- Toncoin saw a sharp decline in interest for Swaps on TON DEX.

- TON has declined by 3.06% over the past 24 hours.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have seen many bull and bear cycles. After analyzing the current state of Toncoin (TON), it appears that we are witnessing another phase of uncertainty and reduced interest in swaps on TON DEX.

Over the past few months, I have followed the growth and development of TON closely, and I must admit that its decline is surprising given its potential. However, upon closer examination, it seems that a combination of factors has contributed to this downturn.

The reduction in open positions, legal issues surrounding the founder’s arrest, and overall unfavorable market conditions have all played their part in driving investors away from decentralized exchanges on TON. It is essential to acknowledge these challenges as they have impacted the altcoin’s trading volume and liquidity.

However, it is crucial not to overlook the strategic opportunities that this situation presents. Historically, periods of low interest and market inactivity have often served as attractive entry points for investors looking to capitalize on long-term gains. As such, I believe that TON could be an excellent buy opportunity for those who are willing to take a calculated risk.

In conclusion, while the decline in swaps on TON DEX is concerning, it does not necessarily mean that the altcoin is doomed. Instead, it presents a strategic opportunity for investors who are willing to navigate through the current market uncertainty and potentially reap significant rewards in the long run.

Now, let me share a little joke with you – Did you hear about the cryptocurrency that got arrested? It was called Toncoin! (I’ll see myself out…)

After experiencing an increase on Christmas Eve, Toncoin (TON) has been moving horizontally in its trades. Following a peak at $6, TON has since dropped to $5.6.

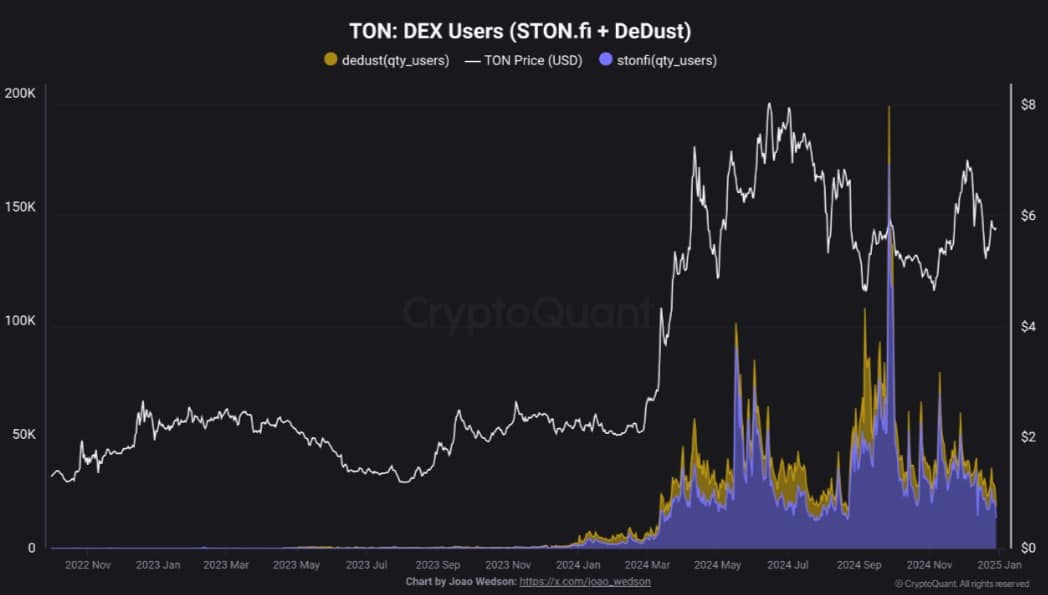

The absence of positive trends in TON has sparked discussions among analysts. Specifically, CryptoQuant analyst Joao Wedson points out the decreasing enthusiasm for Swaps as one reason contributing to the altcoin’s current state.

