- Despite trailing Bitcoin ETFs, which closed 2024 with an impressive $35 billion in inflows, Ethereum ETFs have shown consistent growth.

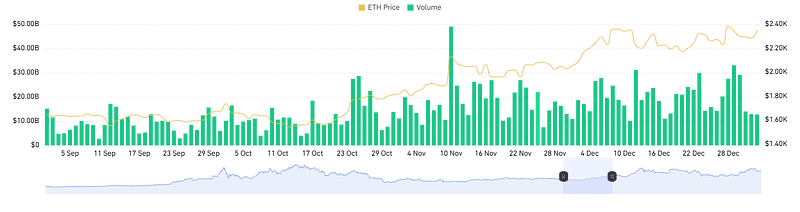

- ETH ETFs experienced a significant surge in trading volume, with December’s figures reaching above $13 Billion.

As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed the evolution of digital assets from their infancy to becoming integral components of global investment portfolios. Having closely observed the growth trajectories of Bitcoin [BTC] and Ethereum [ETH], I am particularly intrigued by the recent surge in popularity among institutional investors towards ETH ETFs.

The impressive net inflows of $2.6 billion in December 2024, coupled with a trading volume exceeding $13 billion, underscores the confidence institutional investors have in Ethereum as a viable investment vehicle. This trend reflects not only the robust ecosystem and expanding use cases of Ethereum but also its unique staking capabilities that provide additional yield-generation opportunities for investors.

While Bitcoin ETFs have undeniably dominated the market, the consistent growth of ETH ETFs indicates a shift in institutional preferences. If certain conditions align, such as favorable regulatory developments and sustained network activity, Ethereum ETFs could surpass Bitcoin ETFs in 2025. However, challenges remain, including building trust among investors, addressing competition from rival networks, and maintaining stability in response to market shifts.

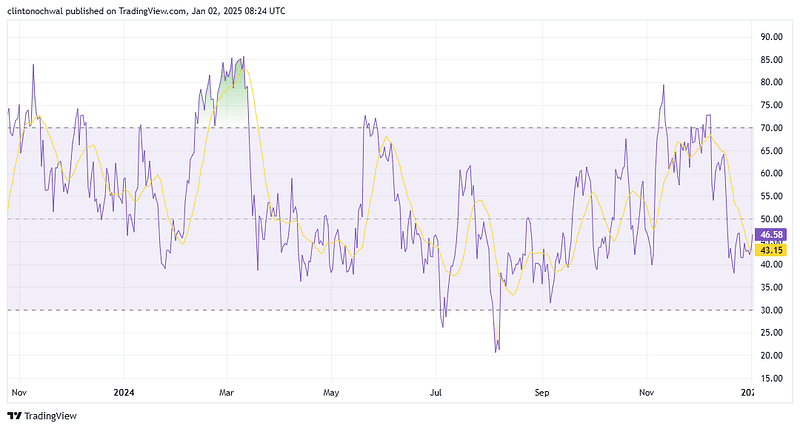

The RSI trends of Ethereum suggest strong bullish momentum, but potential short-term corrections should not be overlooked. As always, investing carries risks, and it’s essential to approach the digital asset space with caution. But hey, who knows? Maybe one day we’ll see a digital asset ETF that outperforms even the most stable blue chips!

On a lighter note, I can’t help but think of the irony: just as Bitcoin was once hailed as “digital gold,” Ethereum could soon become the “digital yield.” Now wouldn’t that be a twist in the tale?

In December, Exchange Traded Funds (ETFs) linked to Ethereum [ETH] witnessed significant growth, attracting approximately $2.6 billion in total investments. This influx underscores the rising institutional appetite for Ethereum as a potential investment option.

Furthermore, Exchange Traded Funds (ETFs) focused on Ethereum (ETH) have demonstrated steady growth, while Bitcoin’s [BTC] ETFs lagged behind, ending 2024 with a significant $35 billion in investments. This pattern indicates increasing faith in Ethereum’s future prospects, driven by its powerful ecosystem and growing list of applications.

