- Ethereum’s long-term holders rose while Bitcoin’s retention fell, signaling shifting market trends

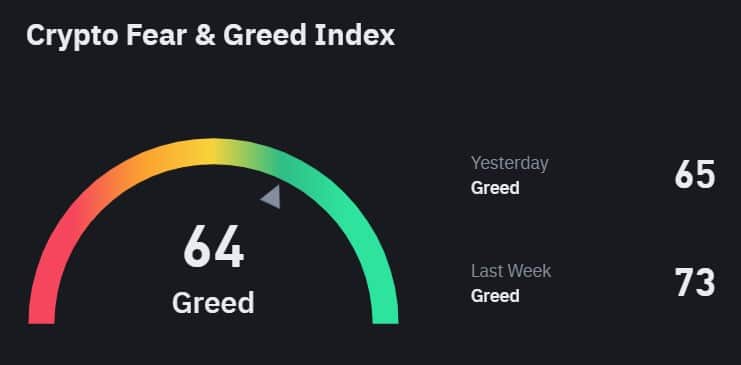

- Fear and Greed Index dropped as crypto crash concerns grew, impacting investor sentiment and market optimism

As a seasoned crypto investor with over a decade of experience navigating market cycles, I’ve learned to adapt and adjust my strategies based on changing trends. The recent shift towards Ethereum [ETH] among long-term holders is an interesting development that I find intriguing.

Remember when they said Bitcoin would never reach $1? Well, here we are, and I can’t wait to see where this journey takes us next!

This year, the long-term investment patterns in the cryptocurrency market have unexpectedly shifted. Although Bitcoin [BTC] has skyrocketed by 122% and Ethereum [ETH] has risen by a more conservative 48%, it’s worth noting that Ethereum has managed to outperform Bitcoin in terms of attracting long-term investors.

This transition underscores an increasing belief among market participants in Ethereum, indicating that as we approach 2025, more and more investors are betting on its promising future prospects.

As a researcher, I find this emerging pattern potentially impactful on the future behavior of markets and investor attitudes.

ETH outshines BTC

According to findings by AMBCrypto, there was an increase in the number of Ethereum (ETH) investors who held onto their assets for more than a year. In January 2024, this group accounted for approximately 59% of all ETH holders. By December 2024, that figure had risen to 75%, as reported by data from IntoTheBlock.

During this timeframe, the percentage of long-term holders for Bitcoin dropped noticeably, from 70% down to approximately 62.3%.

The increasing number of Ethereum holders keeping their investments indicates a surge in investor confidence, fueled by anticipation of upcoming network enhancements and wider practical applications.

In simpler terms, the decrease in long-term Bitcoin holders might be due to selling for profits or moving investments towards Ethereum. This could suggest a change in market opinion, with investors focusing more on Ethereum as we approach 2025.

Fear and Greed Index drops to two-month low

To clarify, it’s important to mention that besides the issue of HODLers leaving, the ‘king coin’ was encountering other challenges as well. On the last day of December, its Crypto Fear and Greed Index dropped to 64, which is its lowest point since October 15th.

Over the last fortnight, the market’s enthusiasm for Bitcoin has noticeably decreased, with its value dropping approximately 12%, leaving it trading around $93,000.

Following a surge to 94 in November, fueled by optimism over pro-cryptocurrency U.S. election outcomes, the index stayed above 70 for most of December before experiencing a downturn. This decline indicated a transition from excessive enthusiasm to a more prudent outlook among investors.

As long as avarice reigned supreme, the downward trend sparked increased worries regarding rapid fluctuations in the market due to Bitcoin’s price changes and ambiguous signs from the larger market. Traders were quick to respond to these shifts.

Read Ethereum [ETH] Price Prediction 2025-2026

BTC in an accumulation phase?

Regardless of the recent drop, investor James Williams sees Bitcoin as moving into a pivotal phase of accumulation. In his most recent social media update (previously known as Twitter), he characterized the present circumstances as a prime moment for establishing long-term investments.

Williams anticipates a period of market consolidation during the upcoming weeks, which may pave the way for a major price surge. With unwavering faith in Bitcoin’s future direction, he sees the current price fluctuations as a normal part of the market cycle and projects a price of $131,500 or more by Q1 2025, stating that such levels are essentially destined to happen.

Emphasizing the point, he mentioned that being patient during times of consolidation can be beneficial for investors, because these periods typically come before significant increases in Bitcoin’s market value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-31 21:12