- FLOKI mirrors PEPE’s price pattern of January to mid-year of 2024.

- Key on-chain metrics point to a bullish outlook amid memecoin resurgence.

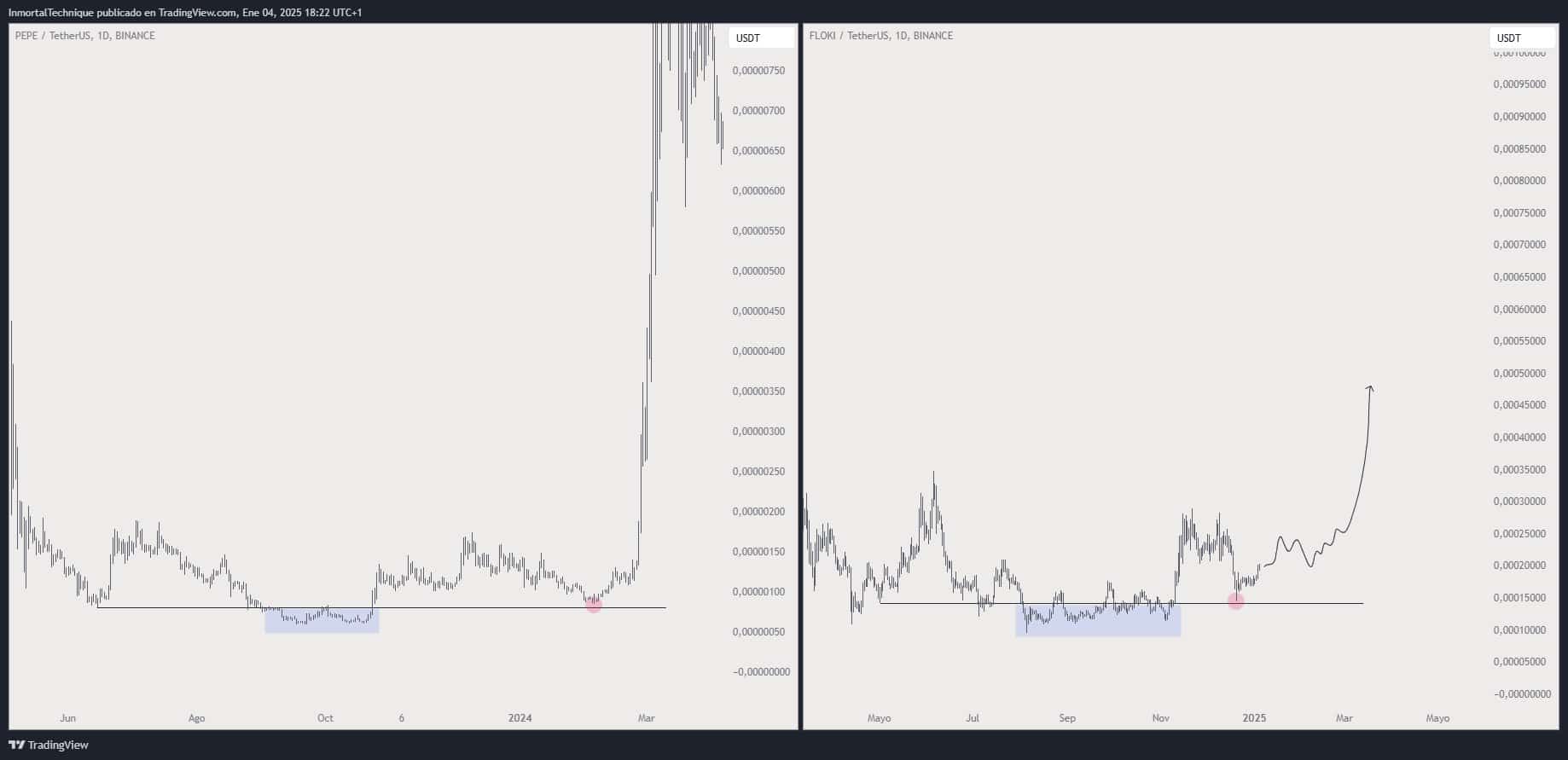

As I analyzed the market trends during 2024 and into early 2025, it became clear that the PEPE and FLOKI tokens exhibited two distinct movements, with their price patterns closely mirroring each other. From my perspective, this correlation in their trajectories was a fascinating aspect to observe.

