- Virtual’s bullish price action breaks key resistance levels, supported by high on-chain profitability.

- Whale activity and technical indicators further strengthened the rally, despite overbought conditions.

As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I’ve seen my fair share of bull and bear markets. The rapid surge of Virtual Protocol [VIRTUAL] has caught my attention, especially considering its impressive 22.19% gain in just 24 hours.

With its strong technicals, increasing user activity, and whale-driven confidence, VIRTUAL is reminiscent of the early days of Bitcoin (BTC) and Ethereum (ETH), which saw exponential growth before consolidating and continuing their upward trajectory. The on-chain profitability ratio of 20.68 at press time is a testament to its strong market sentiment, often linked to sustainable upward trends.

However, as someone who has learned the hard way that even the most bullish coins can experience short-term pullbacks, I’m cautiously optimistic about VIRTUAL’s future. While the overbought conditions may trigger brief corrections, I believe that the token has room to grow and will likely attract more traders looking to capitalize on its momentum.

As always in this market, it’s essential to stay vigilant, monitor technical indicators closely, and be prepared for volatility caused by whale sell-offs. But if VIRTUAL can maintain its upward trajectory and deliver on its ecosystem expectations, I see no reason why it won’t continue to climb the charts.

And as for my favorite joke related to crypto: “Why did Bitcoin cross the road? To get to the other side of the blockchain!”

In a striking development, the tech-driven Virtual Protocol (VIRTUAL) is making headlines for its impressive growth. Within a single day, it experienced a significant jump of 22.19%, currently standing at $4.90 per share as reported at the time of press.

Showing significant growth, the token’s market value has climbed up to an impressive $4.89 billion, while its trading volume surged by 38.45%, reaching $520.01 million. This surge indicates a swift upward trend for the token.

Investors are now curious—what exactly is driving this extraordinary rally?