Can Ethereum ETFs outperform Bitcoin ETFs in 2025?

2025 might see Ethereum ETFs outpacing Bitcoin ETFs according to current market trends. This prediction is based on Ethereum’s distinctive staking features, which offer extra income-producing possibilities for investors.

Positive changes in regulations make ETFs increasingly appealing to a wider range of institutional investors.

From November to December 2024, ETH consistently showed robust market performance by attracting investments for eight straight weeks in a row. This span featured an all-time high inflow of $2.2 billion during the week that ended on November 26th, indicating increased investor trust.

As Bitcoin ETFs continue to lead, Ethereum ETFs are slowly catching up, suggesting that institutions are increasingly favoring Ethereum.

TradingView

Should Ethereum continue its price trend due to rising network usage and technological progress, its ETFs might be among the highest-yielding investments in 2025.

Furthermore, the increasing use of artificial intelligence within Ethereum’s network has added to its attractiveness.

Key challenges for Ethereum’s market ascent

To compete with Bitcoin ETFs, Ethereum needs to tackle significant hurdles such as establishing its own market leadership and outperforming competing networks.

Bitcoin’s strong brand reputation and being the first in the market are still attracting substantial investments. This leaves Ethereum needing to establish a similar level of trust among institutional investors.

According to the latest figures, Ethereum’s market control at 18.7% is significantly lower compared to Bitcoin’s commanding 47.1%, indicating a noticeable difference in investor trust levels between the two cryptocurrencies.

Analysts point out that Ethereum’s market share might expand because its staking incentives are becoming increasingly appealing and as regulatory certainty increases. Sustained growth in ETF investments will play a key role in bridging this divide.

A challenge arises due to Ethereum’s past price instability, which sometimes discourages cautious investors. To surmount this issue, these ETFs need to demonstrate consistency and robustness, especially when faced with broader market fluctuations.

In a dynamic environment influenced by economic factors worldwide and shifts in regulations, Ethereum’s system needs to show resilience and growth potential among competing platforms.

Ethereum’s RSI trends indicate bullish momentum

The Relative Strength Index (RSI) of Ethereum, a crucial technical tool, provides meaningful perspectives on its recent market behavior.

Currently, towards the end of last month (December), the Relative Strength Index (RSI) for ETH was around 68. This value is close to the overbought level of 70, indicating a significant upward trend in its price. However, it also raises worries about possible short-term corrections due to this strong bullish momentum.

Previously, when a coin’s Relative Strength Index (RSI) approached the overbought region, it often signaled temporary declines before continuing its upward trajectory. Furthermore, the recent influx of ETH into Exchange-Traded Funds (ETFs) has ignited enthusiasm among investors, who expect more RSI growth in the future.

Should Ethereum surpass significant resistance points, its Relative Strength Index (RSI) might find equilibrium within a bullish zone, bolstering optimism about its future trajectory.

Surging trading volume highlights…

Trading volume for Ethereum ETFs skyrocketed, exceeding $13 billion during December.

This expansion underscores the increasing enthusiasm amongst investors, fueled by recurring investments and favorable market attitudes.

The significant increase in trading activity suggests strong liquidity, which is vital for institutional investors looking for reliable and expandable investment opportunities. Experts interpret this uptick in trades as a sign of upcoming growth in ETF performance, as it demonstrates growing confidence in Ethereum’s future potential.

Read Ethereum’s [ETH] Price Prediction 2025–2026

In the future, we might observe increasing trading volumes for Ethereum ETFs, especially if the value of Ether keeps climbing and the network’s activity becomes more intense.

With the favorable trends in staking rewards and regulatory backing, this could lead to significant expansion for Ethereum ETFs, potentially making them leading figures in the market by 2025.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-03 10:16