- Bitcoin might be on the brink of a massive capital surge as the countdown to Trump’s return to the White House enters its final two weeks.

- The next move is critical – so, traders should be ready to play their cards right.

Bitcoin [BTC] has been holding steady around the $98,000 mark for two consecutive days.

Following a week of upward market movements fueled by New Year enthusiasm, financial strategists are gearing up for possible changes. These changes could be linked to the upcoming inauguration of Donald Trump, which is only two weeks from now.

Apart from Bitcoin, altcoins are also experiencing activity. For instance, within the last 24 hours, AIOZ has increased by 20%, suggesting that funds aren’t merely being held in one place – they’re moving around the market.

With anticipation growing, is it possible that this surge will propel Bitcoin over the $100,000 threshold? The next fortnight looks particularly captivating based on current trends.

The clock is ticking

At the end of last year’s fourth quarter, Trump’s influence played a role in pushing Bitcoin close to reaching $100K. Yet, the broader market factors soon intervened to dampen the surge, underscoring an essential reality: while powerful triggers may exist, they cannot always shield from the unforeseen effects of broader economic shifts.

Over the course of the last seven days, I’ve observed an impressive 1.7% rise in Bitcoin’s exchange reserves, pushing them up to approximately 2.43 million Bitcoins. This is the highest increase we’ve seen in over three months.

Nevertheless, the story took a turn for the worse. Currently, the Bitcoin reserves stand at an approximately 4-year minimum of 2.3 million BTC, suggesting that more Bitcoins are being withdrawn from the exchanges.

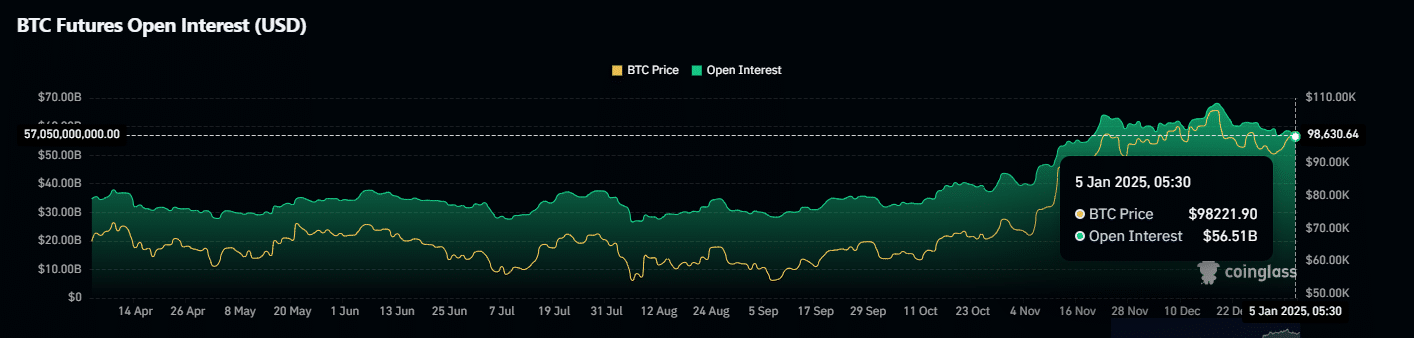

Even with recent events, there’s still a sense of quietness in the activity. Importantly, the Futures Open Interest (OI) is now below $60 billion, which was previously around $70 billion when Bitcoin reached $108K. Moreover, trading volumes have dropped by approximately 6%.

Though there are certain happenings, activity continues to be low-key. Interest in Futures (OI) is now less than $60 billion, compared to about $70 billion when Bitcoin hit $108K. It’s worth noting that trading volumes have also decreased by around 6%.

As Donald Trump’s inauguration is only two weeks off, there might be an increase in both indicators that could give Bitcoin the boost it needs to reach and surpass the six-figure mark – even setting a new record high for itself.

At these prices, a lackluster demand could potentially reverse the trend, causing a sudden retreat instead. The implications are significant.

Bitcoin investors brace for a test of patience

As Bitcoin nears the $100K mark, the “risk” factor is becoming more powerful in the market.

Over four out of five Bitcoin users, who are primarily retail investors, are experiencing mounting tension due to the concern of an impending market drop. The prospect of Bitcoin failing to set a stable price point at $100,000 might lead to reluctance in further investment funds being poured into the market.

Returning to the presidency, Donald Trump might serve as a significant trigger for Bitcoin’s growth. His impact on the market may help Bitcoin maintain its strength, preventing it from slipping back into the range of around $97,000 – $99,000.

Read Bitcoin [BTC] Price Prediction 2025-2026

In the meantime, the market for alternative cryptocurrencies, or altcoins, isn’t lagging too far behind. Ethereum (ETH) seems to be losing strength, with its options volume decreasing by 50% and approximately $7 million in long positions being compressed. The market is currently on the lookout for a definite recovery signal.

Over the next few weeks, you’ll truly be tested with your patience. All the excitement surrounding Donald Trump’s inauguration may lead to a shopping spree, yet if there isn’t more build-up in both Bitcoin and other cryptocurrencies, even Trump’s comeback might not have enough impact.

As a researcher, I’m vigilantly monitoring the trading volume. A substantial increase in buying activity might signal a breakthrough in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-06 09:12