VIRTUAL:Climbing the charts

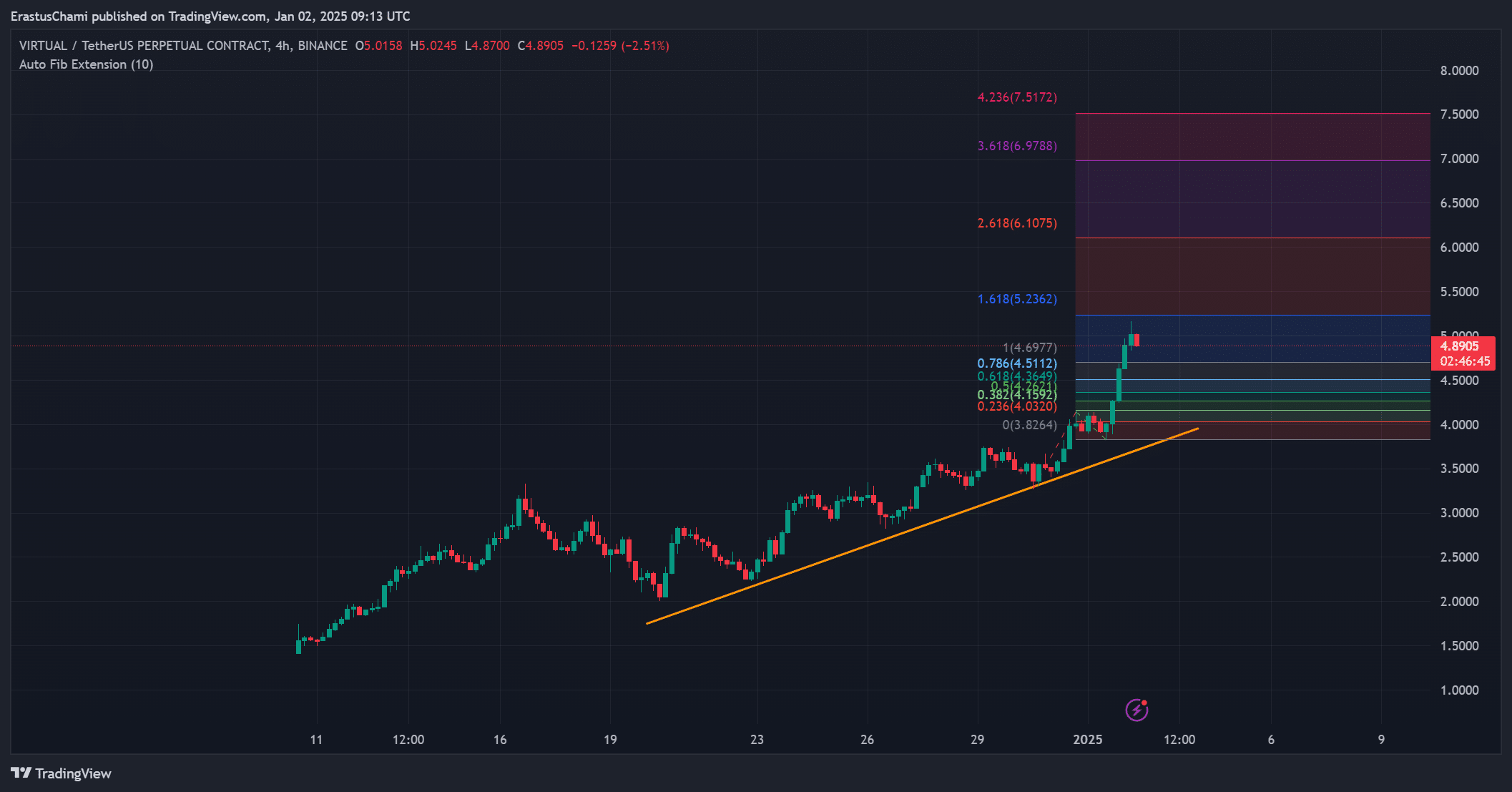

Virtual’s price action is a testament to its strong bullish momentum, as seen on the 4-hour chart.

The token is continuing to climb along a rising trajectory, breaking significant barriers and moving closer to potential Fibonacci goals at $5.23 and above.

Yet, the slight dip from $5.00 implies that some traders are cashing out their gains. This suggests that although the overall trend is upwards, a brief downturn might offer attractive buying chances before another surge.

