- INJ’s demand made a comeback as the price showed signs of pivoting from its bearish performance in December.

- Spot flows and derivatives indicated a shift in favor of the bulls, in line with surging social sentiment.

As a seasoned crypto investor with a keen eye for promising projects and trends, I find myself intrigued by the recent developments surrounding Injective [INJ]. The cryptocurrency’s resurgence in social engagement and its subsequent price action are certainly noteworthy.

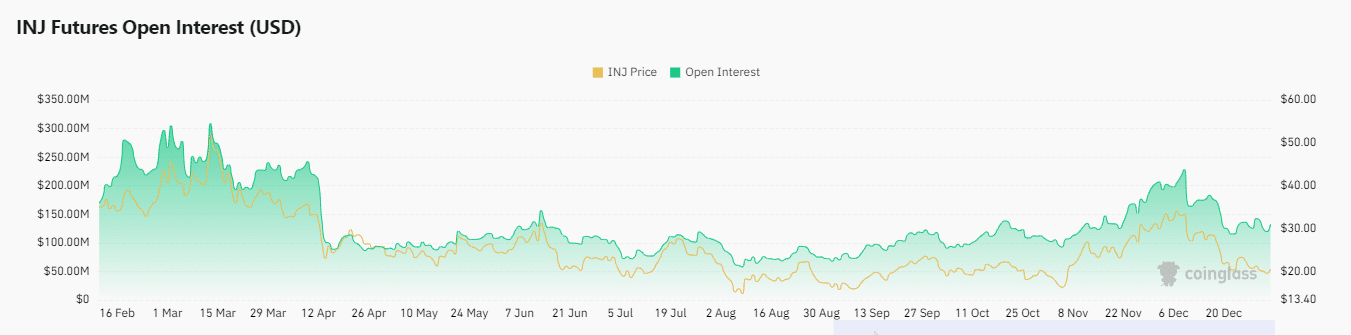

In my experience, a strong social sentiment often precedes significant price movements, and INJ’s recent ranking as the second most engaging AI coin on LunarCrush Analytics is a clear indication that something is brewing. The surge in Open Interest, while seemingly modest, demonstrates renewed bullish demand – a trend we haven’t seen for several weeks.

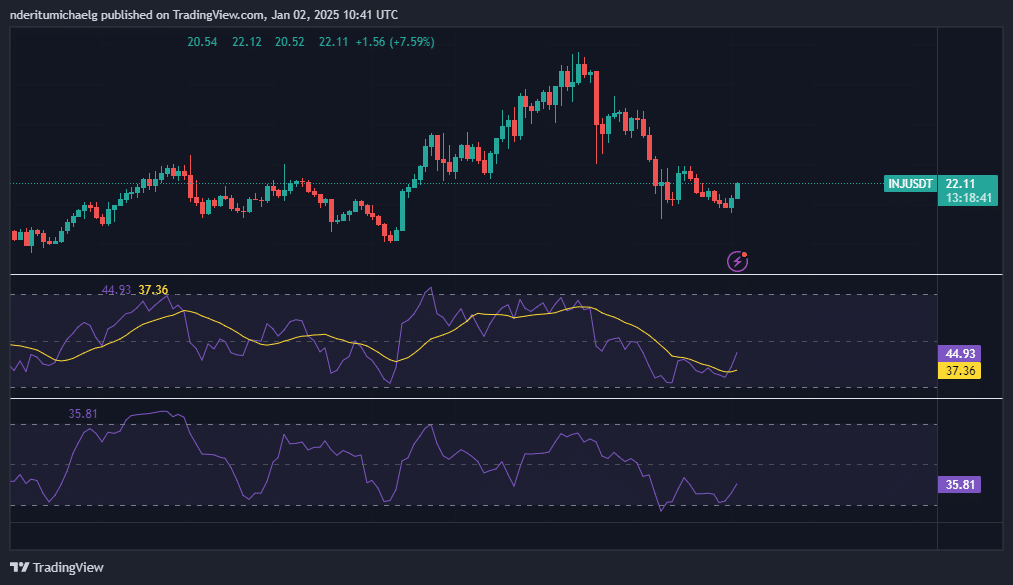

The price action also seems to be aligning with the social sentiment, as INJ has already made a strong start this year, up by 14.80% at press time. The Money Flow Index suggests that liquidity is once again flowing into INJ, potentially setting it up for a return to its December highs.

