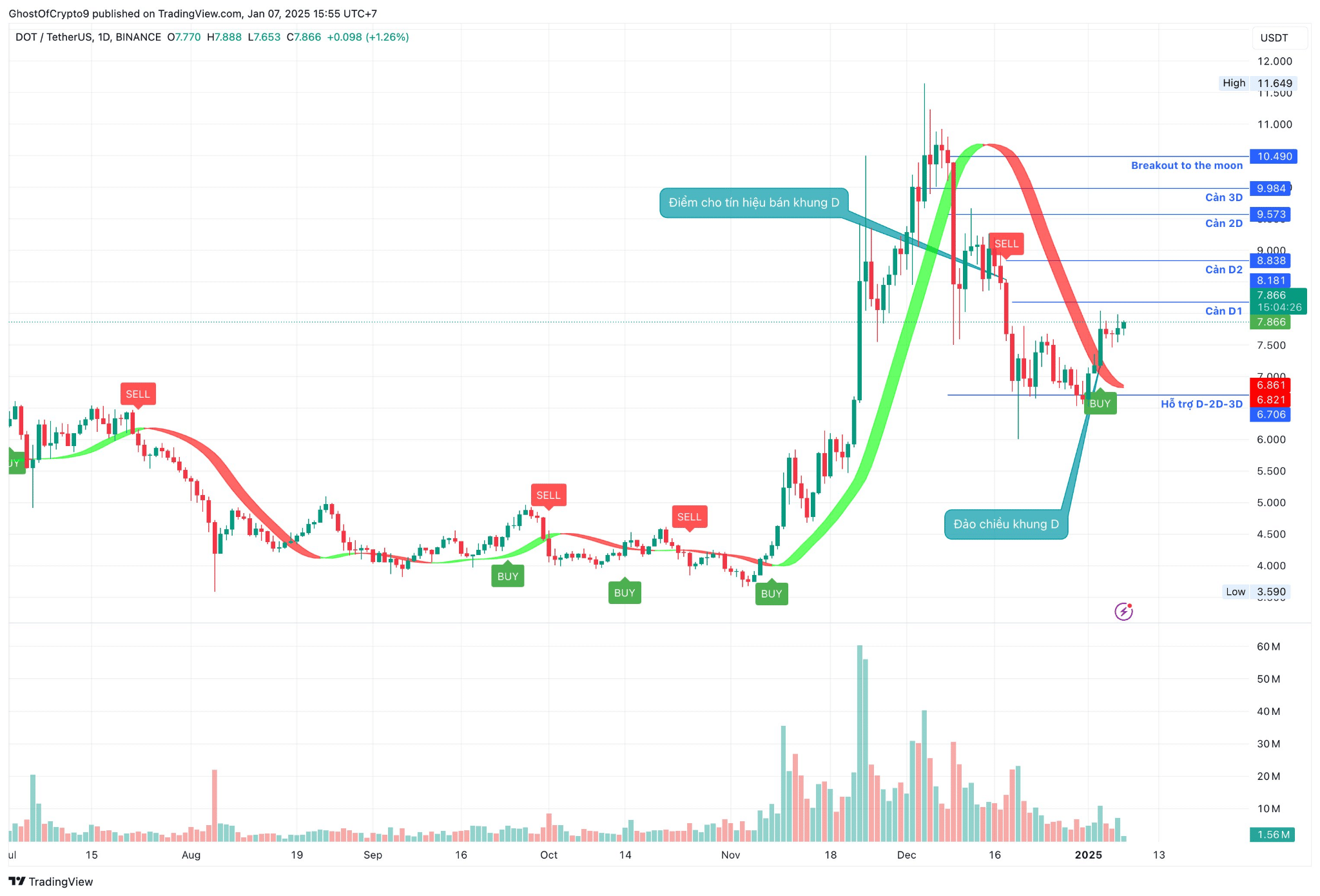

- A significant breakout led to a peak, followed by a correction, with support identified at $6.861.

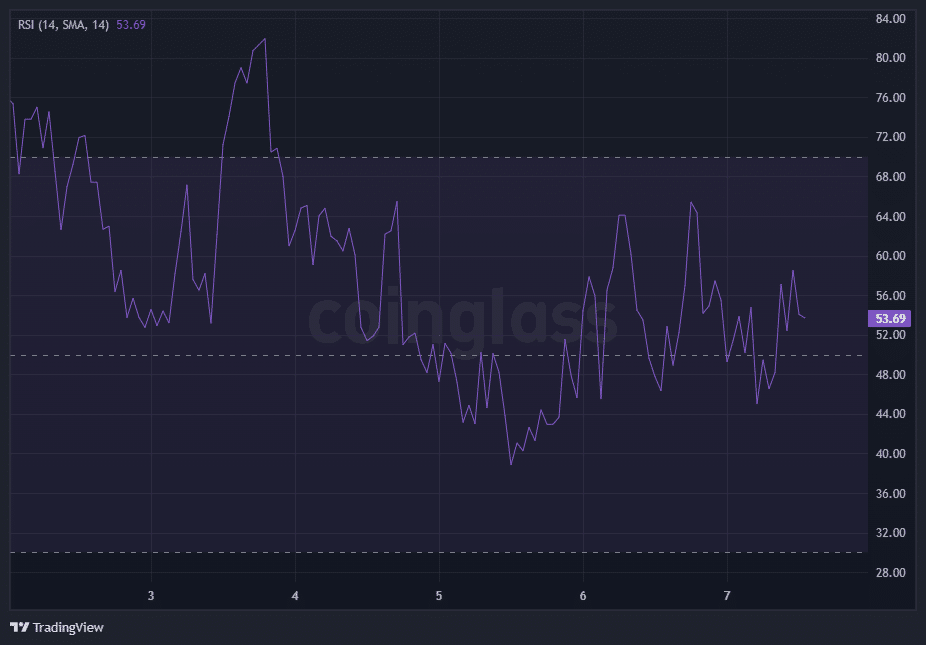

- The RSI hovered around 50, indicating a balance between buying and selling forces.

