- Bitcoin whales have been aggressively accumulating BTC ever since the pandemic disrupted traditional assets.

- Does this signal the precursor to a massive bull rally?

Bitcoin (BTC) surpasses $100,000, demonstrating yet again the robustness of the cryptocurrency market during its Q1 upward trend. However, what’s significant this time around is that a full decade of transformative changes has led to this six-figure milestone in Bitcoin’s value.

Just 10 years ago, BTC kicked off the year at $314. Fast-forward to 2025, and it’s up by 29,639%.

However, it’s not only about the figures. AMBCrypto uncovers a concealed aspect driving this increase – an element that could potentially redefine the market. Yet, the outcome remains uncertain; it might bring positive or negative changes.

Be ready, a major shock is incoming

Even though only about 1.25% of the Bitcoin network is controlled by large investors (often referred to as “whales”), these individuals have played a crucial role in pushing Bitcoin prices beyond significant mental barriers.

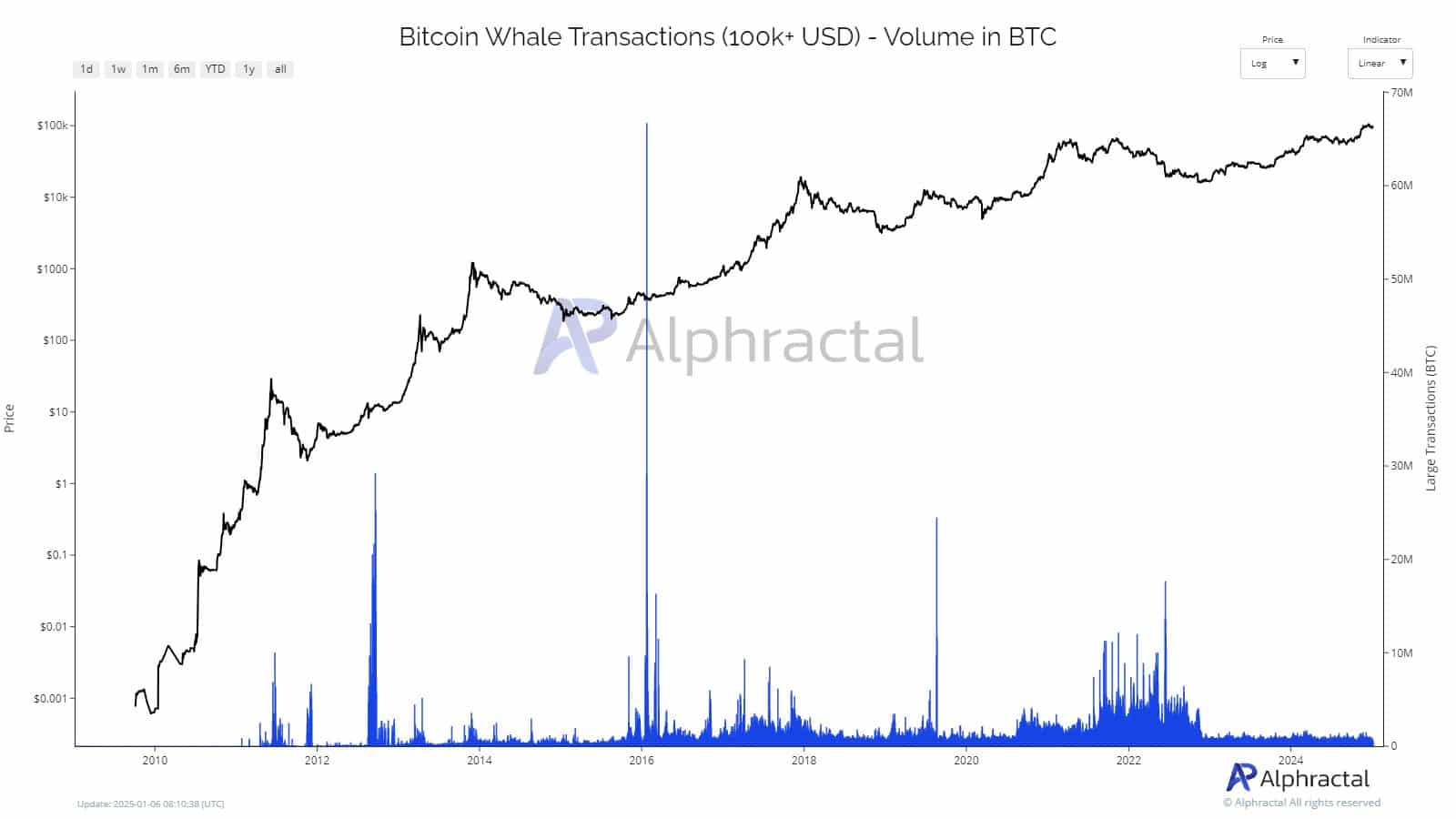

During the 2020-21 period, there was a significant acceleration as the surge following the pandemic caused investors to withdraw from conventional investment avenues.

2021 marked the first instance where Bitcoin surpassed the $20,000 threshold for me as an investor, and it was exciting to witness that significant milestone. Interestingly, I noticed a notable increase in the number of addresses holding over 10,000 Bitcoins, which swelled to approximately 150,000 during this period.

That’s why, when the market gets tough, retail investors turn to these HODLers for guidance.

The significant breakthrough worth $100,000 (currently observed) was primarily fueled by large investors acquiring more Bitcoin, which in turn triggered an enormous surge of investment from individual retailers.

Presently, there’s an intensifying discussion about ‘centralization’ within the Bitcoin community. Some people are of the opinion that as more Bitcoins accumulate in fewer wallets, the market could potentially become more susceptible to abrupt fluctuations.

However, here’s an interesting turn of events: The amount of Bitcoin being moved by large investors (whales) has decreased to levels last observed in 2016. This essentially means that the rate at which Bitcoin is being withdrawn from exchanges has significantly reduced over the past ten years.

Why does this matter? This challenges the idea that Bitcoin whales are manipulating the market.

In essence, if whales continue to amass Bitcoin and the number of transactions decreases, we might be standing at the edge of an unprecedented reduction in the amount of Bitcoin available for circulation – a potential event never before witnessed in the Bitcoin market.

Bitcoin whales are gearing up for 2025

Currently, I find myself riding the waves of an exhilarating high-euphoria phase within the crypto market. Just two weeks ago, Bitcoin managed to reclaim a price point of $102K. This surge in value seems to be driven by a mix of internal and external factors that are fueling its growth.

On this occasion, the scenario appears to be distinct compared to the previous bull run, where Bitcoin faced challenges around the $108K mark primarily due to economic uncertainties and the Federal Reserve’s conservative approach.

As Trump’s inauguration approaches, with Q1 showing a pattern of positive market movements, and an influx of significant investments flowing in from institutional and individual investors, there’s a strong possibility that we might witness a robust market surge that could reach even greater heights.

Additionally, it appears that large-scale Bitcoin investors (often referred to as “whales”) are becoming increasingly convinced about BTC’s role as a form of value storage. This trend hints at the possibility that extreme price volatility might be a thing of the past.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

As a crypto investor, I’ve noticed that the distribution of Bitcoin is becoming more balanced, which means its volatility is gradually reducing. This trend suggests we might be on the verge of an even larger market cycle in the future.

With this change, Bitcoin seems well-equipped to navigate the anticipated turbulence in the 2025 market. In fact, it might even emerge as a more attractive investment option compared to riskier assets in the upcoming period.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-01-07 14:15