- ai16z crypto has rallied by more than 27% in 24 hours and formed a fresh ATH at $1.77.

- These gains came amid plans to launch a layer-one network.

As a seasoned crypto analyst with over a decade of experience in this dynamic and ever-evolving market, I’ve witnessed numerous cryptocurrencies rise and fall like waves on the sea. The recent surge by ai16z [AI16Z], which has rallied by more than 27% in 24 hours to form a fresh ATH at $1.77, is one such event that catches my attention.

Having closely observed the crypto market since its early days, I’ve learned to read between the lines of market trends and technical indicators. The gains in AI16Z come amid plans to launch a layer-one network, which could potentially position this token as a strong contender in the blockchain space. However, history has taught me that while ambitious projects can indeed lead to significant gains, they also carry inherent risks.

In December 2024, AI16Z was among the top performers, with its market capitalization increasing four-fold from below $400 million to $1.75 billion at press time. The token even hit an all-time high of $1.77 on the 31st of December. But as I always remind myself and my fellow traders, past performance is no guarantee of future results.

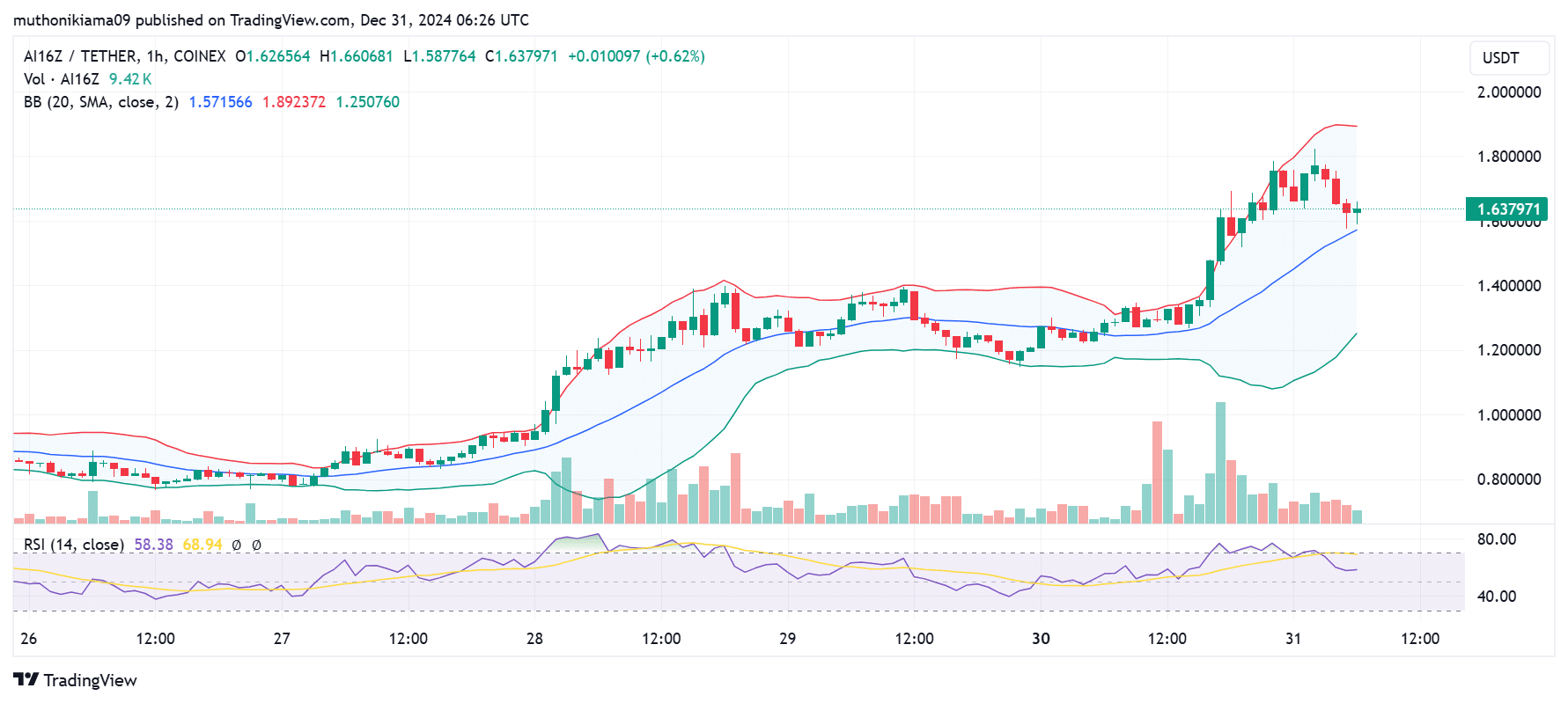

Looking at AI16Z’s hourly chart, I see a tussle between buyers and sellers, with the Relative Strength Index (RSI) tipping south and the token defending support at $1.57. While the Bollinger band indicators suggest a correction to the lower band at $1.25 if selling activity increases, the upper band at $1.89 presents a potential fresh ATH if the rally continues.

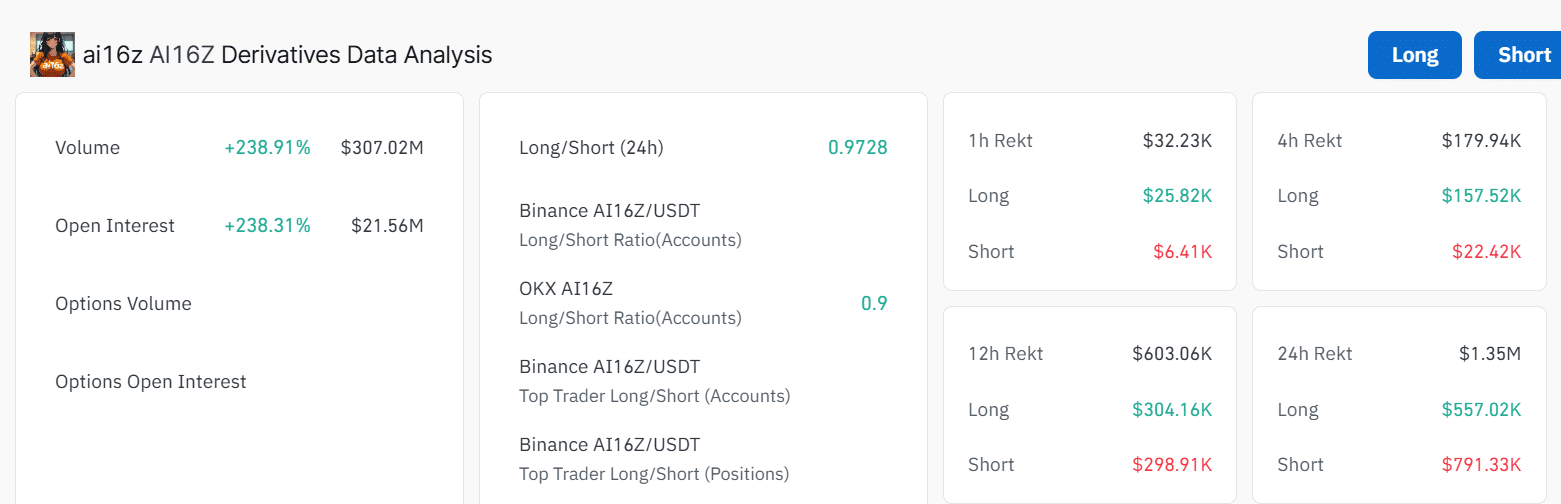

The surge in open interest and derivative trading volumes indicates that traders are taking advantage of the volatile price movements to open and close new positions. However, I always remind myself and others to be cautious when speculative interest is high, as sudden liquidations and closure of open positions can significantly impact future price moves.

