- Recent trends show steady, measured growth for NEAR’s Total Value Locked (TVL).

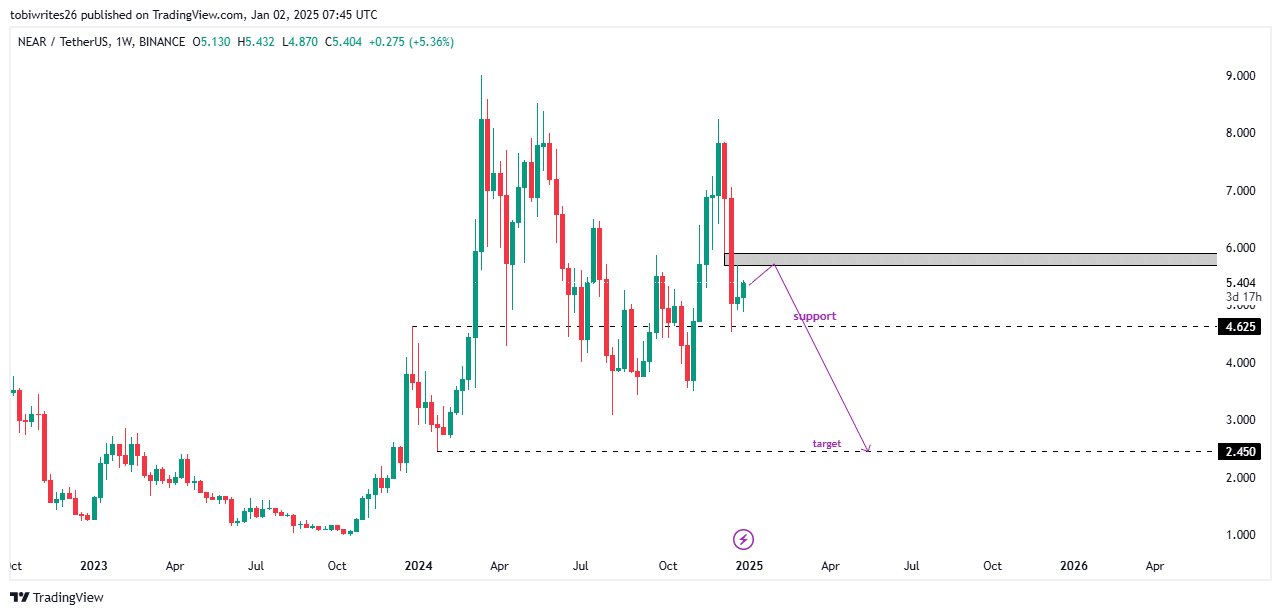

- NEAR could see a brief rally before potentially dropping to the $2.45 level.

As a seasoned crypto investor with over five years of experience under my belt, I’ve witnessed bull markets and bear markets alike. My portfolio has seen its fair share of highs and lows, but one thing remains constant – the need to stay vigilant and adaptable in this rapidly evolving market.

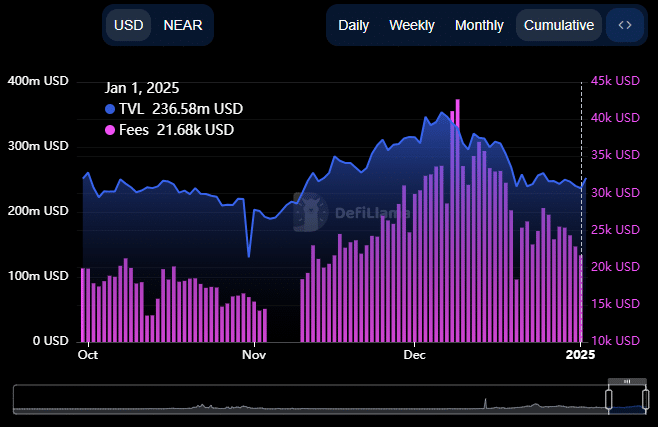

Recently, NEAR Protocol [NEAR] has caught my attention due to its consistent growth and recent surge. With a 10.42% increase in the past 24 hours, it’s clear that NEAR is gaining momentum after a month-long decline. However, a closer look at the Total Value Locked (TVL) and on-chain activity paints a more complex picture.