Decline in Interest for Swaps

I’ve been closely monitoring the cryptocurrency market for quite some time now, and one trend that has caught my attention recently is the decrease in swap activity on the Toncoin network decentralized exchanges. Based on my observations, it seems that this decline could be a sign of underlying issues within the network or a shift in user behavior towards other platforms. As someone who’s been investing in cryptocurrencies for years, I believe it’s important to keep a close eye on such developments and adjust our investment strategies accordingly.

According to him, the average daily users on STON.fi has declined to 13,300 and on DeDust to 5250.

The number of daily users for this altcoin has significantly decreased compared to its September levels, where it boasted nearly 200,000 users across two platforms daily.

Based on my personal experiences and observations in the cryptocurrency market, I have noticed that the decrease in users is primarily influenced by three key factors. Firstly, a significant reduction in open trading positions has been observed, as many traders are either liquidating their investments or scaling back their engagement with decentralized exchanges due to market volatility and uncertainty. Secondly, increased regulatory scrutiny and confusion surrounding the legal status of cryptocurrencies in various jurisdictions has caused some users to shy away from participating in the market altogether. Lastly, the lack of user-friendly interfaces and educational resources for newcomers has made it difficult for beginners to navigate the complex world of decentralized finance, further exacerbating the decline in user adoption. To remedy these issues, I believe that more accessible and informative resources should be provided to help both novice and experienced traders make informed decisions, while also advocating for clear regulations that foster a welcoming environment for all users.

As a member of the TON community, I’ve noticed a wave of apprehension due to the ongoing legal complications that followed the arrest of our founder several months back. This uncertainty has undeniably affected engagement levels and trust within the crypto networks we rely on.

As a crypto investor, I’ve noticed that the digital currency market has been facing some challenging times since the last Federal Reserve interest rate reductions. The trading activity has slowed down, and my risk tolerance level has decreased due to a lessened appetite for risk in the market.