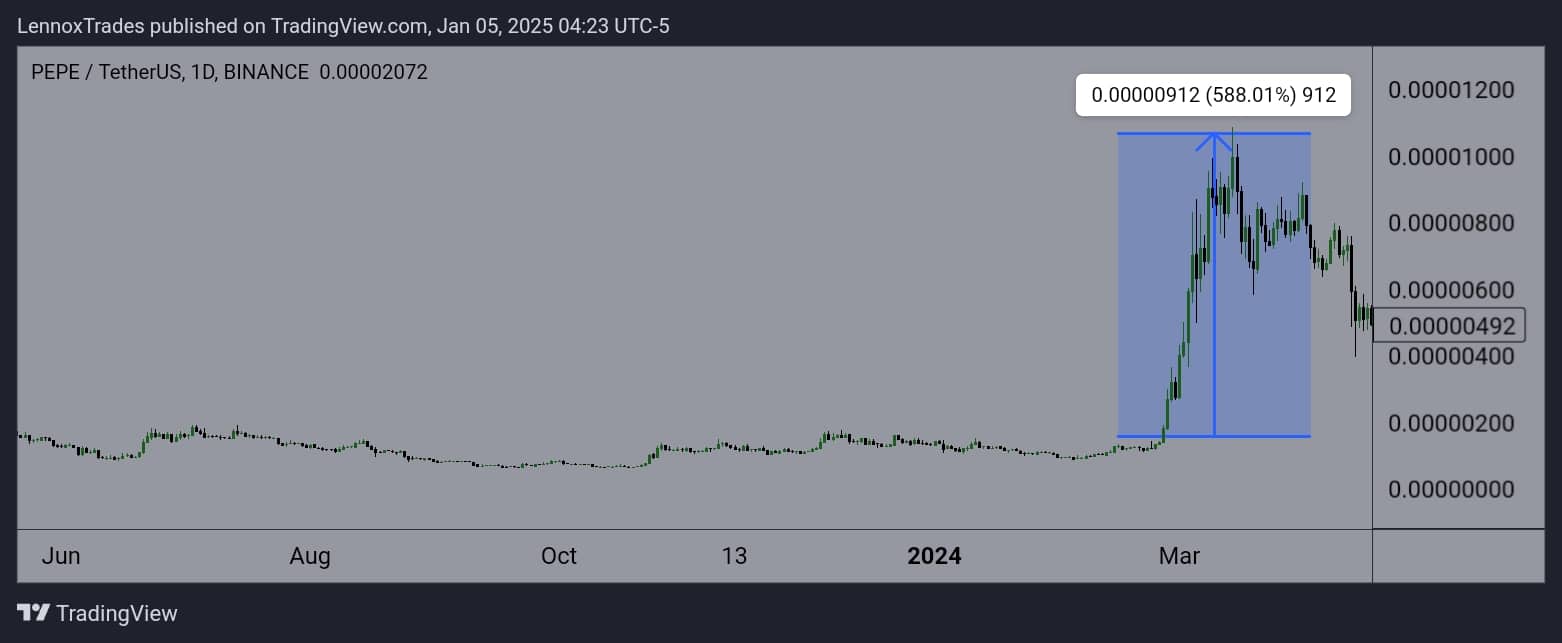

In early January, there was a significant increase in the value of PEPE, which then stabilized before experiencing another surge around March 2024. By the middle of the year, PEPE had yielded over 588% return on investment.

In a similar fashion, FLOKI observed a consistent trend towards the end of 2024, marked by a significant increase commencing currently. This suggests that FLOKI might be on track to match PEPE’s advancements made earlier.

It appears that FLOKI’s price behavior closely mirrored PEPE’s, starting with a period of relative stability before experiencing a sudden surge, which is indicative of a repeated pattern between the two.

In the early months of 2025, FLOKI experienced a substantial increase, following a pattern similar to Pepe’s previous price trend, indicating a somewhat delayed but comparable market response.

It’s possible that the success of PEPE, with its impressive 588% increase, may encourage a similar trend for FLOKI. This could lead to increased attention and speculative trading of FLOKI, mirroring past patterns seen in the movement of PEPE.