The TVL oscillating between $259.85 million and $236.58 million suggests active participation, but it also leaves room for either a significant rally or a sharp decline. While reduced user participation, as indicated by the lower fees collected, could negatively impact NEAR’s price performance, I am cautiously optimistic.

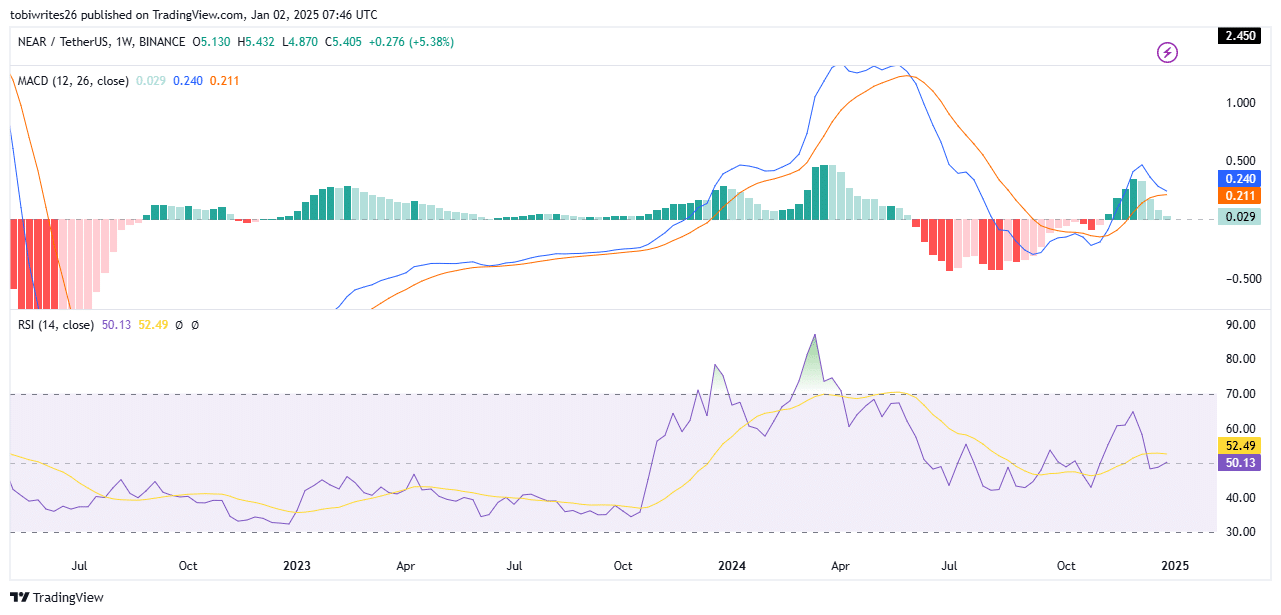

Technical indicators offer mixed signals, with the Moving Average Convergence Divergence (MACD) pointing to a bearish trend and the Relative Strength Index (RSI) suggesting increasing momentum. If the MACD Death Cross materializes as predicted, we might see NEAR’s price trending downwards. However, the RSI’s recent return to the positive region offers a glimmer of hope for bulls.

In my opinion, NEAR is currently teetering on the edge of a potential rally and a possible drop to the $2.45 level. I’d advise fellow investors to exercise caution and stay updated with the latest developments in the NEAR ecosystem before making any investment decisions.

As for a joke, you know what they say – even experienced crypto investors can’t predict the market with 100% accuracy. It’s always a roller coaster ride, and sometimes we just have to hold on tight and enjoy the view!