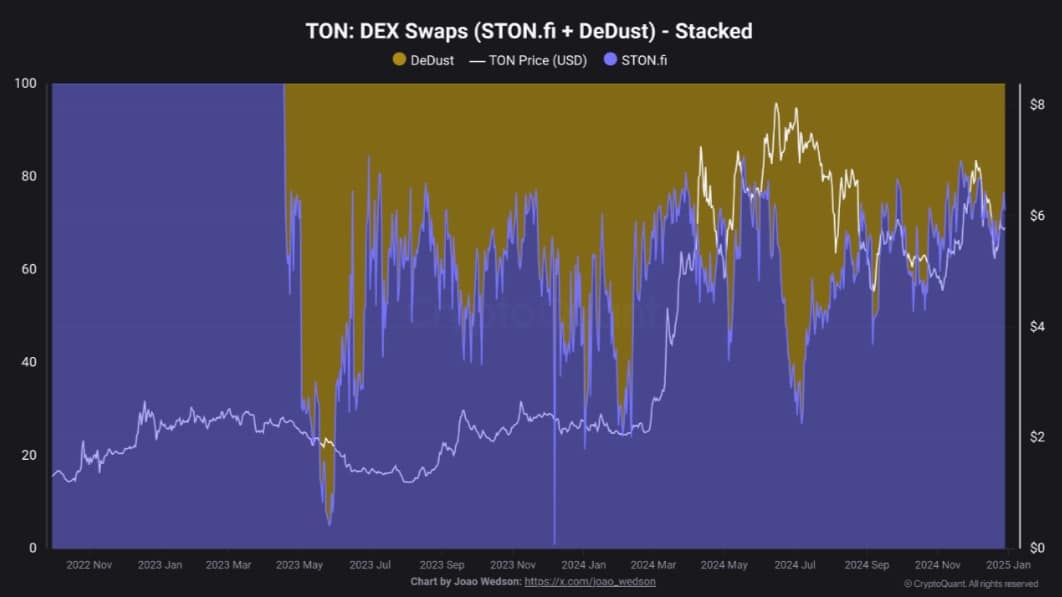

As someone who has been closely following the cryptocurrency market for several years now, I have noticed a significant shift in trends within the Tron (TON) ecosystem. Based on my observations and experiences, it appears that investors are increasingly moving away from decentralized trading towards staking due to a perceived decline in swaps. This change is not surprising, given the volatility and potential risks associated with decentralized trading. In contrast, staking offers a more stable and passive income stream, which aligns well with many investors’ long-term investment strategies. I believe that this trend will continue as more and more people seek out low-risk, high-reward investment opportunities in the rapidly evolving world of cryptocurrency.

Although this decrease might appear difficult, it could equally present a tactical advantage. In the past, times of low-interest rates and market sluggishness often proved to be enticing moments for investors to join in.

What it means for TON

Significantly, a substantial drop in investor interest towards swap agreements was observed, which coincided with decreased purchasing demand. This decrease in demand stemmed from investors’ doubts about the market trend, leading them to minimize their risk involvement.

Consequently, Toncoin is experiencing a significant decrease in demand due to the uncertainties within the market, causing investors to adopt more conservative investment strategies.

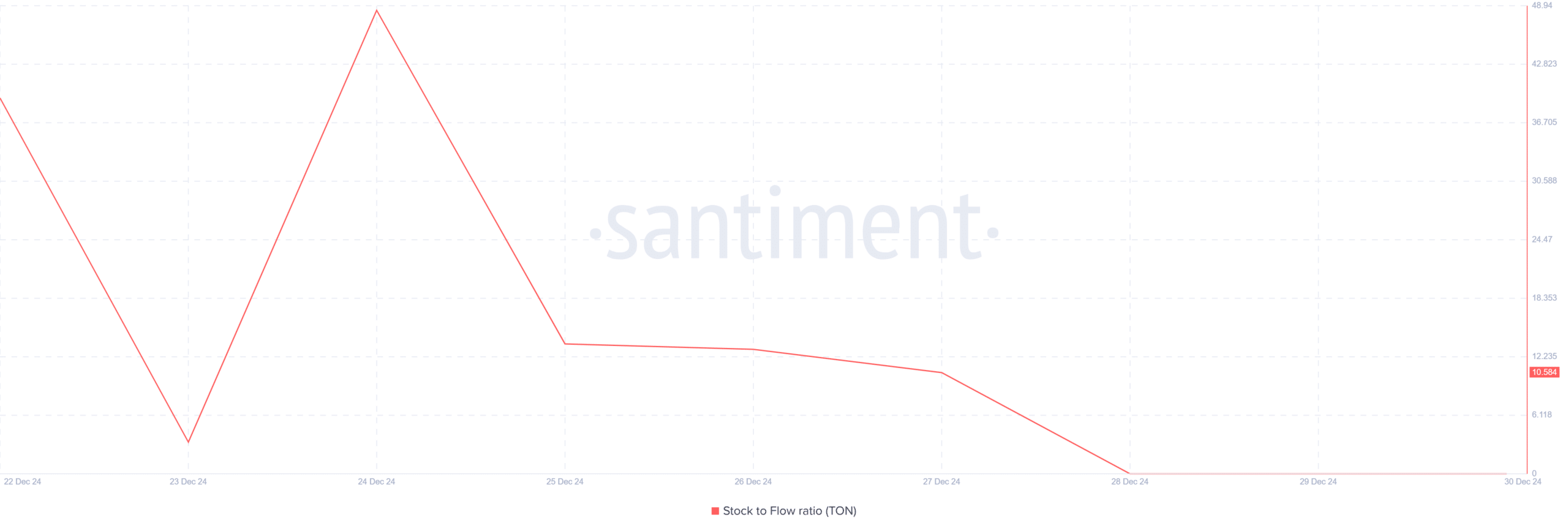

We can analyze this decrease in demand using the Stock-to-Flow Ratio (SFR) of TON’s coins. As per Santiment, the altcoin’s SFR has witnessed a decline over the last three days, reaching zero.

