- Bitcoin retail investors were gone as soon as they arrived.

- BTC has increased by 3.07% over the past week.

After surpassing $100,000 roughly three weeks back, Bitcoin [BTC] has found it tough to exceed this threshold. Consequently, even with the latest price surge, Bitcoin’s trading activity has remained relatively stable.

Currently, as I type, a Bitcoin transaction was taking place at approximately $97,834. This represented a minor decrease of 0.31% on the day’s trading charts. However, prior to this dip, Bitcoin had been climbing steadily, registering an increase of 3.07% over the past week.

The instability here is mainly linked to a decrease in retail involvement, as the market strives for equilibrium, with Bitcoin being transferred from less experienced investors to more seasoned ones.

Bitcoin’s retail investors are gone

As per CryptoQuant’s analysis, it appears that Bitcoin’s retail investors swiftly exited the market immediately after their entry.

According to a 30-day comparison, as Bitcoin neared the $100k mark, the fluctuations in retail demand for Bitcoin increased more than 30%.

An increase in retail demand often indicates increased curiosity, excitement, or the worry of being left behind among individual investors.

Historically speaking, if the fluctuation in retail demand surpasses 15%, it frequently signals an upcoming peak, similar to the event that followed when Bitcoin hit its record high of $108k.

Upon hitting this peak, I observed a corrective phase unfold, resulting in a 16% dip in retail demand. Known for their emotional responses, retail investors often swiftly liquidate their holdings during such market corrections.

When the retail interest falls below 10%, it suggests a substantial decrease in retail involvement. Yet, this decline might present an attractive buying chance for seasoned and expert traders.

As an analyst, I’ve observed that following periods of decline, the market often sees a bullish recovery due to weaker investors surrendering their positions and stronger ones amassing more assets.

What it means for BTC

Based on AMBCrypto’s assessment, there appears to be a transition in Bitcoin trading activities moving from individual investors (retail traders) to strategic investment by more knowledgeable entities (smart money).

The decrease in retail demand suggests that the market is experiencing a cool-down following a period of excessive speculation. Consequently, Bitcoin appears to be shifting from less secure holdings to more reliable ones.

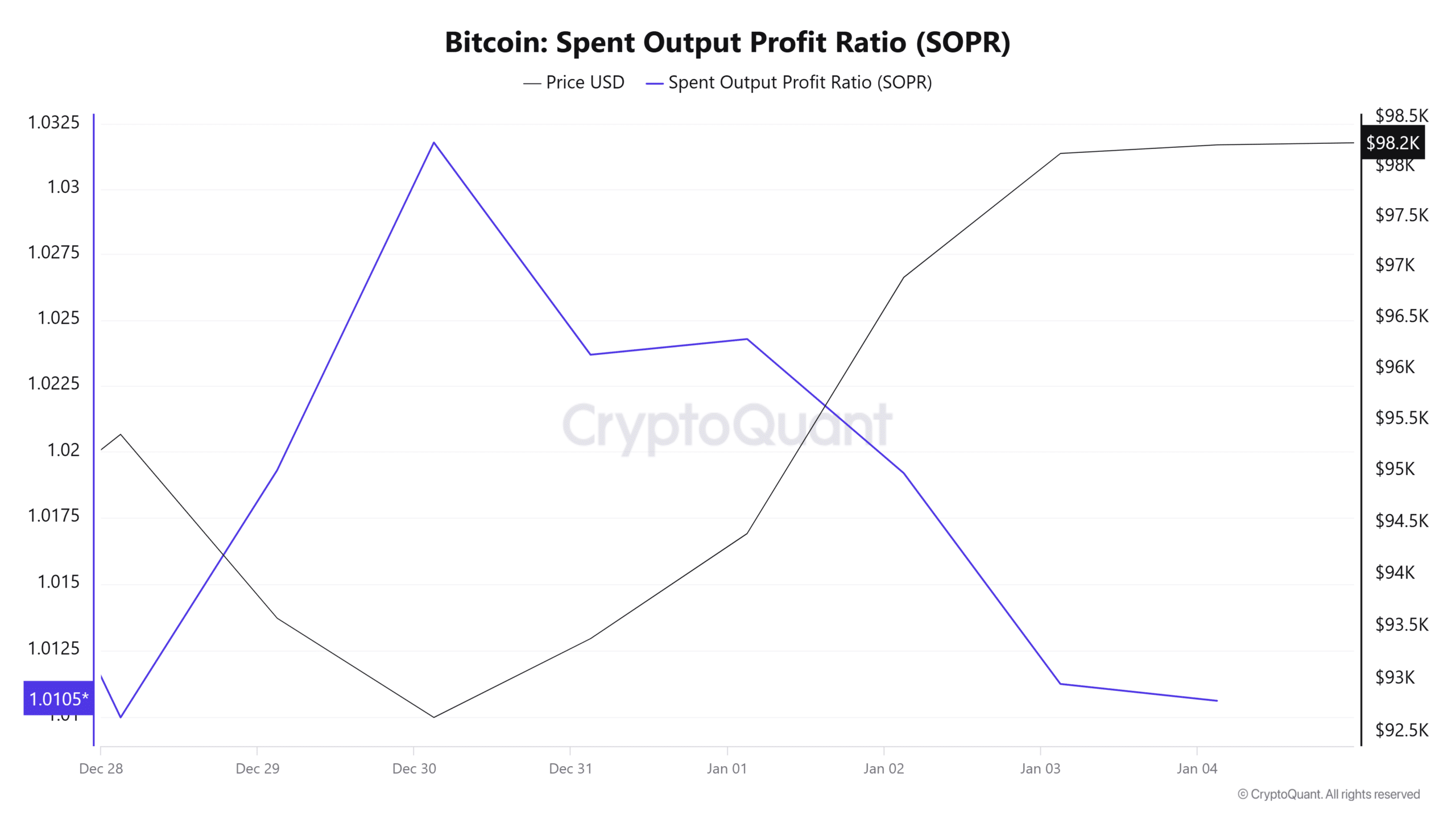

The decrease in the Spent Output Profit Ratio (SOPR) suggests a change in ownership and market behavior. Even though it has decreased, the SOPR still stands at 1.01, implying that owners are reluctant to sell at a loss.

