- Bitcoin’s bull run was driven by Spot Bitcoin ETFs and rising U.S. investor confidence.

- MicroStrategy’s ongoing Bitcoin purchases and Trump’s crypto stance added fuel to the rally.

Bitcoin (BTC) has touched the $100,000 milestone again, a remarkable rebound that’s sparked renewed enthusiasm for the digital currency. With Bitcoin embarking on an upward trend, one aspect that’s gaining attention is the growing influence of American investors.

The increase in purchasing actions can be attributed in part to the acceptance of Spot Bitcoin Exchange-Traded Funds (ETFs). These funds have not only given Bitcoin a stamp of approval from institutional investors, but they’ve also heightened the optimistic feelings among individual investors.

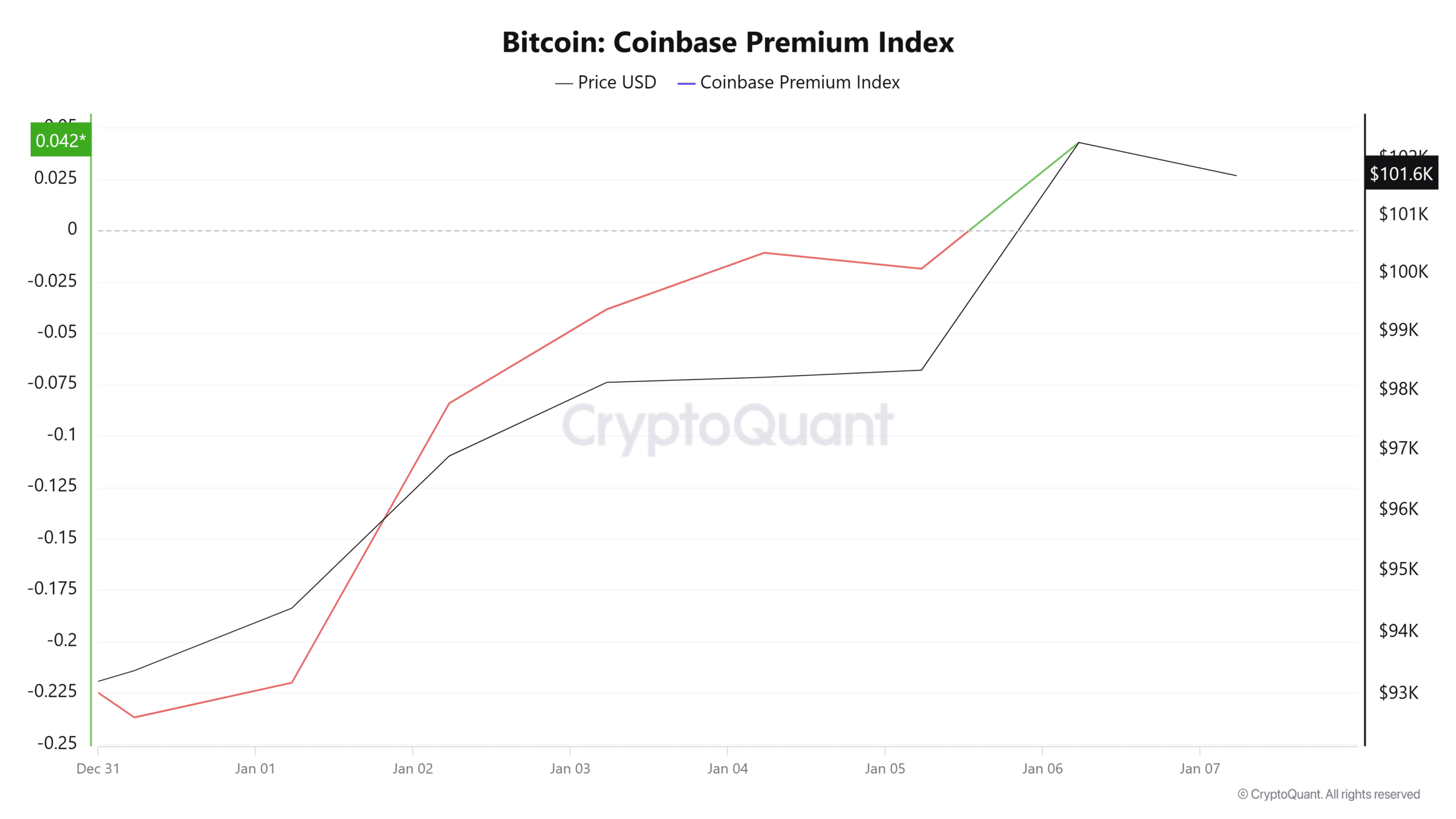

In addition to these advancements, important markers such as the Coinbase Premium Index and substantial Bitcoin withdrawals from trading platforms suggest an increasing influence of American investors in the market.

Bitcoin: A comeback to $100k

For the ninth week in a row, MicroStrategy has significantly contributed to Bitcoin’s upward trend by acquiring additional Bitcoin. As of now, this tech company owns an impressive 447,470 Bitcoins, which is currently worth approximately $27.97 billion.

This strategic buying has undoubtedly contributed to Bitcoin’s rise above the $100k mark.

Moreover, as Donald Trump prepares for his inauguration as the U.S. President on the 20th of January, there’s increasing hope for a supportive cryptocurrency climate during his tenure.

Trump’s proposal of a potential Bitcoin investment fund for the U.S. has added more excitement to the mix.

The mix of institutional backing and political advancements has empowered Bitcoin to overcome major pricing hurdles, suggesting a favorable future trend.

U.S. investors and the positive Coinbase Premium Index

