both markets, Ethereum has a strong chance of breaking out of consolidation ranges and reclaiming higher levels.

So, as an analyst who’s seen the crypto market’s highs and lows, I remain optimistic about Ethereum’s future but also remain vigilant and adaptable to any potential changes in market conditions.

On a lighter note, let me share a little joke to lighten the mood: Why did the Ethereum developer go to therapy? Because it kept telling him it needed more gas!

For the last fortnight, Ethereum (ETH) has found it challenging to sustain a bullish trend. During this timeframe, the cryptocurrency has been oscillating within a narrow band, fluctuating between approximately $3500 and $3300.

Under the current market situation, important parties are pondering on potential factors that might help Ethereum bounce back.

According to an analysis by Burak Kesmeci from CryptoQuant, there are four crucial indicators in the Futures market that hint at Ethereum’s future direction.

Futures markets assess Ethereum

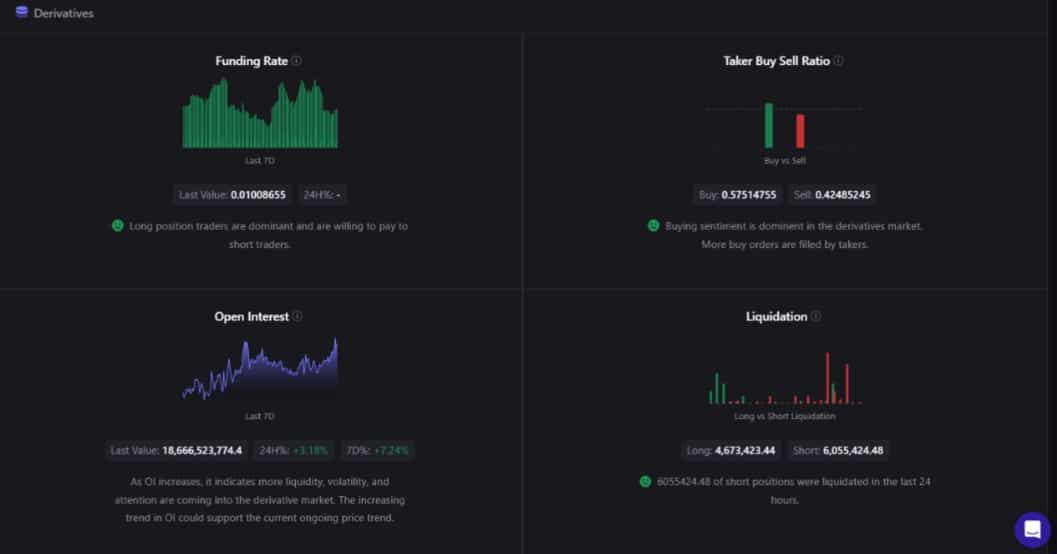

In the course of his examination, Kesmeci highlighted four key indicators used in Futures trading: Funding Rate, the balance between buyers and sellers (Taker Buy-Sell Ratio), the number of outstanding contracts (Open Interest), and the ease with which these contracts can be closed or liquidated.

At the moment of reporting, Ethereum’s Funding Rate stood at 0.01, implying a strong and balanced market where long positions were maintaining the ETH spot market.

Additionally, the Taker Buy Sell ratio on Ethereum stood at 0.57, implying that there was more demand for buying rather than selling in the derivatives market.

As a crypto investor, when I see a surge in buying activity, I recognize that this heightened demand is crucial. It exerts a stronger purchasing pressure, and in turn, can drive up prices because of the increased demand.

As someone who has closely followed the cryptocurrency market over the past few years, I must say that the recent surge of 3.18% in Ethereum’s Open Interest within a 24-hour period is noteworthy. My personal experience with derivatives in this space has taught me to pay close attention to such signals, as they often indicate a heightened activity and potential for short-term volatility. While I don’t make investment decisions based solely on these indicators, I always keep an eye on them to gauge market sentiment and adjust my strategy accordingly. In the world of cryptocurrencies, staying informed and adaptable is crucial, as the market can change rapidly.

To sum up, it appears that Ethereum’s market saw a significant number of short positions being closed out, totaling around $6 million over the last 24 hours, as reported before the current moment.

Lowering selling pressure in derivative markets helps counteract the effect of increasing open interest levels.

Therefore, the demand for ETH Futures has noticeably decreased, but despite a potential buildup suggested by Open Interest, the buyers seem to be increasing their presence and becoming more active in the market.

Could Futures boost ETH toward recovery?

It’s crucial to also examine Ethereum’s performance on the spot market to get a well-rounded perspective of its overall performance in the derivatives markets.

