- Bitcoin exited the ‘extreme greed’ zone and could aid sustainable growth

- MVRV and Pi Cycle Top indicators revealed that BTC still had room for upside

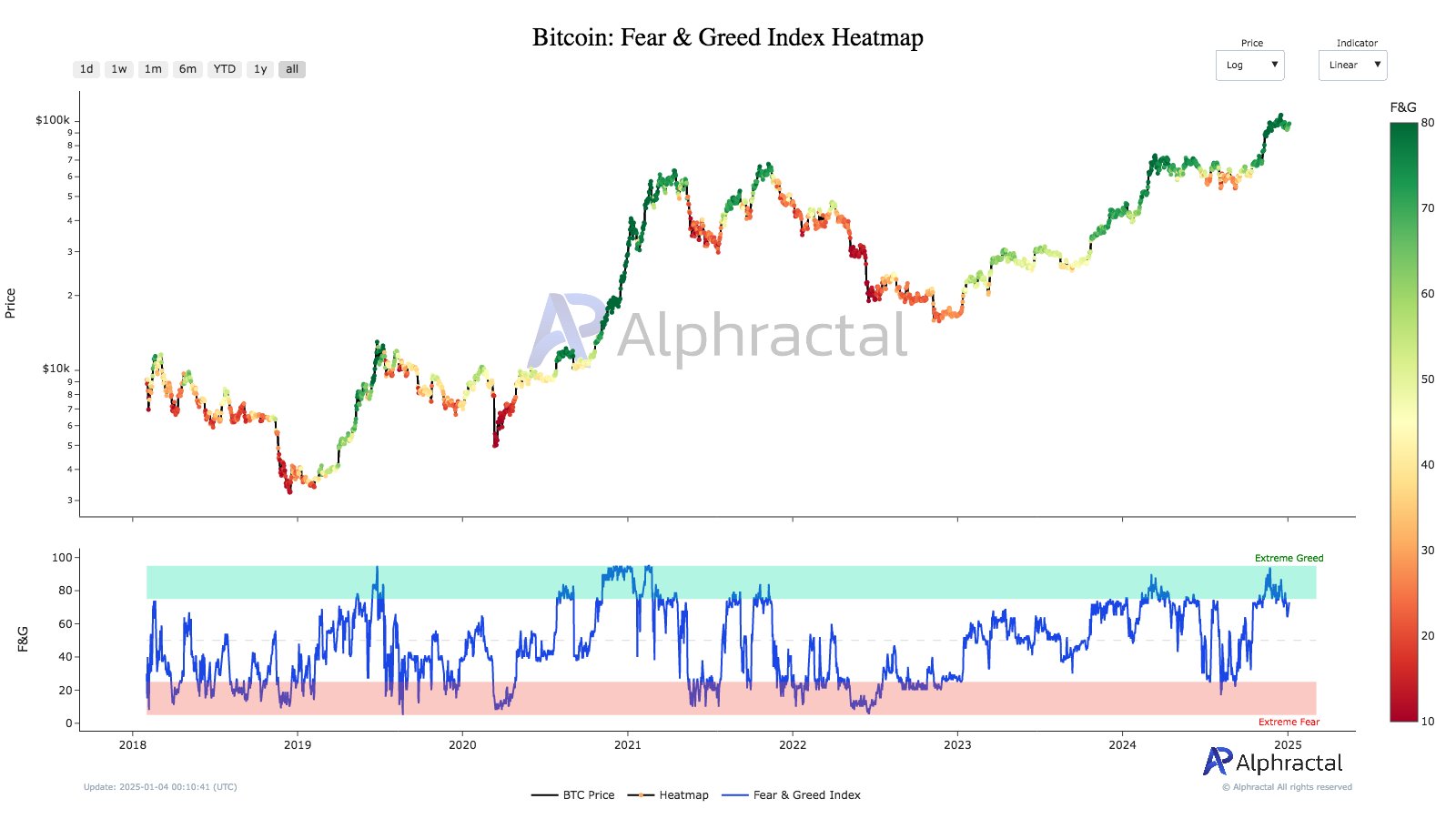

As a researcher studying the cryptocurrency market, I’ve noticed an interesting shift: Bitcoin (BTC) has moved out of the “extreme greed” phase for the first time since the “Trump pump” trade started in November. This development could provide Bitcoin with the necessary breathing space it needs to expand further.