As an analyst, I’ve observed a fascinating shift in the Coinbase Premium Index – it has just turned positive. This change underscores the significant influence of American investors in propelling Bitcoin’s bullish trend.

In simpler terms, when the Consumer Price Index (CPI) increases, it suggests that there is higher demand for Bitcoin specifically on American exchanges such as Coinbase in comparison to other international platforms. This trend indicates a greater force of American buyers pushing up the price of Bitcoin.

As a crypto investor, I’ve noticed an exciting change that’s been gaining momentum since the introduction of spot Bitcoin ETFs. These financial products have sparked increased interest among both institutional and individual investors, fueling a collective excitement in the crypto space.

With Bitcoin breaking through the $100k barrier, it seems that American investors are leading the charge, capitalizing on their renewed faith in the digital currency’s future prospects.

4,012 BTC outflow from Coinbase

4,012 Bitcoin being swiftly released from Coinbase caused a stir in the market, suggesting strong hoarding behavior among investors.

Large institutions or wealthy individuals frequently link significant withdrawals to the process of safeguarding their assets in ‘cold storage’, meaning they keep them secure and inaccessible for regular use.

This supports the prediction of Bitcoin reaching $100k, since significant actions taken by major investors (whales) strengthen the story that the market will continue to rise strongly.

Significantly, these outgoings align with the rise in U.S. investor influence and the CPI’s improvement. With less Bitcoin being held on exchanges, this strengthens the shortage impact, pushing prices even higher.

In simpler terms, as American investors become more influential and the Consumer Price Index (CPI) increases, these outflows occur. As fewer Bitcoins are stored in exchanges, this makes Bitcoin scarcer, which drives up its price even further.