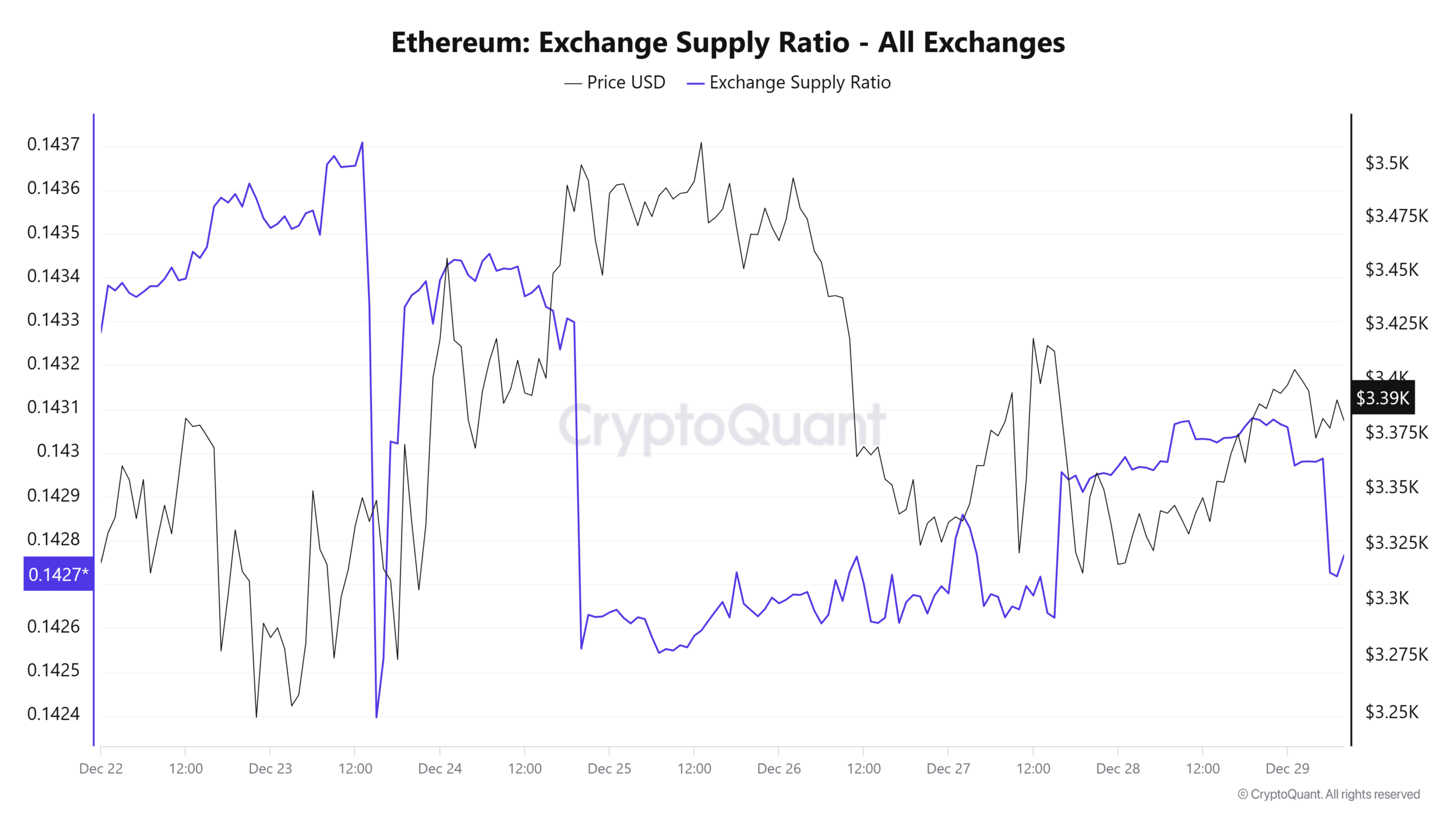

Initially, it’s important to note that the Exchange Supply Ratio isn’t limited to just spot markets. However, the amount of supply available on exchanges tends to mirror the level of activity in those spot markets.

Currently, at this moment, the exchange supply ratio of Ethereum (ETH) has decreased to approximately 0.14 over the last week. This decrease implies that investors might be choosing to hold onto their ETH assets rather than keeping them on exchanges.

This market behavior reflects accumulation and hoarding in anticipation of better prices.