FLOKI addresses by time held and profitability

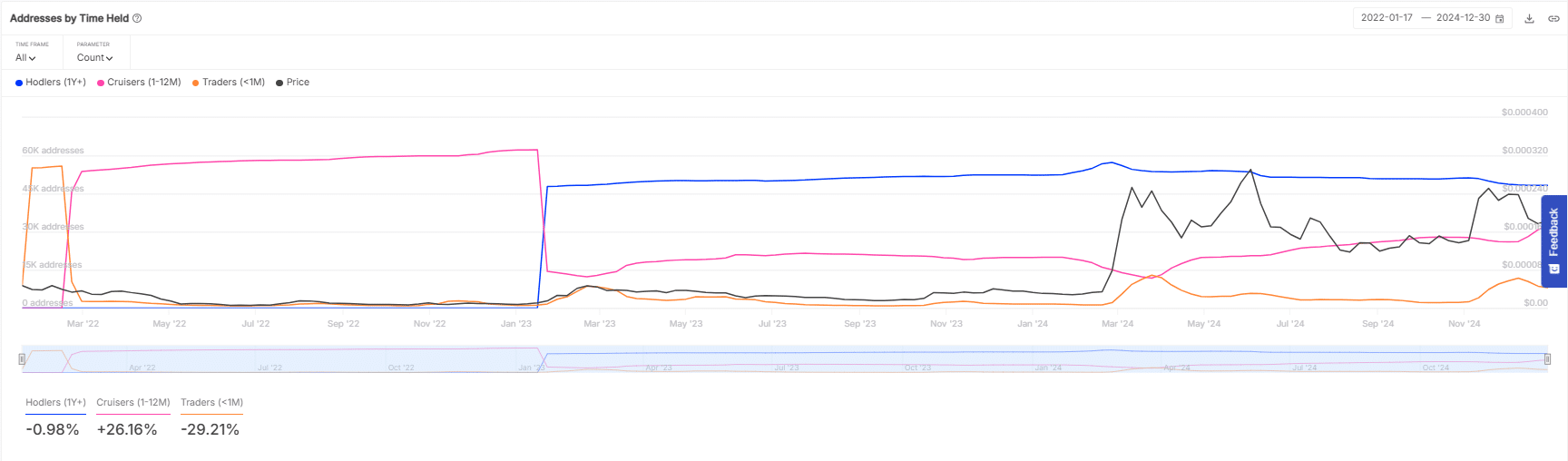

The changes in FLOKI’s address distribution, based on the duration of ownership, showed a marked shift. Those who had held for less than a month experienced a considerable decrease of approximately 29.21%, while the long-term holders, or mid-term cruisers, witnessed an increase of around 26.16%.

Long-term holders over a year barely decreased, showing a minor change of -0.98%.

This piece suggests a shift from immediate to medium-term investment strategy, implying a possible price stability for FLOKI. Traders who usually sell promptly may have already left the market or switched to a longer-term holding position.

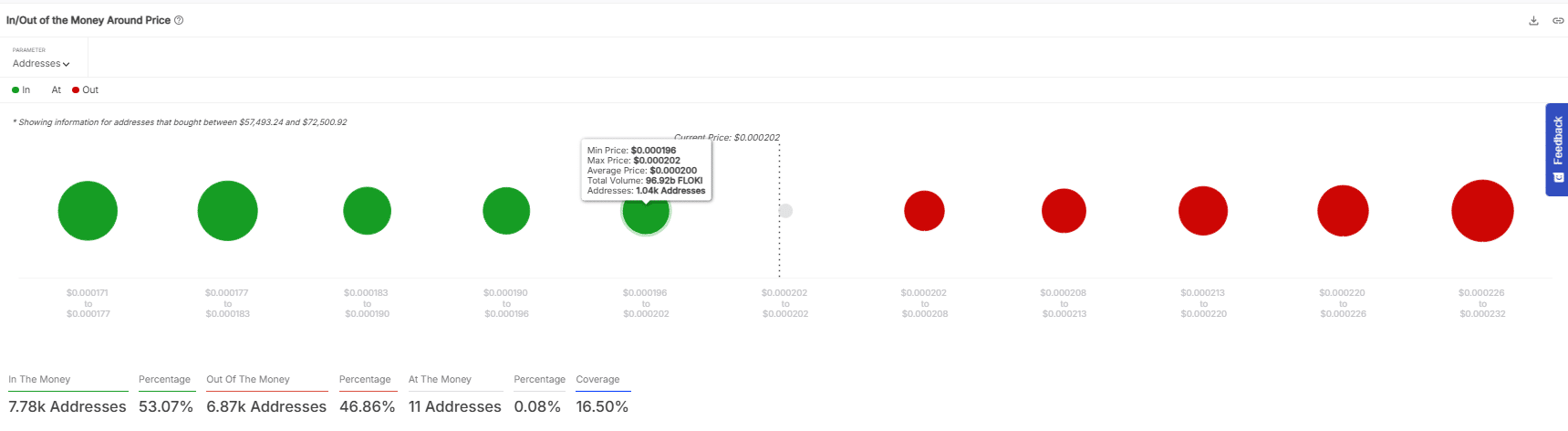

As I write this, approximately 53.07% of the addresses within our study have surpassed their purchase price, indicating a promising region of potential support. This area, notably robust between 0.000196 and 0.000202 dollars, could serve as a crucial anchoring point for future price movements.