As per the anonymous on-chain expert known as Dark Fost, the “extreme greed” stage indicated an overheated market and a possible correction, which might have contributed to the drop in the cryptocurrency’s value from approximately $108,000 to nearly $90,000.

A set-up for a sustained BTC rally?

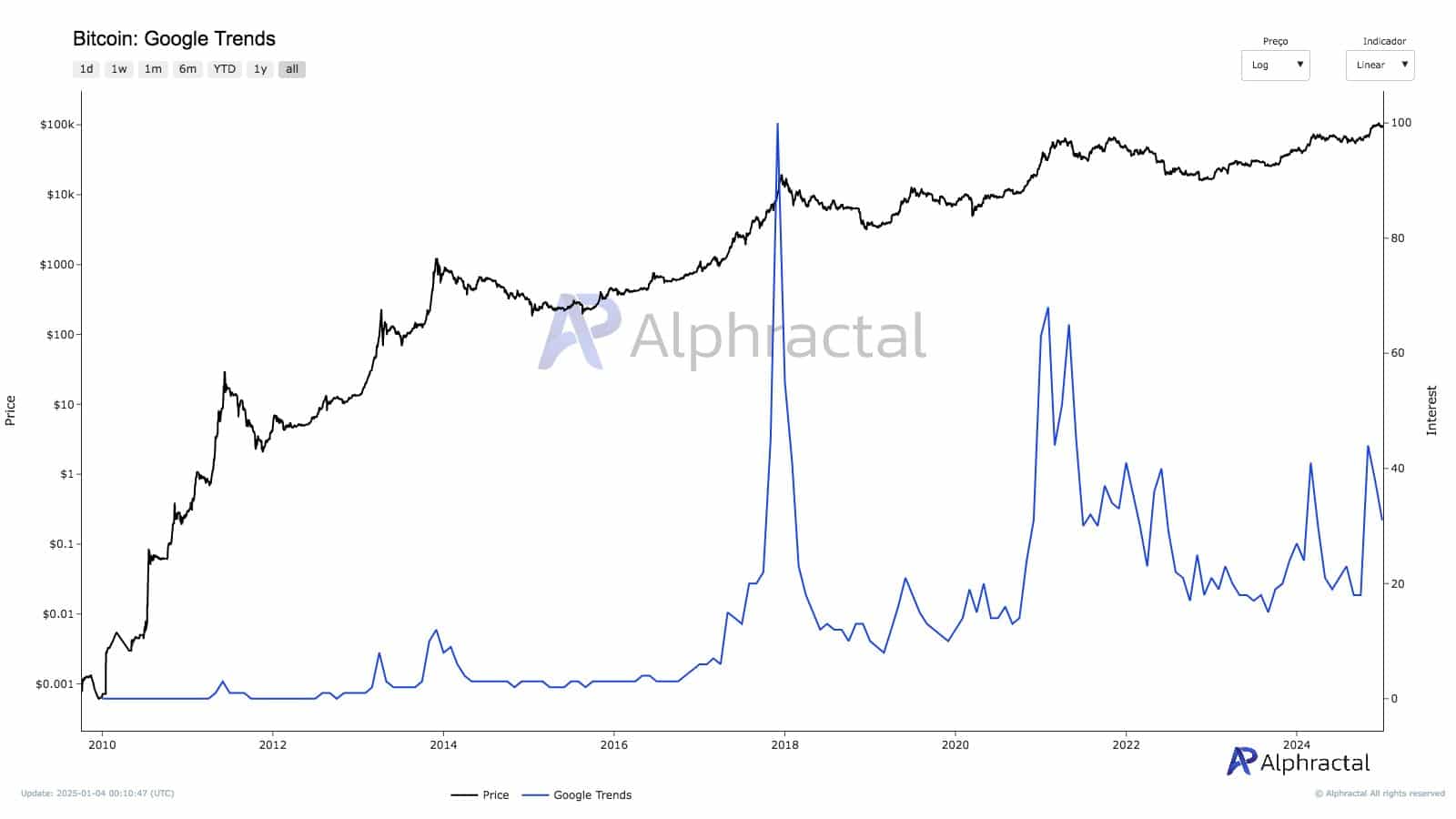

Furthermore, the enthusiasm for Bitcoin in the market, as indicated by Google Trends, saw a substantial decrease when the value of the cryptocurrency dipped beneath the $100k threshold.

