- Shiba Inu’s burn rate plunged amid price struggles.

- Whale transactions continued to influence SHIB’s price, adding both volatility and liquidity concerns.

As a seasoned researcher with years of experience in the crypto market under my belt, I can’t help but feel a sense of déjà vu when observing Shiba Inu [SHIB]. The plummeting burn rate and the continued influence of whale transactions are familiar patterns that have shaped this memecoin’s journey.

While it’s impressive to see the community’s commitment to burning tokens, the impact on price remains limited, much like trying to fill a leaking bucket with holes. The question is whether these efforts can generate long-term value in an increasingly uncertain market landscape.

The recent drop in burn activity and the sustained whale transactions are reminiscent of a game of cat and mouse – the whales driving the price action, and the community trying to control supply through burns. But just like in any game, it’s the broader market conditions that ultimately determine the winner.

Looking ahead, SHIB needs more than just burns and whale-driven liquidity to thrive. Network development, increased adoption, and the foundation of broader utility are crucial for sustainable growth. In essence, SHIB needs to evolve from a cute meme coin into a robust blockchain project with real-world applications.

In the spirit of Shiba Inus and their playful nature, I can’t help but joke that if SHIB doesn’t start showing some serious tricks up its sleeve, it might just end up being someone else’s pet project in 2025!

Over the past day, the rate at which Shiba Inu tokens (SHIB) are being destroyed or “burned” has significantly decreased by approximately 90.69%.

In simpler terms, though token burns are intended to decrease the amount of SHIB available and boost its rarity, their influence on the coin’s price has been relatively minor up until now.

As someone who has closely followed the crypto market for several years now, I’ve seen my fair share of ups and downs. With 2025 looming on the horizon, I find myself questioning whether the ongoing burn efforts, in conjunction with whale activity, will yield lasting value or if the broader market conditions will continue to cast a shadow over these initiatives.

Having witnessed the ebb and flow of various cryptocurrencies, I’ve learned that it’s never wise to make assumptions based on short-term trends alone. The crypto world is notoriously unpredictable, and it’s essential to remain vigilant and adaptable as we navigate this ever-evolving landscape.

In my opinion, the key factor that will determine whether these burn efforts prove fruitful lies in the ability of the broader market to adapt to changing conditions. If the market can evolve in such a way that it accommodates these initiatives while maintaining stability and investor trust, then I believe there is a good chance that long-term value could be generated.

However, if the market continues to be plagued by volatility and lack of transparency, it’s likely that broader conditions will overshadow these efforts. In such a scenario, the potential for lasting value may be limited, and investors might find themselves questioning the wisdom of their investments once again.

Ultimately, only time will tell whether the burn efforts combined with whale activity can generate long-term value or if market conditions will continue to overshadow these initiatives. As always, I encourage everyone to do their due diligence and make informed decisions based on their unique circumstances and risk tolerance levels.

Understanding burn rate and SHIB’s recent price movement

As a seasoned investor with years of experience under my belt, I have encountered various financial mechanisms designed to drive market demand. Among these, burn rate has always intrigued me due to its unique dynamics. Burn rate, in essence, is about permanently removing tokens from circulation, thereby reducing the overall supply and theoretically increasing demand. However, recent data has raised red flags that have compelled me to share my concerns.

I’ve witnessed instances where such mechanisms can lead to inflationary pressures if not managed properly. When a token’s supply is artificially reduced, it may cause prices to skyrocket, leading investors to rush into the market in search of quick profits. This sudden influx of capital can create bubbles that eventually burst, leaving many investors with significant losses.

Moreover, the long-term sustainability of a project heavily relies on its ability to maintain a steady and healthy burn rate. If the mechanism is not well-thought-out or implemented improperly, it could potentially lead to the project’s downfall. As such, I believe that a balanced approach is essential when it comes to implementing burn rate strategies, taking into account both the short-term demand dynamics and long-term project sustainability.

In conclusion, while burn rate can be an effective tool for driving demand, it should be approached with caution and careful consideration. As always, thorough research, due diligence, and a well-informed investment strategy are key to navigating the complex world of cryptocurrencies and ensuring long-term success in this rapidly evolving market.

In the last day, there was a significant reduction of 506,465 Shiba Inu (SHIB) tokens, representing a substantial drop of about 90.69% compared to earlier figures.

The substantial decrease indicates an unexpected reduction in the rate of burning, noticeably following the massive 578% surge that occurred only ten hours prior.

Contrarily, the weekly burns told a distinct tale, revealing a slight growth of 4.5%, equivalent to 65.19 million SHIB tokens being destroyed during that period.

Or more informally:

While things might seem stable, the weekly burns actually showed a small 4.5% rise, with 65.19 million SHIB tokens getting burned over the last seven days.

It shows that despite a decrease in immediate demand reduction pace, the community’s ongoing efforts to limit the supply persist.

