- Litecoin’s bullish breakout above $113 signaled potential gains, with targets set at $199, $243, and $282.

- Active addresses grew 3.53%, but a 6.16% drop in new addresses hinted at mixed market sentiment.

Litecoin (LTC) has successfully surged past its crucial barrier at $113, indicating a possible surge in positive price movement.

At the moment, Litecoin (LTC) is being exchanged for approximately $112.76, showing a significant increase of 12.86% over the last seven days, suggesting robust trading activity in the market.

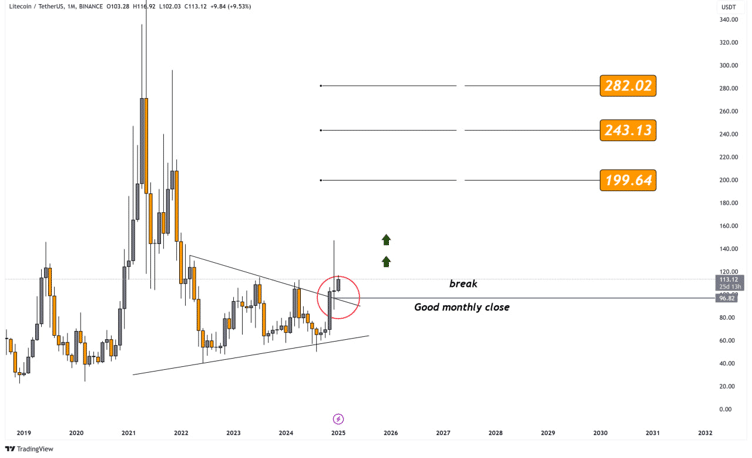

Based on technical analysis, Litecoin (LTC) appears to have breached an extended upward triangular formation, usually indicative of a prolonged bullish trend’s continuance.

Over the past month, closing above $113 has signified a major change in market dynamics, underscoring strong control by buyers.

This breakout suggests a solid foundation for further price gains in the short to medium term.

The area surrounding $113 functions significantly as a strong support point for LTC. Experts predict that so long as LTC stays above this level, the overall positive trend will persist.

Furthermore, the persistent upward trendline around $90 serves as a dynamic safety net. Keep an eye on this level as it becomes crucial during any possible price drops.

Litecoin targets set at $199, $243, and $282

Experts have pinpointed three significant potential price points for LTC. Initially, they highlighted $199.64 as a past barrier to price increase, often referred to as a resistance zone. Secondly, they focused on $243.13, which signifies both a psychologically and technically important level.

Should Long Term Capital (LTC) continue its strong performance, there’s a possibility that it might reach a future price point of around $282.02. This level would bring the long-held high prices back into view once more, signifying a potential return to previous peaks.

Market analysts warn that the price action in recent trading periods has been limited by a resistance around $120. For a clear push beyond this barrier, they believe, will be essential to foster more robust bullish movement towards these projected goals.

Based on technical analysis, overcoming this resistance level might serve as a trigger for the continued upward momentum in the market.

Bullish trends simmer down

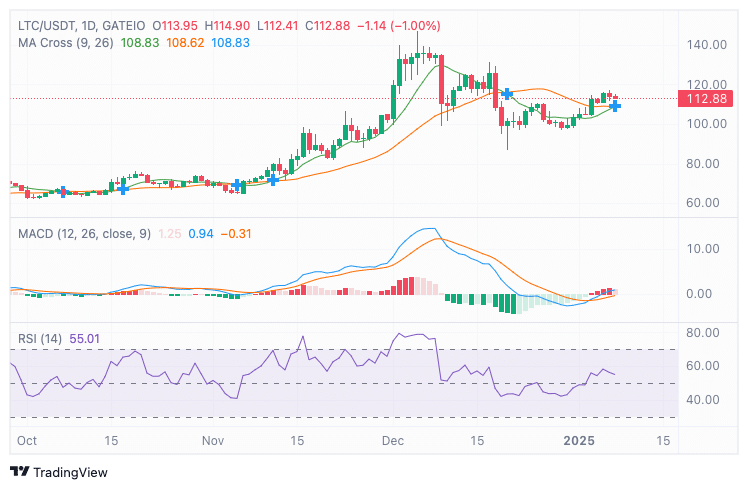

At the current moment, the MACD (Moving Average Convergence Divergence) indicator displayed a modest bullish intersection, where the MACD line stood at approximately 0.94, just slightly higher than the signal line, which was around 0.31.