On the other hand, about 46.86% are currently ‘out-of-the-money’, indicating recent price drops. If investors start purchasing at these reduced prices, it might signal a period of stabilization and could lead to an upward trend in pricing.

In simpler terms, the slight 0.08% fluctuation in the current market conditions showed that FLOKI’s price was highly responsive. This small equilibrium suggested that FLOKI might exhibit price stability or even a rise, creating a somewhat hopeful perspective for its short-term growth potential.

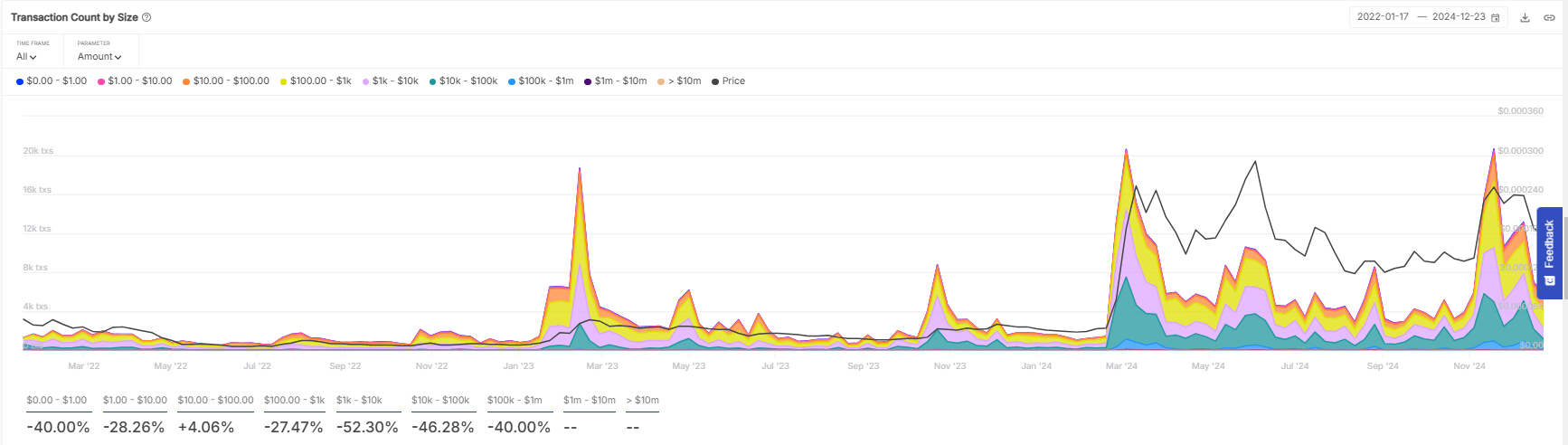

Transactions Volume in USD and count by size

Over the course of the year, Floki observed spikes in transactional activity within the range of $1 to $10 and $100 to $1,000. These peaks suggested periods of heightened activity, which eventually subsided, leaving the level of transactions relatively steady at lower rates.

The decreases in transaction numbers were significant: transactions under a dollar and those between a dollar and a hundred dollars dropped by approximately 26.5% and 29.4%, respectively. In contrast, the range of transactions from one thousand to ten thousand dollars experienced an increase of nearly 5%.

The number of FLOKI transactions based on size experienced a significant spike in smaller transactions, suggesting a rise in retail involvement.

This surge stands out dramatically against the drops observed in bigger transactions, notably those exceeding $100, which saw a significant decrease of approximately 52.30%.

It appears that these actions imply that individual investors continue to show enthusiasm for FLOKI, but institutional investors could be reducing their involvement.

Realistic or not, here’s FLOKI’s market cap in PEPE’s terms

The pattern here indicates that the price fluctuations of FLOKI may be more affected by individual investors’ speculations instead of institutional investments, potentially causing price swings and uncertainty.

In simpler terms, a market that heavily relies on retail sales may cause prices to increase temporarily. However, if there’s not enough significant backing from institutions, it could potentially threaten the market’s long-term balance and stability.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- PI PREDICTION. PI cryptocurrency

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

2025-01-05 17:11