In the last day, NEAR Protocol (NEAR) has become one of the biggest winners in the market, climbing by an impressive 10.42%. This is its initial leap with double-digit growth after a slump over the past month that saw it drop by 25.79%.

As someone who has closely followed the crypto market for many years and experienced its volatile nature firsthand, I can tell you that while NEAR’s recent growth is promising, it’s important to keep a cautious eye on potential challenges ahead. My personal viewpoint is based on my own experiences of navigating through market highs and lows in the past. From what I’ve seen, a broader analysis suggests that there might be obstacles lurking that could halt further expansion for NEAR if they materialize. If these barriers indeed arise, it may lead to a dip in its price, possibly bringing it into lower regions. However, this is just one perspective among many, and the market is always full of surprises.

Consistency amid declining activity

As reported by DeFiLlama, the total value locked (TVL) within the NEAR Protocol network consistently fluctuates, moving between approximately $259.85 million and $236.58 million.

Currently, the Total Value Locked (TVL) is at approximately $253.52 million. Such a figure typically shows high engagement, but it also suggests that we could see either a strong upward trend or a sudden drop in the near future.

In simpler terms, TVL (Total Value Locked) indicates the combined worth of all assets that are secured within a blockchain’s smart contracts. This figure demonstrates the extent of user participation across various functions like staking, borrowing, and providing liquidity.

To get a more comprehensive understanding of NEAR’s on-chain activity, AMBCrypto delved into its transaction fee data instead of relying solely on TVL (Total Value Locked) information.

Higher fees often indicate increased network activity, while lower fees suggest a slowdown.

Currently, NEAR’s transaction fees have reached their lowest point in the last eleven days, accumulating approximately $21,680.

This decrease suggests a drop in user engagement, potentially leading to unfavorable effects on NEAR’s price trends and the expansion path of its ecosystem.

Mixed signals: MACD and RSI diverge

For the cryptocurrency NEAR, the technical indicators showed some contrasting signals: The Moving Average Convergence Divergence (MACD) hinted at a downward trend, whereas the Relative Strength Index (RSI) indicated growing strength and momentum.

Looking at the weekly chart, we’re approaching a potential bearish Death Cross formation. This happens when the blue MACD line dips below the orange signal line, indicating a possible downtrend in the market.

As more red bars appear on the histogram, it usually indicates a stronger negative outlook or bearish market sentiment for NEAR. If this trend continues, we might see NEAR’s price beginning to decline.

Although there seems to be a bearish outlook indicated by the current signal, the Relative Strength Index (RSI) presents a more hopeful perspective. Currently, it has moved back into the positive zone, showing a value of 50.13 at this moment, suggesting a hint of bullish movement.

Nevertheless, the RSI being close to the neutral zone of 50 indicates ambiguity. A fall below this point might initiate a bullish reversal, emphasizing potential downward trends.

According to further examination by AMBCrypto, there might be a brief increase in the RSI, but it’s expected to drop again and go under the neutral level, which coincides with the MACD’s negative prediction.

Key levels come into focus

Looking at the weekly chart, NEAR might initially surge towards a resistance area (supply zone), but then likely reverse direction and move towards a lower support region (support zone). After a brief rebound, it could potentially drop again towards the $2.45 target, as indicated by the current market configuration.

Read NEAR Protocol’s [NEAR] Price Prediction 2025–2026

Based on my years of experience in crypto trading, I believe that if the supply zone for NEAR fails to hold, it could potentially surge higher, rekindling its bullish momentum and possibly reaching a new monthly high. I have seen similar scenarios play out many times before, where an asset’s price breaks through crucial resistance levels and sets off on an impressive upward trajectory. However, it is important to remember that the cryptocurrency market can be highly volatile, so always do your own research and manage your risk accordingly.

Given the approaching “Death Cross” on the MACD chart, potentially leading to a significant decrease in value, combined with other indicators, Near’s outlook seems more inclined towards a bearish trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-03 03:04