Historically, a spike in Google Trends has typically been linked with heightened optimism and possible market adjustments or peaks.

In summary, Dark Fost pointed out that the mentioned tendencies imply a potential for Bitcoin (BTC) to expand in the short-term future. To put it simply, he believes there’s more upward movement ahead for BTC.

The overall feeling is optimistic, but there’s not much excitement from new participants. This could mean that the bullish trend might persist for a while in the near future.

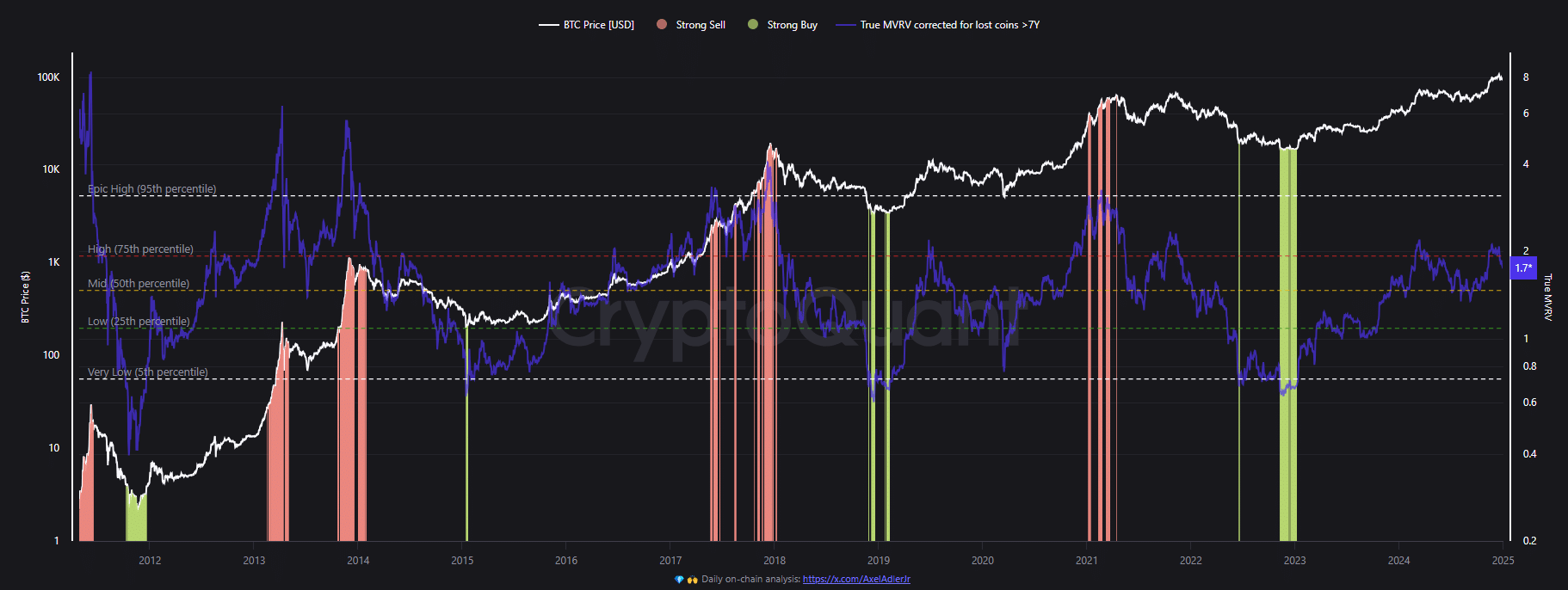

The True MVRV (Market Value to Realized Value), a tool for determining if Bitcoin’s value exceeds its worth, reinforced his observation. This metric helps identify market bubbles and monitors the stages of the cryptocurrency market.

As a crypto investor, I’ve found that this particular metric has been quite reliable in predicting local and market cycle tops. To be precise, it was when this metric hit 2 back in March and December of 2024 that we saw those cycle tops. Typically, a surge to 4 signaled the peak of a cycle for me.

As I write this, the metric has pulled back to 1.7, which is significantly lower than my previous observation of 4. This indicates that the peak of Bitcoin’s current cycle might still be quite a distance away.