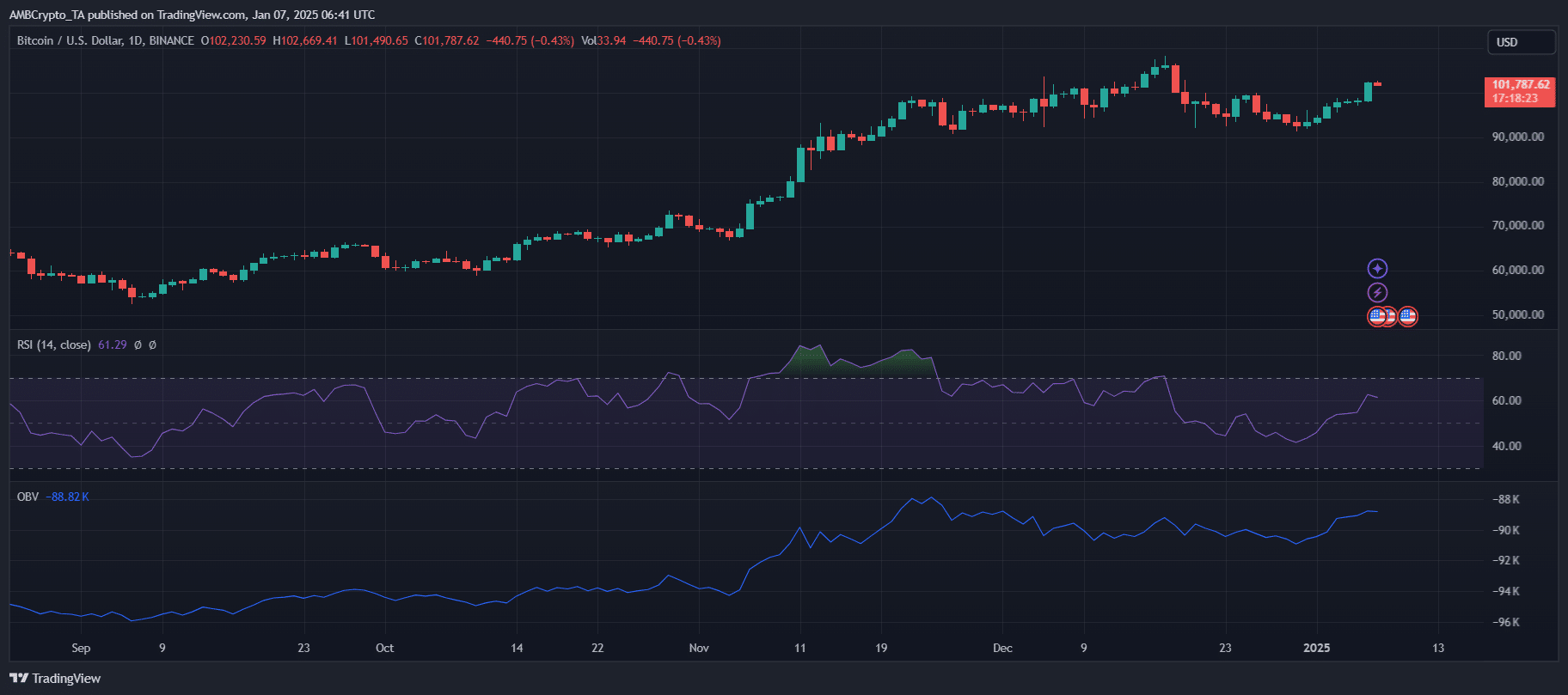

Breaking resistance or retesting key levels?

With Bitcoin holding steady above the $100,000 mark, its future direction hinges on whether it can successfully surpass the significant resistance level around $105,000.

Currently, the Relative Strength Index (RSI) suggests a moderately strong upward trend, leaving some potential for additional gains before reaching overbought levels.

Simultaneously, the OBV implied continuous accumulation, fueled by institutional demand and decreasing foreign currency reserves.

Read Bitcoin’s [BTC] Price Prediction 2025-26

If the price surges significantly beyond $105,000, it might push towards $120,000 due to psychological factors encouraging buyers. Conversely, if the present prices can’t be maintained, there could be a return to the significant support level of $95,000.

Given the potential instability, it’s crucial for investors to keep a close eye on the actions of large investors (whales) and key economic indicators (macroeconomic cues), as they can provide valuable insight about market trends.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2025-01-07 10:32