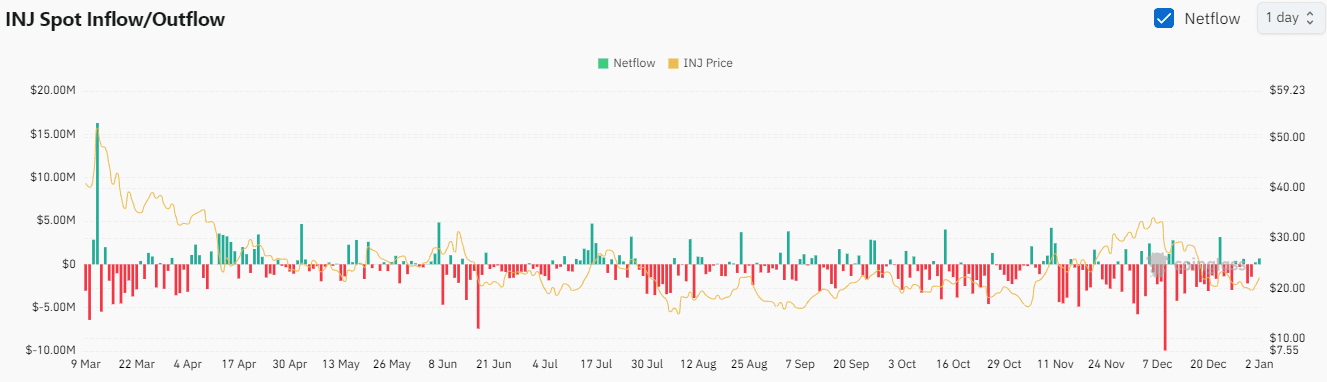

It’s also worth noting that spot flows have switched from outflows to inflows, which could signal the start of another robust bullish run. While inflows are still relatively low at the moment, they could build up in the coming days.

All in all, INJ’s performance in 2024 suggests that it is still undervalued, especially given its potential upside as an AI coin. If the AI narrative continues to prevail, INJ could be a lucrative investment opportunity in 2025.

And now, for a bit of humor to lighten things up: I’ve been investing in crypto long enough to remember when Bitcoin was worth less than a cup of coffee. Back then, I wish I had invested in more coffee and less Bitcoin! But hey, hindsight is 20/20, right?

As a seasoned crypto investor with years of experience under my belt, I believe Injective [INJ] might be gearing up for a bullish resurgence. Recently, this cryptocurrency has made a strong showing in the AI coin category, ranking high in social engagement alongside other key indicators pointing towards renewed enthusiasm. This could potentially be a promising opportunity for those who are keeping an eye on the crypto market.

As a crypto investor, I’ve been intrigued by the latest insights from LunarCrush Analytics. It appears that INJ has moved up to the second spot among artificial intelligence (AI) coins, leading in terms of social engagement. This suggests a significant level of interest and buzz surrounding this coin within the crypto community.

Translation: The increased interest in this cryptocurrency might impact its behavior during the current month.

As someone who has been closely monitoring financial markets for over two decades, I must say that the recent surge in social sentiment and Open Interest is quite intriguing. In my experience, such a significant increase in both indicators within just a couple of days can be an early sign of potential market momentum.

I remember back in 2008 when I first started my career as a financial analyst, I noticed similar patterns that ultimately led to the stock market crash. However, this time around, it seems different. The $20.12 million increase in INJ’s Open Interest during that period is noteworthy and suggests that a substantial number of traders have entered the market with fresh positions or increased their existing ones.

While I can’t predict the future, I do believe that it’s essential to keep a close eye on this trend and consider adjusting my investment strategy accordingly. After all, understanding market sentiment and monitoring Open Interest are crucial elements in making informed decisions as an investor.

In other words, even though it might not seem like a significant change in the bigger picture, this situation indicated that open interest was starting to rebound following the decline seen over the past three weeks in the year 2024.

As a crypto investor, I’ve noticed an encouraging trend: the Open Interest has been climbing after dipping to $115.53 million on December 23rd. In fact, it increased by a substantial 22.12% in just the past 24 hours. This uptick has also brought about a notable surge in volume, with a 9.45% increase recorded during the same period.

This confirmed a resurgence of accumulation and bullish demand.

INJ price action reflects social sentiment

As I analyze the market trends, it seems that Injective’s (INJ) dominance appears to have waned as we approached the close of 2024. At the time of writing, INJ was trading at $21.91. Interestingly, in the first two days of 2025, I observed a notable increase of 14.80%.

Indicating a renewed influx of funds, the Money Flow Index of INJ suggested that the cryptocurrency is experiencing increased investment. With robust interest continuing, INJ might potentially rebound to its December peaks. In such a scenario, the coin could surge approximately 60% higher.

It appears that the indications from the spot flows suggest that Investment Joint Stock (INJ) might be gearing up for another strong upward trend. The significant drop in December was largely due to a high number of outflows from the spot market.

However, outflows have been cooling down, paving the way for inflows to make a comeback.

Initially in January, outflows turned into inflows for about two days, totalling nearly a million dollars. This suggests that while inflows are currently modest, they may grow more substantial in the near future.

Read Injective’s [INJ] Price Prediction 2025–2026

In the first half of 2024, I observed significant outperformance from INJ compared to its performance in the latter part of the year. The second-half underperformance indicates that it might still be undervalued or heavily discounted.

2025 could see INJ becoming a more appealing cryptocurrency due to its possible growth potential, particularly if the AI-related coin story continues to dominate.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2025-01-03 07:04