Over the past period, Polkadot (DOT) has displayed fluctuating price patterns, capturing the attention of traders due to its significant resistance and support levels, as well as relevant on-chain indicators.

The digital currency DOT has shown significant fluctuations, and important resistance points are found at $8.181, $9.573, and $10.490.

A significant breakout led to a peak, followed by a correction, with support identified at $6.861.

During an upward trend, significant increases in volume suggest robust buying activity, while a concentration of price action around $7.866 may indicate a possible rebound is on the horizon.

Assessing Polkadot’s momentum using RSI

Typically, when the Relative Strength Index (RSI) goes above 70, it signals that the market might be overbought, hinting at a potential change in direction or decrease in price. On the other hand, an RSI reading below 30 suggests the market could be oversold, indicating a possible surge or rise in price.

Recently in Polkadot’s price trend, the Relative Strength Index (RSI) moved into overbought territory during the upward trend, indicating a robust bullish drive. As the price peaked and began to correct, the RSI dropped towards average levels, suggesting a decrease in buying pressure.

Currently, as I’m typing this, the Relative Strength Index (RSI) is approximately at 50. This suggests an equilibrium between buying and selling pressures. If the RSI rises above 70 again, it might hint at a resurgence in bullish energy, possibly resulting in another attempt to reach resistance points.

Instead, if the price falls below 30, it could suggest an uptick in selling activity and a potential downward trend towards areas of support.

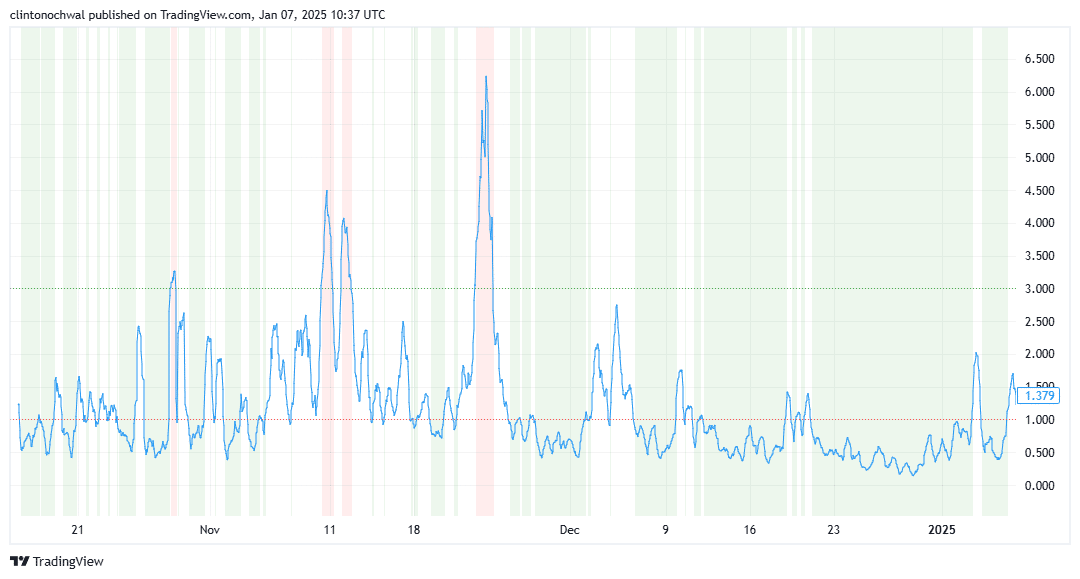

DOT’s MVRV Ratio: Is it overvalued or undervalued?

In simpler terms, when the Market Value to Realized Value (MVRV) Ratio is greater than 1, it means the market value is more than the realized value, possibly indicating that the market might be overpriced or overvalued. Conversely, an MVRV Ratio less than 1 suggests the opposite scenario, where the market value could be lower than its actual worth, potentially implying undervaluation.

In the current surge for Polkadot, the Market Value to Realized Value (MVRV) ratio climbed over 1, a sign that the market worth exceeds the actual value, which is often seen during bullish periods.

With the adjustment in price, the Market Value to Realized Value (MVRV) ratio has trended downward close to 1, indicating a shift towards more balanced valuation. At present, the MVRV ratio slightly surpasses 1, implying that Polkadot is somewhat overpriced at this moment.

Read Polkadot [DOT] Price Prediction 2024-2025

As a researcher, I’ve noticed that an upward trend in the MVRV (Maker Value to Realized Value) ratio could suggest a surge in optimistic market sentiments and possibly upcoming price escalations. Conversely, if this ratio decreases below 1, it might hint at pessimistic trends and potential future adjustments or corrections in the price.

As a researcher, I’ve noticed that the price dynamics of Polkadot lately have been marked by substantial oscillations. Crucially, these shifts have been influenced by notable resistance and support levels, acting as pivotal points in the price movement.

Using technical indicators such as the Relative Strength Index (RSI) and Market Value to Realized Value (MVRV) ratios can offer useful perspectives on an asset’s performance momentum and market value relative to its realized value, respectively.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-01-08 02:31