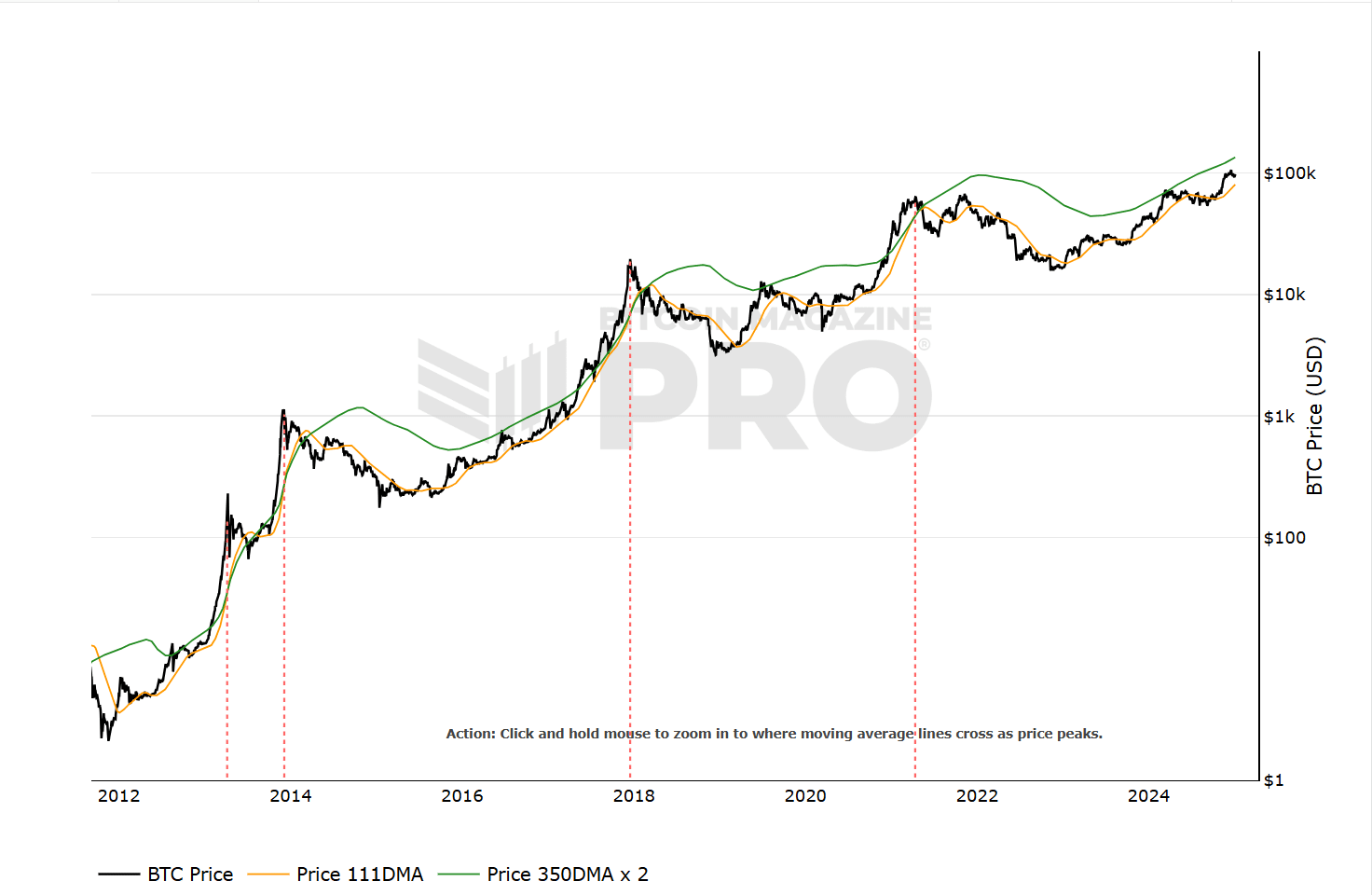

In simpler terms, the Pi Cycle Top indicator, which signals market peaks, has not yet been activated during this market surge. This tool signaled past market peaks when the short-term (111-day) moving average crossed over the long-term (350-day), adjusted moving average and cycle.

Read Bitcoin [BTC] Price Prediction 2025-2026

Put simply, the pullback of BTC from “extreme greed” could signal a beneficial respite for prolonged and long-lasting growth in the future. Additionally, the likelihood of further gains was emphasized by crucial market cycle top signals that have not yet triggered what seems to be a probable peak for this cryptocurrency.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2025-01-05 07:03