In conclusion, while AI16Z’s recent rally is indeed impressive, it remains to be seen if the momentum can be sustained. As always, traders should approach this market with caution, armed with a solid understanding of the project and its potential risks and rewards. And as they say in the crypto world, “never invest more than you can afford to lose – even in the most promising projects.”

Oh, and remember: “The best time to buy was yesterday, the second-best time is today!

At the current moment, AI16Z was valued at $1.61, marking a significant 27% increase over the past day. This surge in value comes as a result of growing interest in this alternative coin, following a notable 101% jump in trading volumes, according to CoinMarketCap.

In December 2024, AI16z stood out as one of the leading performers, as its market value quadrupled throughout the month, rising from around $400 million to approximately $1.75 billion by the time of publication.

In fact, these gains saw the token hit an all-time high of $1.77 on the 31st of December.

One reason for the recent all-time high is a suggestion to transform ai16z into a layer one network, which could be key to its future growth. This plan includes strategies to enhance its token economics and generate more worth for AI16Z.

AI16z Crypto is at present functioning on the Solana blockchain (SOL). But, if it were to introduce its own tier-one blockchain and enhance its usefulness, it might bring about favorable results in the long term.

ai16z crypto price prediction

16z’s hourly graph demonstrates a struggle between buyers and sellers, with traders who had purchased during the upward trend taking advantage of the stall in the rally to cash out their earnings.

On the smaller chart, the Relative Strength Index (RSI) was pointing downwards, indicating decreasing buyer enthusiasm. Moreover, the RSI line generated a selling signal when it fell beneath the signal line.

According to the Bollinger band analysis, the AI16Z cryptocurrency is moving downwards, shifting from the top band to the midpoint band.

As a seasoned crypto investor with a knack for spotting trends and patterns, I have my eyes firmly fixed on the token that currently stands at $1.57. While it has been holding its ground so far, I can’t help but feel a sense of caution as I recall similar situations in my past where tokens seemed stable but eventually plummeted. If this token fails to defend its current position, it may be headed for a correction towards the lower band at $1.25. It’s essential to stay vigilant and keep a close watch on market movements, as the crypto world can change rapidly. I learned my lesson the hard way in the past when I let my guard down and lost significant investments due to sudden market shifts. So, while I hope for the best, I always prepare for the worst.

Instead, the significant resistance point can be found at the top of the Bollinger band, which is around $1.89. Should the ai16z crypto manage to reach this level, it would mark a new all-time high (ATH) for the cryptocurrency.

Derivatives data analysis

The examination of the derivatives market by ai16z indicates a significant surge in speculative enthusiasm. As we speak, the open interest amounts to $21 million, following an extraordinary increase of 238% within just 24 hours.

Derivative trading volumes had also surged to $308 million.

This spike indicates that traders are seizing the opportunity provided by the market’s fluctuating prices to initiate and terminate fresh trades.

An increase in Open Interest, along with price increases, demonstrates strong belief among traders regarding the direction of price changes.

The significant increase in both types of trades (long and short) over the past day has contributed to the market’s unstable price fluctuations as well.

Can ai16z sustain the gains?

A significant increase in purchasing actions contributes largely to AI16Z’s surge. Maintaining this pace of acquisitions may allow the cryptocurrency to preserve its upward trend.

Having traded financial markets for many years, I’ve learned that a rally can quickly lose momentum if the buying enthusiasm starts to dwindle and selling activity picks up as traders cash in their profits. This is often a sign that the market has reached its peak, and a correction may be imminent. It’s important to pay close attention to these signals and adjust one’s trading strategy accordingly. I’ve seen too many rallies falter because traders failed to heed this warning and held onto their positions for too long.

Read ai16z’s [AI16Z] Price Prediction 2025–2026

Furthermore, the increased activity among derivative traders has fueled the recent fluctuations in prices.

Keep a close eye on abrupt closures of ongoing trades and forced liquidations, since these events can influence subsequent price changes too.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-31 22:16