Bullish momentum remains

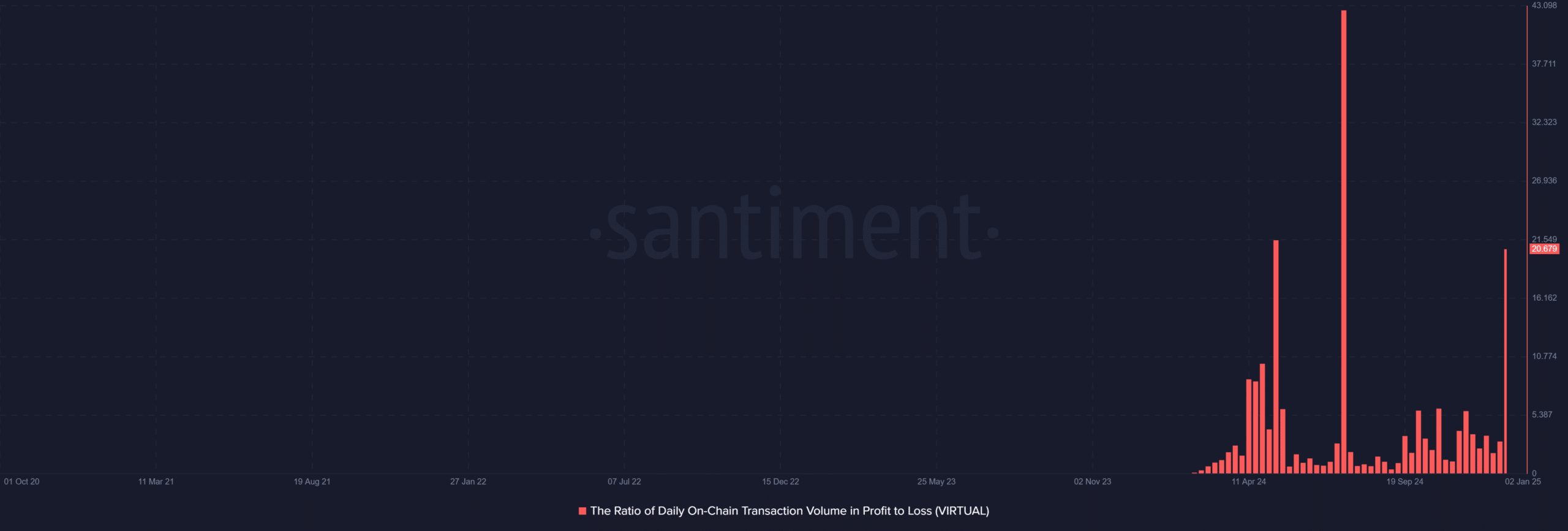

At the moment of reporting, the profit-vs-loss ratio on the blockchain was an impressive 20.68, indicating that many traders are currently experiencing significant profits.

This increase in profitable deals indicates a robust optimism within the market, typically associated with continuous positive growth patterns.

This optimistic signal might keep drawing in investors aiming to cash in on VIRTUAL’s growth spurt. Yet, increased selling for profits could lead to temporary pullbacks as the market experiences a cooling period.

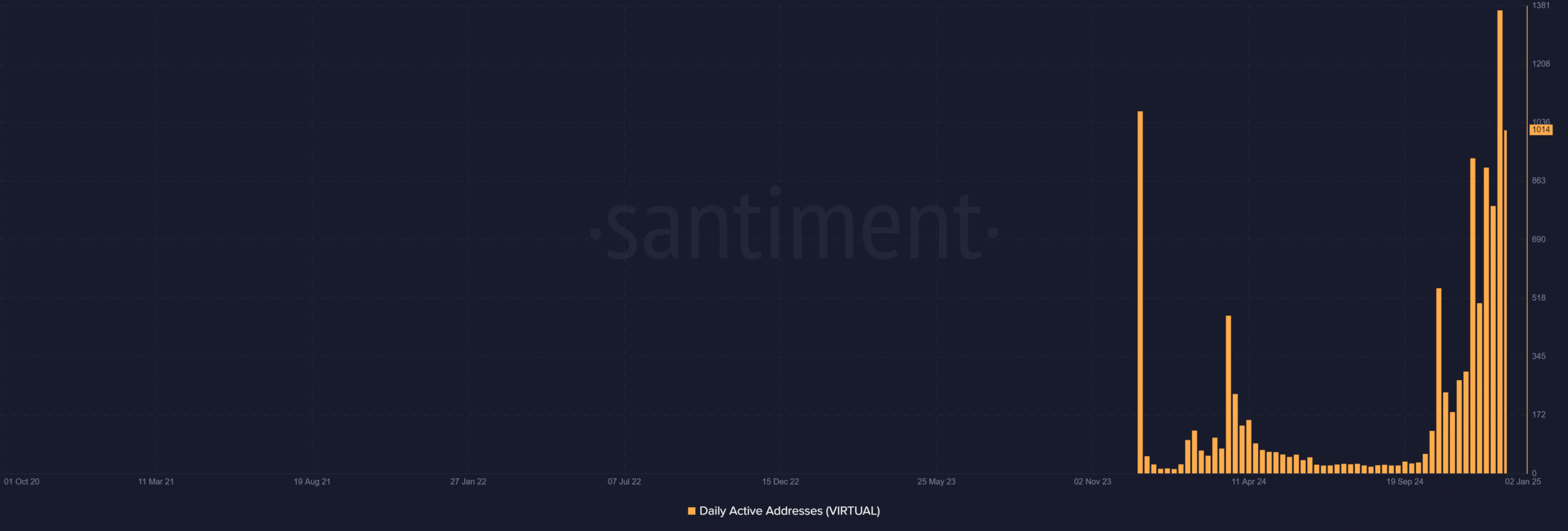

Growing network: Daily active addresses skyrocket

The number of daily active users on Virtual has exceeded 1,000, indicating a substantial growth in user interaction.