On the other hand, diminishing histogram bars suggest a moderately bullish trend, implying a possible period of flat movement in the near future. Analysts point out that higher trading volumes might be necessary to maintain the uptrend.

The RSI (14) sat at 55.01, reflecting neutral momentum but leaning slightly toward bullish.

Experts suggest that if the Relative Strength Index (RSI) surpasses 60, it might indicate increased buying momentum. On the other hand, if the RSI falls below 50, it could signal a possible correction, with price levels approaching the $100 mark to test support.

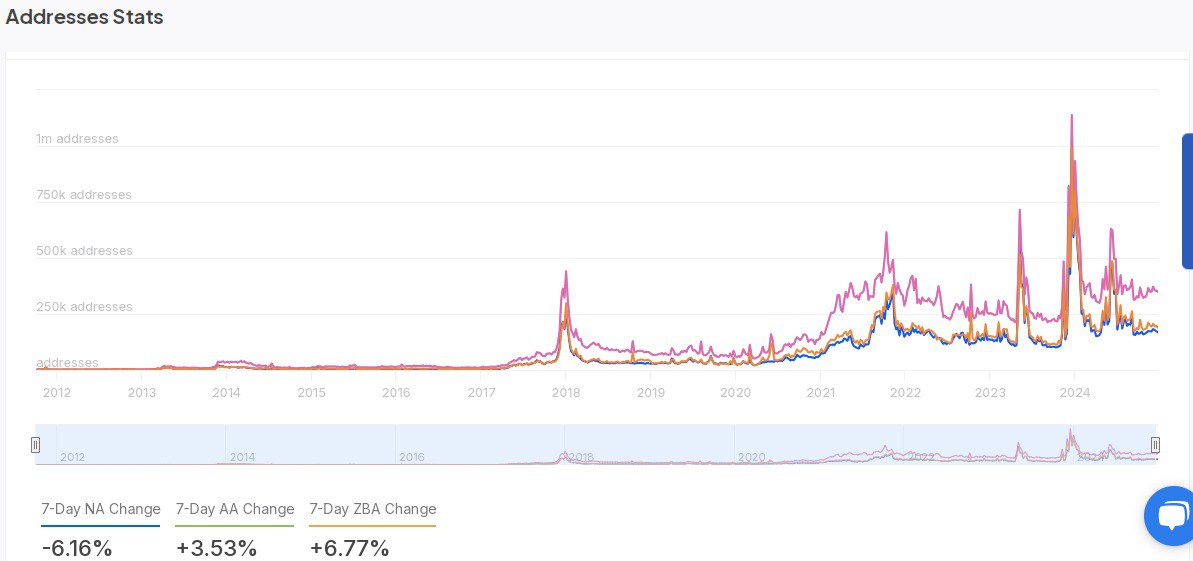

Address activity suggests mixed sentiment

705,440 Litecoin addresses, as shown by blockchain data from IntoTheBlock, were active on the 23rd of December 2024.

This week, we generated 168,130 new addresses, which is a decrease of 6.16% from the number created in the last week.

As a researcher, I’ve noticed an uptick of 3.53% in active addresses, implying that the existing user base is staying engaged, even as there seems to be a decline in participation from newcomers.

The increase of 6.14% in the count of accounts with no balance could indicate either profits being withdrawn or the clearing out of unused digital wallets.

Read Litecoin’s [LTC] Price Prediction 2025–2026

A consistent level of overall involvement is being maintained, but a decrease in the generation of new addresses might suggest that potential new investors are adopting a more cautious stance.

A strong surge past crucial thresholds by LTC, along with its continued powerful push, offers hope for even more growth ahead.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-08 04:40