Based on my years of trading experience and observing market trends, I have come to understand that when the Supply/Demand Ratio (SFR) decreases dramatically, it often indicates an oversupply situation and a reduction in scarcity. This increased supply can lead to selling pressure, which in turn creates downward pressure on prices for the altcoin. As someone who has seen numerous market cycles, I always keep a close eye on SFR trends as they can be crucial indicators of potential price fluctuations.

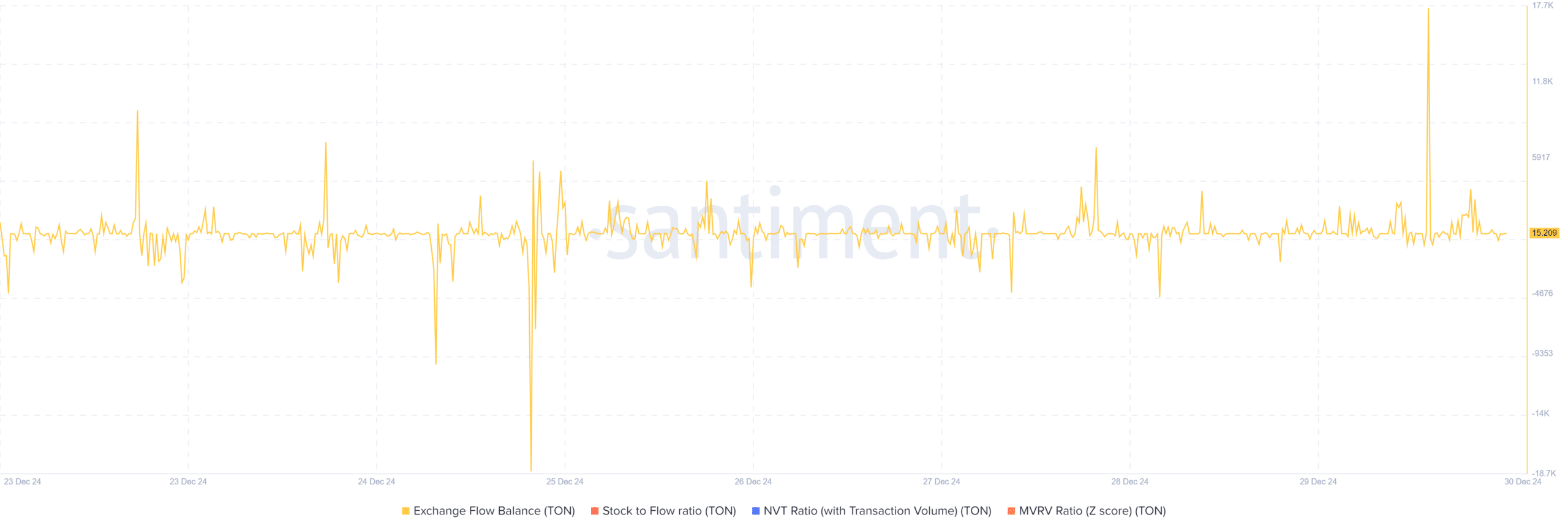

This excess is also indicated by an increase in TON tokens available on trading platforms. Consequently, the net flow between exchanges has risen significantly to reach 3459 units, implying that investors are transferring more of their assets to these platforms for trading.

Read Toncoin’s [TON] Price Prediction 2025–2026

From my perspective as a crypto investor, I’ve noticed a significant decrease in interest for TON. It seems that caution has become the norm among investors, leading many to close their positions and minimize risk. This trend suggests a lack of confidence in the market, indicating that we might be facing some challenging times ahead.

If these circumstances continue, it’s possible that TON could fall to $5.2. But should investors perceive this dip as a chance to invest, the altcoin might surge past its current range, potentially reaching $6.1.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-30 15:04