Price action and market sentiment

Currently, Shiba Inu (SHIB) is finding it challenging to keep up with its November peak prices. As of this writing, the meme token is being traded at approximately $0.00002167.

Although there was a slight increase of 1.69% during the last day, overall market feelings were still muted. The token’s decreasing Relative Strength Index (RSI) suggested a dominating bearish trend.

Moving forward, I noticed that the On-Balance Volume (OBV) indicated a lack of demand growth, while the decrease in trading volumes hinted at declining retail involvement.

Shiba Inu whale activity

It’s important to point out that the whale trades have significantly influenced the market behavior of Shiba Inu.

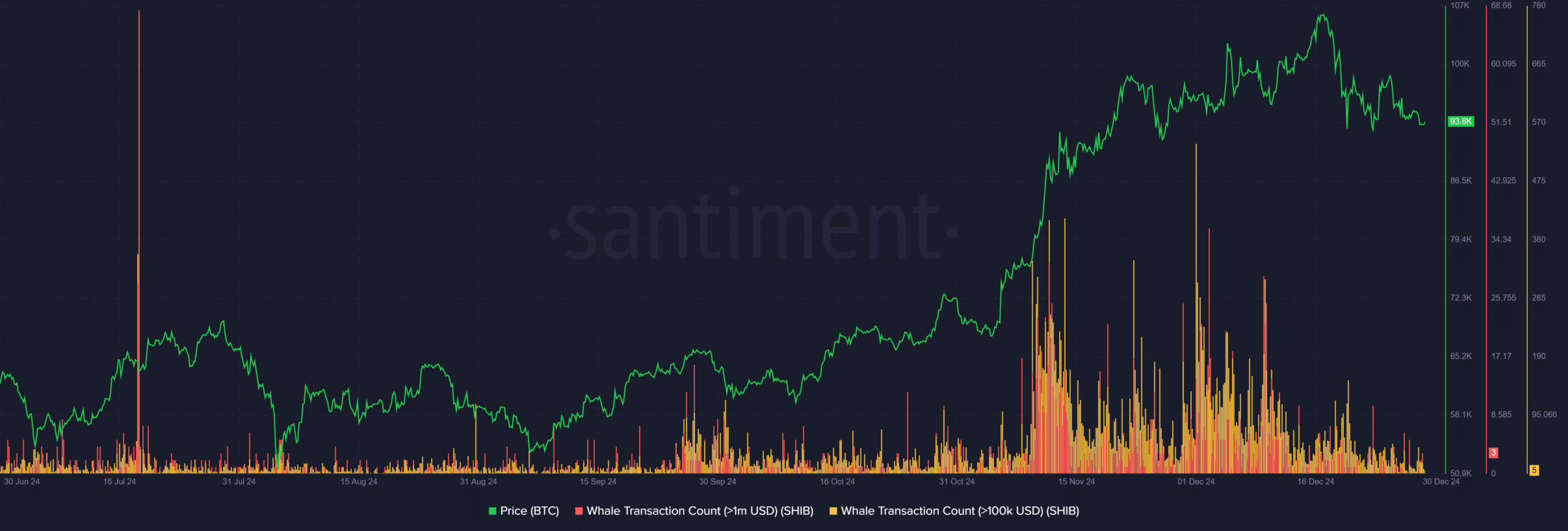

According to an analysis by AMBCrypto using data from Santiment, there was a significant increase in whale trading activity coinciding with major price surges for SHIB in October and November of 2024. This finding implies a strong link between large-scale transactions and the movement of SHIB’s market momentum.

It’s worth noting that recent figures indicate a persistent increase in high-value whale transactions. Specifically, the number of transactions over $100K has been consistently around 93.8 thousand, suggesting continued investment enthusiasm among wealthy individuals.

As a researcher, I find that this increased action significantly contributes to market liquidity, yet it brings about an element of unpredictability due to potential large-scale sell-offs. These abrupt selling sprees might hinder the process of price rebound.

When the behavior of “whales” (large investors) is considered alongside the burn rate dynamics, their actions can have two significant impacts: they can boost price fluctuations by fueling speculation, leading to sharp rises; at the same time, their activities can amplify market corrections, making downturns more pronounced.

This dynamic remains critical for SHIB’s short-term trajectory heading into 2025.

Regardless of the increased whale activities and burn initiatives, there haven’t been significant price surges yet. This could be due to the fact that lingering economic uncertainties are dampening investor enthusiasm.

The heavy dependence of Shib on burning mechanisms and large investor-provided liquidity, combined with a lack of a solid basis in broader functionality, limits its possible growth potential.

Read Shiba Inu’s [SHIB] Price Prediction 2025–2026

Moving into 2025, the token’s trajectory remains influenced by these dynamics.

To turn SHIB’s current downward trend around and encourage long-term expansion in the coming year, it’s crucial to focus on network advancements and broader acceptance.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-31 02:16