- ADA has surged by 23.8% over the past week.

- Cardano whales have bought 40 million ADA tokens in 48 hours.

Over the past week, I’ve witnessed a significant surge in the value of my Cardano [ADA] investment. After hitting a low at $0.878, it has climbed up to $1.119, representing an impressive increase of 23.80%. This growth is clearly visible on the weekly charts.

Over the past 24 hours, I’ve noticed a minor dip in the altcoin’s performance on the daily charts. Interestingly, at the moment of writing this, Cardano is being traded at approximately $1.106. This represents a small but encouraging increase of 1.23% compared to its price yesterday.

After the latest surge in ADA’s price, many financial experts are discussing the reasons behind this trend. As per well-known crypto analyst Ali Martinez, one key factor influencing the rise in ADA’s value is an increase in demand or buying pressure.

Cardano whales purchase 40 million tokens

According to Martinez’s examination, it appears that large investors (whales) in Cardano have been actively purchasing the token. Specifically, they have acquired approximately 40 million ADA tokens within the last two days.

When whales decide to invest in a particular asset, it signifies their optimism about the market and their belief in its growth potential.

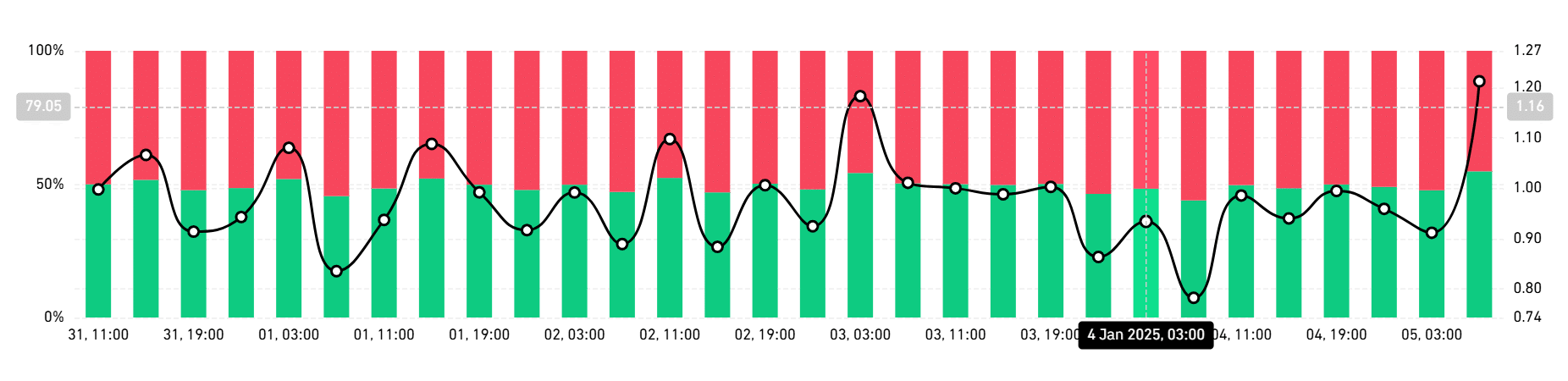

It’s worth noting that the interest in ADA isn’t limited to just whales; retail traders are also actively purchasing it. As a result, other market players have been actively acquiring the altcoin since New Year’s Eve.

The significant increase in the Relative Strength Index (RSI), moving from 39 to 62, suggests a surge of strong buying activity. This upward movement implies that buyers hold more control over the market, as they are exerting greater influence compared to sellers.

What ADA charts suggest

As more significant purchases are being made by both “whales” and regular investors, this suggests that Cardano (ADA) is poised for even greater increases in value.

As per the analysis by AMBCrypto, there’s a noticeable increase in positive momentum for Cardano due to increased interest from buyers.