As an analyst, I’m observing a surge in interest and adoption within the virtual realm, which typically fosters long-term viability and sustainability for the projects involved.

Furthermore, increased interaction at higher addresses implies a growing user community, which strengthens the argument for the token’s bullish outlook.

Maintaining this progress relies on Virtual’s capacity to continue its positive trend and fulfill the requirements of its ecosystem.

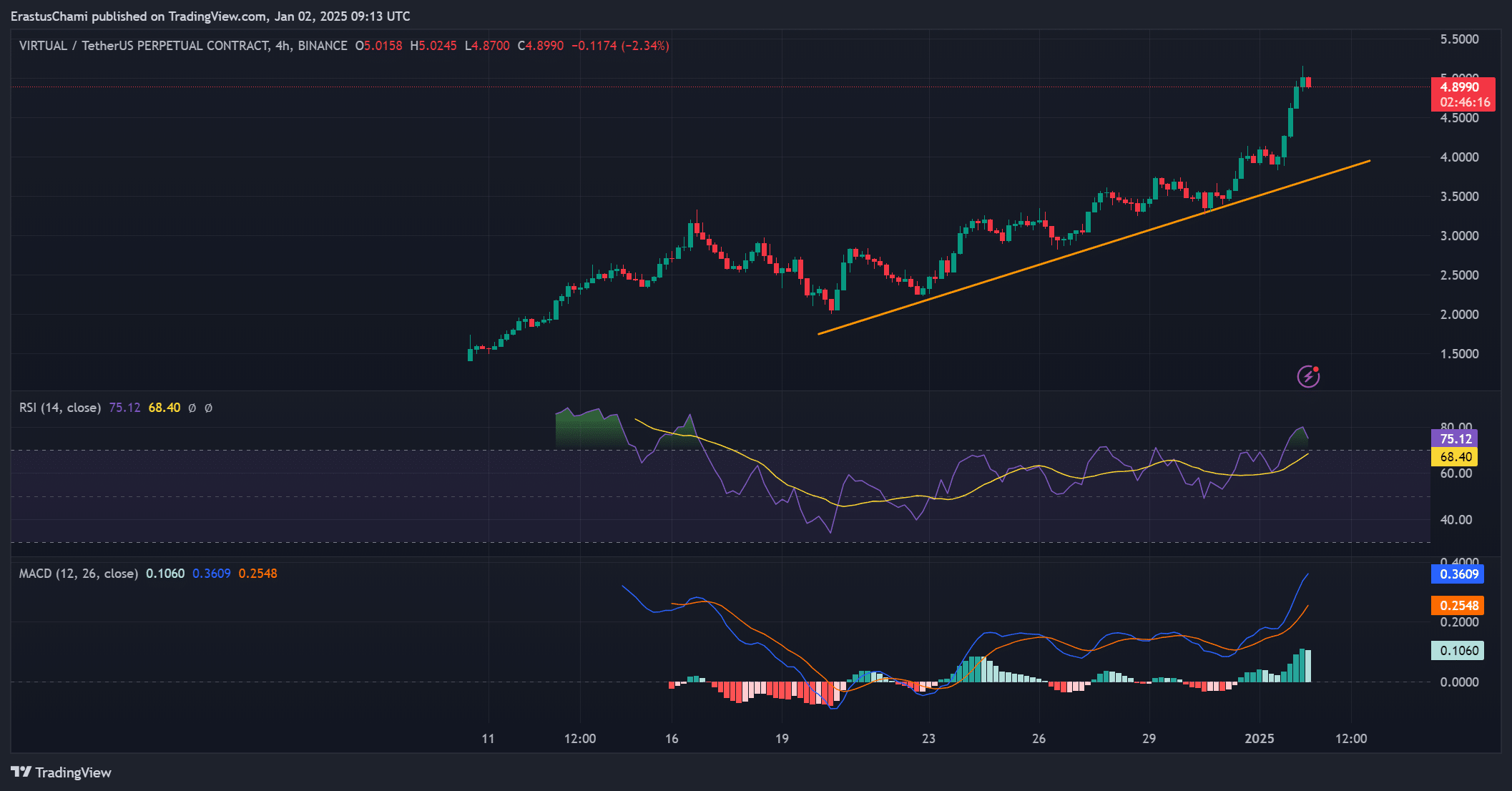

Reading the charts: Technical momentum builds

Based on technical analysis, it appears the current rally still has potential to continue, albeit with a note of caution. The Relative Strength Index (RSI) stands at 75.12, suggesting the market may be overbought, potentially leading to brief reversals or corrections in the short term.

However, the MACD remained bullish, with a positive crossover confirming upward momentum.

Furthermore, the broadening of the histogram indicates a rise in buyer confidence, suggesting that the market conditions could continue to improve. Consequently, it’s advisable for traders to keep a close eye on these indicators for any signs of change.

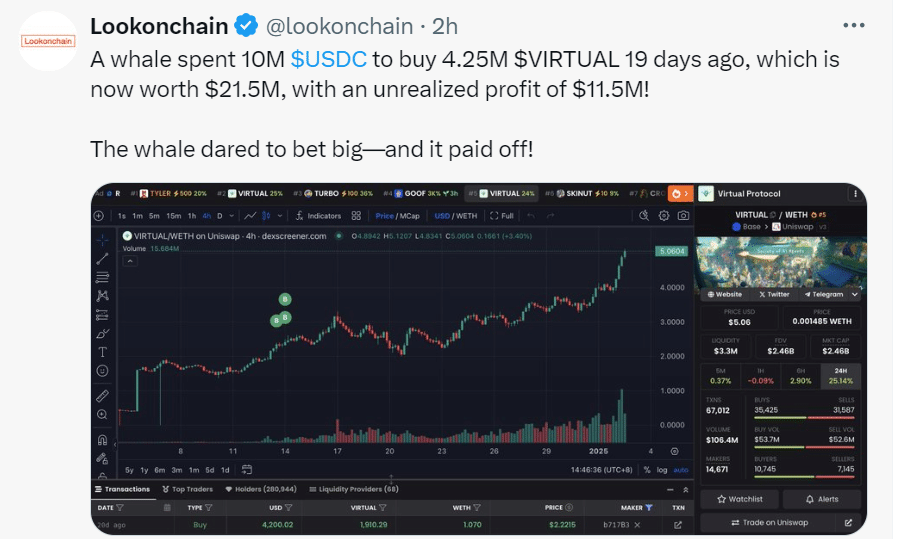

Whales make waves: High-stakes bets pay off

Investment in Virtual has seen significant growth due to the impact of whales, as one investor transformed a $10 million initial stake into a $21.5 million portfolio, earning an impressive $11.5 million in potential profits.

These substantial deals boosted investor confidence, frequently encouraging retail involvement.

Furthermore, the increased whale involvement often fuels a rising trend, capturing more interest. Yet, abrupt whale selling sprees might bring about market turbulence, highlighting the importance of staying alert.

Read Virtuals Protocol’s [VIRTUAL] Price Prediction 2025–2026

Conclusion: What’s next for VIRTUAL?

The rapid surge in Virtual’s growth is propelled by robust technical factors, growing user engagement, and a boost in investor confidence due to the activities of large investors (whales).

As an analyst, I’m observing that the current bullish trend seems robust, but I must caution against potential short-term risks. Overextended buying activity suggests we may be approaching overbought conditions, and profit-taking could potentially arise from this situation. Therefore, it’s important to stay vigilant and consider strategic maneuvers to minimize exposure during these periods.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-02 21:12