- Ethereum liquidity providers reduced their long positions.

- ETH investors remained bullish into 2025, despite high speculation.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles and trends. In the case of Ethereum [ETH], the recent reduction in long positions by liquidity providers has certainly caught my attention. However, it’s important to remember that market sentiment can shift rapidly, and this reduction doesn’t necessarily equate to a bearish outlook for ETH.

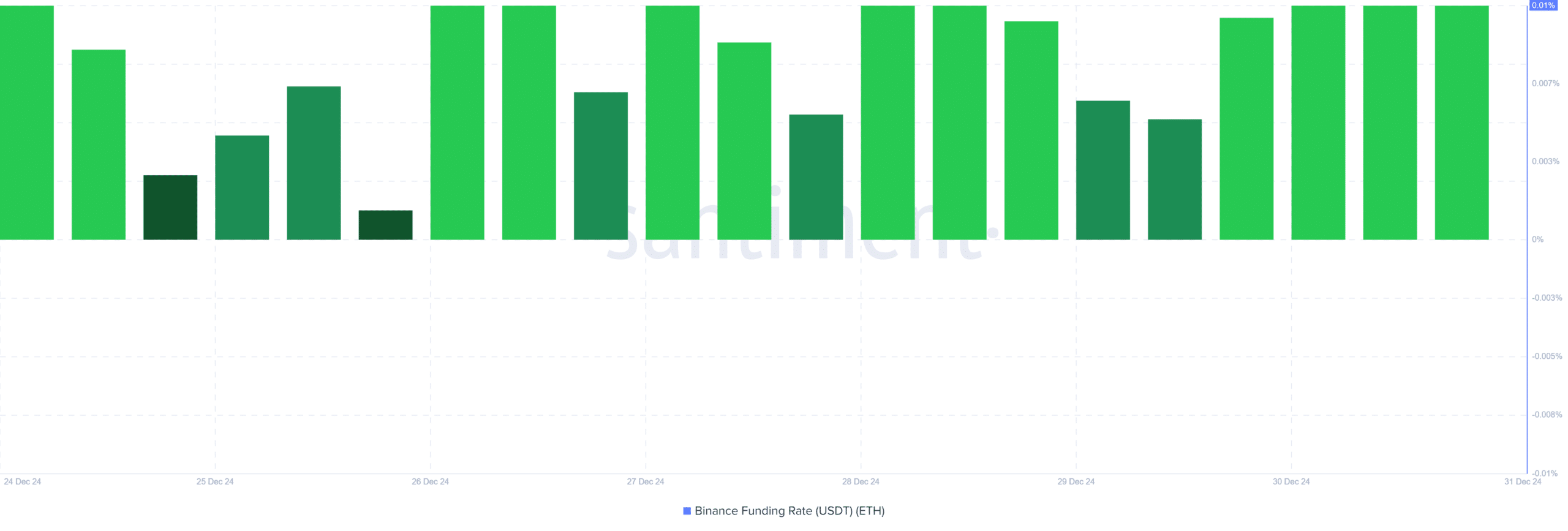

The sustained demand for long positions, despite the high speculative activity, is a testament to the resilience of Ethereum’s bullish momentum. The surge in the estimated leverage ratio and the positive Binance Funding Rate further underscore this point.

However, it’s crucial to remember that markets driven by speculation can be unpredictable. As I’ve often said, even a blind squirrel finds a nut every now and then. So, while ETH is entering 2025 with positive sentiment, we must stay vigilant and prepared for potential corrections.

In the spirit of keeping things light-hearted, let me leave you with this: Just as a blind squirrel might find a nut, a bearish market can sometimes catch even the most bullish investor off guard. So, always keep an eye on those acorns and be ready to adjust your strategy accordingly!