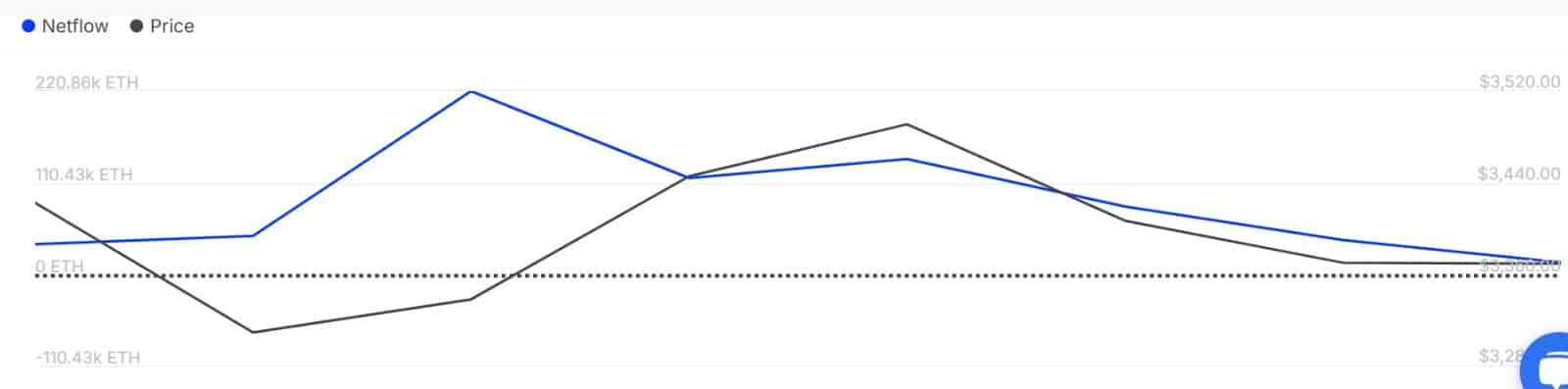

Over the last seven days, a generally optimistic outlook has been shared by significant investors as well. Consequently, their collective net flow has stayed consistently positive all through this period.

This indicated more capital inflow from whales.

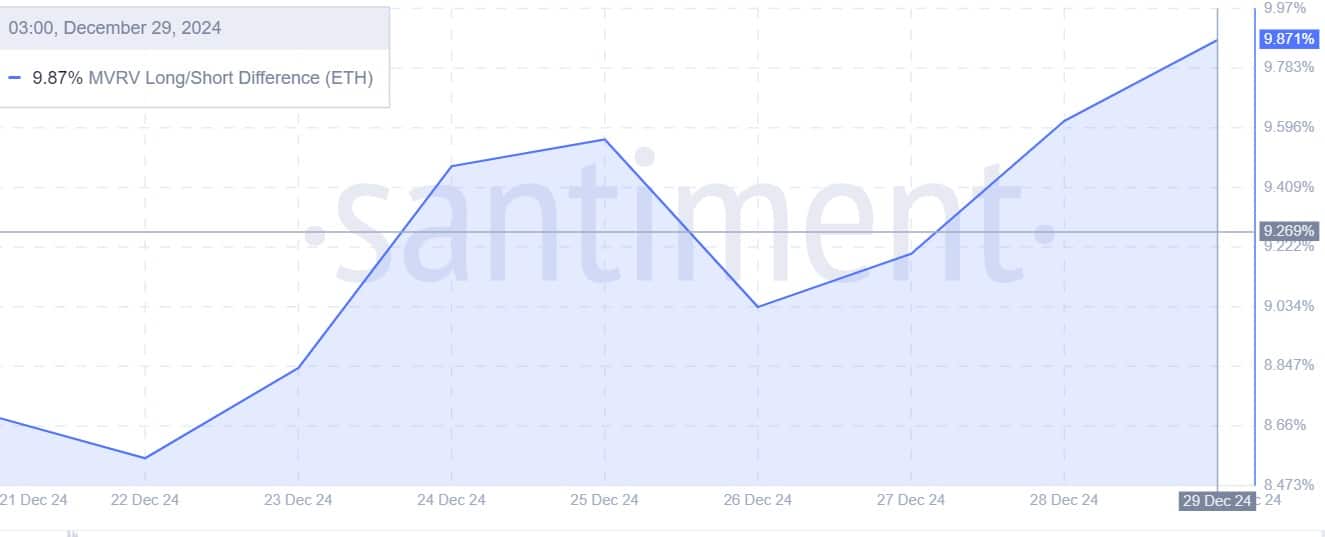

Ultimately, even with an increase in ownership, long-term ETH investors have grown optimistic about its future and are assured of its potential, as their returns exceed those of short-term holders.

Based on my years of experience in the financial markets, I’ve noticed that when investor confidence strengthens across derivatives and spot market activity, it often signals a positive trend for assets like Ethereum. In such situations, I have observed significant recoveries in their prices on the charts. This is a pattern I’ve seen play out multiple times, so if you’re considering investing in Ethereum, now might be an interesting time to pay close attention to these market indicators.

Read Ethereum’s [ETH] Price Prediction 2025–2026

As optimism grows within the market, it’s plausible that Ethereum (ETH) will experience further increases in its price chart. Should this positive trend persist, there is a strong possibility that Ethereum could break free from its current range and regain the $3700 price point.

However, if bears outweigh bulls crashing these sentiments, ETH will drop to $3200.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-30 00:08