The way traders are acting indicates a more firm grip on the market, suggesting that investors have faith in maintaining their investments, regardless of temporary market adjustments or downturns.

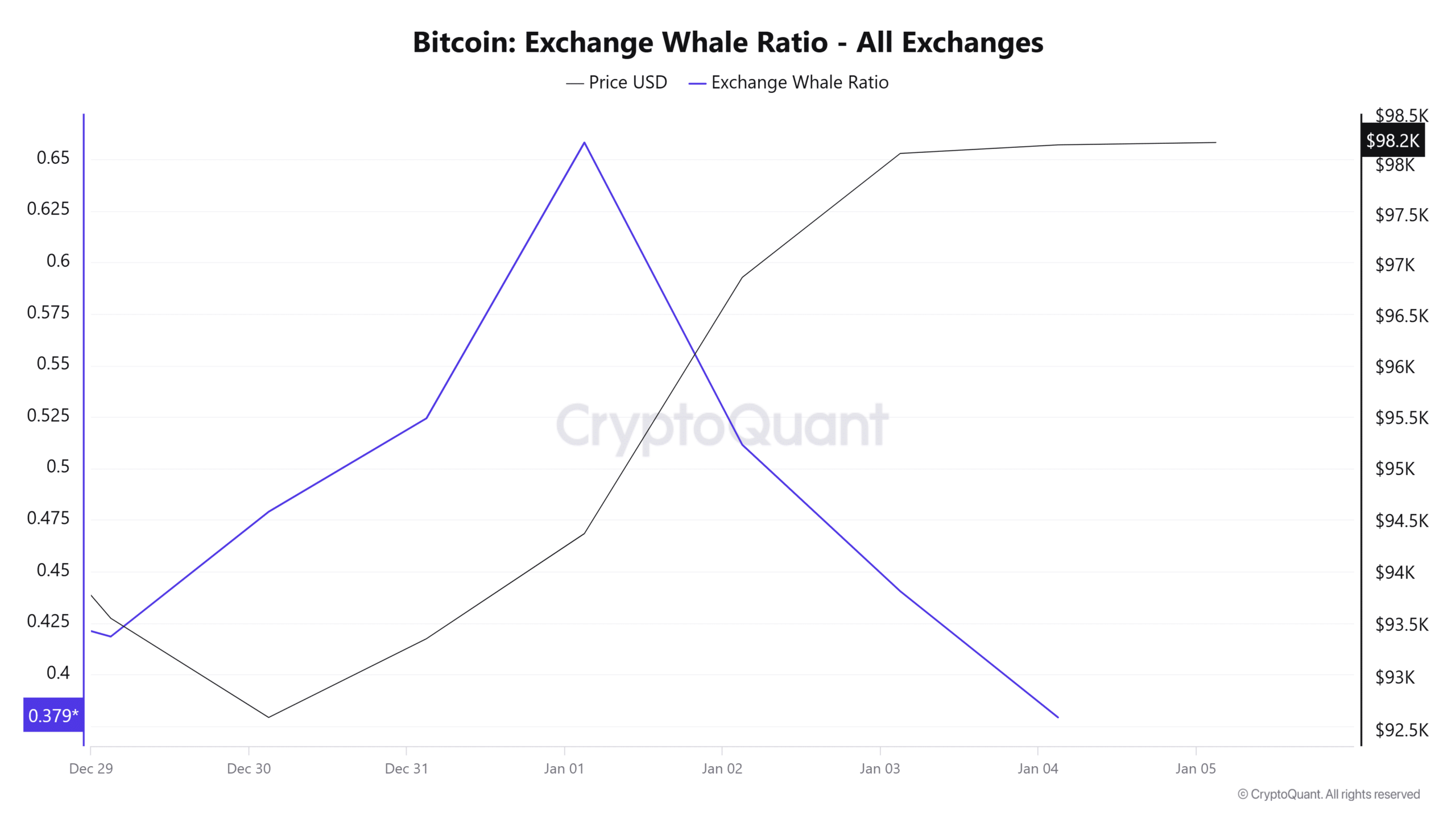

The downward trend in the number of ‘whales’ (large investors) sending their cryptocurrency to exchanges continues, providing more evidence for this accumulation pattern. A decrease to a ratio of 0.37 suggests that these whales are holding onto their coins instead of selling them, which is often referred to as ‘HODLing’.

It appears that whales (large investors) are transferring their Bitcoin (BTC) tokens into private wallets. This move suggests a positive outlook on the market, as it implies they expect more growth in the future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I can say that the decrease in retail demand has opened up a chance for large-scale investors to amass Bitcoin at reduced prices. Given these circumstances, it seems that Bitcoin is poised for further growth. Consequently, if the present market trends persist, we might see Bitcoin regaining its peak of $98,700.

As a crypto investor, I believe that surpassing the current level would bolster Bitcoin’s potential to retake the $100,000 mark. However, if the market takes a downturn, we might witness Bitcoin dipping down to around $96,100.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

2025-01-06 10:15