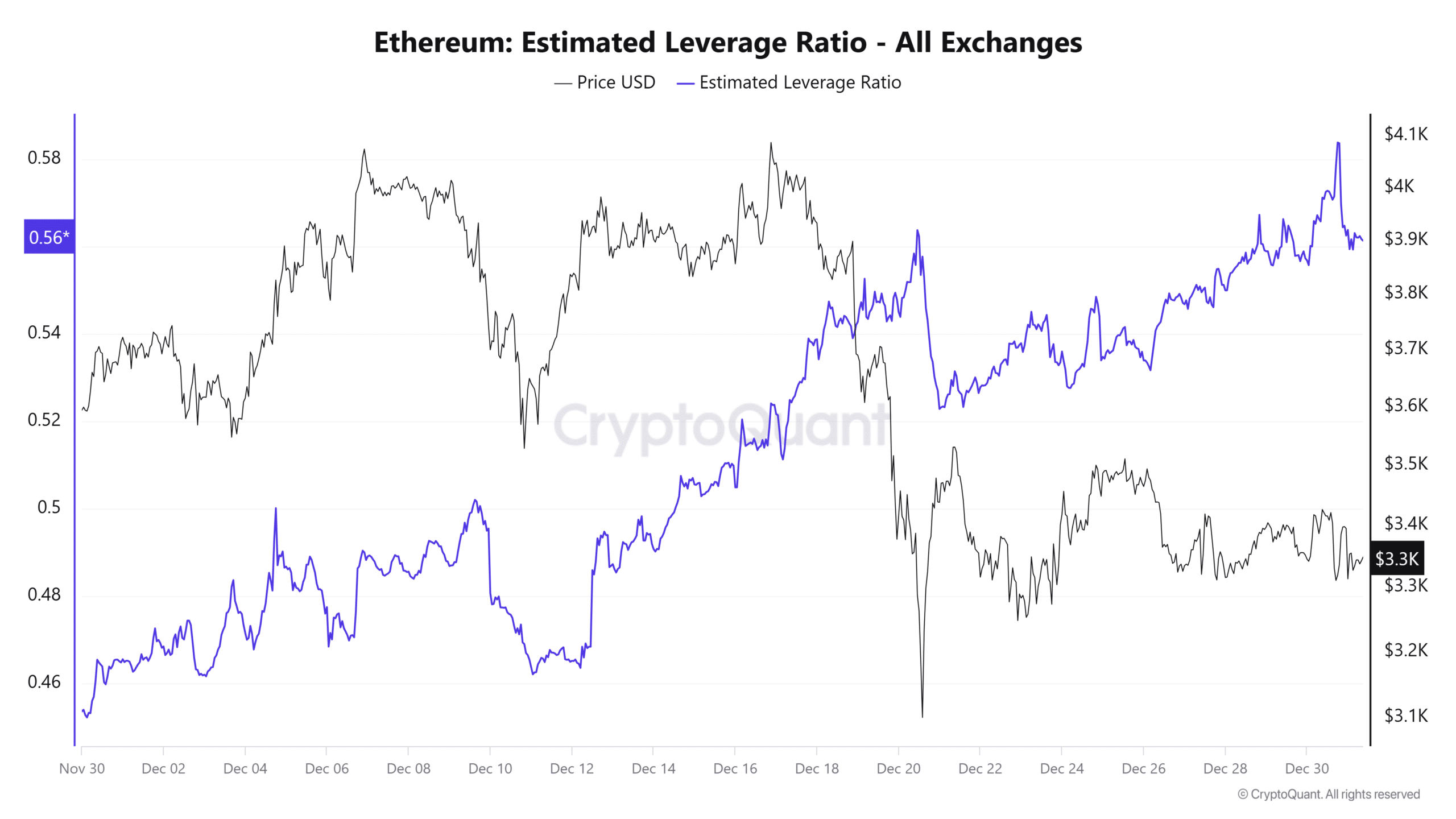

For approximately 14 days now, the value of Ethereum (ETH) has shown significant ups and downs. During this time frame, the price per ETH plunged from around $4109 to $3219. This volatile market trend has caused ETH to move back and forth within a narrow range in trading.

Under the current market circumstances, experts are discussing Ethereum’s potential trajectory up until 2025. Moreover, Cryptoquant analyst Sun Moon foresees a strong showing from ETH during Q1 2025 due to anticipated market stabilization.

Ethereum’s liquidity providers reduce long positions

Based on data from CryptoQuant, it appears that Ethereum’s liquidity providers are trimming their long positions. This action, taken by those who inject capital into ETH, suggests a change in overall sentiment.

Reducing participation from liquidity providers could make it challenging for the market to maintain its upward trend, as it may lack the necessary push from new buyers to keep the bullish movement going.

The analyst pointed out that even with a change in investor feelings, the number of long positions being liquidated on Ethereum has decreased significantly. This lack of extensive liquidations suggests that the market is growing more secure and steady.

Thus, market corrections are less likely to trigger cascading sell-offs.

Looking ahead to 2025, it appears that Ethereum (ETH) is mirroring its price trend from last year. Towards the end of December 2023, ETH prices experienced a significant increase, moving from $2045 to $2448. However, following this surge, there was a correction that led to a decline, and by the end of the year, the price had settled at $2259.

From January 2024 onwards, the price first surged dramatically from $2281 to $2717, then experienced a two-week period of stability. After that, it saw a powerful increase that took it all the way up to $4090.

Given that prices continue on their current trajectory and past trends are any indication, it’s likely we’ll witness a robust surge in ETH prices as early as Q1 2025, as suggested by the analyst.

What it means for ETH

Although liquidity providers are decreasing their long positions on Ethereum, there remains a robust demand for such positions due to high levels of speculation, suggesting that Ethereum continues to attract interest for long-term investment.

As such, according to AMBCrypto’s analysis, Ethereum is currently seeing a leverage-driven market.

To begin with, I’ve noticed an upward trend in our estimated leverage ratio. Specifically, over the past month, it has climbed significantly from 0.4 to 0.56.

This increase indicates a higher level of risk-taking among investors, who are more likely to use credit to amplify their returns, both profits and losses.

Additionally, the Binance Funding Rate has remained positive over the past month.

It’s evident that despite liquidity providers consistently decreasing their investment, traders remain optimistic about price increases as demand for long positions remains robust.

ETH, going into 2025

As a seasoned trader with years of experience under my belt, I can confidently say that the current trend in liquidity providers reducing their funds might seem concerning at first glance. However, upon closer inspection, it appears that the demand for long positions in ETH remains robust. This observation is consistent with the market’s tendency to exhibit strong speculative activities, a pattern I have witnessed countless times during my trading career. Therefore, based on my experience and analysis of the current situation, I believe ETH is still experiencing significant speculation activities, which could potentially lead to further price increases in the near future.

Despite the risk of market prices plummeting due to speculative activities, these activities can also cause temporary price surges in the short run.

By the year 2025, it’s crucial for Ethereum’s market to enhance its underlying values and reduce its dependency on speculation, as it tends to experience corrections when driven primarily by speculation.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Consequently, since the demand for long positions remains strong, it indicates that the market continues to be optimistic towards ETH, and it approaches 2025 with a favorable outlook.

Should optimism persist, Ethereum (ETH) might surge past its current $3500 consolidation zone and attempt to overtake the $4000 resistance level. Yet, if the hype surrounding it deflates, Ethereum could potentially fall beneath $3000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-31 13:12