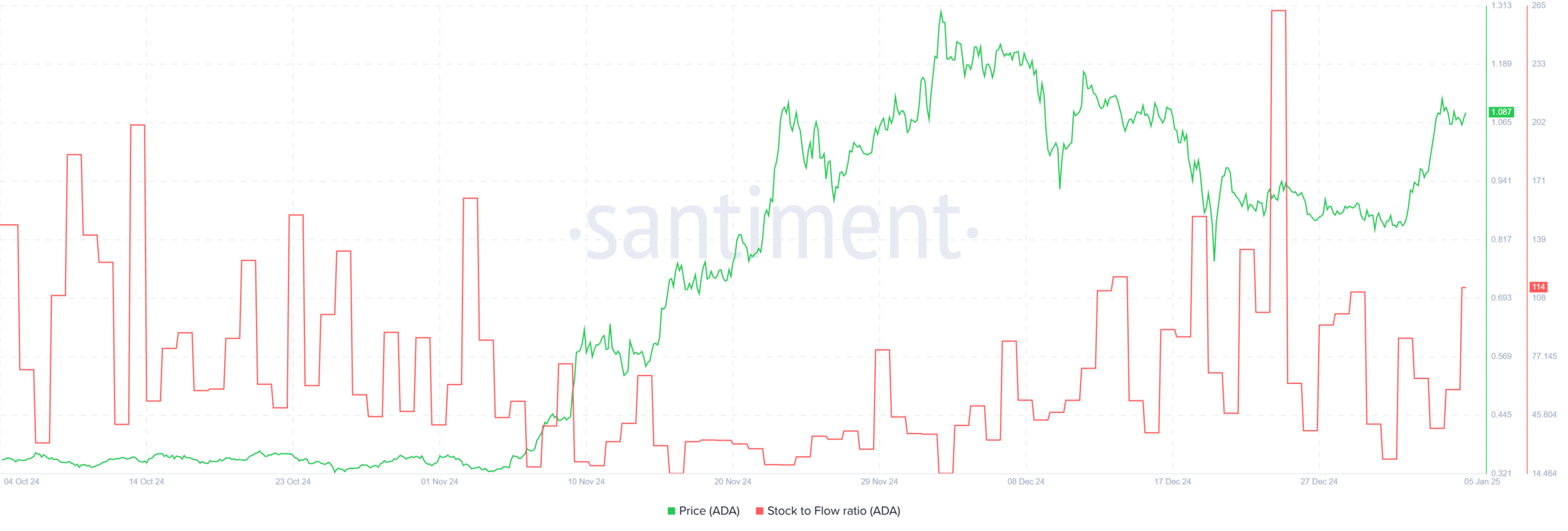

The growing interest in Cardano seems apparent as its scarcity rises, a trend that’s clearly visible in the escalating Stock-to-Flow ratio. Currently, this ratio stands at approximately 133.7.

As the rate of Supply Factor Rise (SFR) increases, it suggests that the availability of Asset Distribution Asset (ADA) is decreasing relative to demand. Frequently, heightened demand can propel prices upward.

Moreover, there’s a significant preference among traders for holding the altcoin in a buy-and-hold strategy. According to the long/short ratio, about 54% of traders are adopting this approach.

When longs dominate the market, it means most traders are bullish and expect prices to increase.

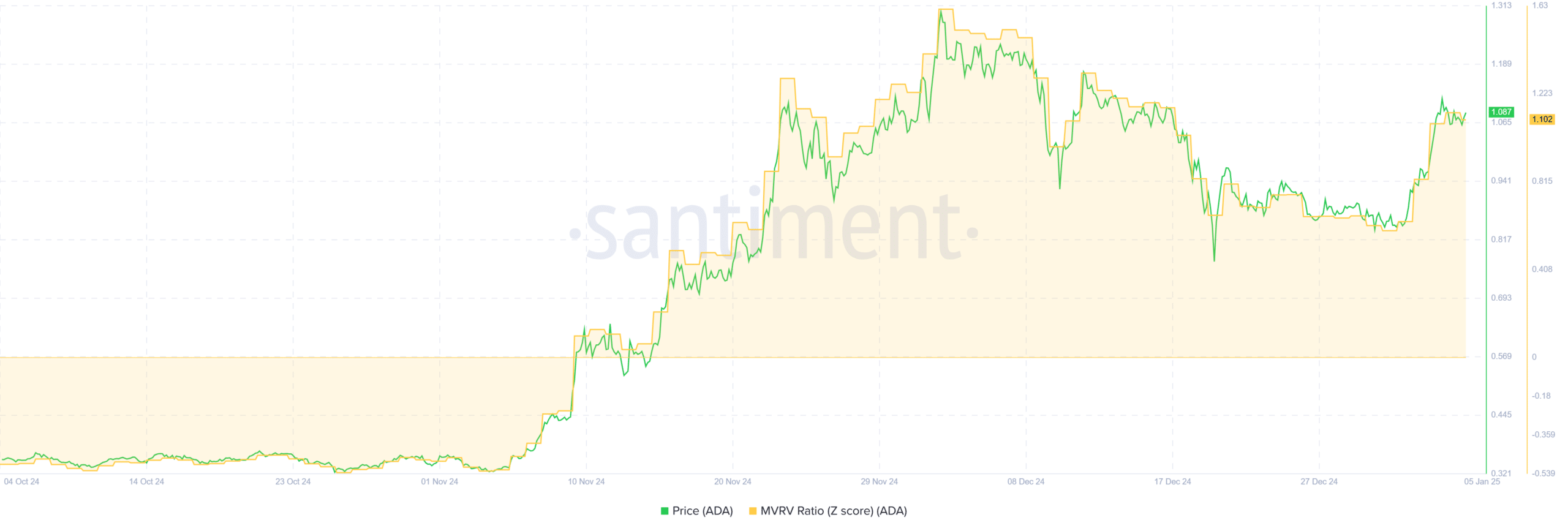

To put it simply, the Market Value to Realized Value (MVRV) Ratio for Cardano currently stands at 1.1, indicating a reduced urge among holders to sell due to profit-taking being comparatively minimal at this level.

At this level, the price has room to grow before it reaches overbought levels.

In the midst of heightened actions by both whales and retail traders, I observe a surging upward momentum for ADA. Given the optimistic atmosphere, Cardano appears primed for further growth.

Read Cardano’s [ADA] Price Prediction 2025–2026

If the trend of buyer control persists, there’s a possibility that ADA could regain its previous high of around $1.2, a level it has struggled with before. Should it successfully break through this point, the altcoin might surge towards $1.5.

Conversely, if a market correction arises, the altcoin will dip to $0.89.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-01-05 13:11